In this modern-day world of consumers, everyone loves a good deal. One option to obtain significant savings when you shop is with Gst On Rebatess. They are a form of marketing that retailers and manufacturers use to offer consumers a partial discount on purchases they made after they've taken them. In this post, we'll take a look at the world that is Gst On Rebatess and explore the nature of them and how they operate, and the best way to increase your savings using these low-cost incentives.

Get Latest Gst On Rebates Below

Gst On Rebates

Gst On Rebates -

Web 1 mars 2021 nbsp 0183 32 Is there any tax liability under GST laws on the appellant for the amount received as reimbursement of discount or rebate provided by the Principal Company as

Web GST and rebates How GST applies to rebates you pay and receive and other trade incentive payments that are common in manufacturing wholesaling and retailing How

A Gst On Rebates, in its simplest version, is an ad-hoc refund to a purchaser following the purchase of a product or service. It's a powerful instrument that businesses use to draw buyers, increase sales and promote specific products.

Types of Gst On Rebates

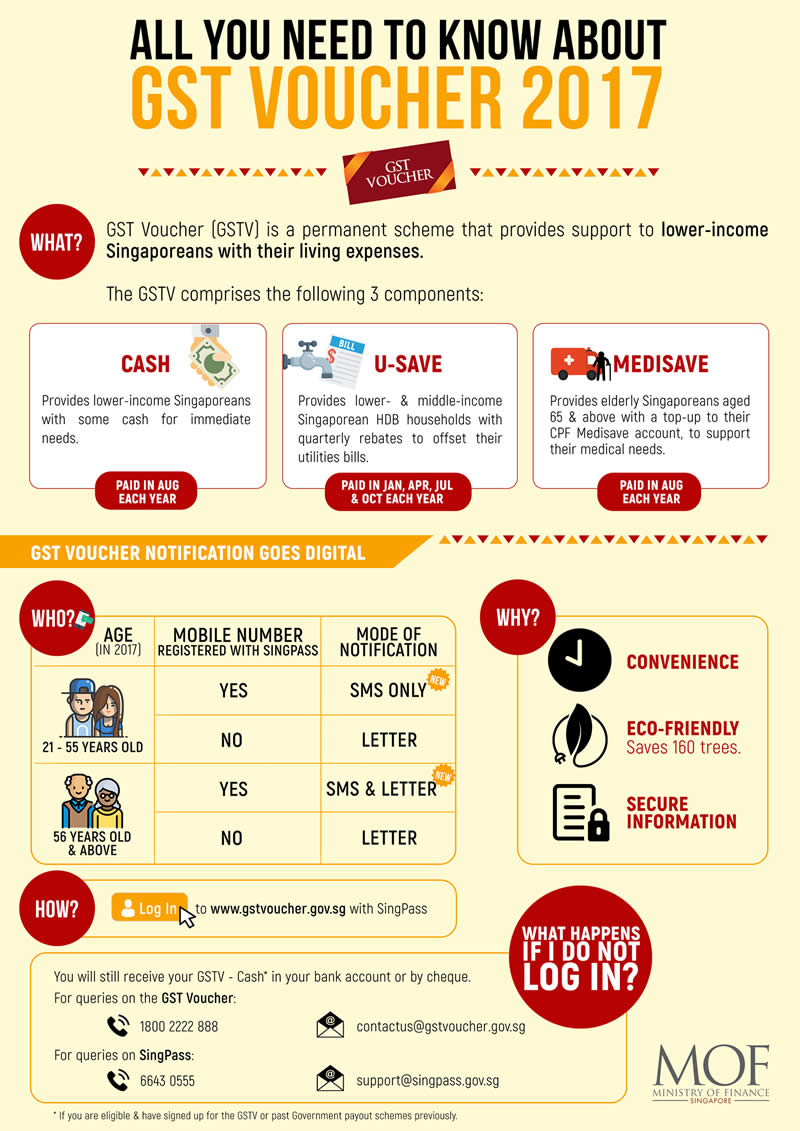

You Can Now Check Your GST Voucher And U Save Household Rebate 2017

You Can Now Check Your GST Voucher And U Save Household Rebate 2017

Web 5 juil 2023 nbsp 0183 32 Those eligible for the GST rebate as of January 2023 will be eligible for the one time top up no application is required The payment amounts are based on net

Web 30 d 233 c 2019 nbsp 0183 32 GST on Discounts Dr Sanjiv Agarwal Goods and Services Tax Articles Download PDF 30 Dec 2019 58 464 Views 0 comment In any tax law tax has to be paid

Cash Gst On Rebates

Cash Gst On Rebates can be the simplest kind of Gst On Rebates. Clients receive a predetermined amount of money back upon buying a product. These are typically for costly items like electronics or appliances.

Mail-In Gst On Rebates

Mail-in Gst On Rebates require consumers to present the proof of purchase in order to receive the refund. They're a little more involved, but can result in huge savings.

Instant Gst On Rebates

Instant Gst On Rebates are credited at the point of sale, which reduces prices immediately. Customers don't have to wait until they can save through this kind of offer.

How Gst On Rebates Work

Gst Rebate Canada Fill Out And Sign Printable PDF Template SignNow

Gst Rebate Canada Fill Out And Sign Printable PDF Template SignNow

Web 26 juil 2021 nbsp 0183 32 Sec 15 of the CGST Act 2017 reproduced below deals with the provision of discount as under The value of the supply shall not include any discount which is

The Gst On Rebates Process

The process typically comprises a couple of steps that are easy to follow:

-

Purchase the product: First purchase the product just like you normally would.

-

Fill out this Gst On Rebates forms: The Gst On Rebates form will need to supply some details including your address, name, and purchase information, to submit your Gst On Rebates.

-

Submit the Gst On Rebates depending on the nature of Gst On Rebates you may have to fill out a paper form or send it via the internet.

-

Wait for approval: The company will scrutinize your submission to determine if it's in compliance with the requirements of the Gst On Rebates.

-

Take advantage of your Gst On Rebates: Once approved, the amount you receive will be whether via check, credit card or another method specified by the offer.

Pros and Cons of Gst On Rebates

Advantages

-

Cost Savings Gst On Rebates can substantially decrease the price for a product.

-

Promotional Offers These deals encourage customers to try new products or brands.

-

Improve Sales The benefits of a Gst On Rebates can improve the sales of a company as well as its market share.

Disadvantages

-

Complexity In particular, mail-in Gst On Rebates particularly the case of HTML0, can be a hassle and tedious.

-

Extension Dates Many Gst On Rebates impose extremely strict deadlines to submit.

-

Risk of Non-Payment: Some customers may not get their Gst On Rebates if they don't observe the rules precisely.

Download Gst On Rebates

FAQs

1. Are Gst On Rebates the same as discounts? No, they are a partial refund upon purchase, while discounts lower the purchase price at time of sale.

2. Do I have to use multiple Gst On Rebates on the same item The answer is dependent on the conditions applicable to Gst On Rebates is offered as well as the merchandise's quality and eligibility. Some companies may allow it, and some don't.

3. What is the time frame to receive a Gst On Rebates? The period differs, but it can last from a few weeks until a few months to get your Gst On Rebates.

4. Do I have to pay tax when I receive Gst On Rebates funds? the majority of situations, Gst On Rebates amounts are not considered taxable income.

5. Can I trust Gst On Rebates deals from lesser-known brands Do I need to conduct a thorough research and verify that the organization which is providing the Gst On Rebates is reputable prior making an acquisition.

You ll Get Your GST Voucher U Save Rebate This Oct If You Live In A HDB

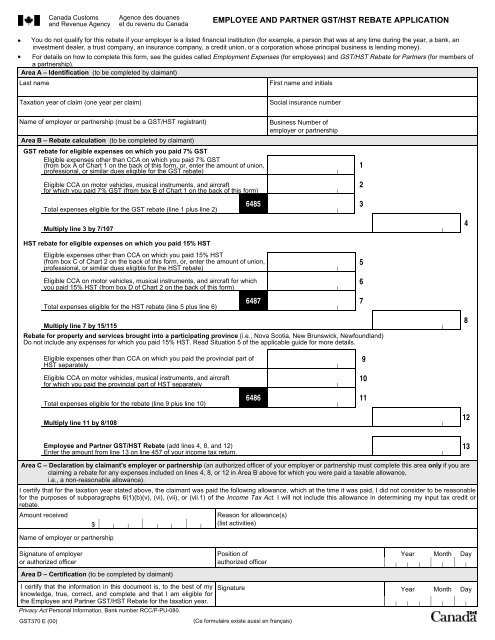

GST370 Employee And Partner GST HST Rebate Application

Check more sample of Gst On Rebates below

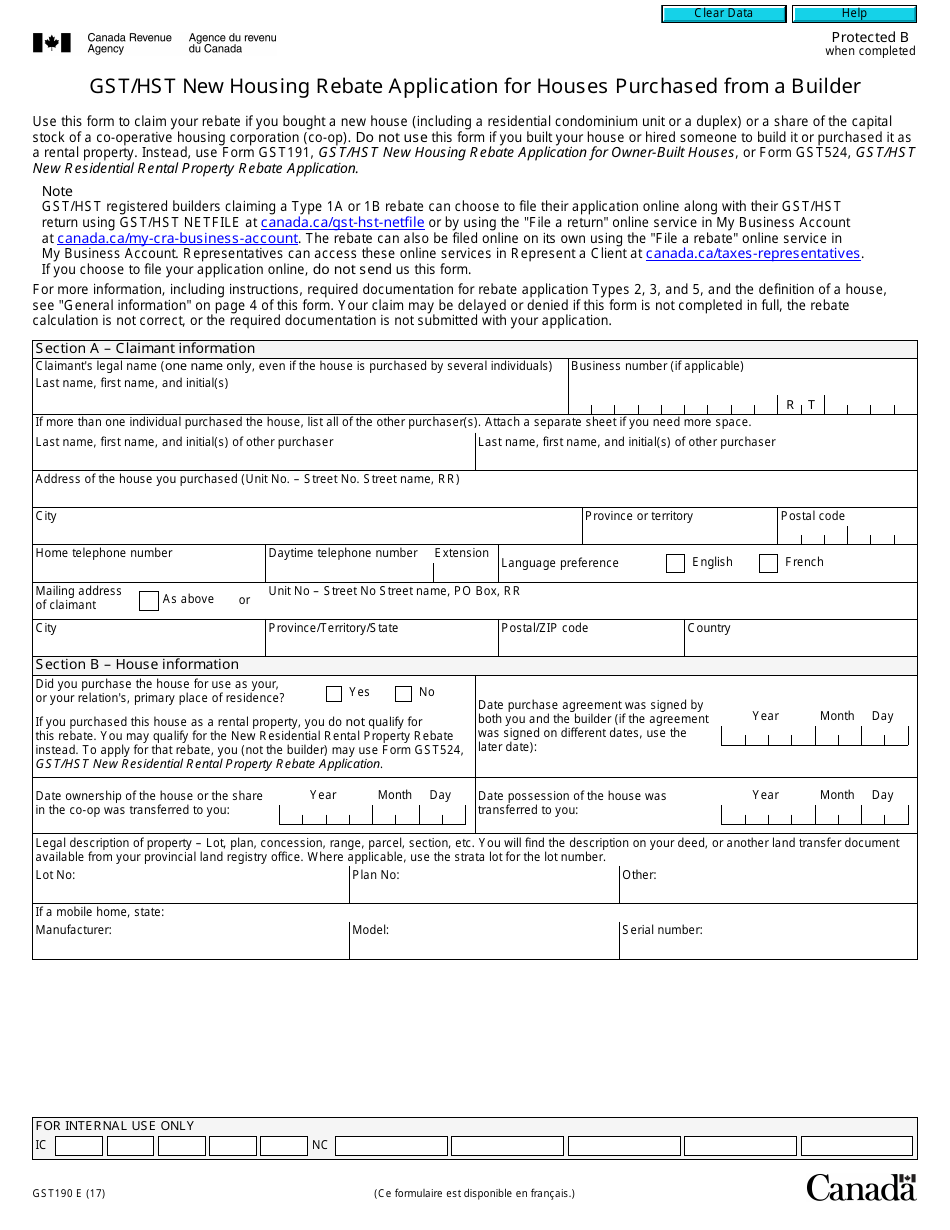

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

880 000 HDB Households To Get GST Voucher Rebate In Oct TODAY

GST11 How To Enter Telephone Bill With GST Element Rebate YouTube

Gst Vouchers Rebates To Be Given To 860 000 HDB Households In January

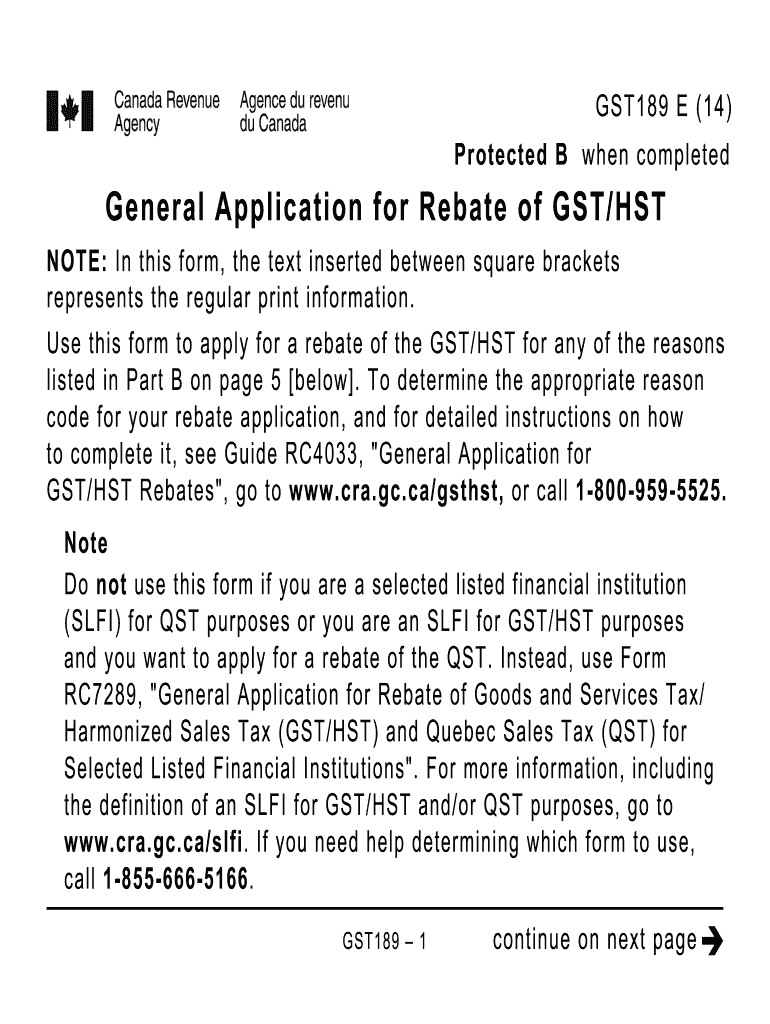

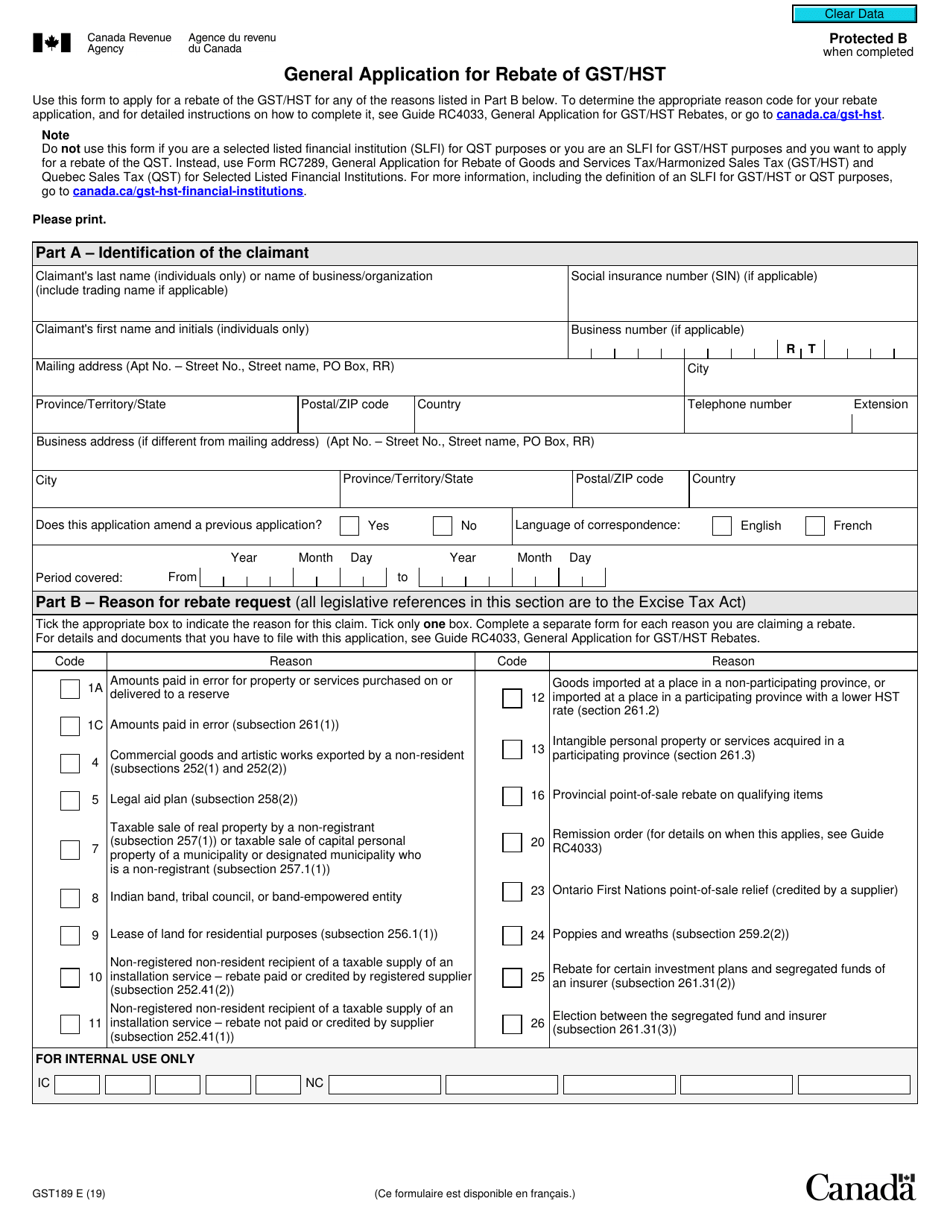

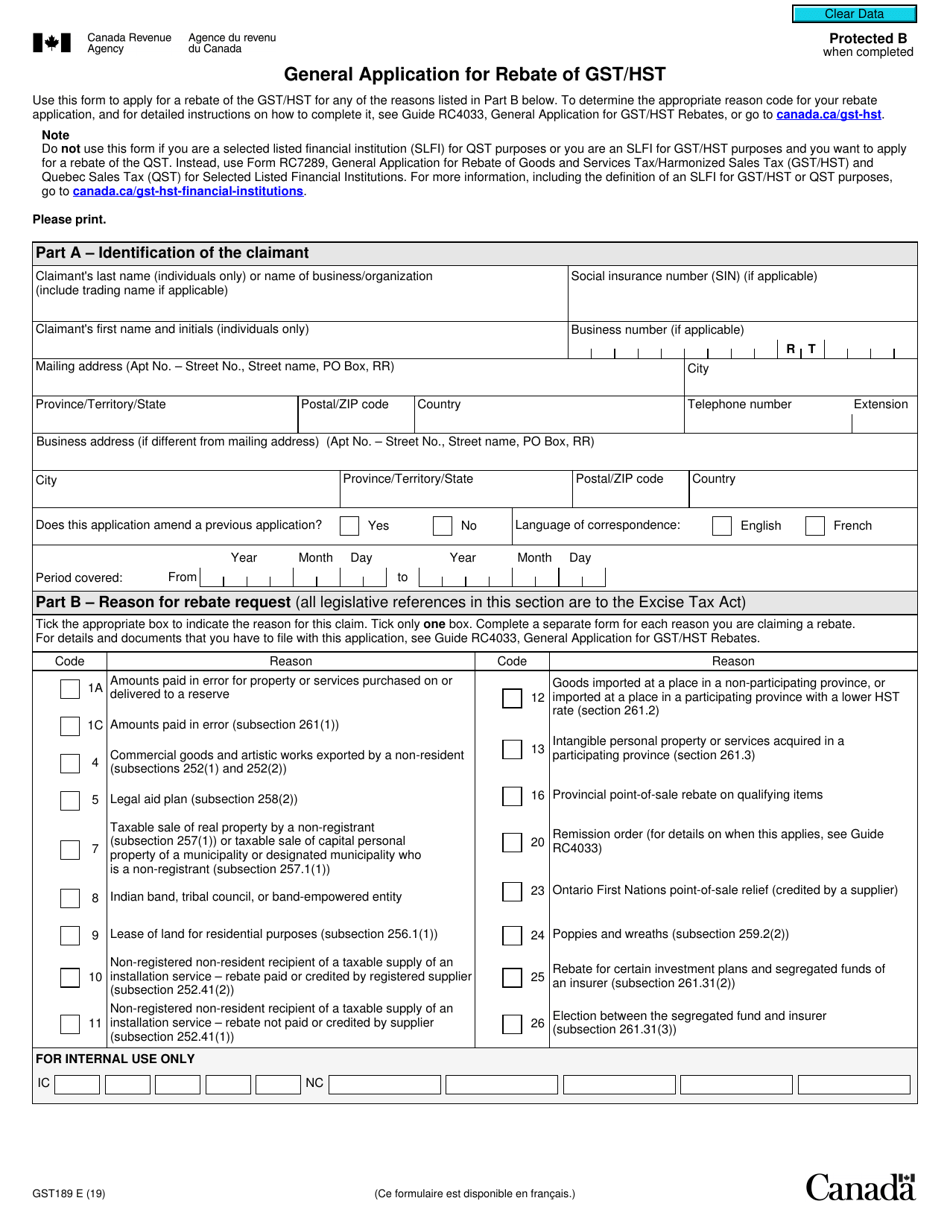

Form GST189 Download Fillable PDF Or Fill Online General Application

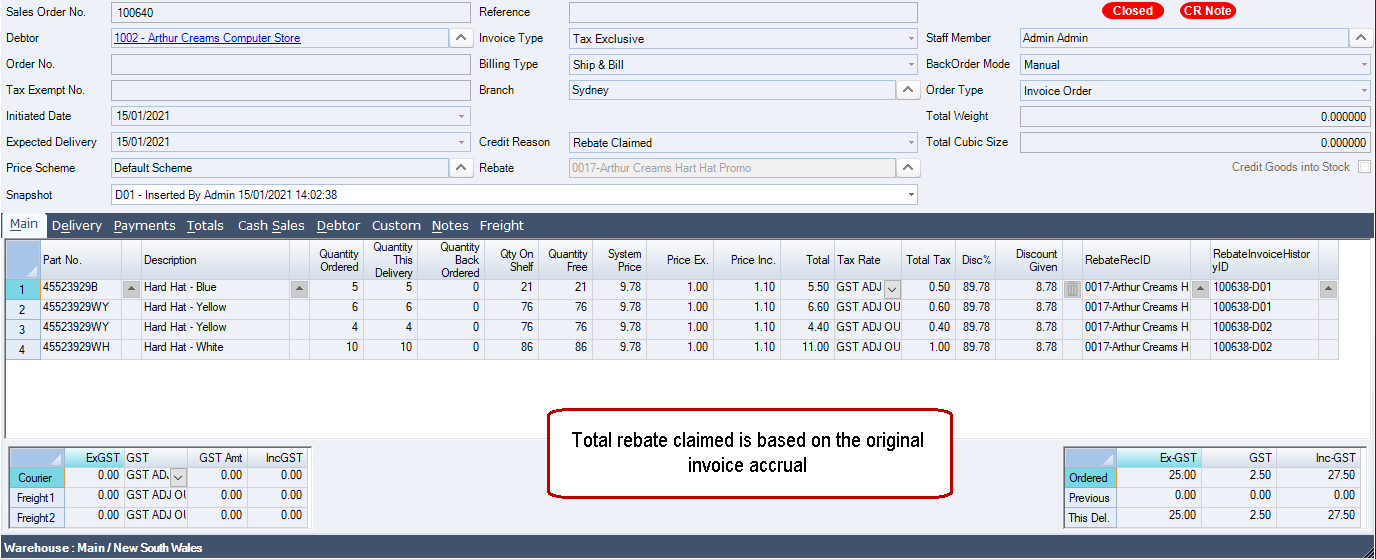

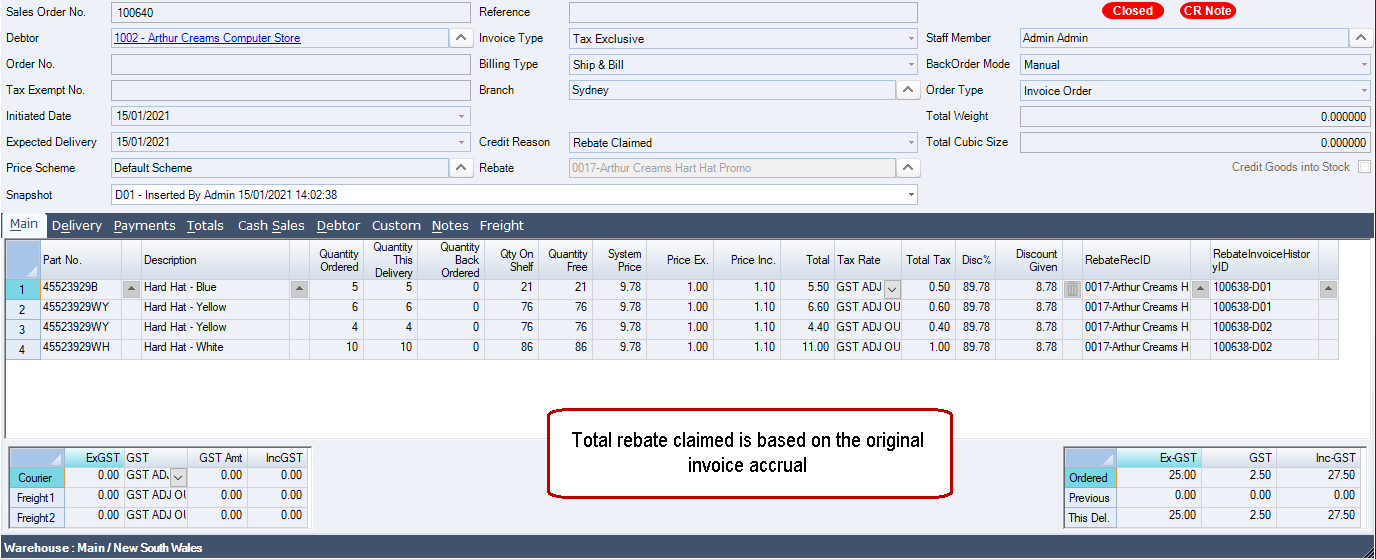

Rebates Rebate Allocation Form JIWA Training

https://www.ato.gov.au/.../Rules-for-specific-transactions/GST-and-rebates

Web GST and rebates How GST applies to rebates you pay and receive and other trade incentive payments that are common in manufacturing wholesaling and retailing How

https://www.canada.ca/.../gst-hst-rebates/application.html

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per

Web GST and rebates How GST applies to rebates you pay and receive and other trade incentive payments that are common in manufacturing wholesaling and retailing How

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per

Gst Vouchers Rebates To Be Given To 860 000 HDB Households In January

880 000 HDB Households To Get GST Voucher Rebate In Oct TODAY

Form GST189 Download Fillable PDF Or Fill Online General Application

Rebates Rebate Allocation Form JIWA Training

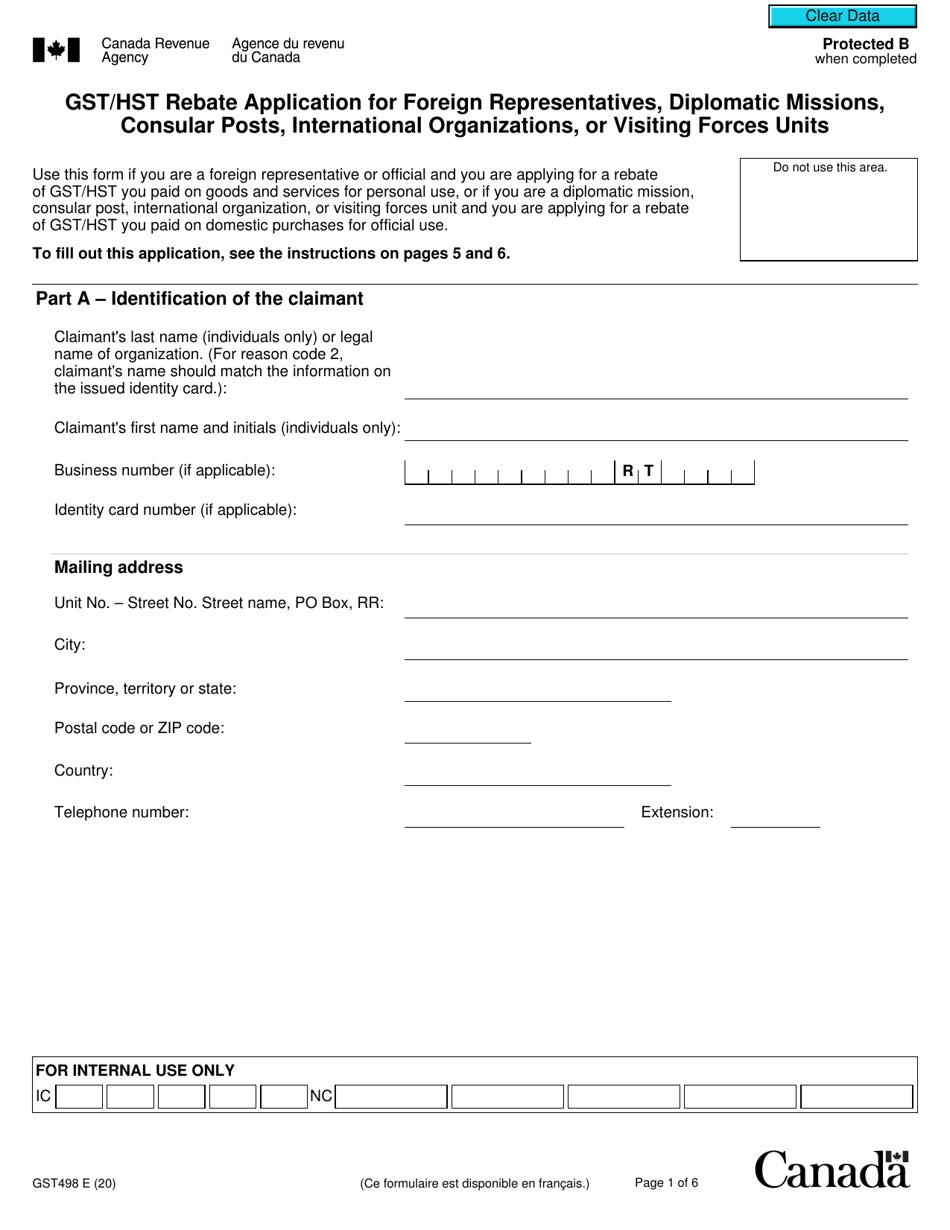

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Budget 2020 GST Voucher U Save Rebates More Key Announcements

Budget 2020 GST Voucher U Save Rebates More Key Announcements

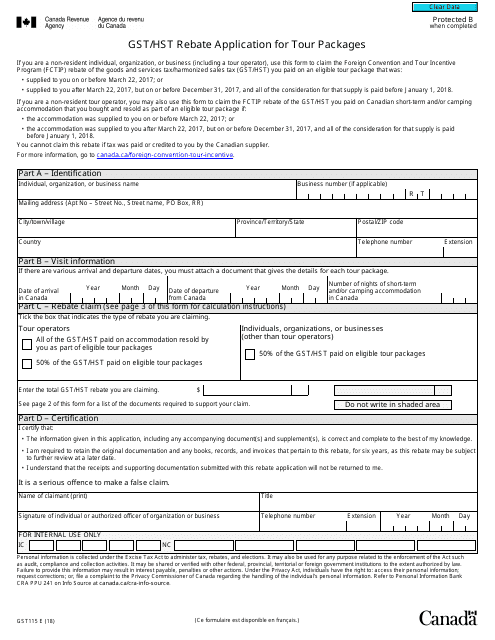

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada