In today's consumer-driven world we all love a good bargain. One method to get substantial savings on your purchases is by using Form 1040 Sr Recovery Rebate Credits. Form 1040 Sr Recovery Rebate Credits are a marketing strategy used by manufacturers and retailers to provide customers with a portion of a refund for their purchases after they have purchased them. In this article, we'll examine the subject of Form 1040 Sr Recovery Rebate Credits, looking at what they are, how they work, and ways you can increase the savings you can make by using these cost-effective incentives.

Get Latest Form 1040 Sr Recovery Rebate Credit Below

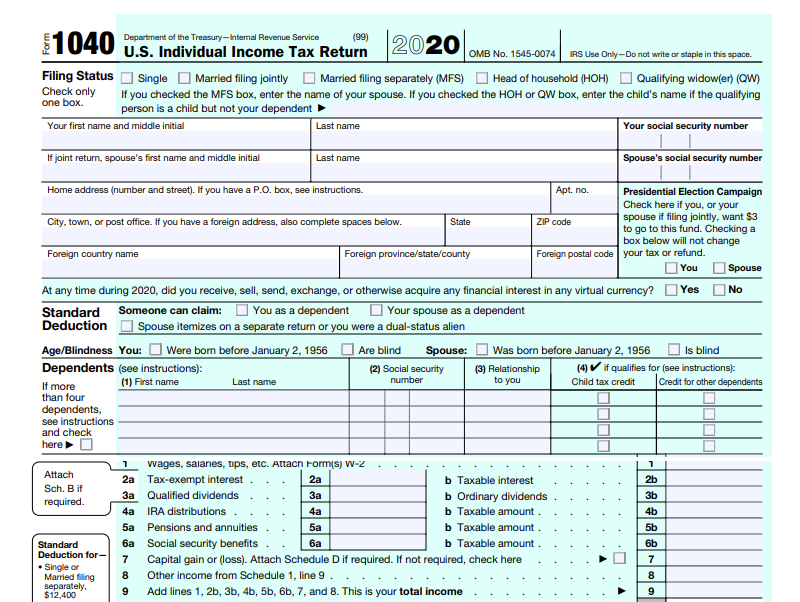

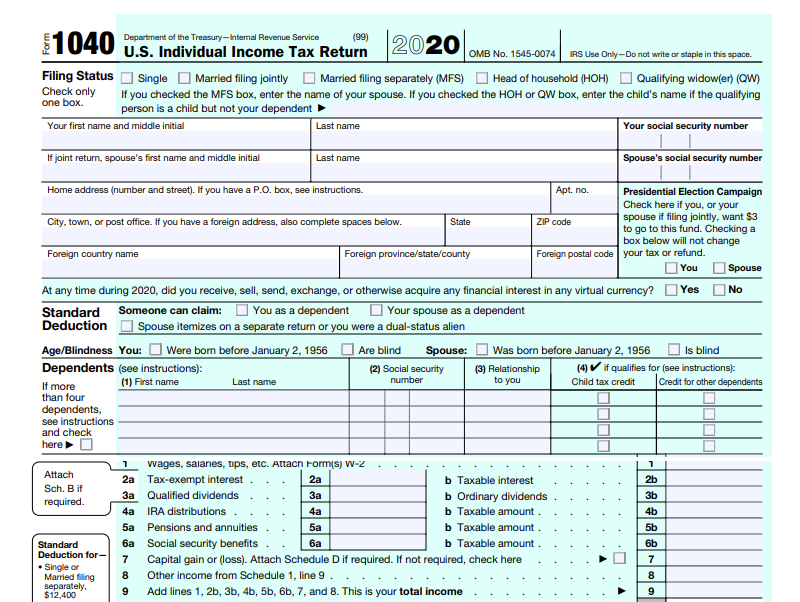

Form 1040 Sr Recovery Rebate Credit

Form 1040 Sr Recovery Rebate Credit -

Verkko 2021 Economic Impact Payments 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

A Form 1040 Sr Recovery Rebate Credit as it is understood in its simplest model, refers to a partial refund given to a client after purchasing a certain product or service. It is a powerful tool that companies use to attract customers, increase sales and even promote certain products.

Types of Form 1040 Sr Recovery Rebate Credit

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Verkko 13 tammik 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file

Verkko Recovery Rebate Credit 1040 The third Economic Impact Payment EIP3 is part of the American Rescue Plan Act enacted on March 11 2021 and is a tax credit against the

Cash Form 1040 Sr Recovery Rebate Credit

Cash Form 1040 Sr Recovery Rebate Credit are by far the easiest kind of Form 1040 Sr Recovery Rebate Credit. The customer receives a particular amount of cash back after purchasing a item. This is often for products that are expensive, such as electronics or appliances.

Mail-In Form 1040 Sr Recovery Rebate Credit

Mail-in Form 1040 Sr Recovery Rebate Credit need customers to send in their proof of purchase before receiving their refund. They're more involved, however they can yield significant savings.

Instant Form 1040 Sr Recovery Rebate Credit

Instant Form 1040 Sr Recovery Rebate Credit are applied right at the point of sale, reducing the purchase price immediately. Customers don't have to wait for savings when they purchase this type of Form 1040 Sr Recovery Rebate Credit.

How Form 1040 Sr Recovery Rebate Credit Work

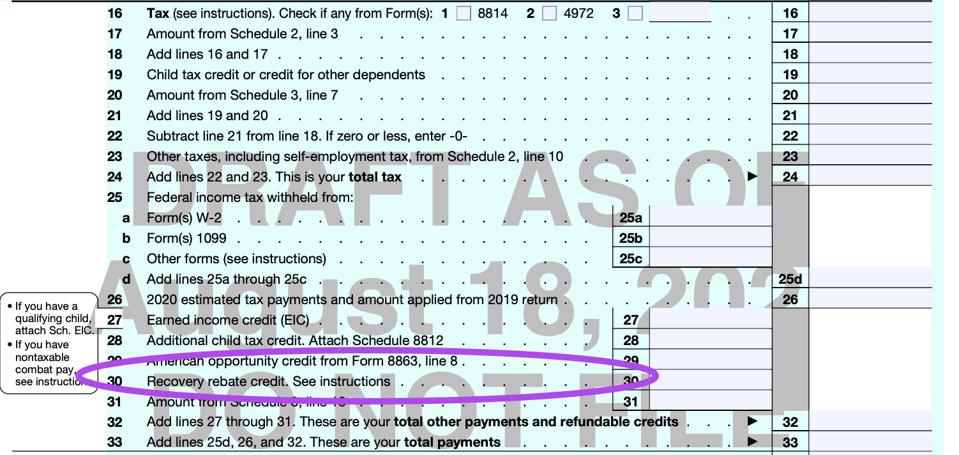

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Verkko The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments issued in 2020 You will

The Form 1040 Sr Recovery Rebate Credit Process

The process typically involves couple of steps that are easy to follow:

-

Then, you purchase the product you purchase the product exactly as you would normally.

-

Complete the Form 1040 Sr Recovery Rebate Credit forms: The Form 1040 Sr Recovery Rebate Credit form will need to provide some information, such as your name, address and details about your purchase, in order to receive your Form 1040 Sr Recovery Rebate Credit.

-

Make sure you submit the Form 1040 Sr Recovery Rebate Credit: Depending on the type of Form 1040 Sr Recovery Rebate Credit you will need to fill out a paper form or make it available online.

-

Wait until the company approves: The company will evaluate your claim to determine if it's in compliance with the Form 1040 Sr Recovery Rebate Credit's terms and conditions.

-

Receive your Form 1040 Sr Recovery Rebate Credit Once it's approved, you'll receive your cash back either through check, prepaid card or another option as per the terms of the offer.

Pros and Cons of Form 1040 Sr Recovery Rebate Credit

Advantages

-

Cost savings Rewards can drastically reduce the price you pay for the item.

-

Promotional Offers They encourage customers to try new products or brands.

-

Boost Sales Form 1040 Sr Recovery Rebate Credit can enhance an organization's sales and market share.

Disadvantages

-

Complexity Form 1040 Sr Recovery Rebate Credit that are mail-in, in particular, can be cumbersome and long-winded.

-

The Expiration Dates Most Form 1040 Sr Recovery Rebate Credit come with rigid deadlines to submit.

-

A risk of not being paid Certain customers could not receive their Form 1040 Sr Recovery Rebate Credit if they don't follow the regulations precisely.

Download Form 1040 Sr Recovery Rebate Credit

Download Form 1040 Sr Recovery Rebate Credit

FAQs

1. Are Form 1040 Sr Recovery Rebate Credit similar to discounts? No, Form 1040 Sr Recovery Rebate Credit offer a partial refund upon purchase, whereas discounts decrease your purchase cost at moment of sale.

2. Are there any Form 1040 Sr Recovery Rebate Credit that I can use on the same item What is the best way to do it? It's contingent on terms in the Form 1040 Sr Recovery Rebate Credit promotions and on the products suitability. Certain companies might allow it, while other companies won't.

3. How long does it take to get an Form 1040 Sr Recovery Rebate Credit? The amount of time will vary, but it may be anywhere from a few weeks up to a couple of months for you to receive your Form 1040 Sr Recovery Rebate Credit.

4. Do I need to pay taxes regarding Form 1040 Sr Recovery Rebate Credit amounts? In the majority of circumstances, Form 1040 Sr Recovery Rebate Credit amounts are not considered taxable income.

5. Can I trust Form 1040 Sr Recovery Rebate Credit offers from lesser-known brands it is crucial to conduct research and ensure that the business providing the Form 1040 Sr Recovery Rebate Credit is credible prior to making an acquisition.

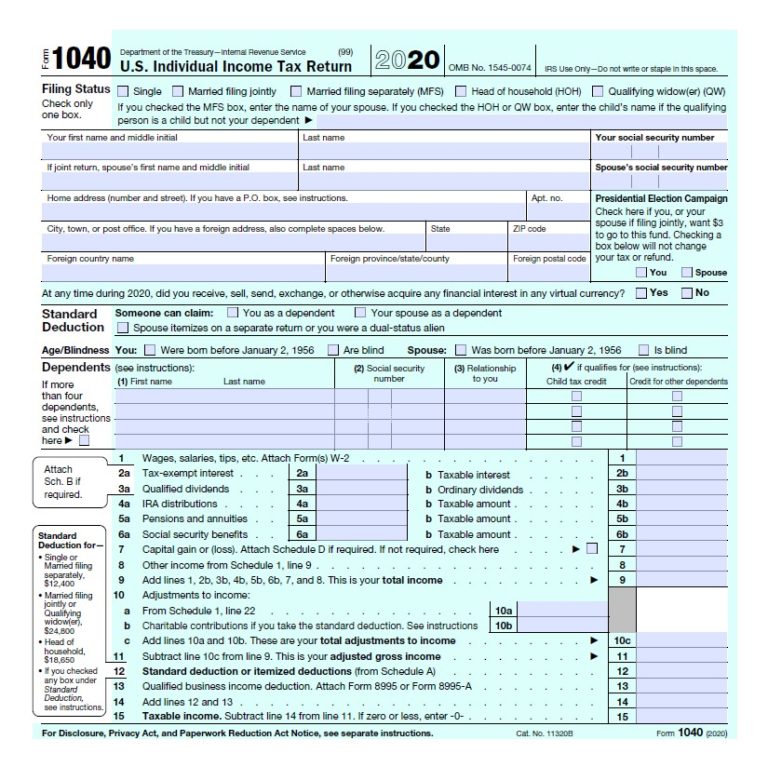

How Do I Claim The Recovery Rebate Credit On My Ta

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Check more sample of Form 1040 Sr Recovery Rebate Credit below

How To Claim The Stimulus Money On Your Tax Return Wltx

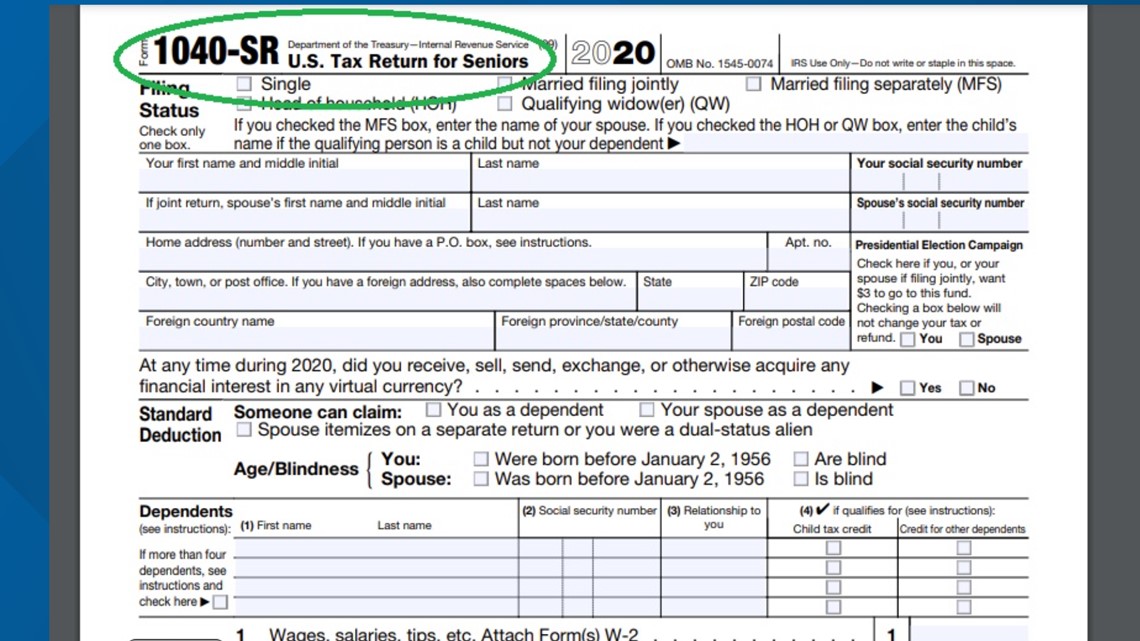

Formulaire 1040 SR Les Personnes g es Re oivent Un Nouveau

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

Formulaire 1040 SR Les Personnes g es Re oivent Un Nouveau

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

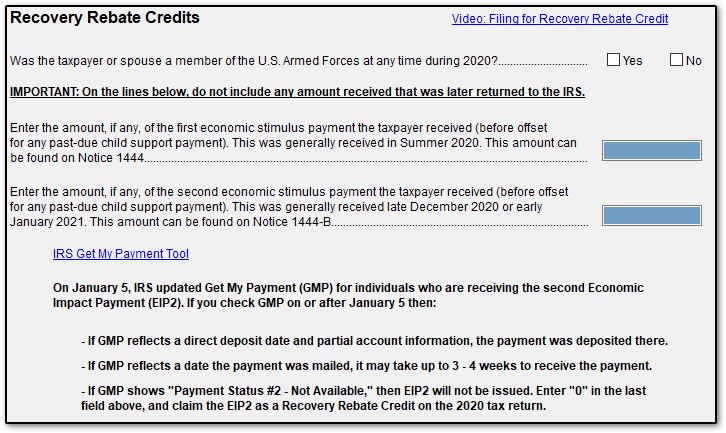

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Solved Recovery Rebate Credit Error On 1040 Instructions

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-d...

Verkko 17 helmik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

Verkko 17 helmik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If

1040 Recovery Rebate Credit Drake20

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

Formulaire 1040 SR Les Personnes g es Re oivent Un Nouveau

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Solved Recovery Rebate Credit Error On 1040 Instructions

1040 EF Message 0006 Recovery Rebate Credit Drake20

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Federal Income Tax