In today's consumer-driven world everyone is looking for a great bargain. One of the ways to enjoy substantial savings in your purchase is through Gst Rebate Forms For Charitiess. Gst Rebate Forms For Charitiess are an effective marketing tactic used by manufacturers and retailers to provide customers with a portion of a discount on purchases they made after they have completed them. In this post, we'll investigate the world of Gst Rebate Forms For Charitiess. We'll discuss what they are and how they work and ways to maximize your savings via these cost-effective incentives.

Get Latest Gst Rebate Forms For Charities Below

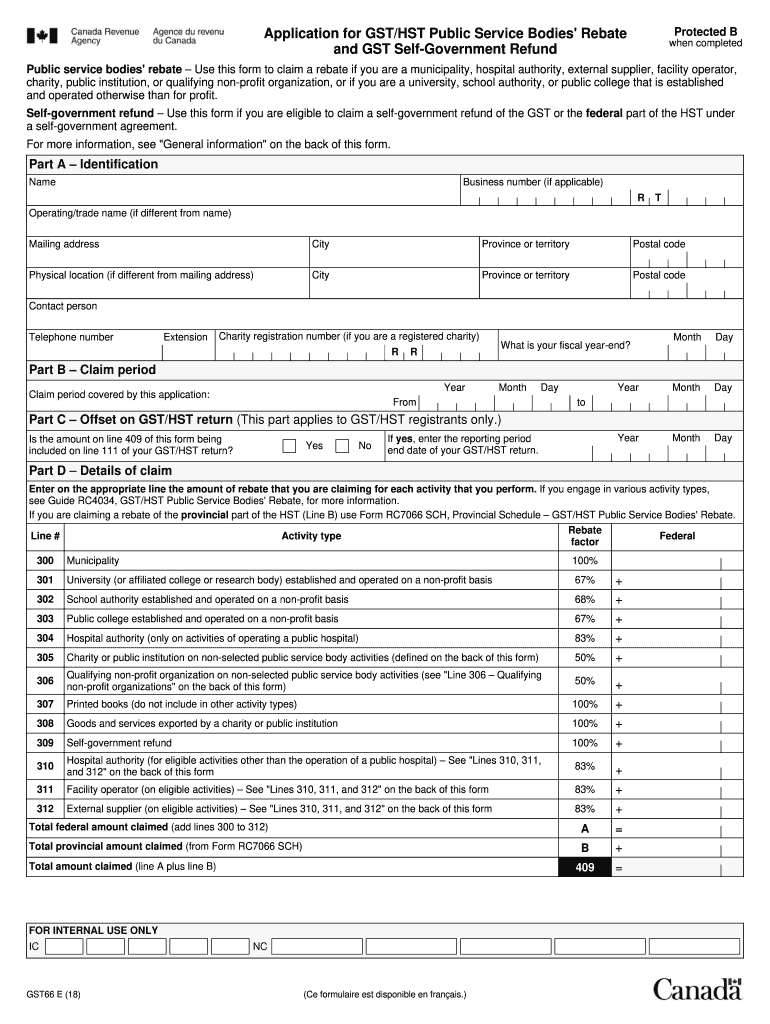

Gst Rebate Forms For Charities

Gst Rebate Forms For Charities - Gst Rebate Forms For Charities, Gst Rebate For Charitable Organizations, Gst Rebate For Registered Charities, Can I Claim Gst On A Donation, Who Qualifies For Gst Rebate, Is There Gst On Donations

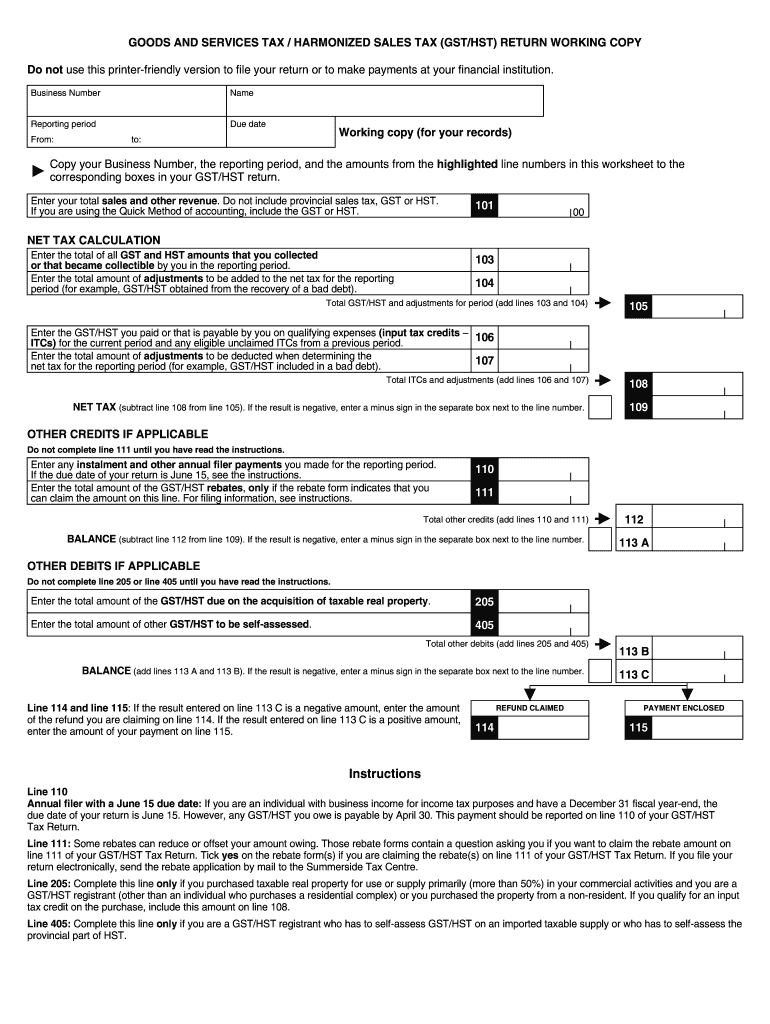

Web 6 d 233 c 2021 nbsp 0183 32 This guide explains how GST HST applies to registered charities and registered Canadian amateur athletic associations

Web A charity is entitled to claim a public service bodies rebate to recover a percentage of the GST HST paid or payable on eligible purchases and expenses for which it cannot claim

A Gst Rebate Forms For Charities in its simplest description, is a return to the customer after purchasing a certain product or service. It is a powerful tool that businesses use to draw buyers, increase sales and also to advertise certain products.

Types of Gst Rebate Forms For Charities

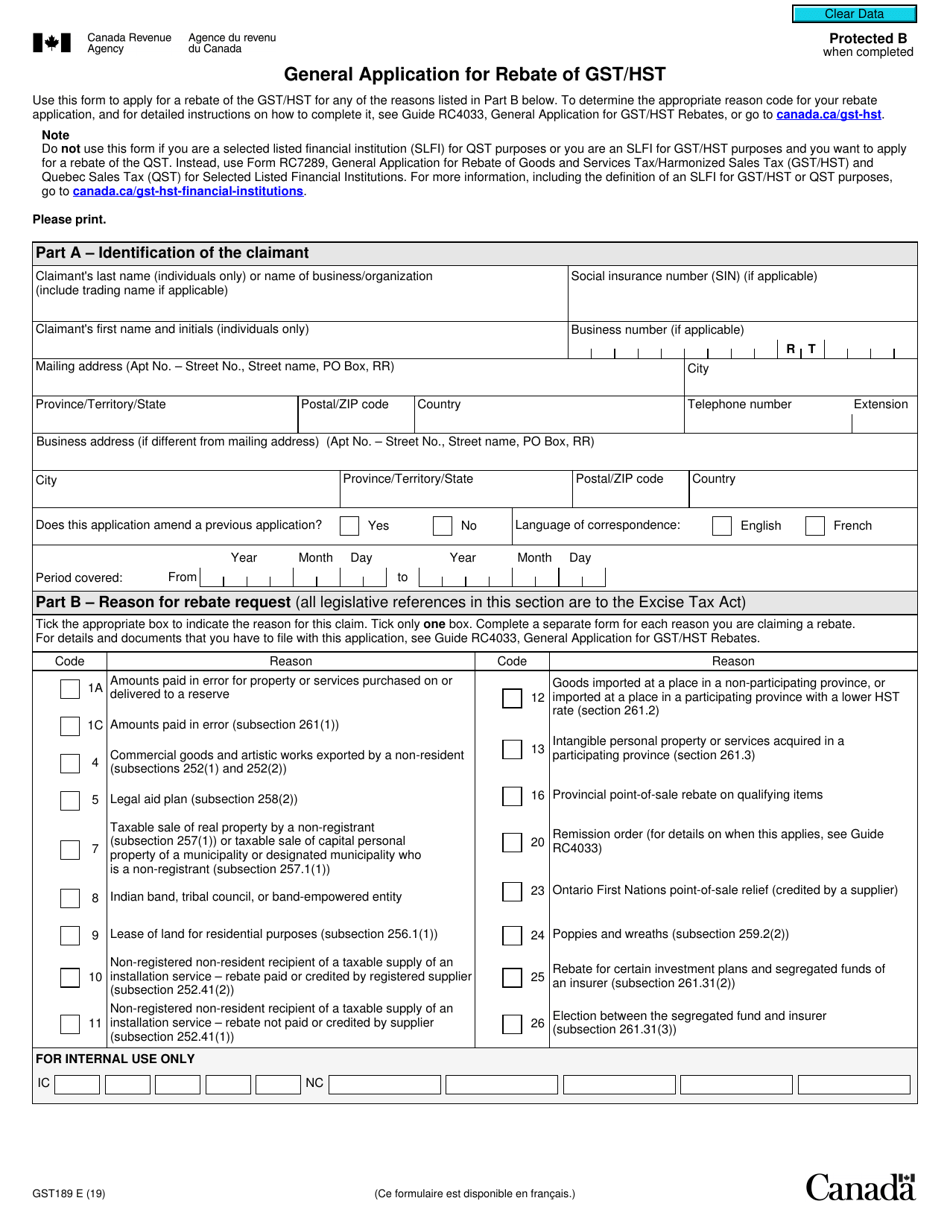

Gst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

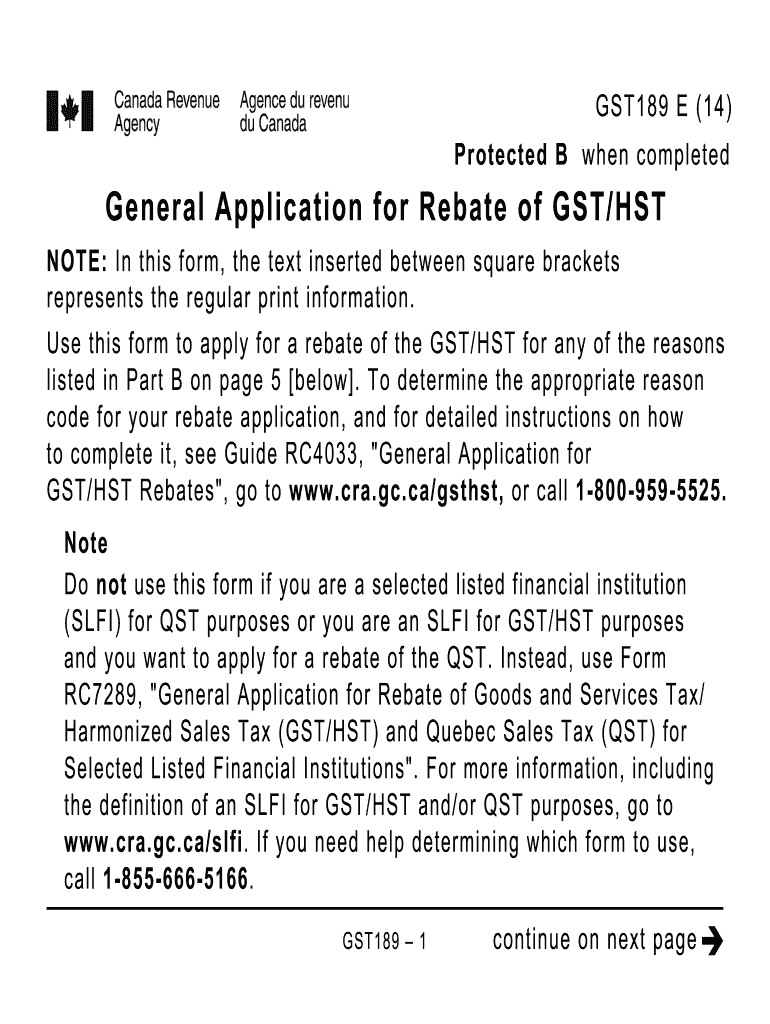

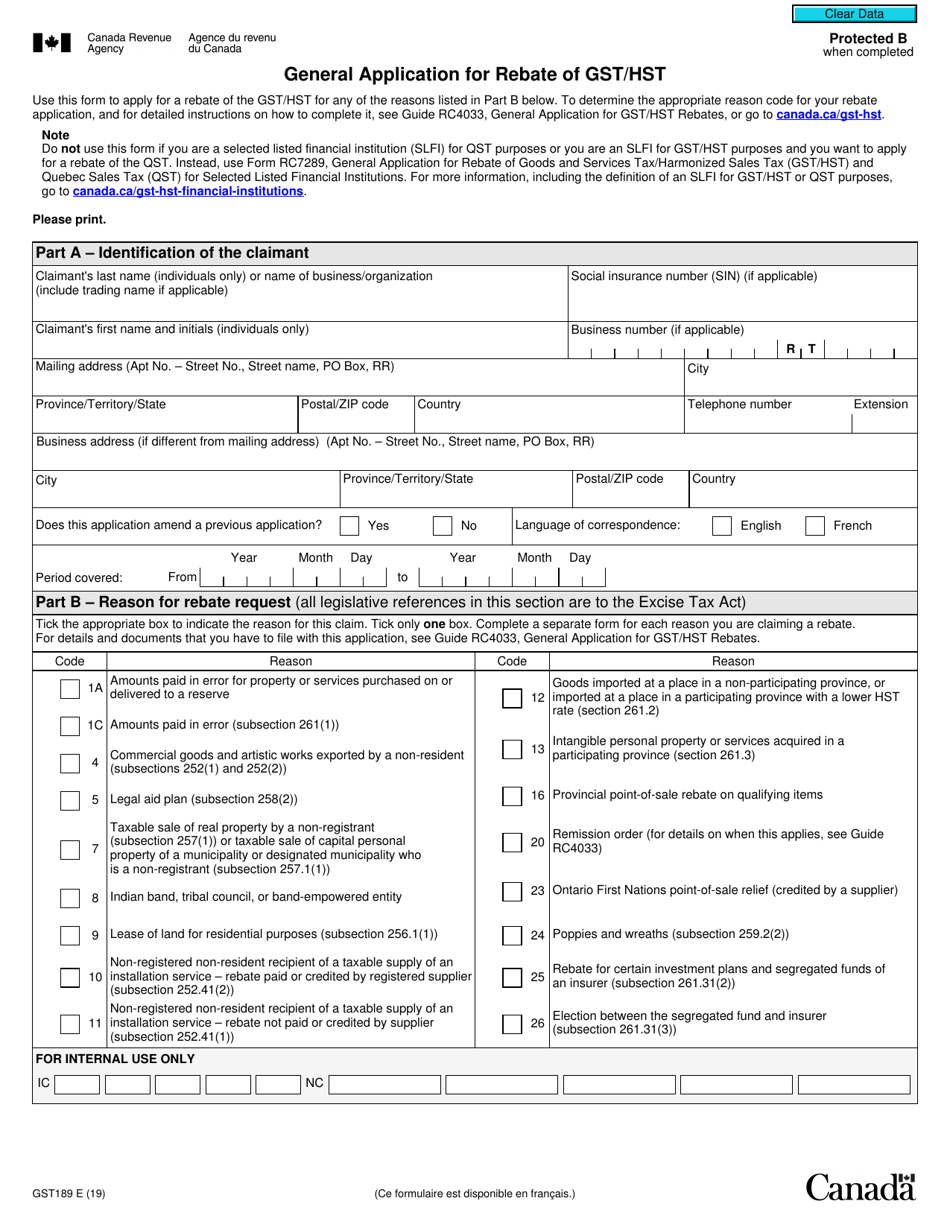

Web 16 f 233 vr 2021 nbsp 0183 32 GST189 General Application for GST HST Rebates For best results download and open this form in Adobe Reader See General information for details You

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

Cash Gst Rebate Forms For Charities

Cash Gst Rebate Forms For Charities are a simple type of Gst Rebate Forms For Charities. Customers receive a certain amount back in cash after purchasing a item. This is often for high-ticket items like electronics or appliances.

Mail-In Gst Rebate Forms For Charities

Mail-in Gst Rebate Forms For Charities require the customer to send in documents of purchase to claim their refund. They're somewhat more involved, but offer huge savings.

Instant Gst Rebate Forms For Charities

Instant Gst Rebate Forms For Charities apply at the point of sale, reducing the purchase price immediately. Customers do not have to wait for their savings when they purchase this type of Gst Rebate Forms For Charities.

How Gst Rebate Forms For Charities Work

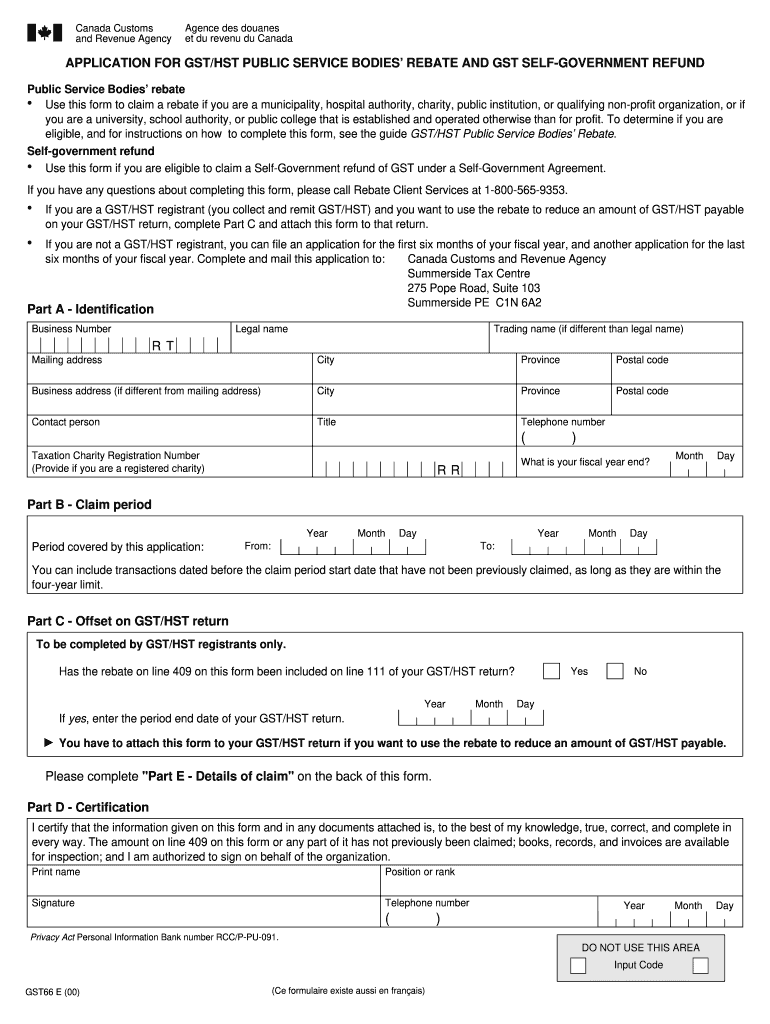

2000 Form Canada GST66 E Fill Online Printable Fillable Blank

2000 Form Canada GST66 E Fill Online Printable Fillable Blank

Web Calculate the rebate of the GST The non creditable GST charged is 800 800 0 see How to calculate non creditable tax charged The GST rebate factor for charities is

The Gst Rebate Forms For Charities Process

The procedure usually involves a few steps:

-

Buy the product: Firstly you purchase the item just like you normally would.

-

Complete your Gst Rebate Forms For Charities application: In order to claim your Gst Rebate Forms For Charities, you'll have to supply some details including your name, address and purchase details, to be eligible for a Gst Rebate Forms For Charities.

-

Complete the Gst Rebate Forms For Charities If you want to submit the Gst Rebate Forms For Charities, based on the type of Gst Rebate Forms For Charities you might need to mail a Gst Rebate Forms For Charities form in or upload it online.

-

Wait for the company's approval: They will scrutinize your submission to make sure that it's in accordance with the rules and regulations of the Gst Rebate Forms For Charities.

-

Accept your Gst Rebate Forms For Charities: Once approved, the amount you receive will be whether by check, prepaid card, or other option specified by the offer.

Pros and Cons of Gst Rebate Forms For Charities

Advantages

-

Cost savings: Gst Rebate Forms For Charities can significantly lower the cost you pay for a product.

-

Promotional Offers: They encourage customers in trying new products or brands.

-

Help to Increase Sales Gst Rebate Forms For Charities can enhance an organization's sales and market share.

Disadvantages

-

Complexity Gst Rebate Forms For Charities that are mail-in, in particular they can be time-consuming and demanding.

-

Day of Expiration A lot of Gst Rebate Forms For Charities have strict time limits for submission.

-

Risque of Non-Payment: Some customers may not get their Gst Rebate Forms For Charities if they do not adhere to the guidelines precisely.

Download Gst Rebate Forms For Charities

Download Gst Rebate Forms For Charities

FAQs

1. Are Gst Rebate Forms For Charities the same as discounts? No, Gst Rebate Forms For Charities require a partial refund upon purchase, while discounts lower the cost of purchase at moment of sale.

2. Are there multiple Gst Rebate Forms For Charities I can get on the same product This is dependent on conditions of the Gst Rebate Forms For Charities offered and product's ability to qualify. Some companies may allow it, but others won't.

3. How long does it take to get an Gst Rebate Forms For Charities? The duration will differ, but can take several weeks to a few months for you to receive your Gst Rebate Forms For Charities.

4. Do I need to pay taxes with respect to Gst Rebate Forms For Charities the amount? most situations, Gst Rebate Forms For Charities amounts are not considered to be taxable income.

5. Do I have confidence in Gst Rebate Forms For Charities deals from lesser-known brands It's crucial to research and confirm that the brand offering the Gst Rebate Forms For Charities is reputable prior making the purchase.

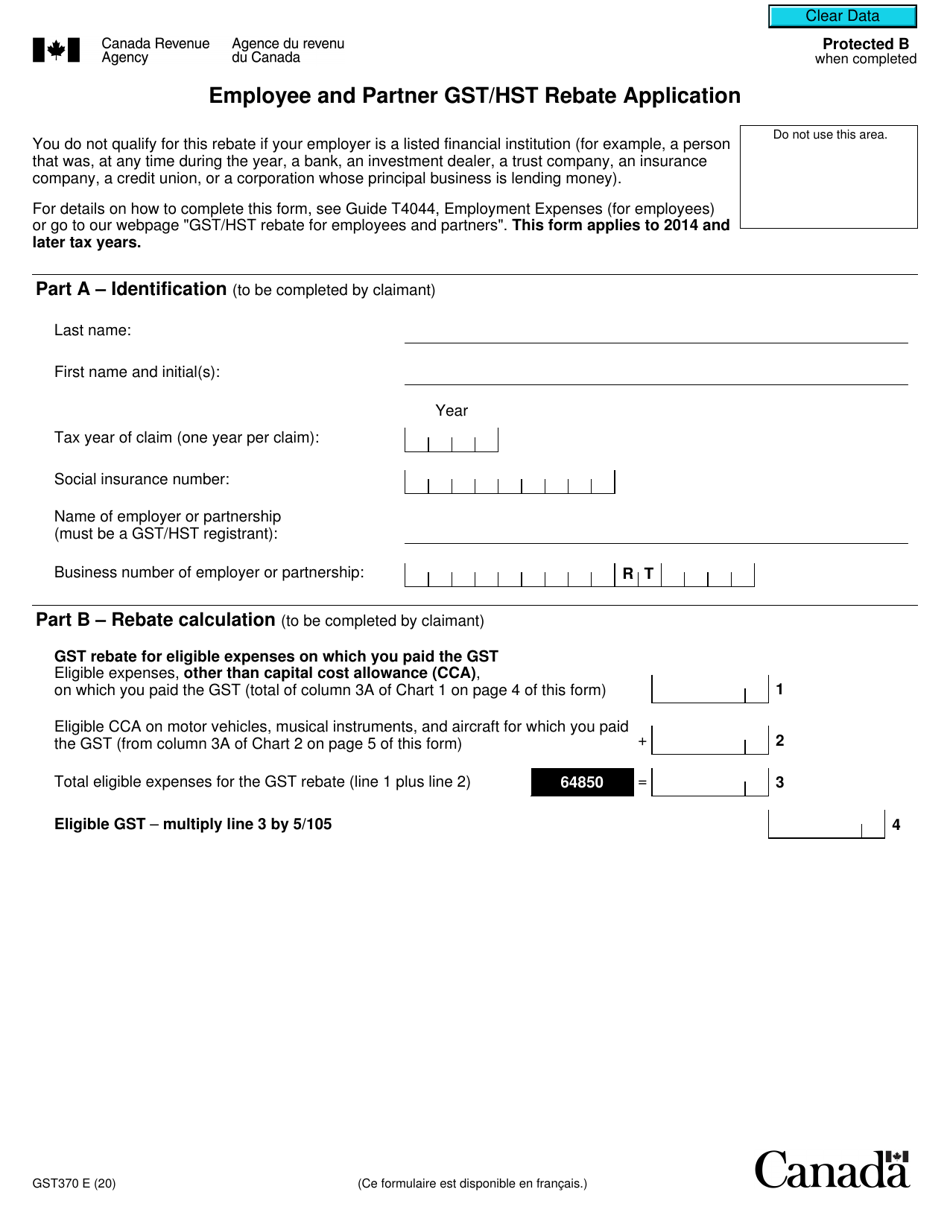

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Gst66 E Fill Out Sign Online DocHub

Check more sample of Gst Rebate Forms For Charities below

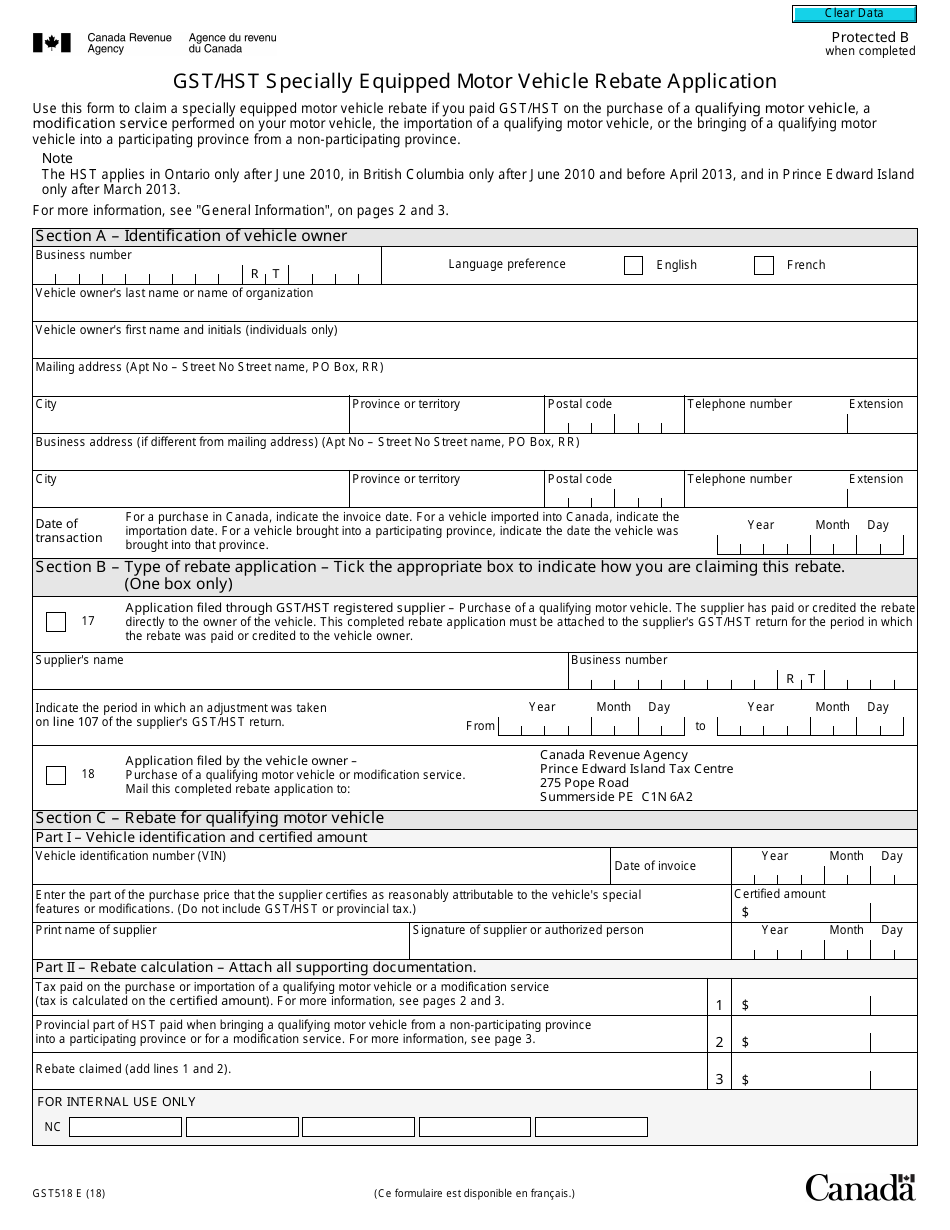

Form GST518 Download Fillable PDF Or Fill Online Gst Hst Specially

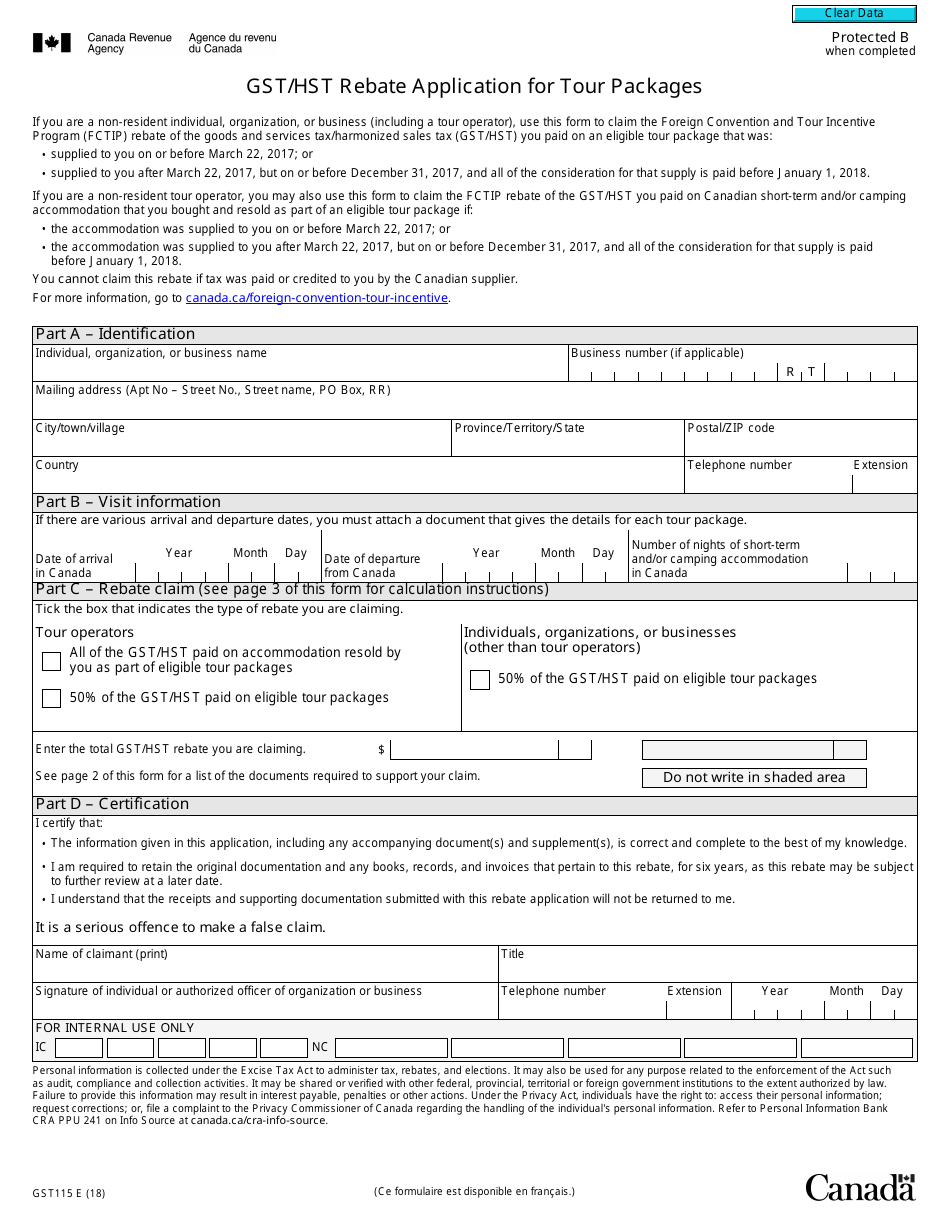

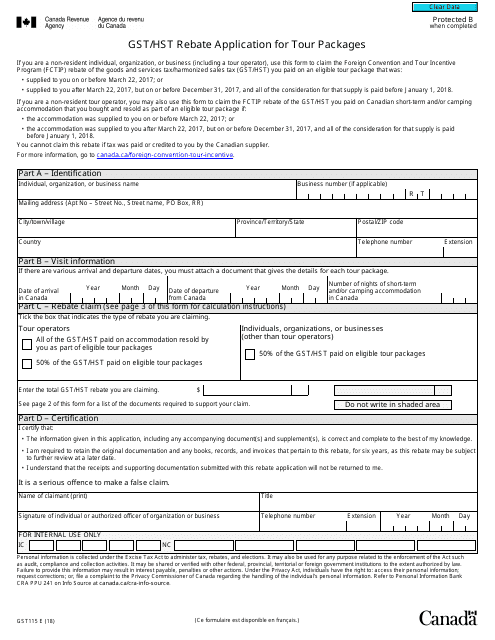

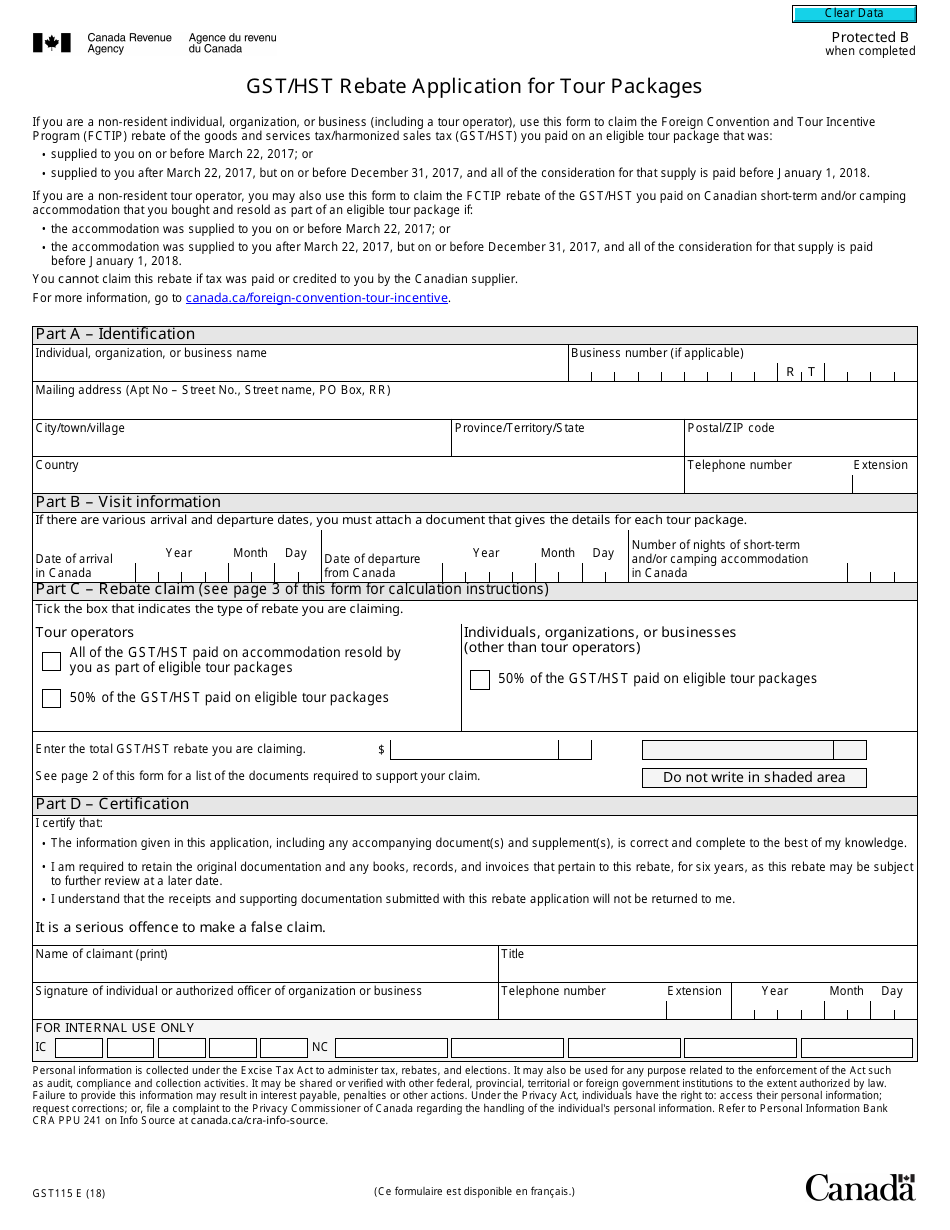

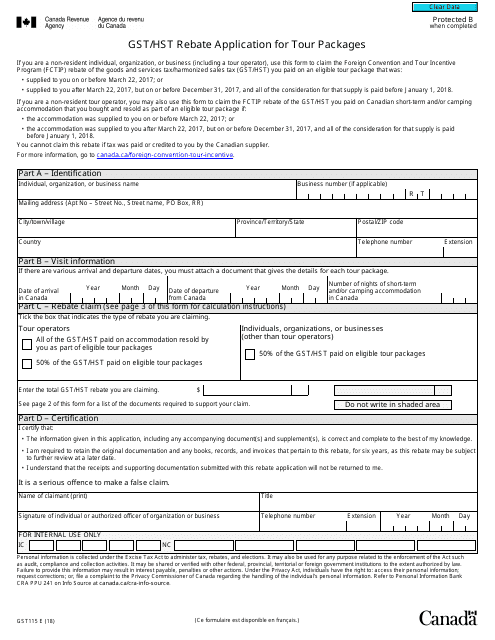

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Gst Rebate Canada Fill Out And Sign Printable PDF Template SignNow

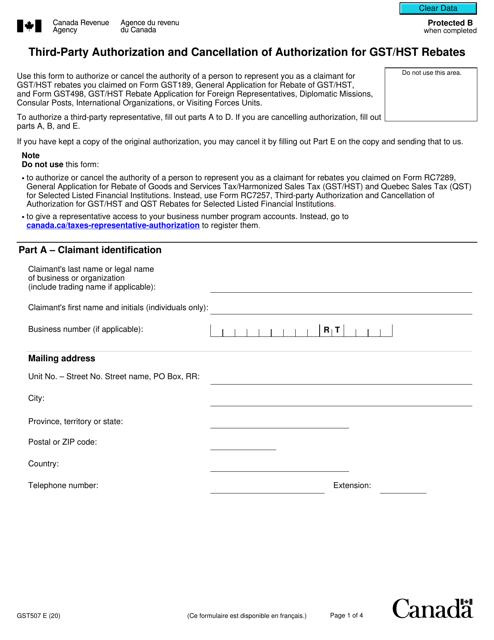

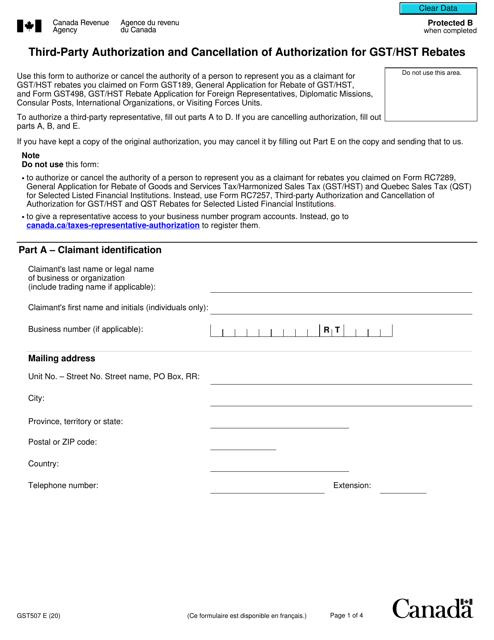

Form GST507 Download Fillable PDF Or Fill Online Third Party

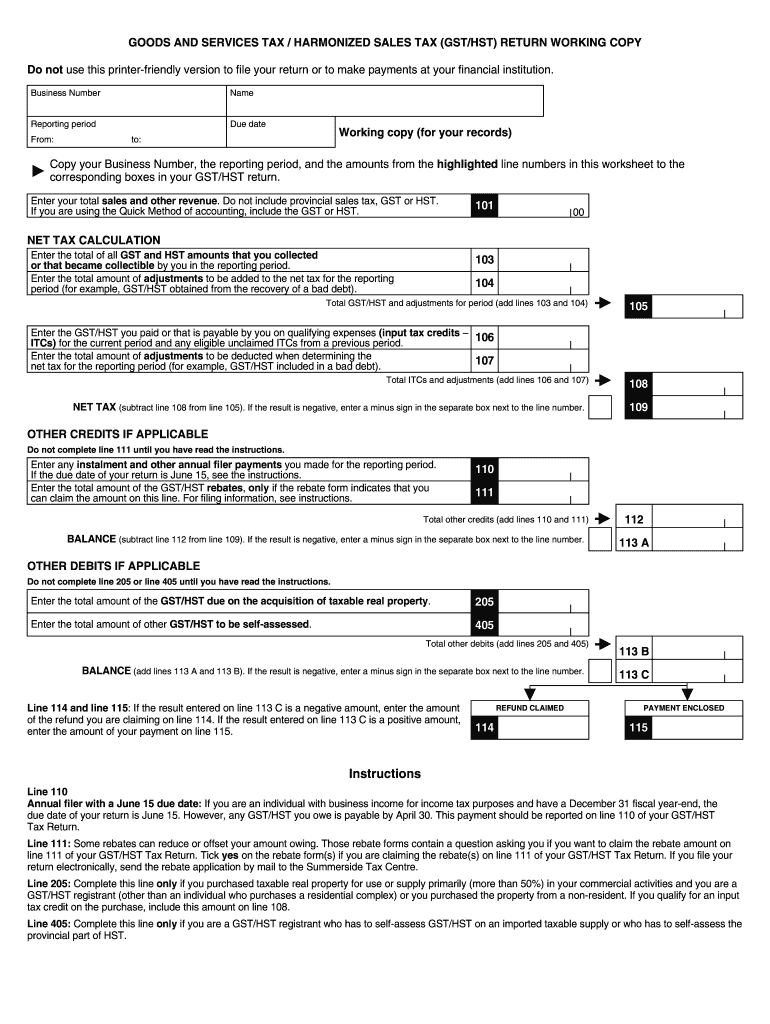

Business Gst Remittance Form Santos Czerwinski s Template

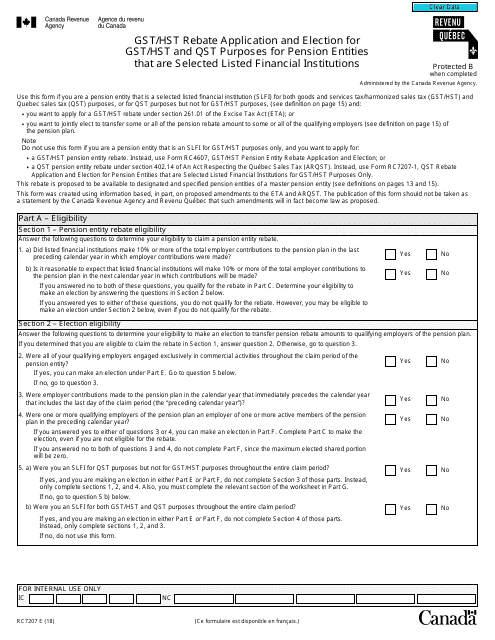

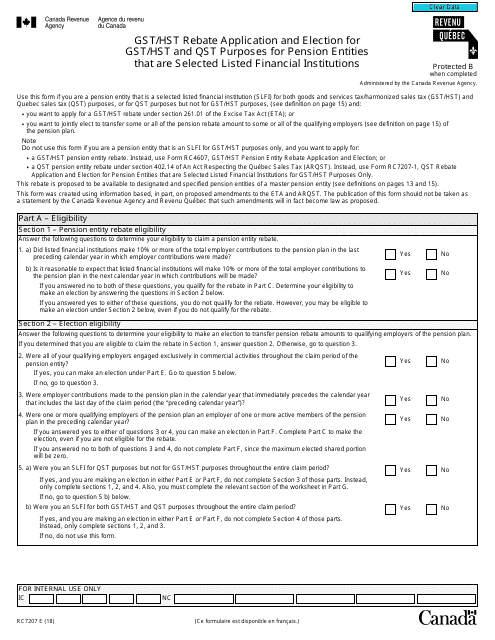

Form R7207 Download Fillable PDF Or Fill Online Gst Hst Rebate

https://www.canada.ca/.../gi-066/a-charity-completes-gst-hst-return.html

Web A charity is entitled to claim a public service bodies rebate to recover a percentage of the GST HST paid or payable on eligible purchases and expenses for which it cannot claim

https://www.canada.ca/.../gst-hst-rebates/public-service-bodies.html

Web 30 juin 2021 nbsp 0183 32 PSB rebate eligibility You may be able to claim the public service bodies rebate PSB rebate of the GST or the federal part of the HST paid or payable on

Web A charity is entitled to claim a public service bodies rebate to recover a percentage of the GST HST paid or payable on eligible purchases and expenses for which it cannot claim

Web 30 juin 2021 nbsp 0183 32 PSB rebate eligibility You may be able to claim the public service bodies rebate PSB rebate of the GST or the federal part of the HST paid or payable on

Form GST507 Download Fillable PDF Or Fill Online Third Party

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Business Gst Remittance Form Santos Czerwinski s Template

Form R7207 Download Fillable PDF Or Fill Online Gst Hst Rebate

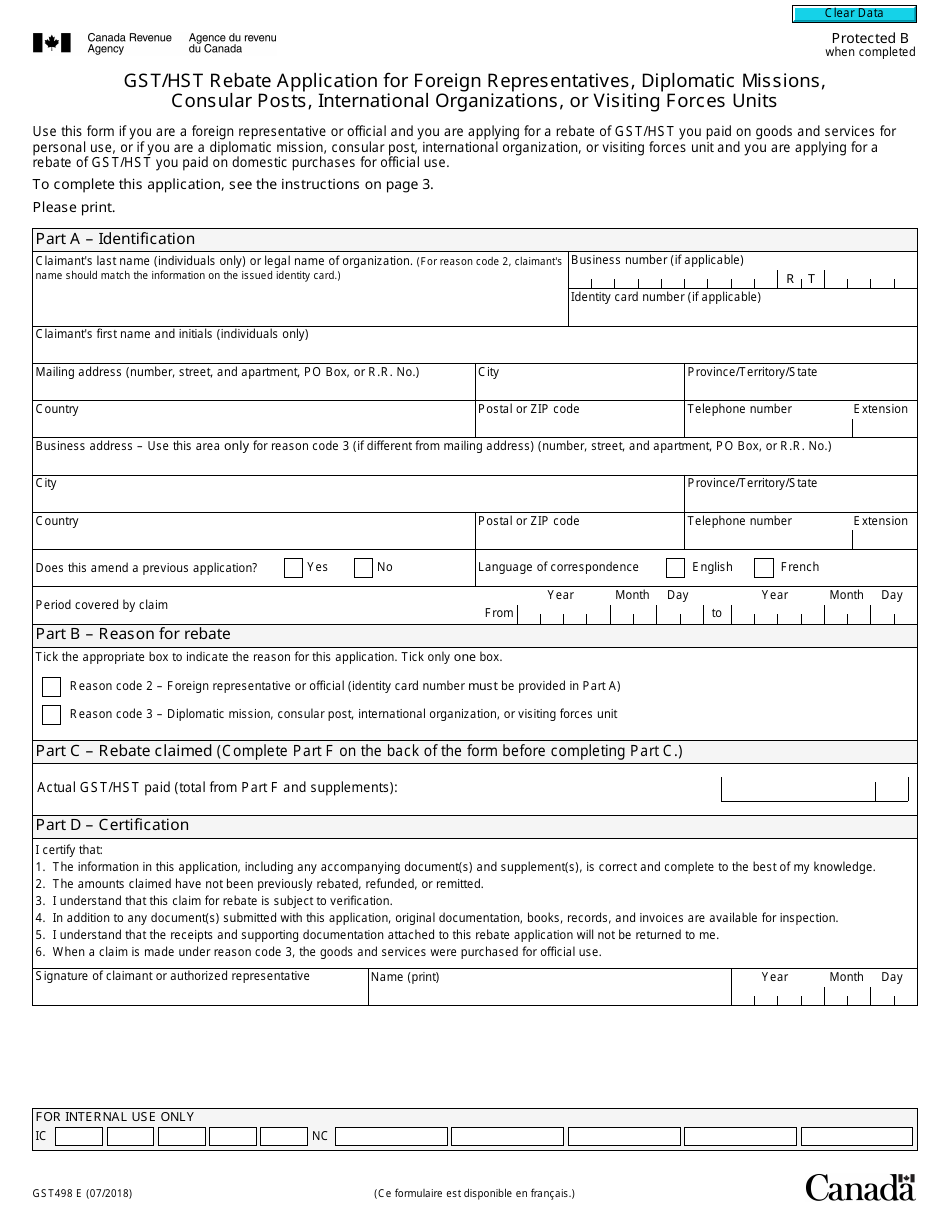

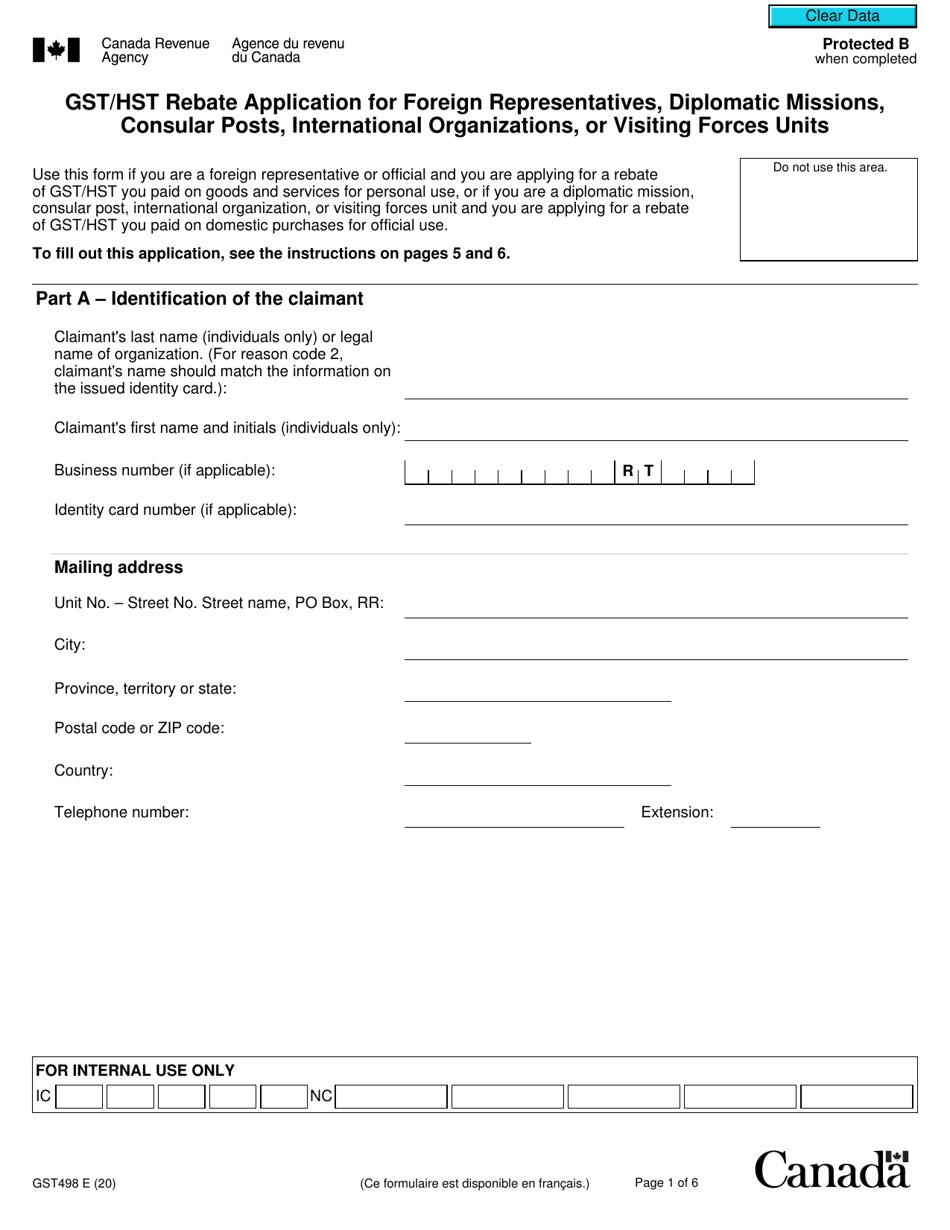

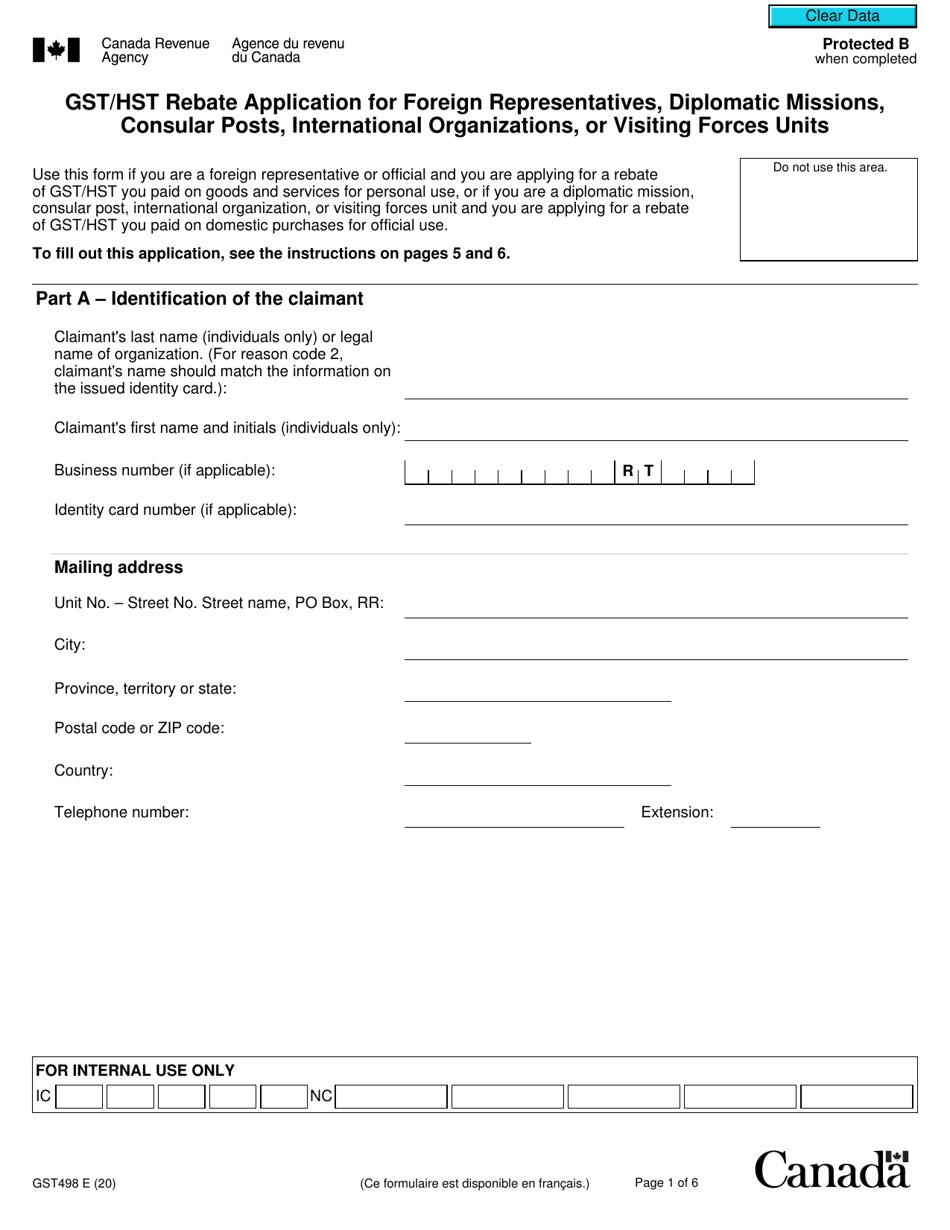

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Gst Fillable Form Printable Forms Free Online