In the modern world of consumerization everyone is looking for a great deal. One way to make significant savings in your purchase is through Gst Rebate Form Albertas. The use of Gst Rebate Form Albertas is a method used by manufacturers and retailers to provide customers with a portion of a payment on their purchases, after they have made them. In this article, we'll go deeper into the realm of Gst Rebate Form Albertas, exploring what they are, how they work, and how you can maximise your savings via these cost-effective incentives.

Get Latest Gst Rebate Form Alberta Below

Gst Rebate Form Alberta

Gst Rebate Form Alberta -

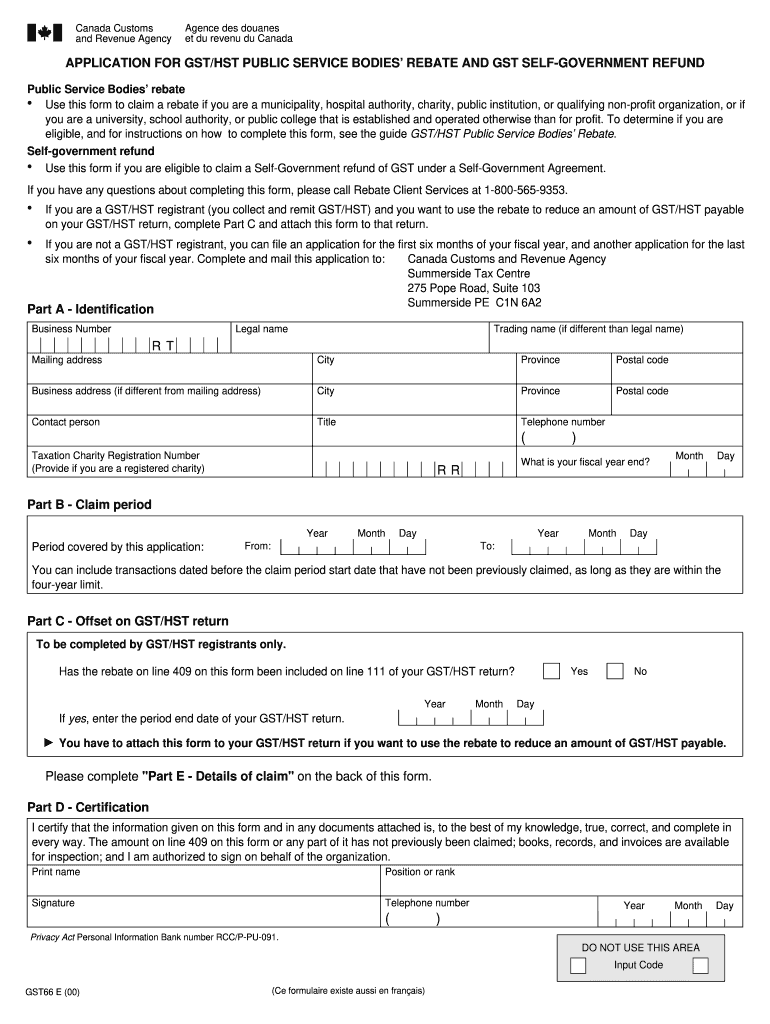

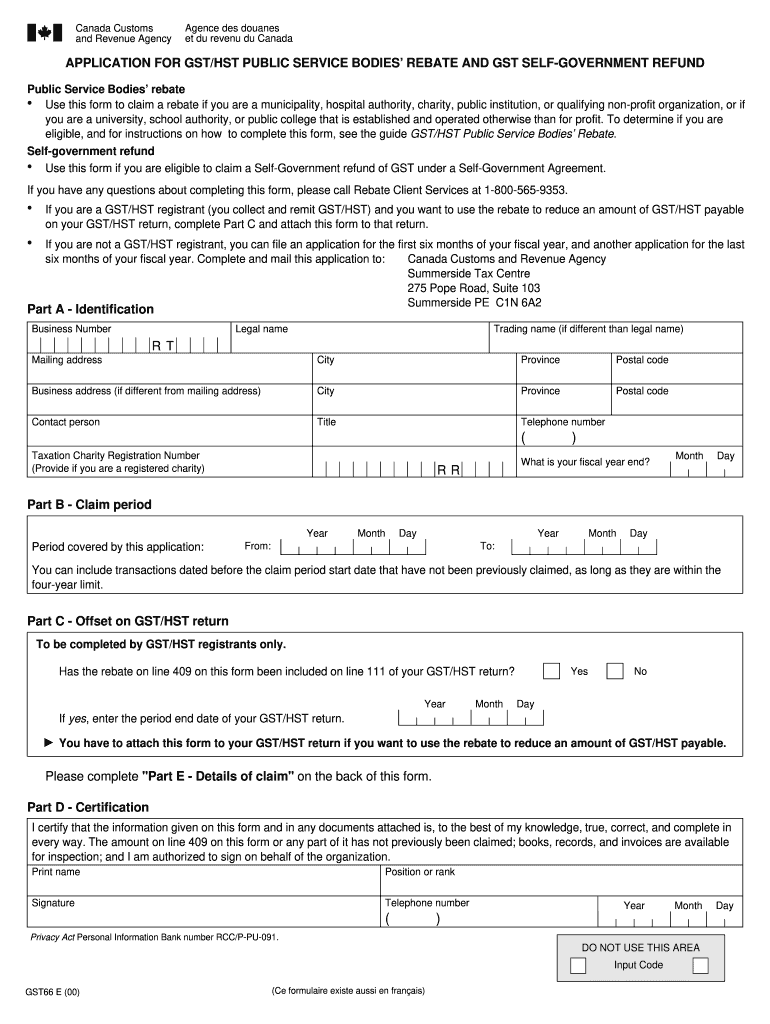

Web Forms GST66 and GST284 Application for GST HST Public Service Bodies Rebate and GST Self Government Refund can be sent to us quickly and easily using our web form

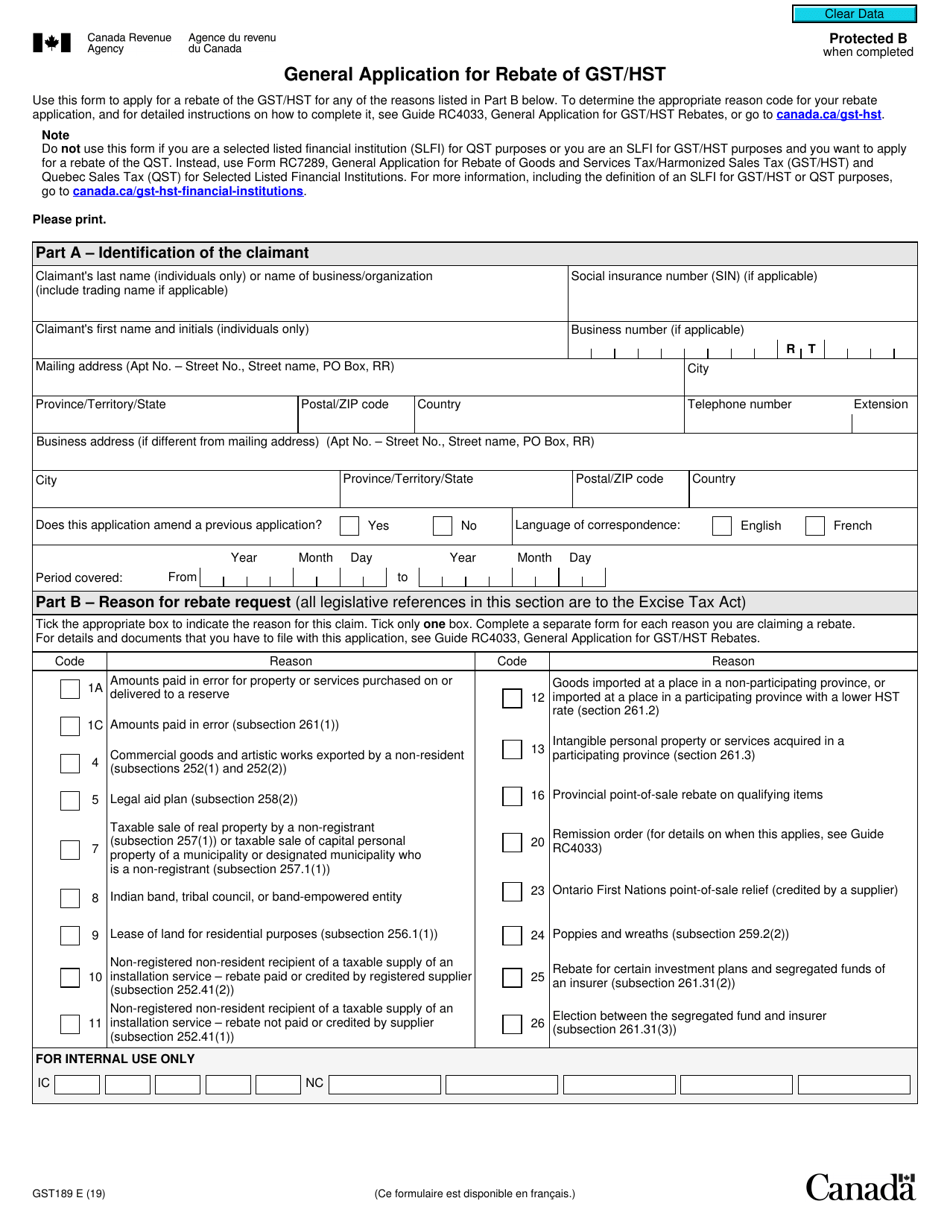

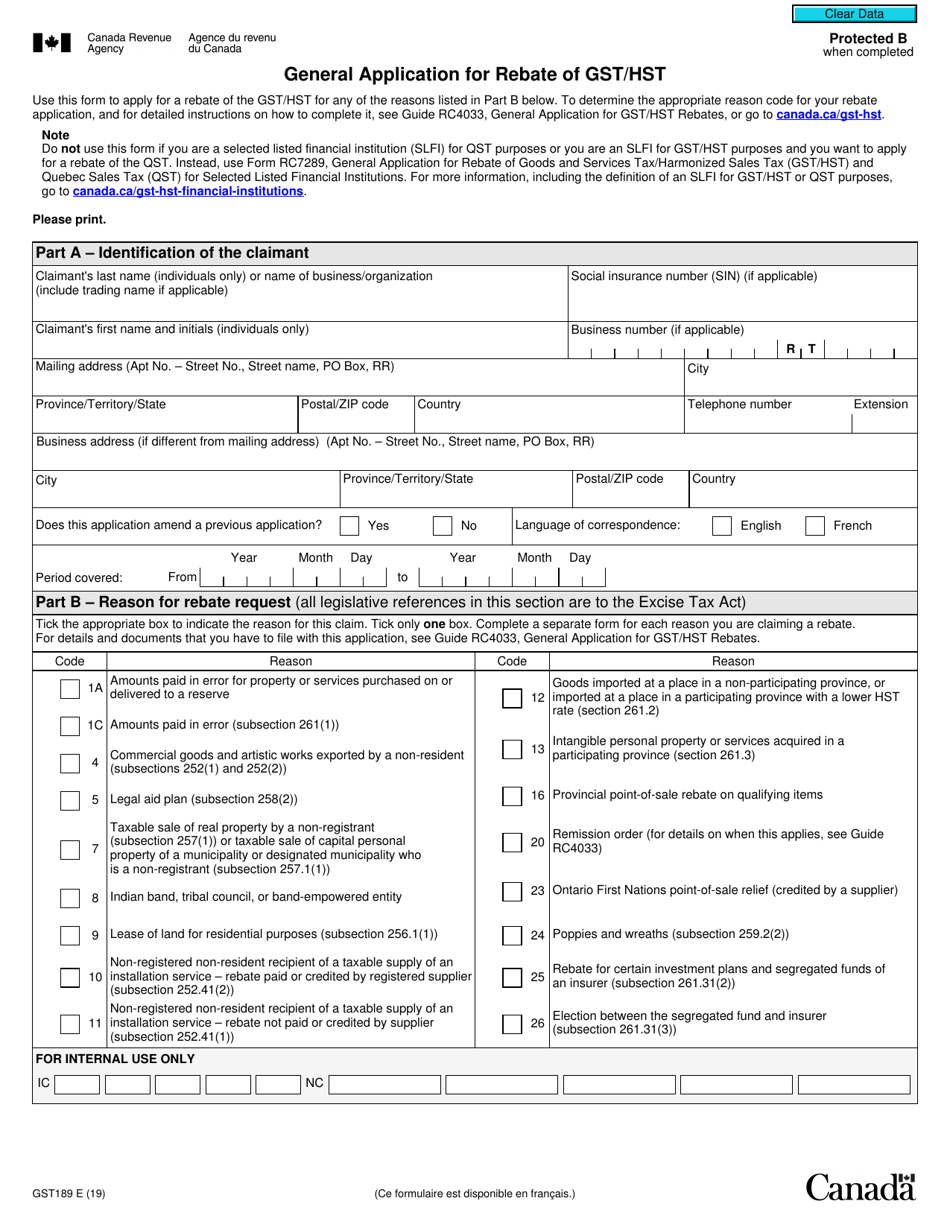

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

A Gst Rebate Form Alberta is, in its most basic model, refers to a partial refund to a purchaser after they've bought a product or service. It's a powerful method employed by companies to attract customers, increase sales and promote specific products.

Types of Gst Rebate Form Alberta

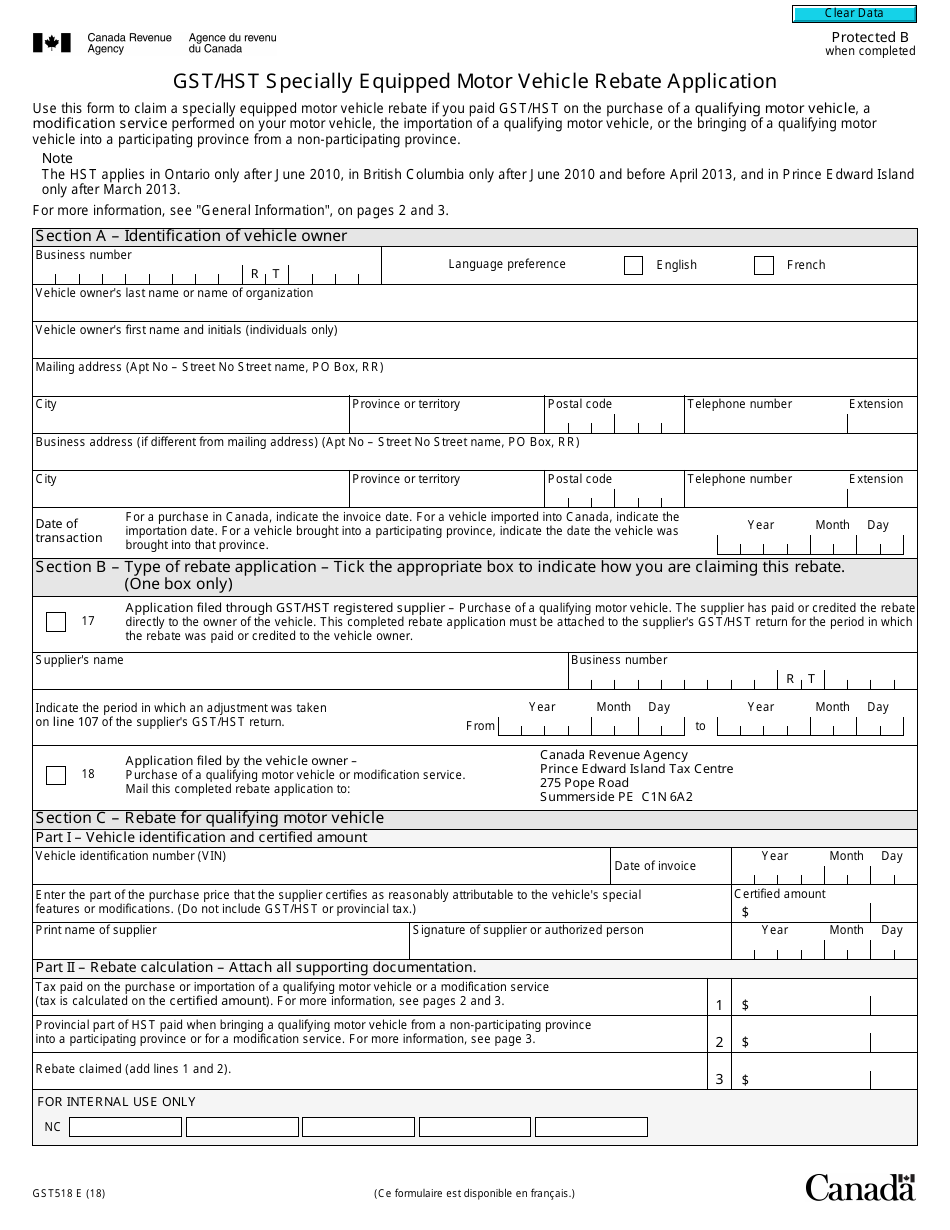

Form GST189 Download Fillable PDF Or Fill Online General Application

Form GST189 Download Fillable PDF Or Fill Online General Application

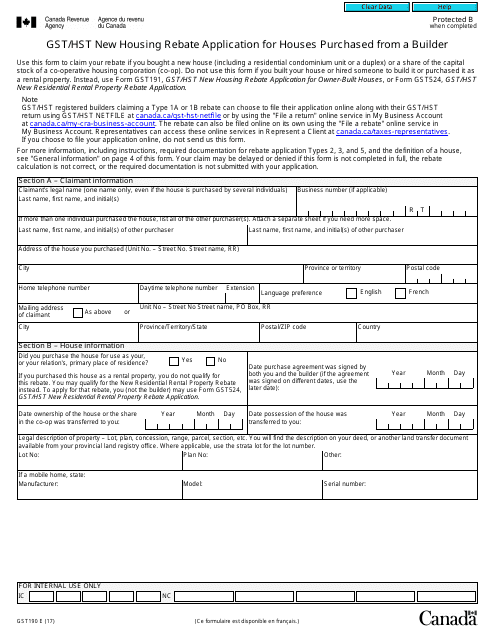

Web Definitions Important terms Determining if you are a builder for GST HST purposes Determining what is considered a house for purposes of the new housing rebate

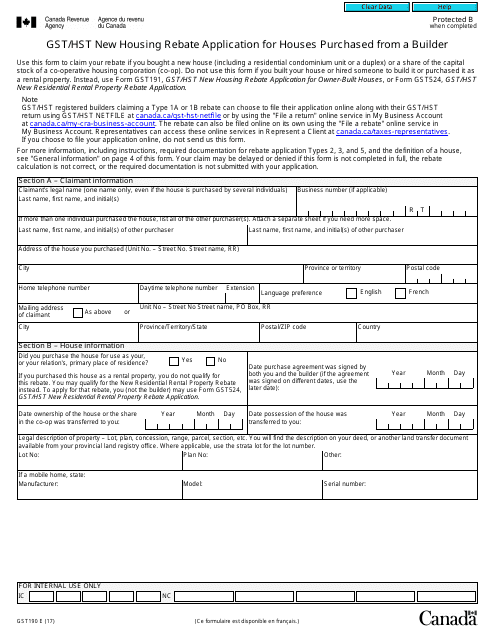

Web 5 juil 2022 nbsp 0183 32 GST190 GST HST New Housing Rebate Application for Houses Purchased from a Builder For best results download and open this form in Adobe Reader See

Cash Gst Rebate Form Alberta

Cash Gst Rebate Form Alberta are the simplest kind of Gst Rebate Form Alberta. Customers receive a certain amount of money back upon purchasing a product. They are typically used to purchase big-ticket items, like electronics and appliances.

Mail-In Gst Rebate Form Alberta

Mail-in Gst Rebate Form Alberta demand that customers present documents of purchase to claim their reimbursement. They're somewhat more complicated but could provide substantial savings.

Instant Gst Rebate Form Alberta

Instant Gst Rebate Form Alberta are applied at the point of sale and reduce the price of purchases immediately. Customers do not have to wait for savings when they purchase this type of Gst Rebate Form Alberta.

How Gst Rebate Form Alberta Work

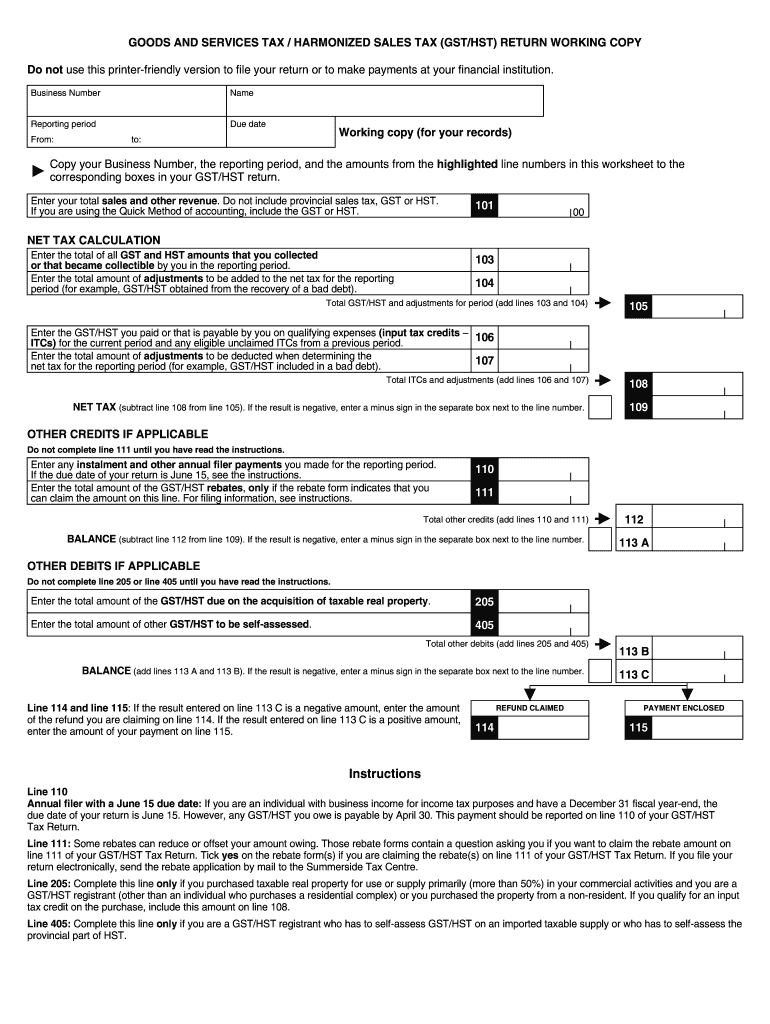

Tax Gst Return Fill Online Printable Fillable Blank PdfFiller

Tax Gst Return Fill Online Printable Fillable Blank PdfFiller

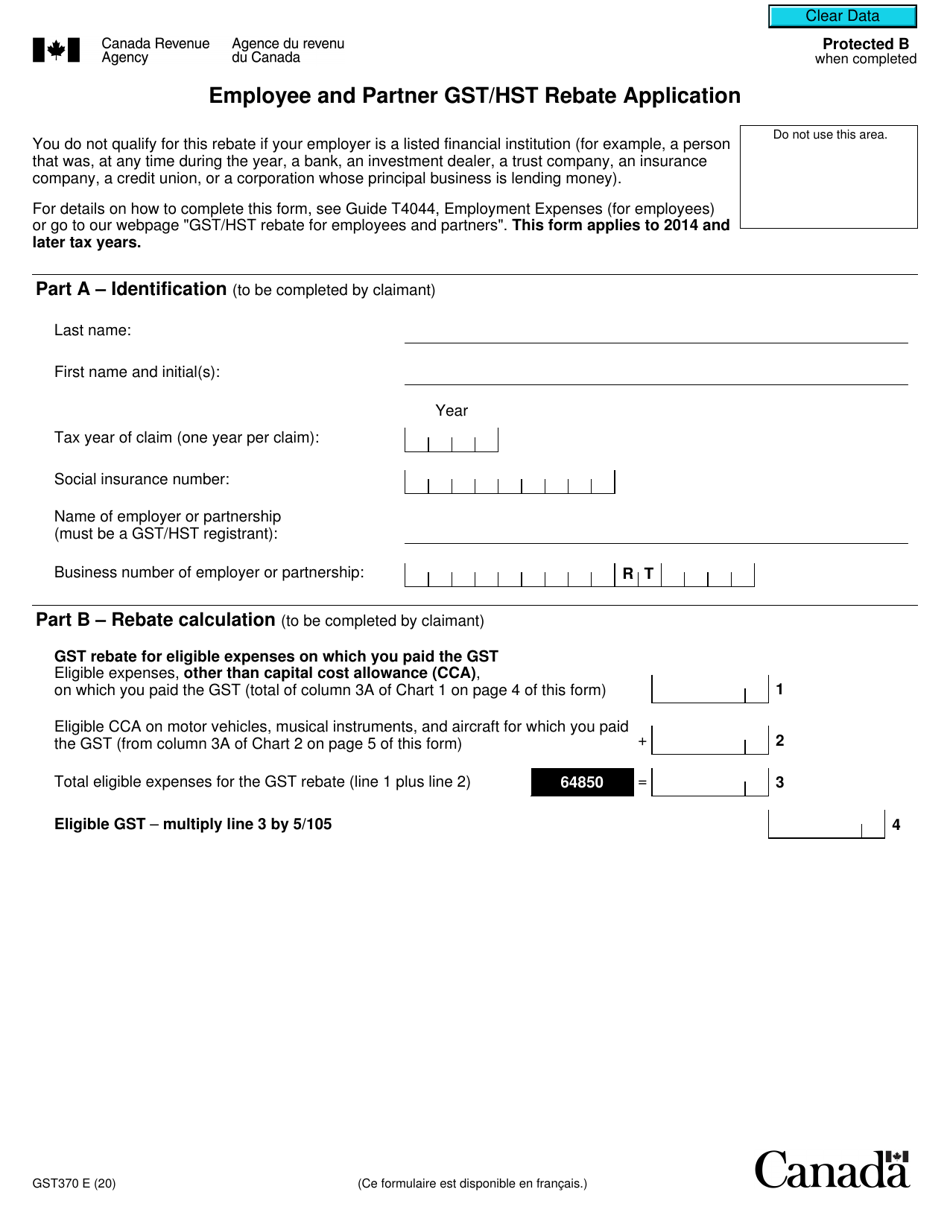

Web Overview How the GST HST rebate affects your income tax Rebate eligibility Expenses that are eligible for the rebate Information you need to fill out Form GST370 How to fill

The Gst Rebate Form Alberta Process

The process typically involves a couple of steps that are easy to follow:

-

Purchase the product: First you buy the product exactly as you would normally.

-

Fill out this Gst Rebate Form Alberta form: You'll need to provide some data including your address, name, and purchase details, in order to apply for your Gst Rebate Form Alberta.

-

Send in the Gst Rebate Form Alberta It is dependent on the kind of Gst Rebate Form Alberta the recipient may be required to fill out a form and mail it in or make it available online.

-

Wait for approval: The business will review your request to verify that it is compliant with the refund's conditions and terms.

-

You will receive your Gst Rebate Form Alberta After you've been approved, you'll receive the refund through a check, or a prepaid card, or a different option specified by the offer.

Pros and Cons of Gst Rebate Form Alberta

Advantages

-

Cost Savings The use of Gst Rebate Form Alberta can greatly lower the cost you pay for products.

-

Promotional Offers The aim is to encourage customers to test new products or brands.

-

boost sales Gst Rebate Form Alberta can enhance an organization's sales and market share.

Disadvantages

-

Complexity Gst Rebate Form Alberta that are mail-in, in particular, can be cumbersome and demanding.

-

The Expiration Dates Many Gst Rebate Form Alberta are subject to specific deadlines for submission.

-

Risk of not receiving payment: Some customers may not receive Gst Rebate Form Alberta if they don't adhere to the rules exactly.

Download Gst Rebate Form Alberta

Download Gst Rebate Form Alberta

FAQs

1. Are Gst Rebate Form Alberta similar to discounts? Not at all, Gst Rebate Form Alberta provide only a partial reimbursement following the purchase, while discounts lower the cost of purchase at time of sale.

2. Can I make use of multiple Gst Rebate Form Alberta on the same item? It depends on the terms for the Gst Rebate Form Alberta deals and product's potential eligibility. Some companies may allow it, while other companies won't.

3. How long does it take to receive the Gst Rebate Form Alberta? The timing can vary, but typically it will take anywhere from a couple of weeks to a few months before you receive your Gst Rebate Form Alberta.

4. Do I need to pay taxes in relation to Gst Rebate Form Alberta amounts? In most circumstances, Gst Rebate Form Alberta amounts are not considered taxable income.

5. Do I have confidence in Gst Rebate Form Alberta offers from lesser-known brands You must research and verify that the brand giving the Gst Rebate Form Alberta is reputable prior to making an acquisition.

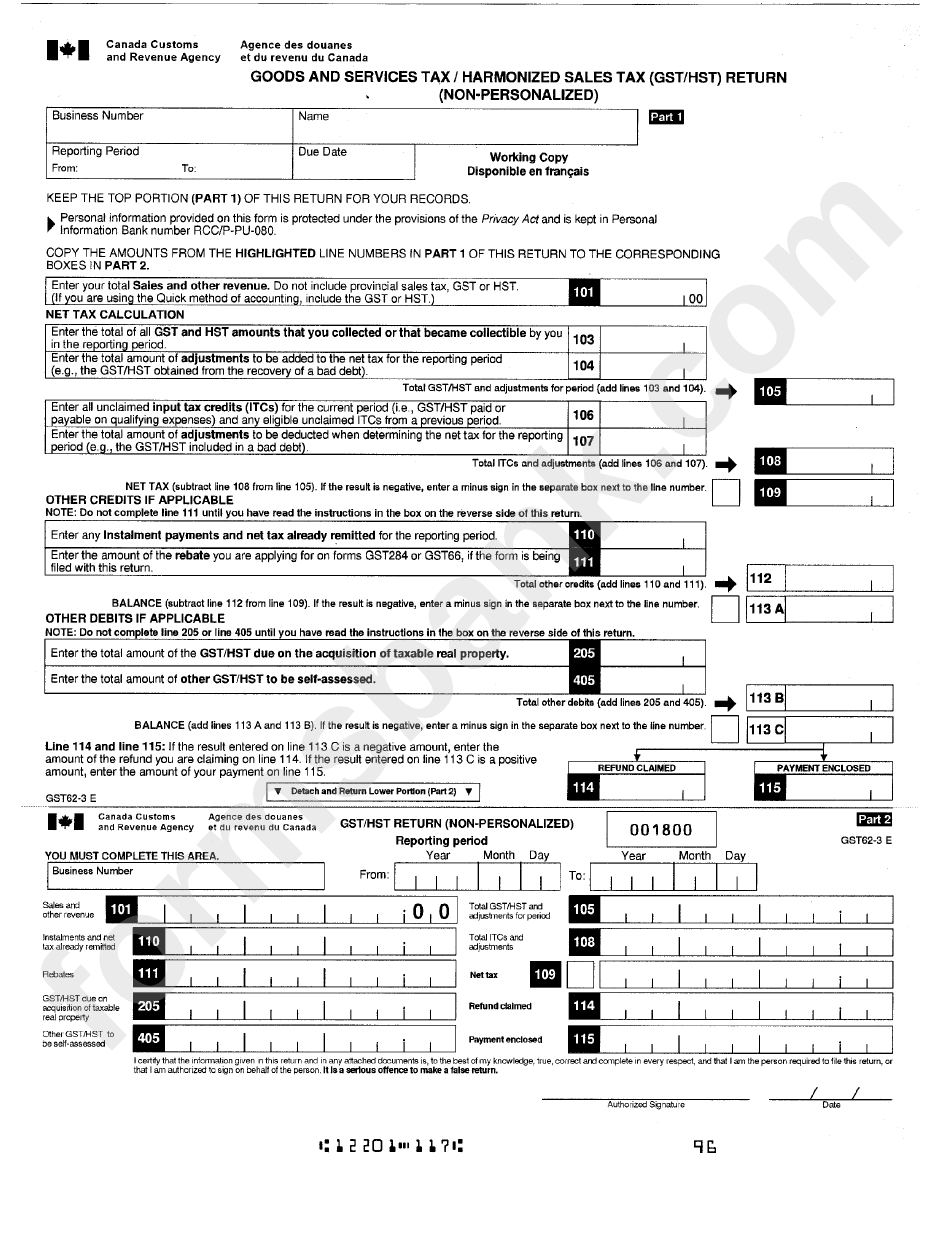

Cra Business Gst Return Form Charles Leal s Template

Gst Fillable Form Printable Forms Free Online

Check more sample of Gst Rebate Form Alberta below

Form Gst62 3 E Goods And Services Tax harmonized Sales Tax Gst hst

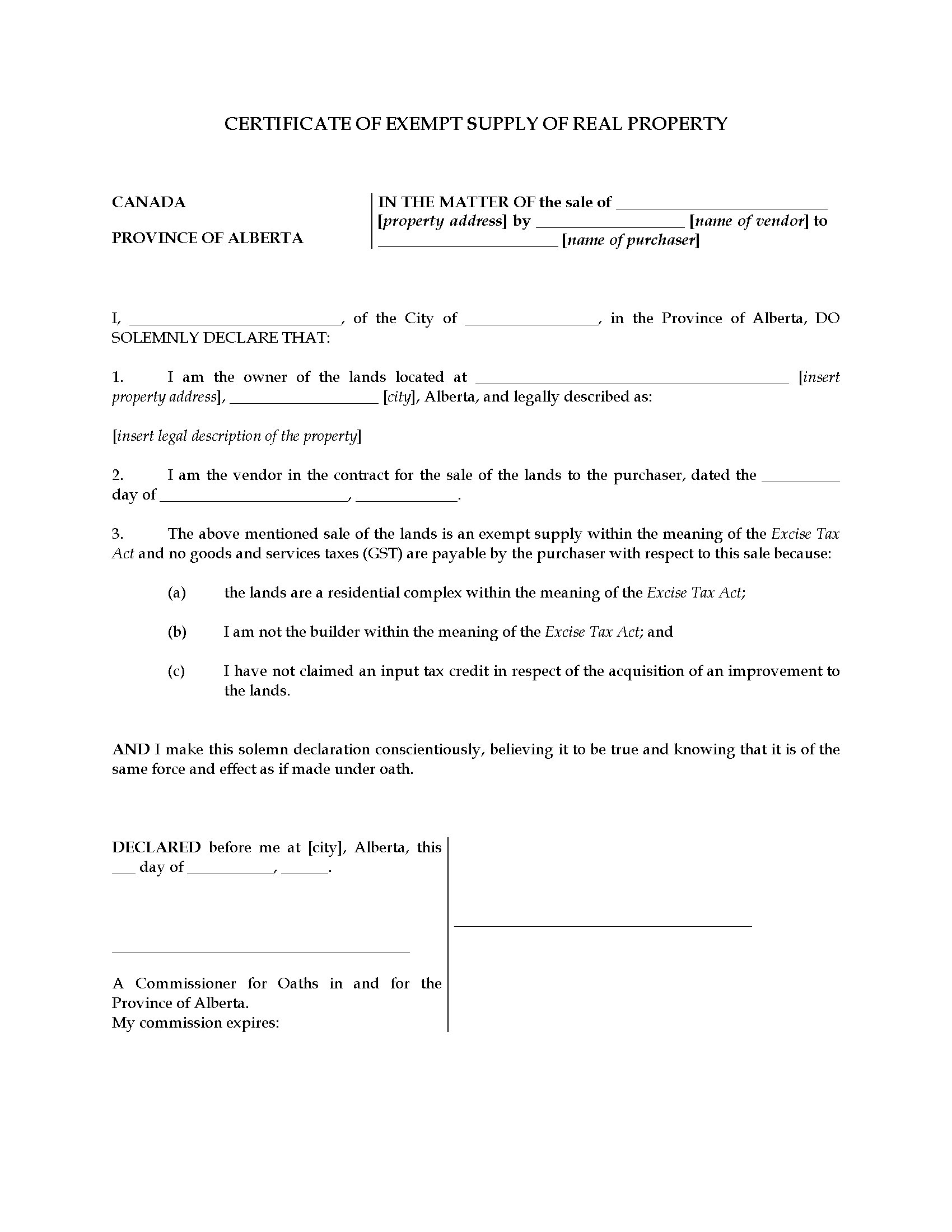

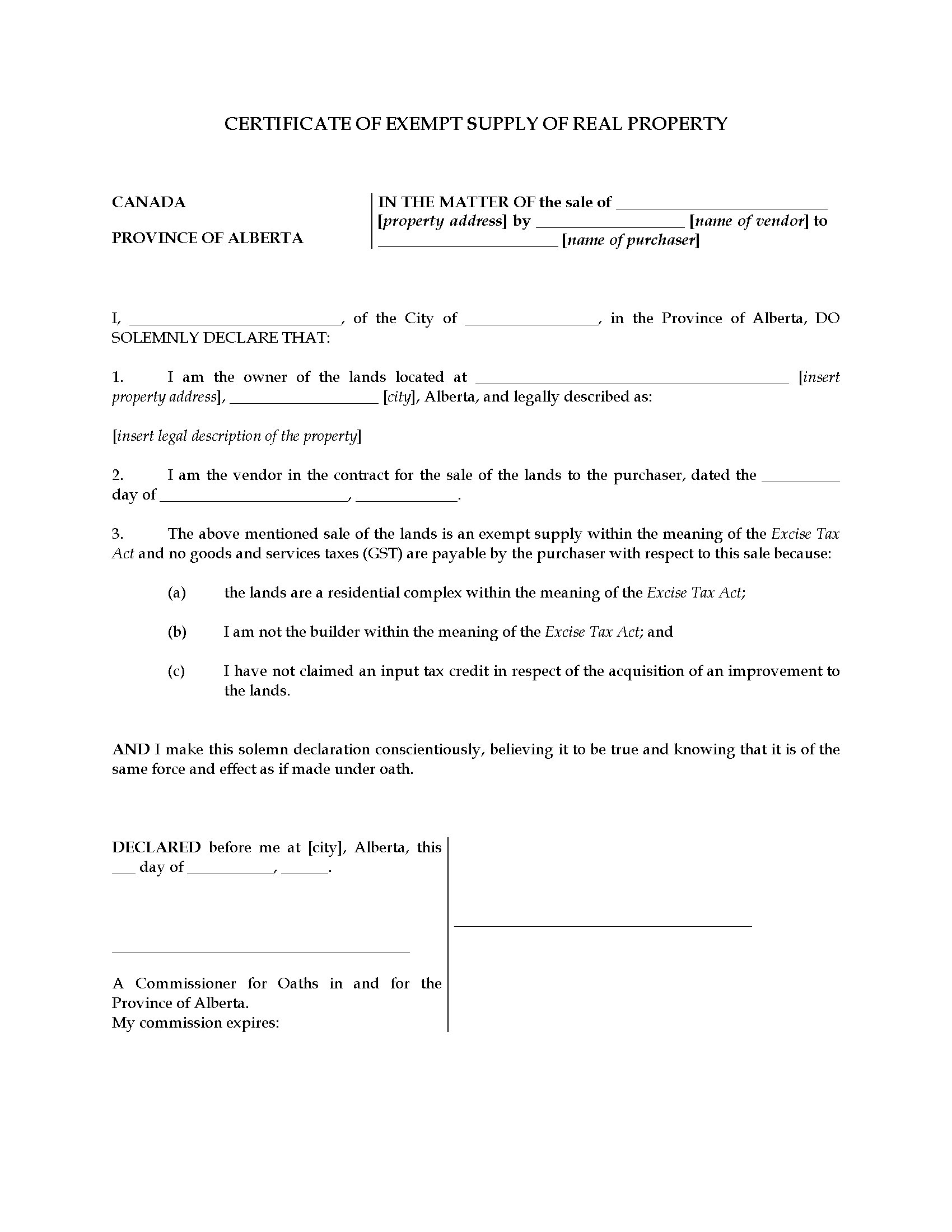

Alberta GST Exemption Certificate For Sale Of Real Property Legal

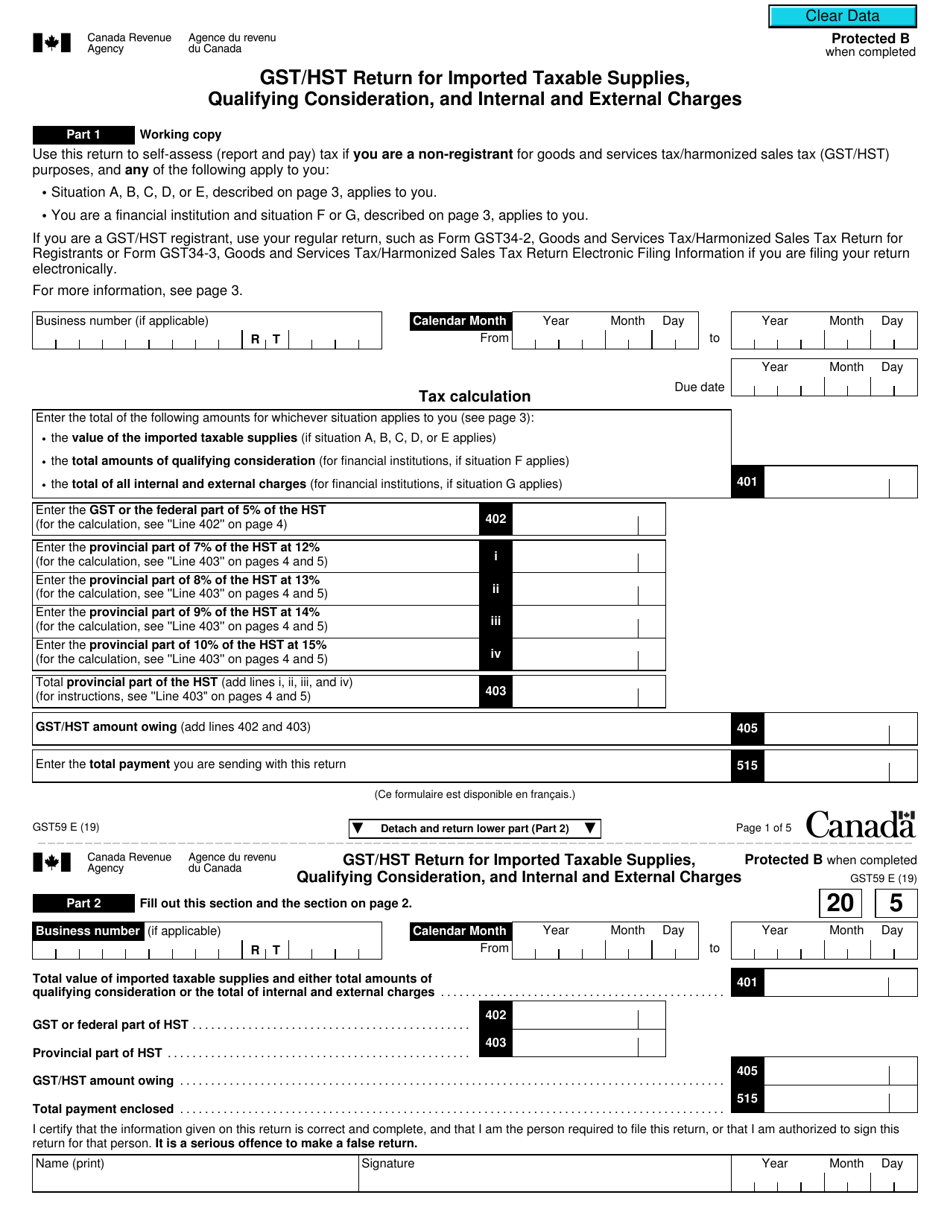

Gst Fillable Form Printable Forms Free Online

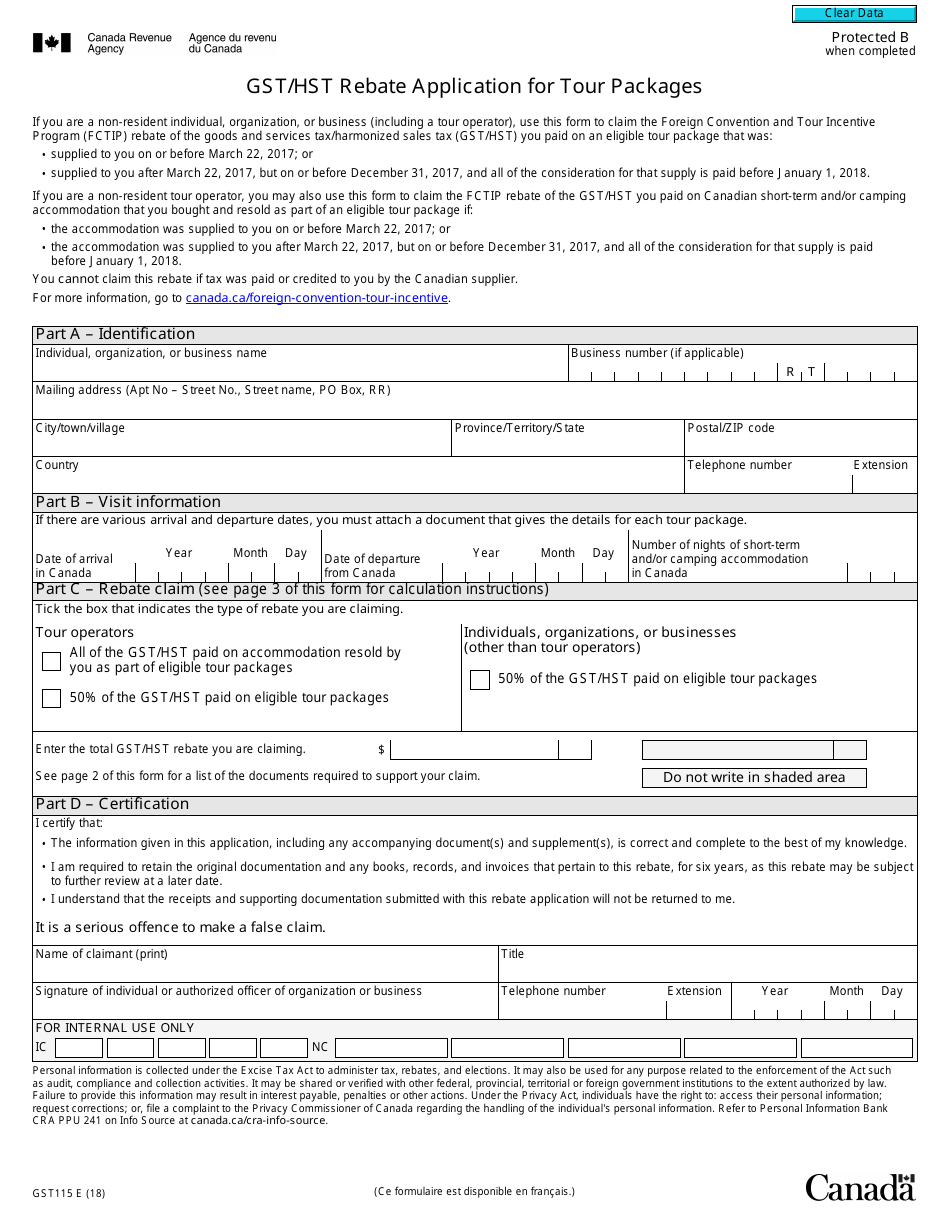

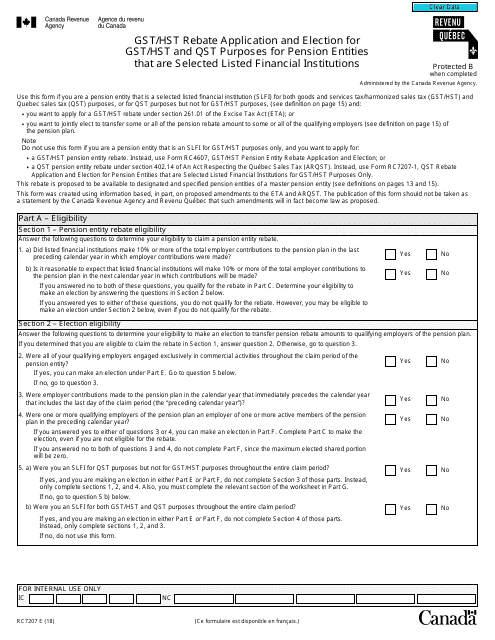

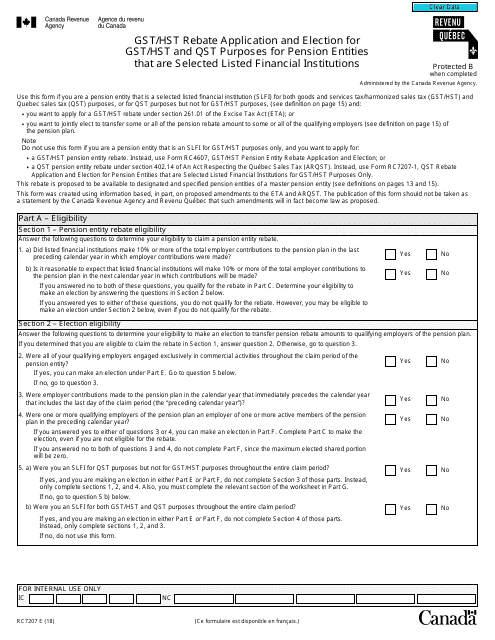

Form R7207 Download Fillable PDF Or Fill Online Gst Hst Rebate

2000 Form Canada GST66 E Fill Online Printable Fillable Blank

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

https://www.canada.ca/.../gst-hst-rebates/application.html

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

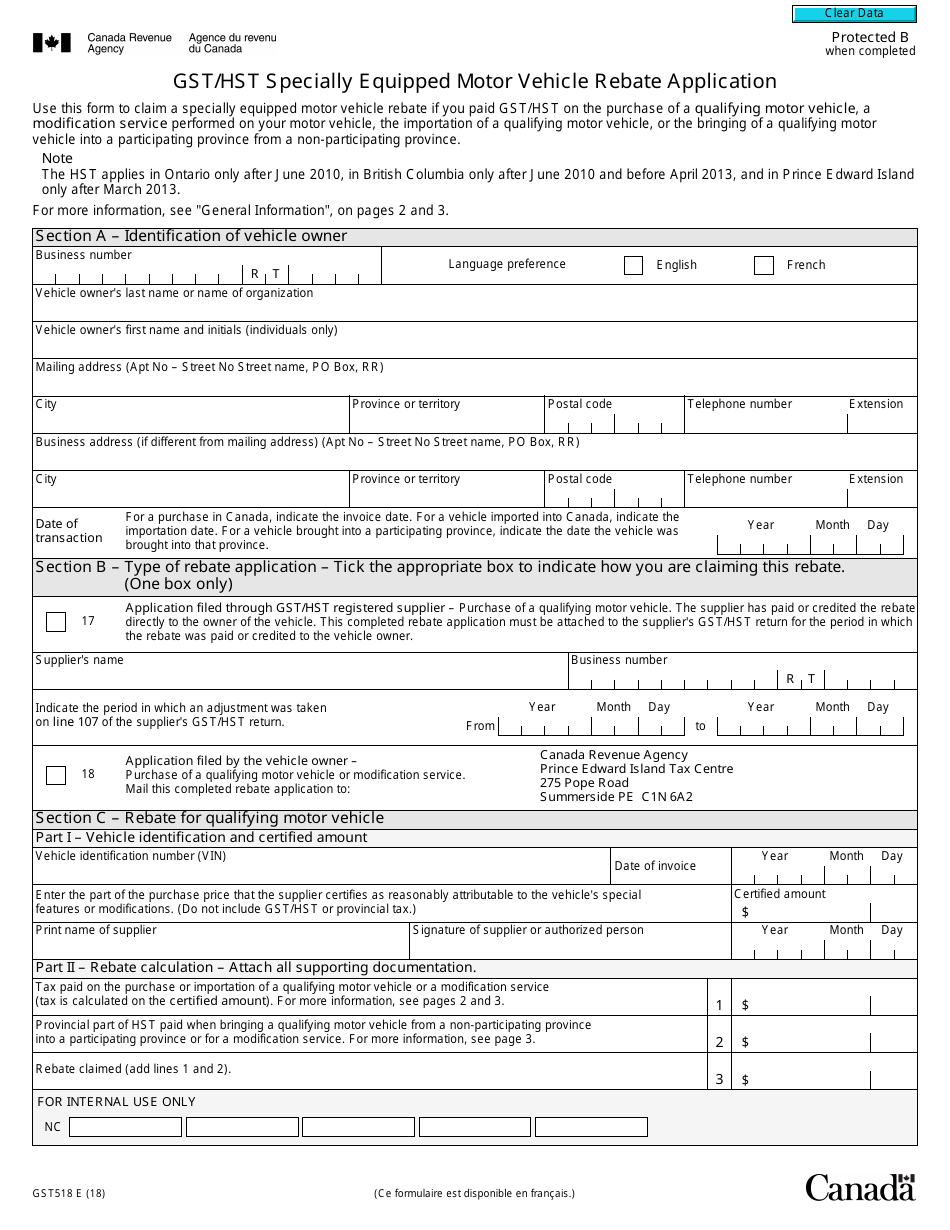

https://www.canada.ca/.../gst-hst-rebates/provincial-part-hst.html

Web Eligibility for a rebate of the provincial part of the HST for eligible specified motor vehicles Other rebates for the provincial part of the HST on imported goods or on services

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

Web Eligibility for a rebate of the provincial part of the HST for eligible specified motor vehicles Other rebates for the provincial part of the HST on imported goods or on services

Form R7207 Download Fillable PDF Or Fill Online Gst Hst Rebate

Alberta GST Exemption Certificate For Sale Of Real Property Legal

2000 Form Canada GST66 E Fill Online Printable Fillable Blank

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

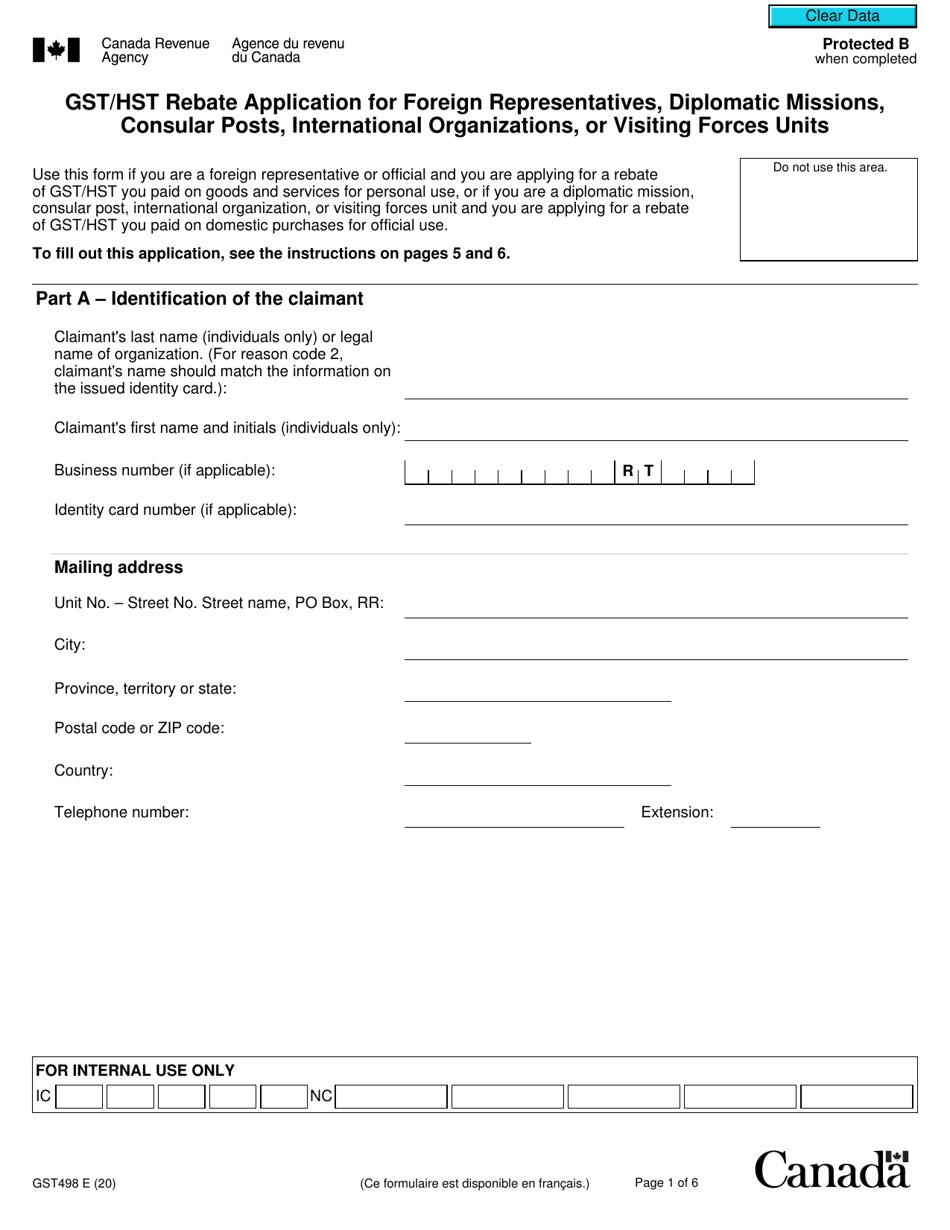

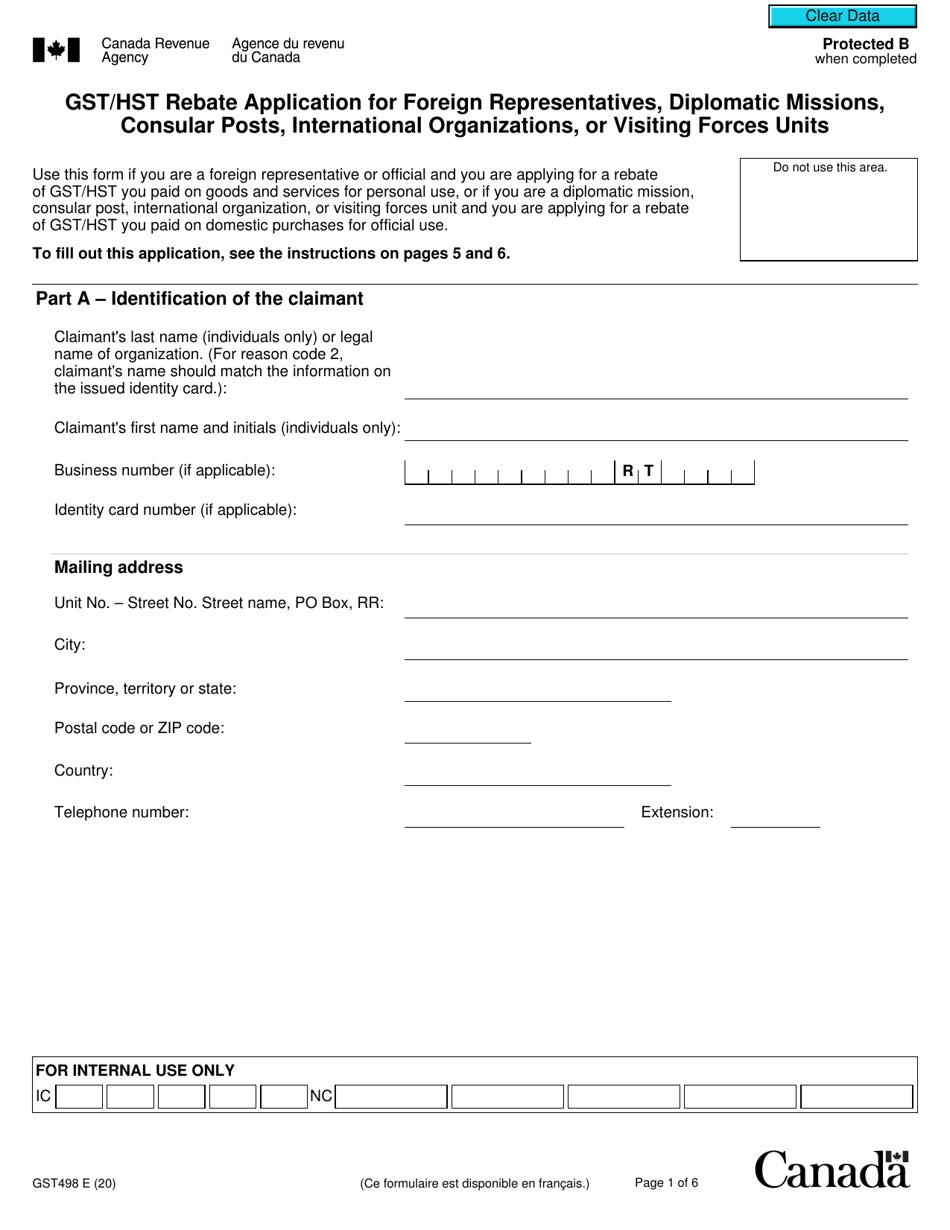

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

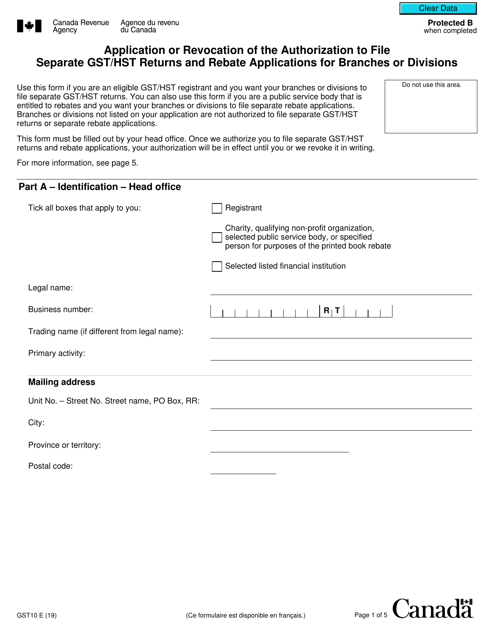

Form GST10 Download Fillable PDF Or Fill Online Application Or