In our current world of high-end consumer goods everyone is looking for a great bargain. One way to make substantial savings on your purchases is to use Form 5500 Schedule C Investment Rebates. Form 5500 Schedule C Investment Rebates are an effective marketing tactic used by manufacturers and retailers to offer customers a partial refund on their purchases after they have placed them. In this article, we will look into the world of Form 5500 Schedule C Investment Rebates. We'll look at what they are about, how they work, and how you can maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Form 5500 Schedule C Investment Rebate Below

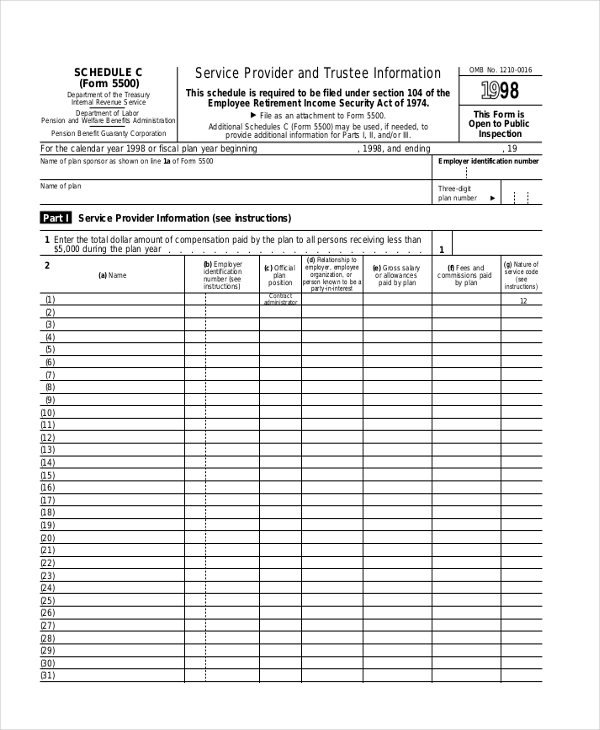

Form 5500 Schedule C Investment Rebate

Form 5500 Schedule C Investment Rebate -

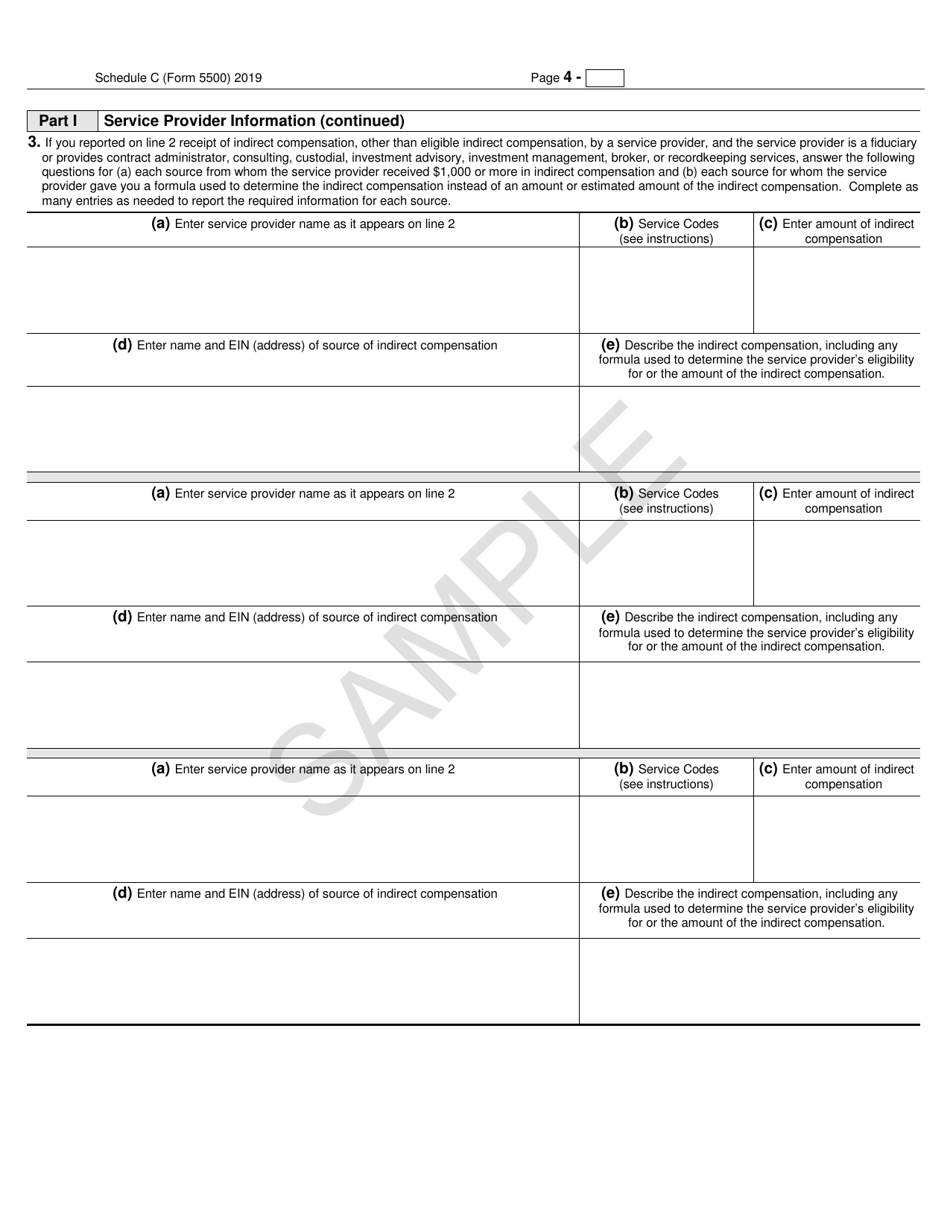

Web Form 5500 will vary according to the type of plan or arrangement The section What To File summarizes what information must be reported for different types of plans and

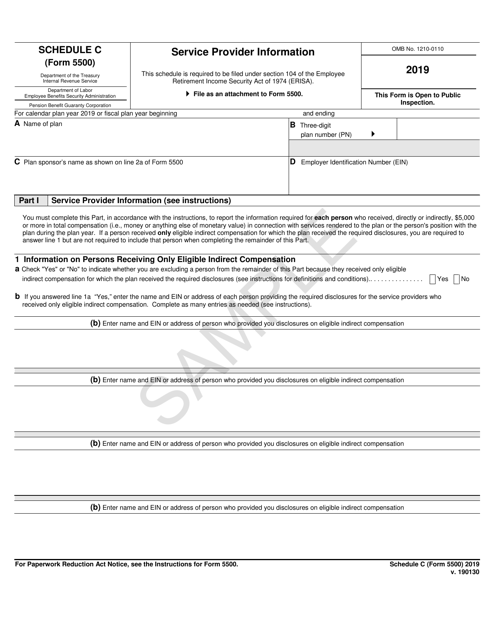

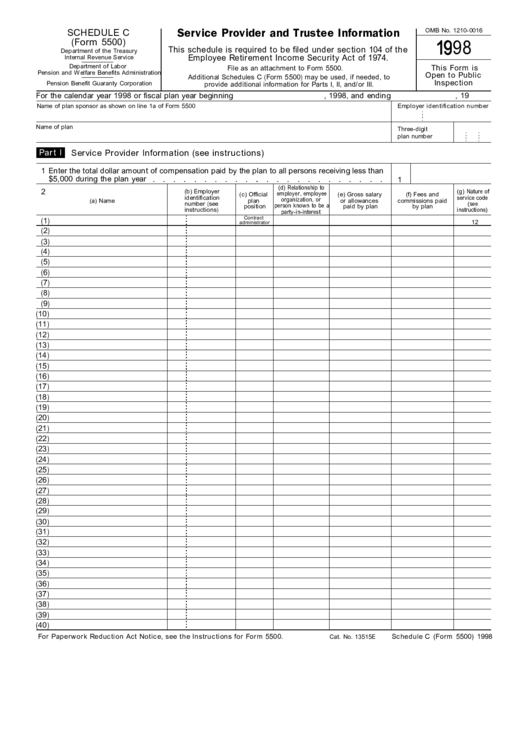

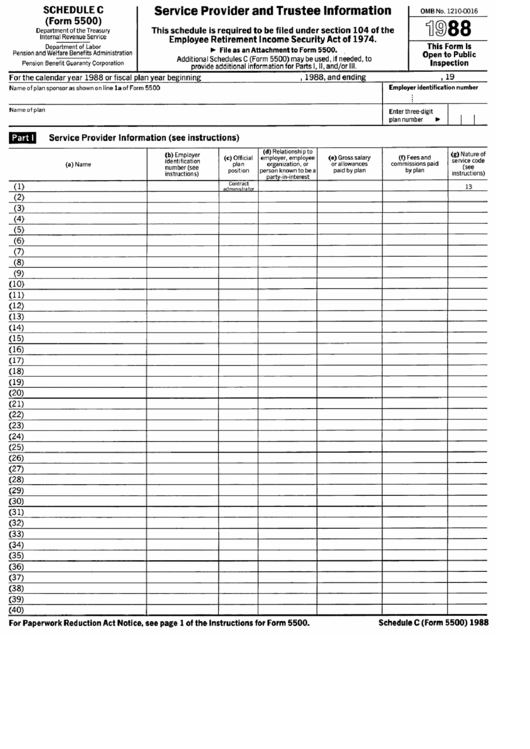

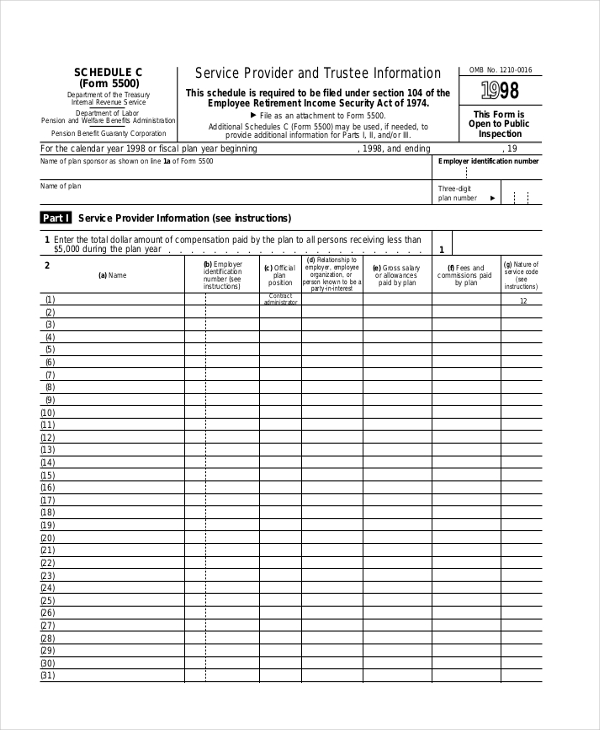

Web This schedule is required to be filed under section 104 of the Employee Retirement Income Security Act of 1974 ERISA File as an attachment to Form 5500 OMB No 1210 0110

A Form 5500 Schedule C Investment Rebate in its simplest type, is a refund that a client receives who has purchased a particular product or service. It's an effective way used by businesses to attract clients, increase sales and to promote certain products.

Types of Form 5500 Schedule C Investment Rebate

FREE 9 Sample Schedule C Forms In PDF MS Word

FREE 9 Sample Schedule C Forms In PDF MS Word

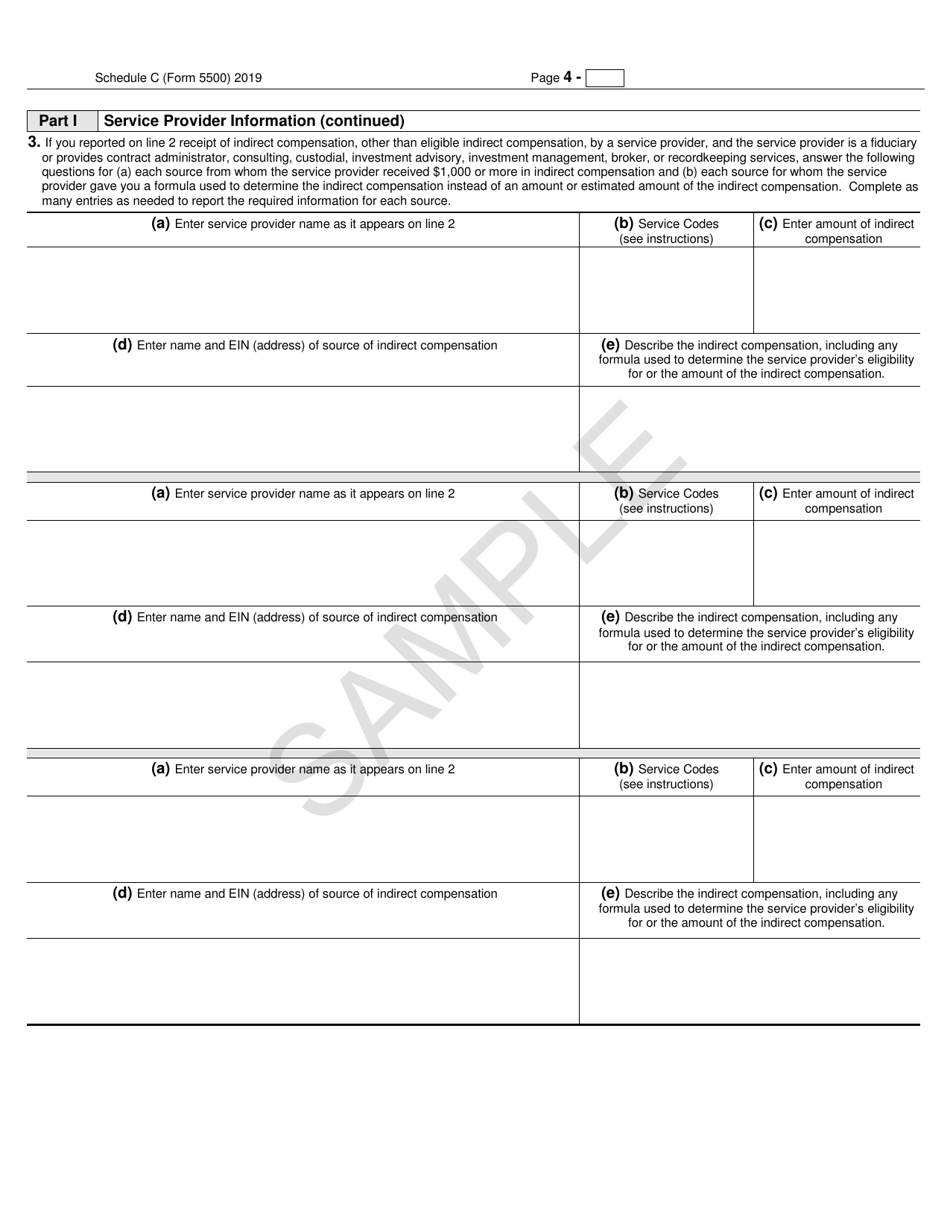

Web Schedule C Form 5500 must be attached to a Form 5500 filed for a large pension or welfare benefit plan an MTIA a 103 12 IE or a GIA to report certain information

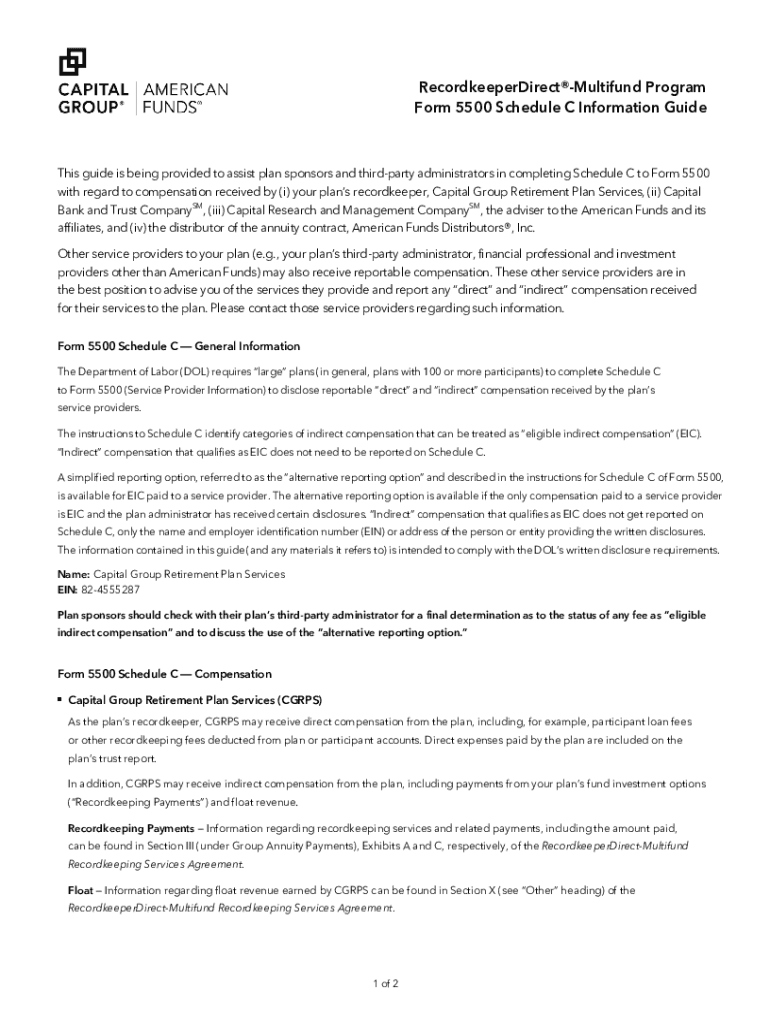

Web 10 avr 2023 nbsp 0183 32 Form 5500 Schedule C Eligible indirect compensation disclosure guide This guide is designed to help plan sponsors complete Form 5500 Schedule C Service

Cash Form 5500 Schedule C Investment Rebate

Cash Form 5500 Schedule C Investment Rebate is the most basic kind of Form 5500 Schedule C Investment Rebate. Customers receive a specified amount of money after purchasing a product. This is often for expensive items such as electronics or appliances.

Mail-In Form 5500 Schedule C Investment Rebate

Mail-in Form 5500 Schedule C Investment Rebate require consumers to provide proof of purchase to receive the money. They're somewhat more complicated, but they can provide huge savings.

Instant Form 5500 Schedule C Investment Rebate

Instant Form 5500 Schedule C Investment Rebate are made at the moment of sale, cutting the price instantly. Customers don't need to wait for their savings when they purchase this type of Form 5500 Schedule C Investment Rebate.

How Form 5500 Schedule C Investment Rebate Work

IRS Form 5500 Schedule C Download Fillable PDF Or Fill Online Service

IRS Form 5500 Schedule C Download Fillable PDF Or Fill Online Service

Web The Schedule C of Form 5500 disclosure rules provide that each retirement plan required to file a Schedule C of Form 5500 review and potentially report any direct and

The Form 5500 Schedule C Investment Rebate Process

The procedure usually involves a few steps:

-

Then, you purchase the product, you purchase the item just like you normally would.

-

Complete your Form 5500 Schedule C Investment Rebate application: In order to claim your Form 5500 Schedule C Investment Rebate, you'll have to give some specific information like your name, address as well as the details of your purchase to apply for your Form 5500 Schedule C Investment Rebate.

-

Complete the Form 5500 Schedule C Investment Rebate It is dependent on the nature of Form 5500 Schedule C Investment Rebate, you may need to submit a claim form to the bank or make it available online.

-

Wait for the company's approval: They will look over your submission to ensure it meets the guidelines and conditions of the Form 5500 Schedule C Investment Rebate.

-

Get your Form 5500 Schedule C Investment Rebate Once it's approved, you'll receive a refund either through check, prepaid card or through a different option that's specified in the offer.

Pros and Cons of Form 5500 Schedule C Investment Rebate

Advantages

-

Cost savings Form 5500 Schedule C Investment Rebate can substantially reduce the cost for a product.

-

Promotional Offers These promotions encourage consumers to experiment with new products, or brands.

-

Help to Increase Sales Reward programs can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Form 5500 Schedule C Investment Rebate that are mail-in, particularly could be cumbersome and tedious.

-

Day of Expiration Many Form 5500 Schedule C Investment Rebate impose the strictest deadlines for submission.

-

Risk of Non-Payment Customers may not receive their Form 5500 Schedule C Investment Rebate if they don't follow the rules exactly.

Download Form 5500 Schedule C Investment Rebate

Download Form 5500 Schedule C Investment Rebate

FAQs

1. Are Form 5500 Schedule C Investment Rebate equivalent to discounts? No, Form 5500 Schedule C Investment Rebate involve an amount of money that is refunded after the purchase, while discounts lower their price at point of sale.

2. Are there Form 5500 Schedule C Investment Rebate that can be used on the same item This depends on the terms that apply to the Form 5500 Schedule C Investment Rebate offered and product's ability to qualify. Certain companies allow it, but some will not.

3. How long will it take to get an Form 5500 Schedule C Investment Rebate What is the timeframe? is different, but it could take several weeks to a couple of months before you get your Form 5500 Schedule C Investment Rebate.

4. Do I have to pay taxes with respect to Form 5500 Schedule C Investment Rebate funds? most situations, Form 5500 Schedule C Investment Rebate amounts are not considered taxable income.

5. Should I be able to trust Form 5500 Schedule C Investment Rebate offers from brands that aren't well-known Consider doing some research to ensure that the name that is offering the Form 5500 Schedule C Investment Rebate is reliable prior to making the purchase.

Schedule C Form 5500 Service Provider And Trustee Information

Schedule C Form 5500 Service Provider And Trustee Information

Check more sample of Form 5500 Schedule C Investment Rebate below

2017 Form 5500 Ez Fill Out Sign Online DocHub

IRS Form 5500 Schedule C 2019 Fill Out Sign Online And Download

Fillable Online Multifund Program Form 5500 Schedule C Information

69 2014 Irs Form 1040 Page 3 Free To Edit Download Print CocoDoc

Schedule C Form 5500 Service Provider

Form 5500 Instructions 5 Steps To Filing Correctly

https://www.dol.gov/.../reporting-and-filing/form-5500/2022-s…

Web This schedule is required to be filed under section 104 of the Employee Retirement Income Security Act of 1974 ERISA File as an attachment to Form 5500 OMB No 1210 0110

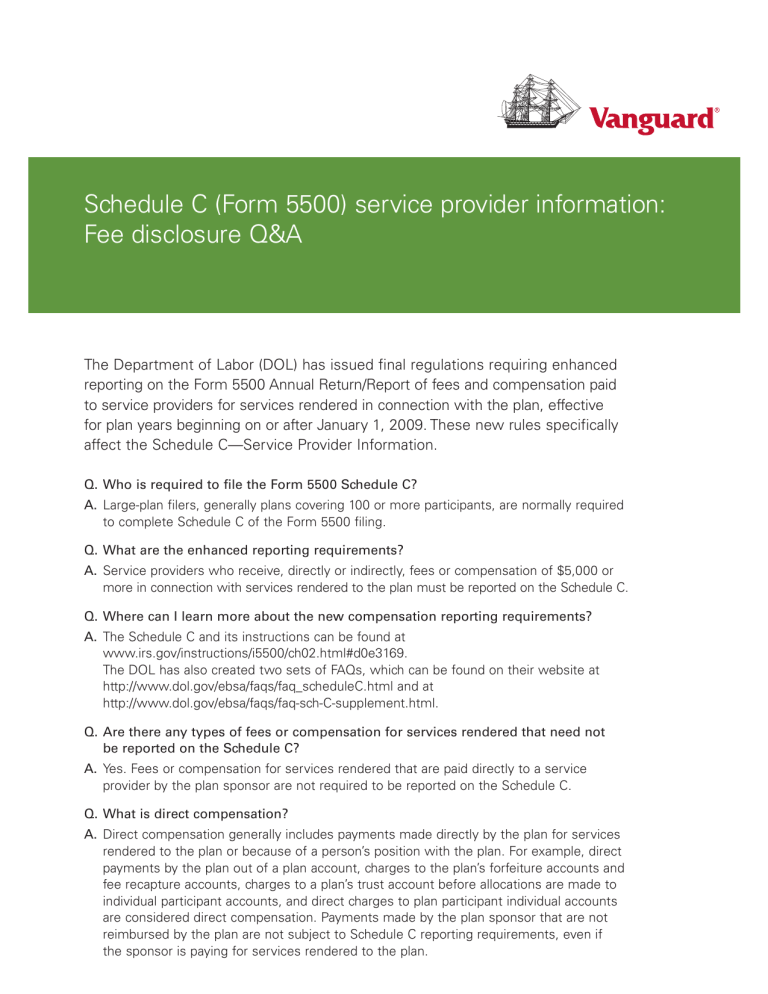

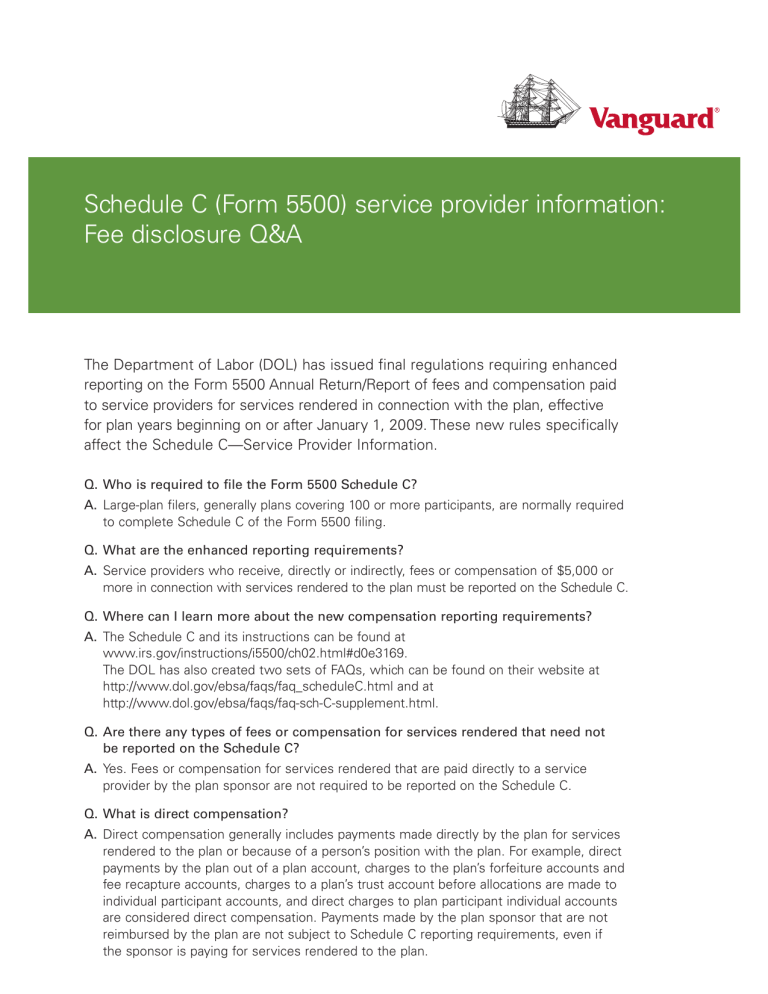

https://institutional.vanguard.com/.../pdf/2023/form-5500-202…

Web completing Form 5500 Schedule C Service Provider Information It contains information regarding eligible indirect compensation received by Vanguard and others from

Web This schedule is required to be filed under section 104 of the Employee Retirement Income Security Act of 1974 ERISA File as an attachment to Form 5500 OMB No 1210 0110

Web completing Form 5500 Schedule C Service Provider Information It contains information regarding eligible indirect compensation received by Vanguard and others from

69 2014 Irs Form 1040 Page 3 Free To Edit Download Print CocoDoc

IRS Form 5500 Schedule C 2019 Fill Out Sign Online And Download

Schedule C Form 5500 Service Provider

Form 5500 Instructions 5 Steps To Filing Correctly

Da Form 5500 R Fillable Printable Forms Free Online

Form 5500 Schedule C Filings Benefits Compliance Consulting

Form 5500 Schedule C Filings Benefits Compliance Consulting

Department Of Labor 2000 5500 Schedule C mp PDF