In the modern world of consumerization everyone appreciates a great deal. One way to gain significant savings on your purchases is by using First Time Home Buyer Rebate Forms. First Time Home Buyer Rebate Forms are marketing strategies used by manufacturers and retailers for offering customers a percentage refund for their purchases after they have made them. In this article, we will look into the world of First Time Home Buyer Rebate Forms and explore the nature of them their purpose, how they function and ways to maximize the savings you can make by using these cost-effective incentives.

Get Latest First Time Home Buyer Rebate Form Below

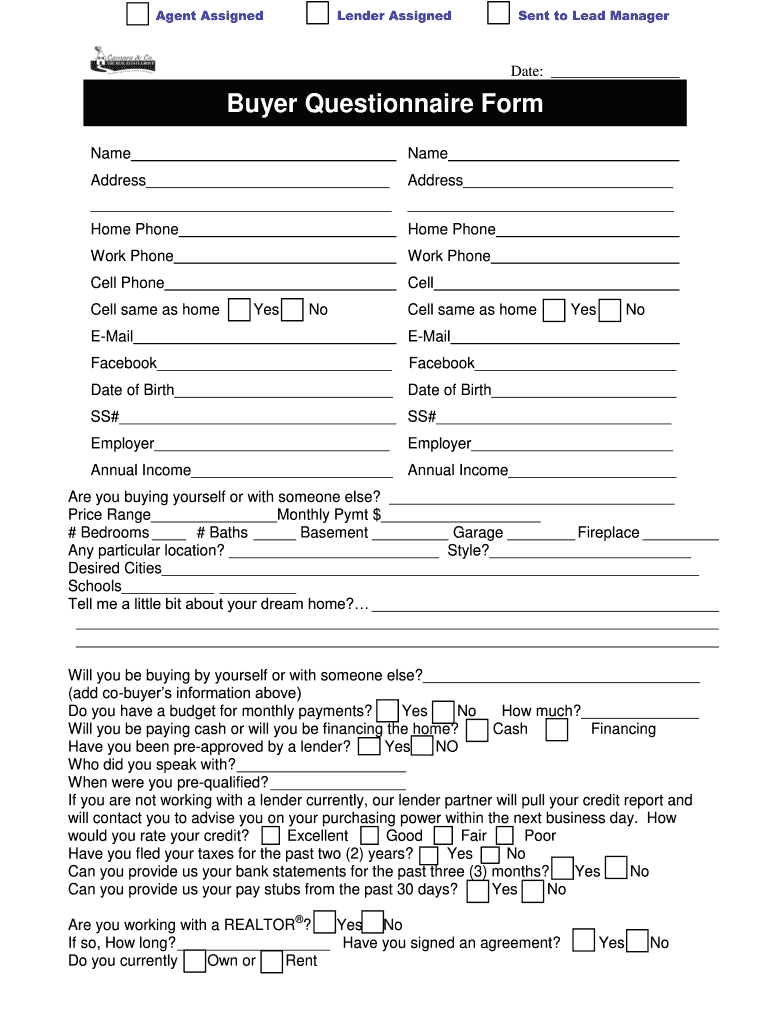

First Time Home Buyer Rebate Form

First Time Home Buyer Rebate Form - First Time Home Buyer Rebate Form, First Time Home Buyer Tax Form, First Time Home Buyer Credit Form 2022, First Time Home Buyer Rrsp Tax Form, First Time Home Buyer Tax Credit 2022 Form, First Time Home Buyer Ira Withdrawal Tax Form, Michigan First Time Home Buyer Tax Credit Form 5972, Is There A Rebate For First Time Home Buyers

Web 5 or 10 for a first time buyer s purchase of a newly constructed home 5 for a first time buyer s purchase of a resale existing home 5 for a first time buyer s purchase

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

A First Time Home Buyer Rebate Form or First Time Home Buyer Rebate Form, in its most basic model, refers to a partial reimbursement to a buyer when they purchase a product or service. It's a powerful method for businesses to entice customers, increase sales or promote a specific product.

Types of First Time Home Buyer Rebate Form

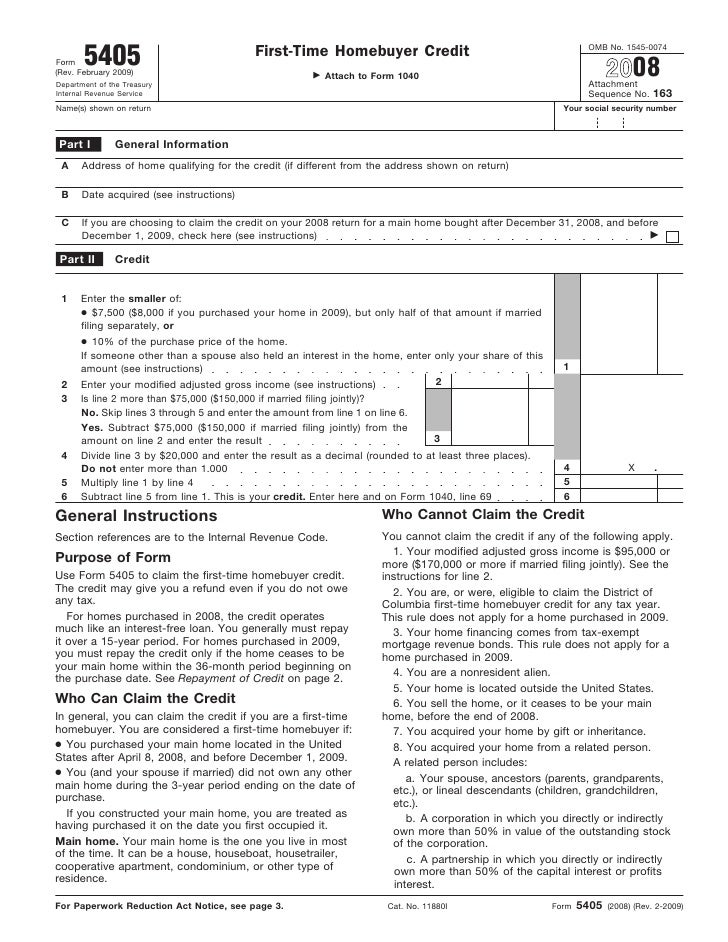

Form 5405 First Time Homebuyer Credit

Form 5405 First Time Homebuyer Credit

Web 14 f 233 vr 2023 nbsp 0183 32 About Form 5405 Repayment of the First Time Homebuyer Credit Use this form to Notify the IRS that the home for which you claimed the credit was disposed of

Web 19 mai 2020 nbsp 0183 32 The minimum down payment required is 5 for homes less than 500 000 10 for the amount above 500 000 and below 1 000 000 And you are a permanent resident of Canada How much can I qualify

Cash First Time Home Buyer Rebate Form

Cash First Time Home Buyer Rebate Form are the most basic type of First Time Home Buyer Rebate Form. The customer receives a particular amount of cash back after purchasing a item. These are typically applied to products that are expensive, such as electronics or appliances.

Mail-In First Time Home Buyer Rebate Form

Mail-in First Time Home Buyer Rebate Form require the customer to provide proof of purchase to receive their cash back. They're somewhat more involved, but offer substantial savings.

Instant First Time Home Buyer Rebate Form

Instant First Time Home Buyer Rebate Form will be applied at place of purchase, reducing the price of your purchase instantly. Customers don't have to wait for their savings through this kind of offer.

How First Time Home Buyer Rebate Form Work

TIPS FOR FIRST TIME HOME BUYERS FREE HOUSE HUNTING WORKSHEET Home

TIPS FOR FIRST TIME HOME BUYERS FREE HOUSE HUNTING WORKSHEET Home

Web Form Number 013 0300 Title Ontario Land Transfer Tax Refund Affidavit for First Time Purchasers of Eligible Homes Description Allows taxpayers to manually claim the

The First Time Home Buyer Rebate Form Process

The process typically involves couple of steps that are easy to follow:

-

Purchase the product: Then you buy the product like you would normally.

-

Fill out your First Time Home Buyer Rebate Form questionnaire: you'll need to fill in some information, such as your name, address, and purchase details, in order to claim your First Time Home Buyer Rebate Form.

-

Send in the First Time Home Buyer Rebate Form Based on the nature of First Time Home Buyer Rebate Form you might need to submit a form by mail or send it via the internet.

-

Wait for the company's approval: They will review your request to make sure that it's in accordance with the terms and conditions of the First Time Home Buyer Rebate Form.

-

Get your First Time Home Buyer Rebate Form Once you've received your approval, the amount you receive will be whether by check, prepaid card, or any other option as per the terms of the offer.

Pros and Cons of First Time Home Buyer Rebate Form

Advantages

-

Cost Savings First Time Home Buyer Rebate Form can dramatically decrease the price for products.

-

Promotional Offers The aim is to encourage customers to test new products or brands.

-

boost sales First Time Home Buyer Rebate Form can increase sales for a company and also increase market share.

Disadvantages

-

Complexity Pay-in First Time Home Buyer Rebate Form via mail, in particular difficult and tedious.

-

Expiration Dates Many First Time Home Buyer Rebate Form impose rigid deadlines to submit.

-

Risk of Not Being Paid Some customers might lose their First Time Home Buyer Rebate Form in the event that they do not follow the rules exactly.

Download First Time Home Buyer Rebate Form

Download First Time Home Buyer Rebate Form

FAQs

1. Are First Time Home Buyer Rebate Form the same as discounts? No, First Time Home Buyer Rebate Form are a partial refund after the purchase, while discounts lower your purchase cost at moment of sale.

2. Can I use multiple First Time Home Buyer Rebate Form on the same product What is the best way to do it? It's contingent on conditions in the First Time Home Buyer Rebate Form offered and product's ability to qualify. Certain companies may permit it, but some will not.

3. What is the time frame to get an First Time Home Buyer Rebate Form? The length of time is variable, however it can be anywhere from a few weeks up to a few months before you receive your First Time Home Buyer Rebate Form.

4. Do I need to pay tax when I receive First Time Home Buyer Rebate Form funds? most circumstances, First Time Home Buyer Rebate Form amounts are not considered taxable income.

5. Can I trust First Time Home Buyer Rebate Form deals from lesser-known brands It's important to do your research and make sure that the company giving the First Time Home Buyer Rebate Form is reputable prior to making the purchase.

Rebate Form Download Printable PDF Templateroller

Marriage And DESIGN Have More In Common Than You Think

Check more sample of First Time Home Buyer Rebate Form below

First Time Home Buyer Form Fillable Printable Forms Free Online

Tax Credits Rebates For First Time Home Buyers In Toronto Buying

Real Estate Buyer Questionnaire Form Fill Out Sign Online DocHub

Spring Special For First Time Home Buyers 500 Rebate At Closing

Pin By Realtor Julie On First Time Home Buyer Home Buying Checklist

First Time Home Buyer Checklist Template Resume Examples

https://www.canada.ca/en/revenue-agency/programs/about-canada-reven…

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

https://www.ratehub.ca/blog/what-is-the-first-t…

Web 15 mars 2021 nbsp 0183 32 The First Time Home Buyers Tax Credit is a 10 000 non refundable tax credit Up until 2021 the tax credit amount was 5 000

Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

Web 15 mars 2021 nbsp 0183 32 The First Time Home Buyers Tax Credit is a 10 000 non refundable tax credit Up until 2021 the tax credit amount was 5 000

Spring Special For First Time Home Buyers 500 Rebate At Closing

Tax Credits Rebates For First Time Home Buyers In Toronto Buying

Pin By Realtor Julie On First Time Home Buyer Home Buying Checklist

First Time Home Buyer Checklist Template Resume Examples

Buyer Rebate Agreement Template HQ Template Documents

Buyer Rebate Agreement Template HQ Template Documents

Buyer Rebate Agreement Template HQ Template Documents

Home Buyers Plan Sample Form Free Download