In today's world of consumerism people love a good bargain. One way to score substantial savings on your purchases can be achieved through Federal Electric Vehicle Credit Rebate H R Block Tax Forms. Federal Electric Vehicle Credit Rebate H R Block Tax Forms are marketing strategies employed by retailers and manufacturers to provide customers with a partial refund on purchases made after they've bought them. In this post, we'll delve into the world of Federal Electric Vehicle Credit Rebate H R Block Tax Forms. We'll discuss the nature of them and how they work and how to maximize your savings using these low-cost incentives.

Get Latest Federal Electric Vehicle Credit Rebate H R Block Tax Form Below

Federal Electric Vehicle Credit Rebate H R Block Tax Form

Federal Electric Vehicle Credit Rebate H R Block Tax Form -

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying vehicle and are looking to claim the Qualified Plug In Electric Motor Vehicle Credit or Clean Vehicle Credit you ll use Form 8936 with your tax return TABLE OF CONTENTS What

Web Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your credit for

A Federal Electric Vehicle Credit Rebate H R Block Tax Form is, in its most basic description, is a refund to a purchaser after they've purchased a good or service. It's a powerful instrument that businesses use to draw customers, boost sales, and market specific products.

Types of Federal Electric Vehicle Credit Rebate H R Block Tax Form

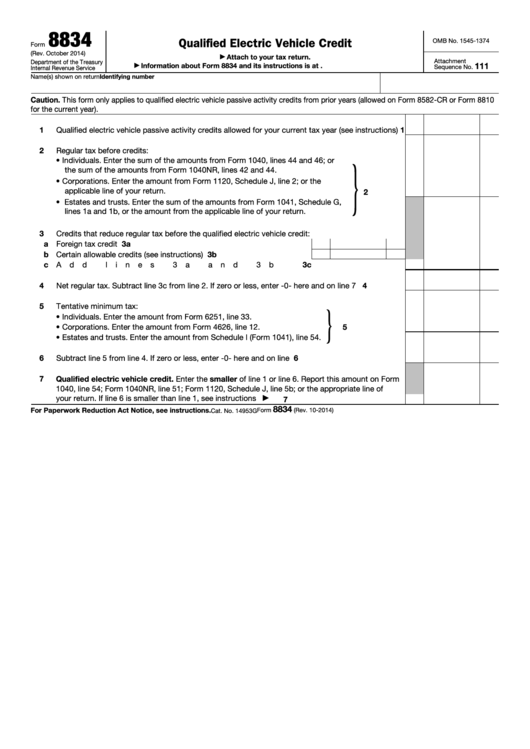

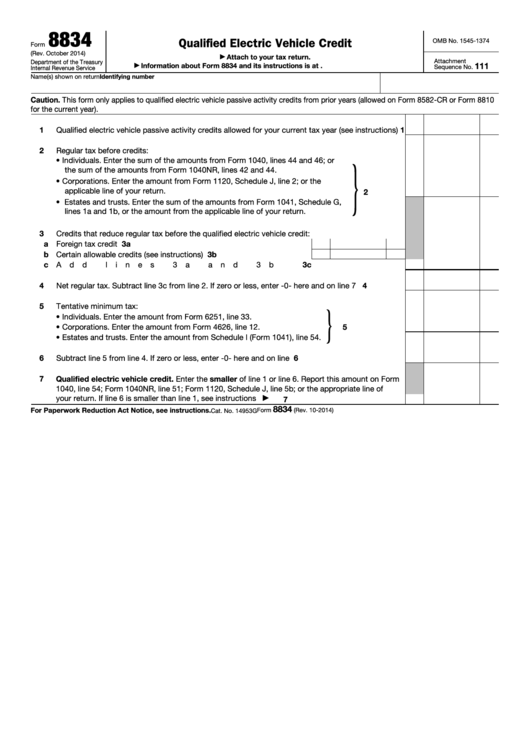

Fillable Form 8834 Qualified Electric Vehicle Credit Printable Pdf

Fillable Form 8834 Qualified Electric Vehicle Credit Printable Pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Cash Federal Electric Vehicle Credit Rebate H R Block Tax Form

Cash Federal Electric Vehicle Credit Rebate H R Block Tax Form are a simple kind of Federal Electric Vehicle Credit Rebate H R Block Tax Form. The customer receives a particular amount of money when purchasing a particular item. These are often used for big-ticket items, like electronics and appliances.

Mail-In Federal Electric Vehicle Credit Rebate H R Block Tax Form

Customers who want to receive mail-in Federal Electric Vehicle Credit Rebate H R Block Tax Form must send in documents of purchase to claim their reimbursement. They're somewhat more involved but offer substantial savings.

Instant Federal Electric Vehicle Credit Rebate H R Block Tax Form

Instant Federal Electric Vehicle Credit Rebate H R Block Tax Form are applied at the point of sale, which reduces the purchase cost immediately. Customers do not have to wait until they can save with this type.

How Federal Electric Vehicle Credit Rebate H R Block Tax Form Work

Used Electric Vehicle Rebate

Used Electric Vehicle Rebate

Web General Instructions Purpose of Form Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year The credit

The Federal Electric Vehicle Credit Rebate H R Block Tax Form Process

The process generally involves a few steps:

-

You purchase the item: First, you purchase the item just as you would ordinarily.

-

Complete this Federal Electric Vehicle Credit Rebate H R Block Tax Form request form. You'll need provide certain information including your name, address, and information about the purchase to make a claim for your Federal Electric Vehicle Credit Rebate H R Block Tax Form.

-

In order to submit the Federal Electric Vehicle Credit Rebate H R Block Tax Form The Federal Electric Vehicle Credit Rebate H R Block Tax Form must be submitted in accordance with the type of Federal Electric Vehicle Credit Rebate H R Block Tax Form the recipient may be required to either mail in a request form or make it available online.

-

Wait for the company's approval: They will evaluate your claim to make sure that it's in accordance with the requirements of the Federal Electric Vehicle Credit Rebate H R Block Tax Form.

-

Accept your Federal Electric Vehicle Credit Rebate H R Block Tax Form When it's approved you'll receive your money back, either through check, prepaid card, or another way specified in the offer.

Pros and Cons of Federal Electric Vehicle Credit Rebate H R Block Tax Form

Advantages

-

Cost Savings: Federal Electric Vehicle Credit Rebate H R Block Tax Form can significantly reduce the cost for a product.

-

Promotional Offers These deals encourage customers to try out new products or brands.

-

Enhance Sales Federal Electric Vehicle Credit Rebate H R Block Tax Form can help boost companies' sales and market share.

Disadvantages

-

Complexity Federal Electric Vehicle Credit Rebate H R Block Tax Form that are mail-in, particularly difficult and tedious.

-

Expiration Dates Many Federal Electric Vehicle Credit Rebate H R Block Tax Form are subject to specific deadlines for submission.

-

Risk of not receiving payment Certain customers could not be able to receive their Federal Electric Vehicle Credit Rebate H R Block Tax Form if they do not adhere to the guidelines exactly.

Download Federal Electric Vehicle Credit Rebate H R Block Tax Form

Download Federal Electric Vehicle Credit Rebate H R Block Tax Form

FAQs

1. Are Federal Electric Vehicle Credit Rebate H R Block Tax Form equivalent to discounts? No, Federal Electric Vehicle Credit Rebate H R Block Tax Form involve partial reimbursement after purchase whereas discounts will reduce their price at point of sale.

2. Are there any Federal Electric Vehicle Credit Rebate H R Block Tax Form that I can use on the same product The answer is dependent on the terms that apply to the Federal Electric Vehicle Credit Rebate H R Block Tax Form provides and the particular product's suitability. Certain companies may allow it, while others won't.

3. How long does it take to get a Federal Electric Vehicle Credit Rebate H R Block Tax Form What is the timeframe? varies, but it can last from a few weeks until a few months for you to receive your Federal Electric Vehicle Credit Rebate H R Block Tax Form.

4. Do I need to pay taxes of Federal Electric Vehicle Credit Rebate H R Block Tax Form the amount? the majority of cases, Federal Electric Vehicle Credit Rebate H R Block Tax Form amounts are not considered to be taxable income.

5. Should I be able to trust Federal Electric Vehicle Credit Rebate H R Block Tax Form deals from lesser-known brands Consider doing some research and verify that the organization that is offering the Federal Electric Vehicle Credit Rebate H R Block Tax Form is reputable prior making a purchase.

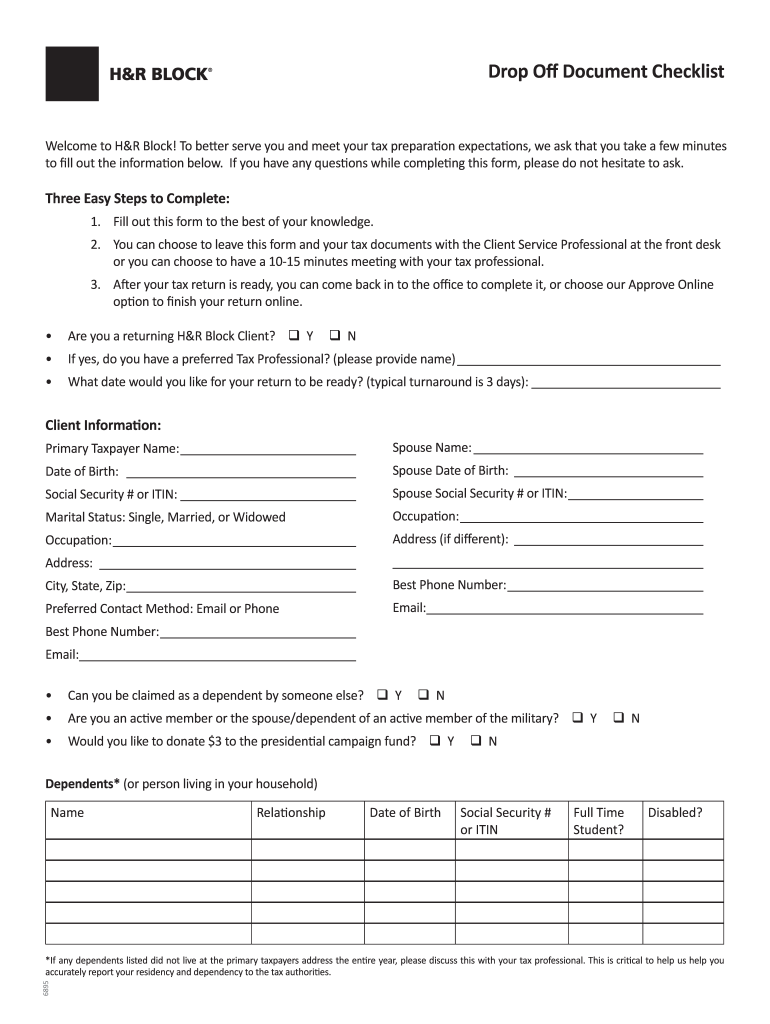

Hr Block Drop Off Forms Fill Out Sign Online DocHub

How Do I Claim The Recovery Rebate Credit On My Ta

Check more sample of Federal Electric Vehicle Credit Rebate H R Block Tax Form below

How To Get Tax Breaks On Hybrids YourMechanic Advice

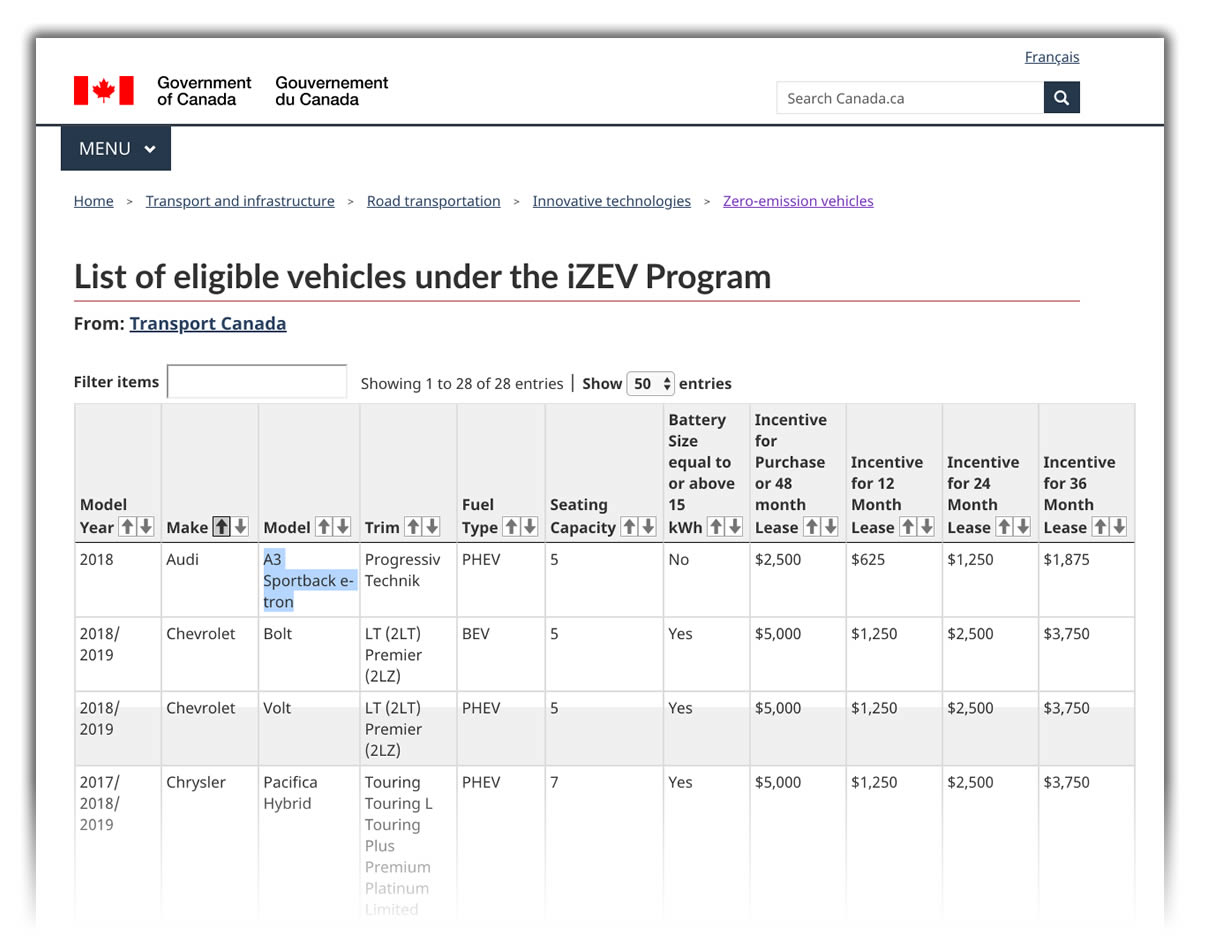

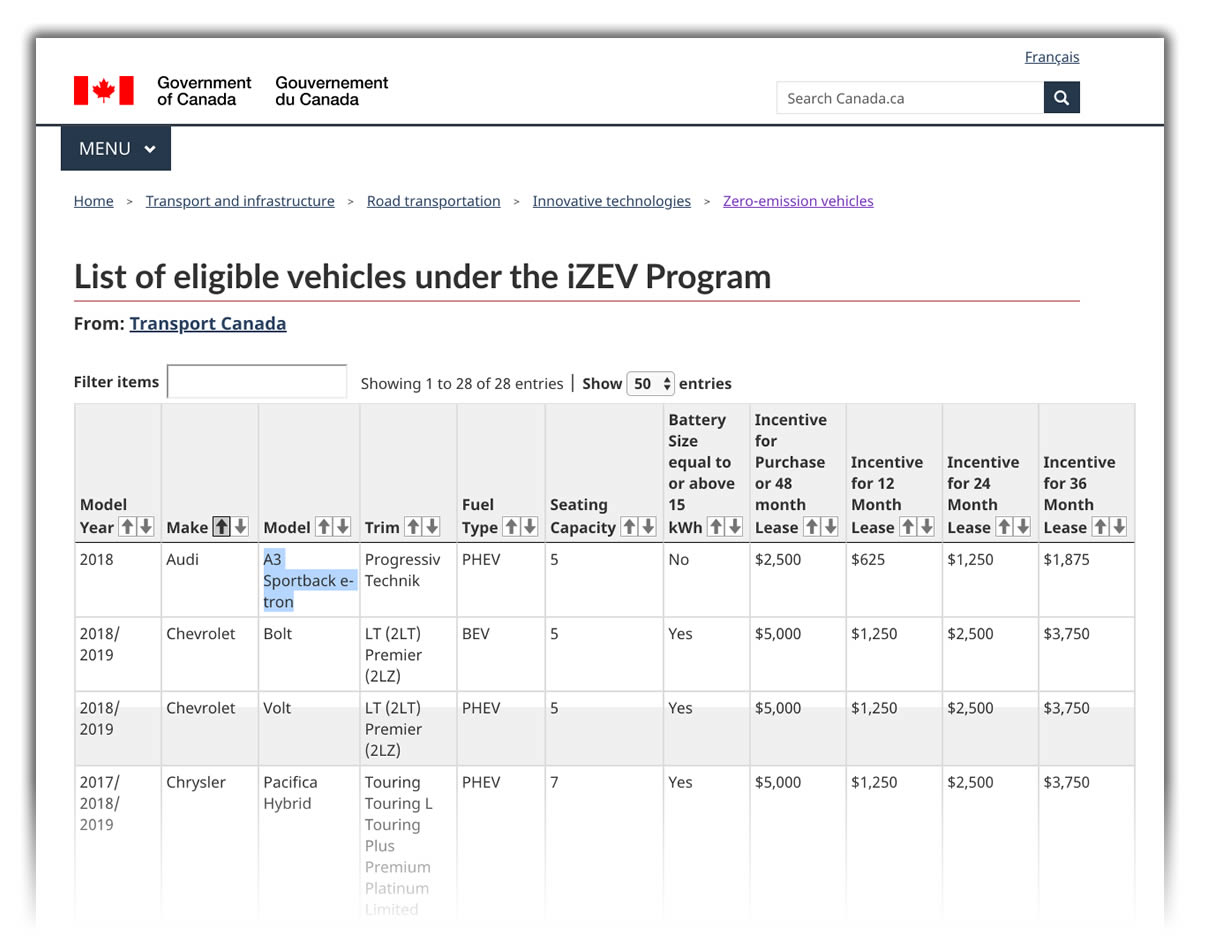

Government Of Canada Electric Vehicle Rebates ElectricRebate

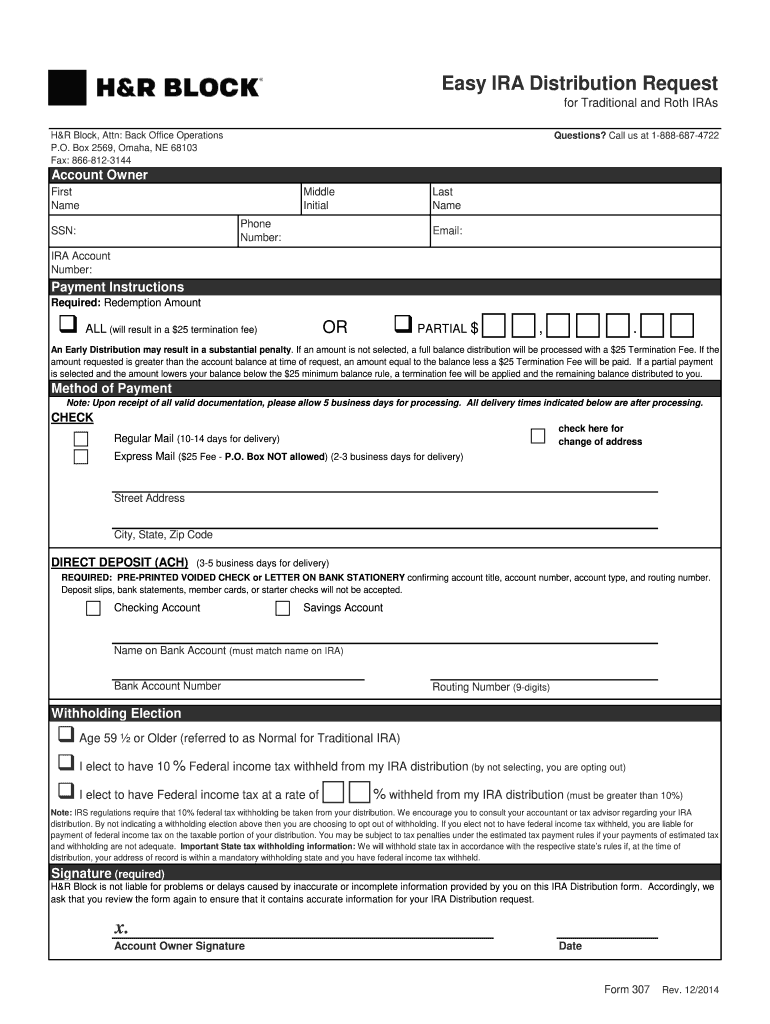

H R Block Distribution Fill Out Sign Online DocHub

Filing Tax Returns EV Credits Tesla Motors Club

Recovery Rebate Credit Form Printable Rebate Form

Irs 1040 Form What Is Form 1040 H R Block Delgado Godge1936

https://www.irs.gov/instructions/i8936

Web Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your credit for

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Web Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your credit for

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Filing Tax Returns EV Credits Tesla Motors Club

Government Of Canada Electric Vehicle Rebates ElectricRebate

Recovery Rebate Credit Form Printable Rebate Form

Irs 1040 Form What Is Form 1040 H R Block Delgado Godge1936

H And R Block State Tax Calculator Printable Rebate Form

I Am Using H R Block Online Software To File My 2010 Taxes I Have Some

I Am Using H R Block Online Software To File My 2010 Taxes I Have Some

Tax Refund Calculator With Electric Car Rebate 2023 Carrebate