In our current world of high-end consumer goods everyone enjoys a good bargain. One way to gain significant savings from your purchases is via Farmland School Tax Rebate Formss. Farmland School Tax Rebate Formss are a strategy for marketing used by manufacturers and retailers for offering customers a percentage cash back on their purchases once they have bought them. In this article, we will explore the world of Farmland School Tax Rebate Formss. We'll look at the nature of them as well as how they work and how you can maximise your savings with these cost-effective incentives.

Get Latest Farmland School Tax Rebate Forms Below

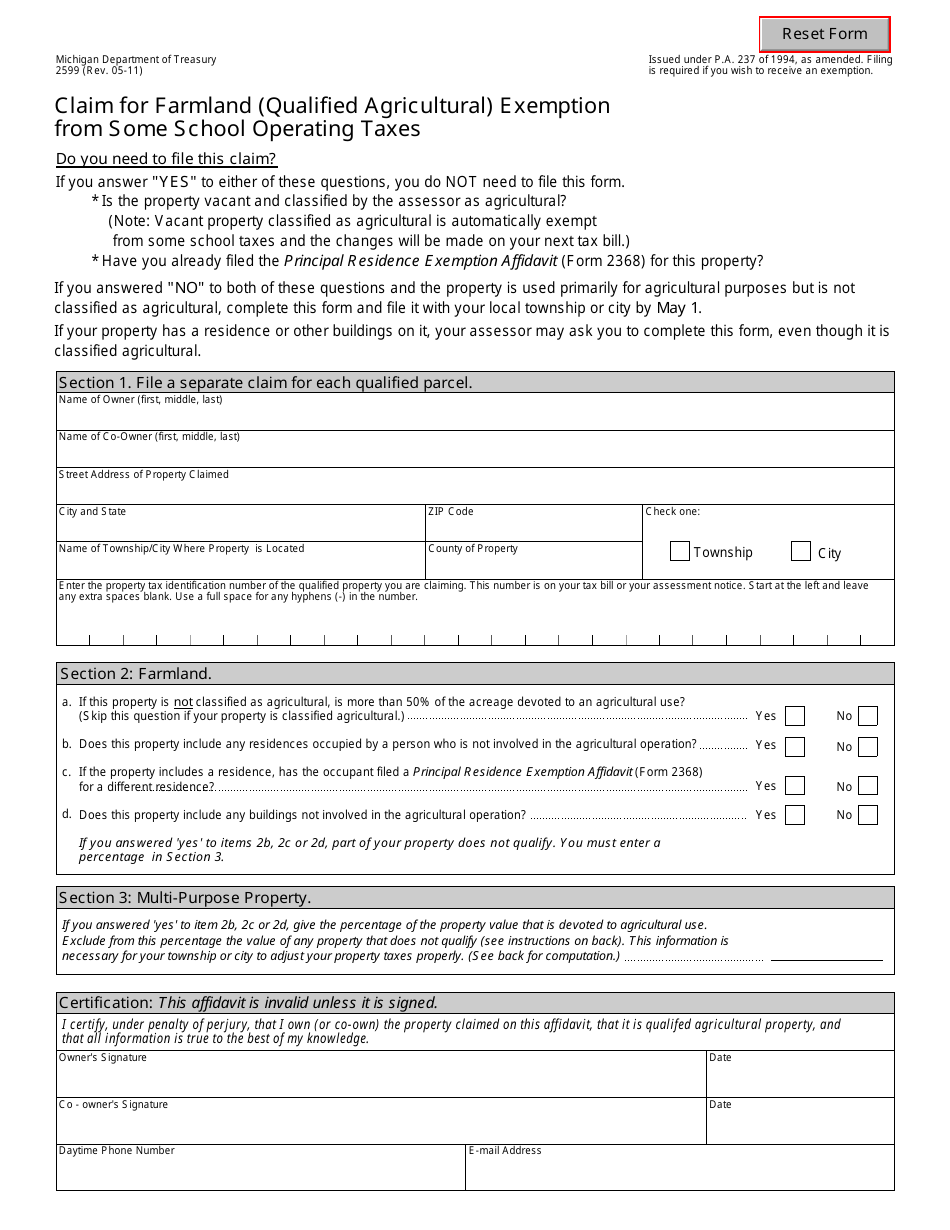

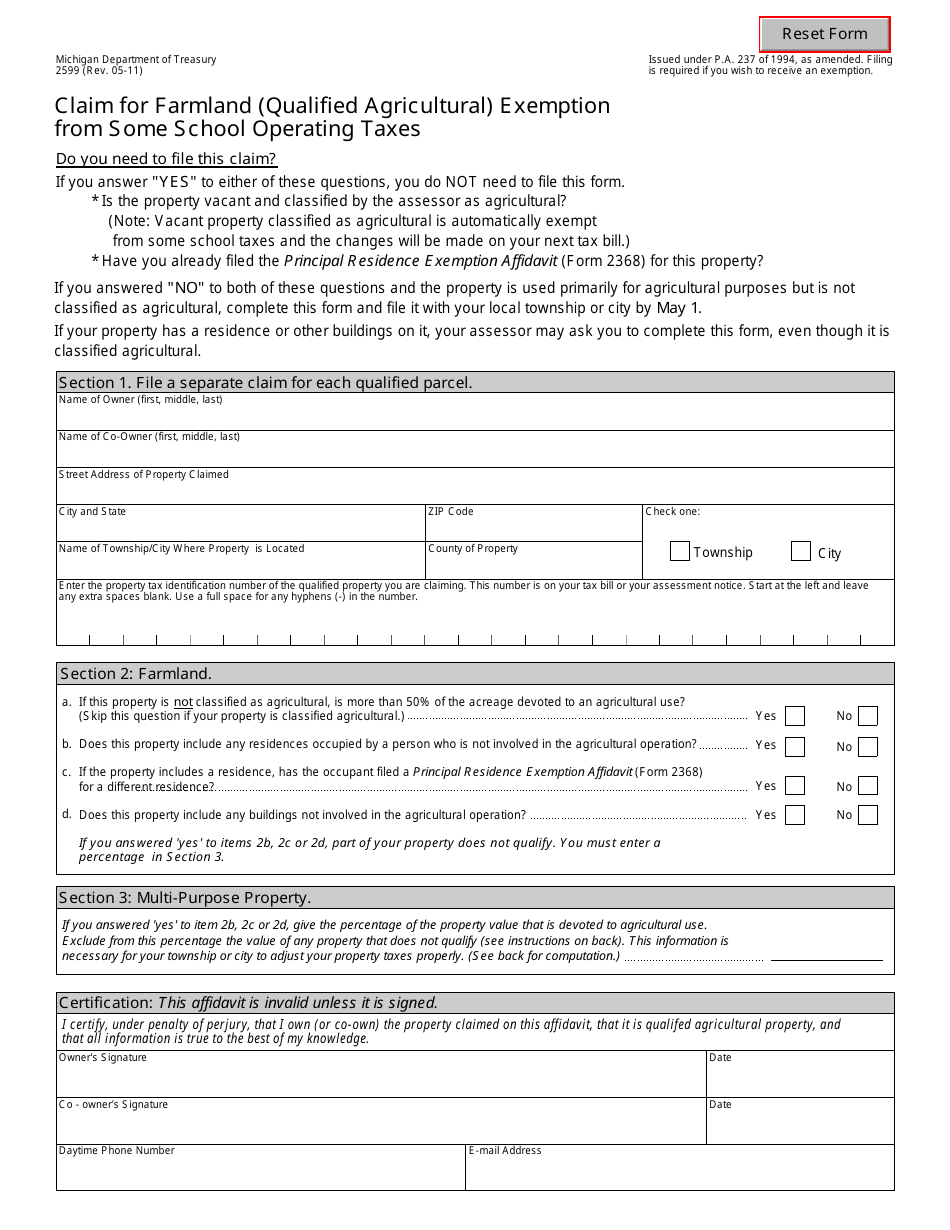

Farmland School Tax Rebate Forms

Farmland School Tax Rebate Forms -

Web Farmland School Tax Rebate If you own farmland in Manitoba you may be eligible for a rebate on the farmland portion of your school taxes Farmland does not currently have

Web Note The deadline to apply for the 2022 rebate and prior years has now passed If you have not previously applied for a rebate you must request a current year application form Please contact a if you would like a 2023

A Farmland School Tax Rebate Forms, in its simplest model, refers to a partial refund given to a client after purchasing a certain product or service. It's a powerful instrument employed by companies to draw buyers, increase sales as well as promote particular products.

Types of Farmland School Tax Rebate Forms

2013 Farmland School Tax Rebate Application Form Canada Manuals

2013 Farmland School Tax Rebate Application Form Canada Manuals

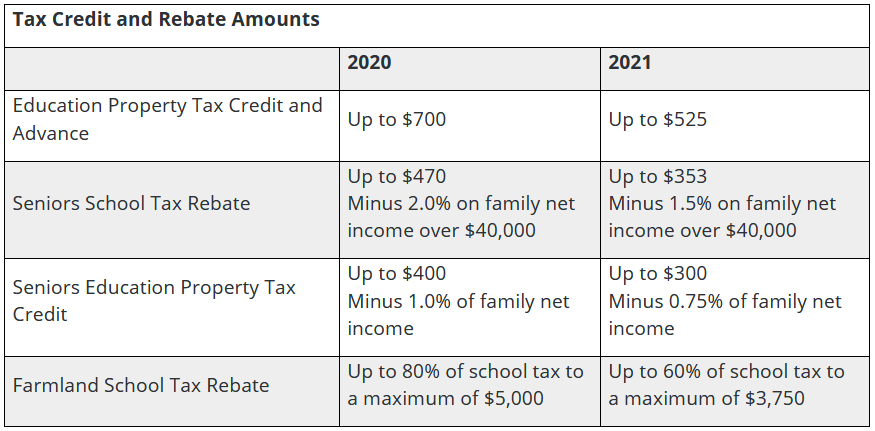

Web Farmland School Tax Rebate Up to 80 of school tax to a maximum of 5 000 Up to 60 of school tax to a maximum of 3 750 Up to 50 of school tax to a maximum of 3 125 Up to 40 of school tax to a

Web Residential and farm property owners will receive a rebate of 50 per cent of their gross school tax payable in 2023 up from 37 5 per cent in 2022

Cash Farmland School Tax Rebate Forms

Cash Farmland School Tax Rebate Forms are the most straightforward type of Farmland School Tax Rebate Forms. Customers receive a specified amount back in cash after buying a product. These are usually used for expensive items such as electronics or appliances.

Mail-In Farmland School Tax Rebate Forms

Mail-in Farmland School Tax Rebate Forms need customers to present proof of purchase in order to receive their money back. They are a bit more involved but offer significant savings.

Instant Farmland School Tax Rebate Forms

Instant Farmland School Tax Rebate Forms can be applied at the point of sale, reducing the price instantly. Customers don't need to wait long for savings when they purchase this type of Farmland School Tax Rebate Forms.

How Farmland School Tax Rebate Forms Work

Provincial Education Property Tax Rebate Roll Out Rural Municipality

Provincial Education Property Tax Rebate Roll Out Rural Municipality

Web The Education Property Tax Rebate will automatically be issued to property owners no application form will be necessary Farm property owners will still be required to apply

The Farmland School Tax Rebate Forms Process

The procedure typically consists of a few simple steps:

-

When you buy the product you purchase the item in the same way you would normally.

-

Complete the Farmland School Tax Rebate Forms form: You'll have submit some information, such as your address, name, as well as the details of your purchase in order to get your Farmland School Tax Rebate Forms.

-

Complete the Farmland School Tax Rebate Forms In accordance with the nature of Farmland School Tax Rebate Forms you could be required to fill out a form and mail it in or make it available online.

-

Wait for the company's approval: They will scrutinize your submission and ensure that it's compliant with refund's conditions and terms.

-

Get your Farmland School Tax Rebate Forms After approval, you'll receive the refund in the form of a check, prepaid card, or another method that is specified in the offer.

Pros and Cons of Farmland School Tax Rebate Forms

Advantages

-

Cost Savings Farmland School Tax Rebate Forms can dramatically lower the cost you pay for products.

-

Promotional Offers Customers are enticed to try new products and brands.

-

Improve Sales The benefits of a Farmland School Tax Rebate Forms can improve sales for a company and also increase market share.

Disadvantages

-

Complexity Pay-in Farmland School Tax Rebate Forms via mail, in particular they can be time-consuming and demanding.

-

Time Limits for Farmland School Tax Rebate Forms: Many Farmland School Tax Rebate Forms have deadlines for submission.

-

Risque of Non-Payment Certain customers could lose their Farmland School Tax Rebate Forms in the event that they don't follow the rules precisely.

Download Farmland School Tax Rebate Forms

Download Farmland School Tax Rebate Forms

FAQs

1. Are Farmland School Tax Rebate Forms similar to discounts? No, Farmland School Tax Rebate Forms involve a partial refund after purchase, while discounts reduce the price of the purchase at the moment of sale.

2. Are multiple Farmland School Tax Rebate Forms available on the same item It's contingent upon the conditions for the Farmland School Tax Rebate Forms provides and the particular product's quality and eligibility. Certain companies may permit it, and some don't.

3. How long will it take to receive a Farmland School Tax Rebate Forms What is the timeframe? will vary, but it may last from a few weeks until a few months before you receive your Farmland School Tax Rebate Forms.

4. Do I need to pay tax of Farmland School Tax Rebate Forms amounts? In most cases, Farmland School Tax Rebate Forms amounts are not considered taxable income.

5. Should I be able to trust Farmland School Tax Rebate Forms deals from lesser-known brands? It's essential to research and verify that the brand giving the Farmland School Tax Rebate Forms is trustworthy prior to making any purchase.

Manitoba Agricultural Services Corporation MASC

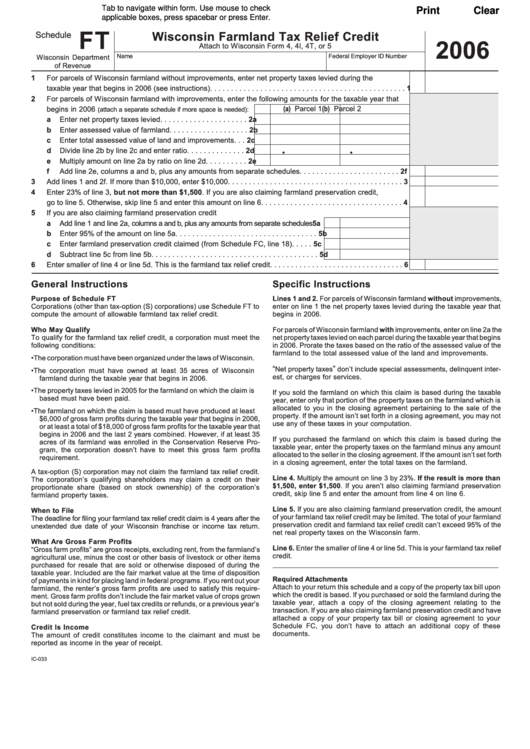

Fillable Form Ic 033 Wisconsin Farmland Tax Relief Credit 2006

Check more sample of Farmland School Tax Rebate Forms below

2013 Farmland School Tax Rebate Application Form

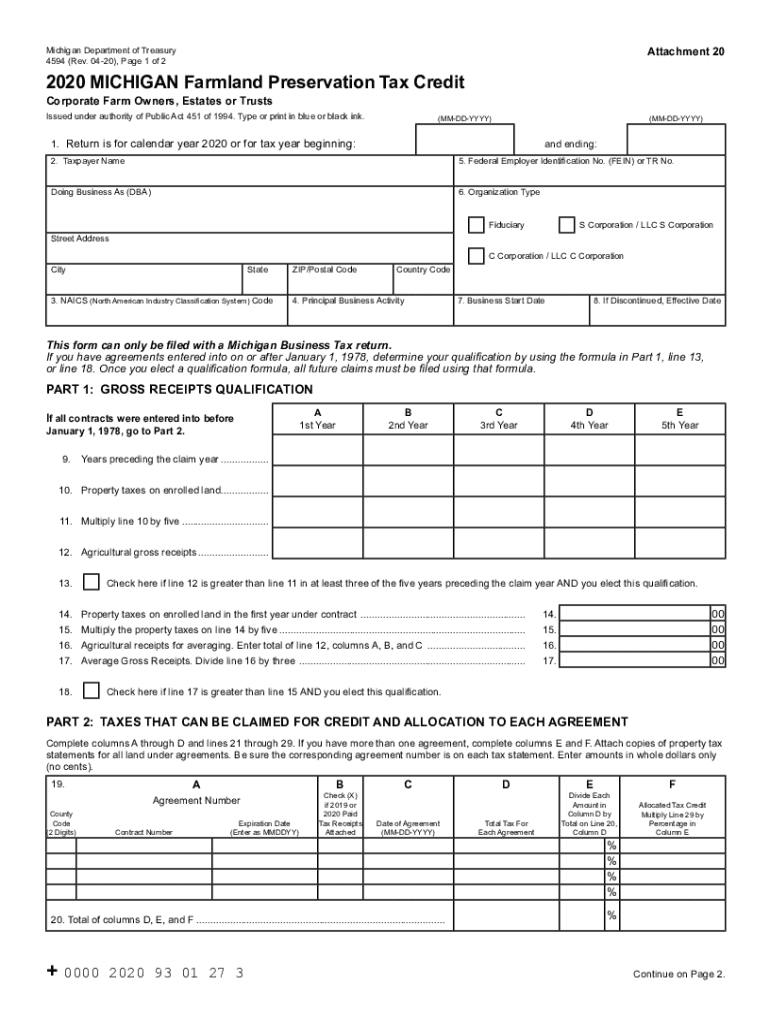

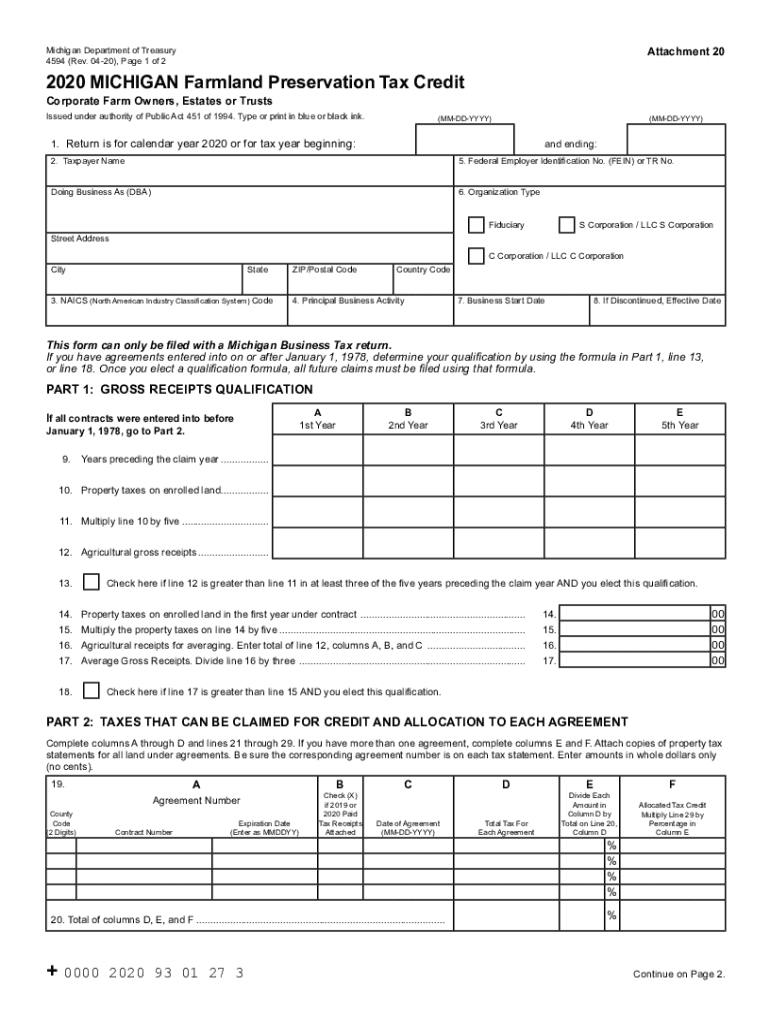

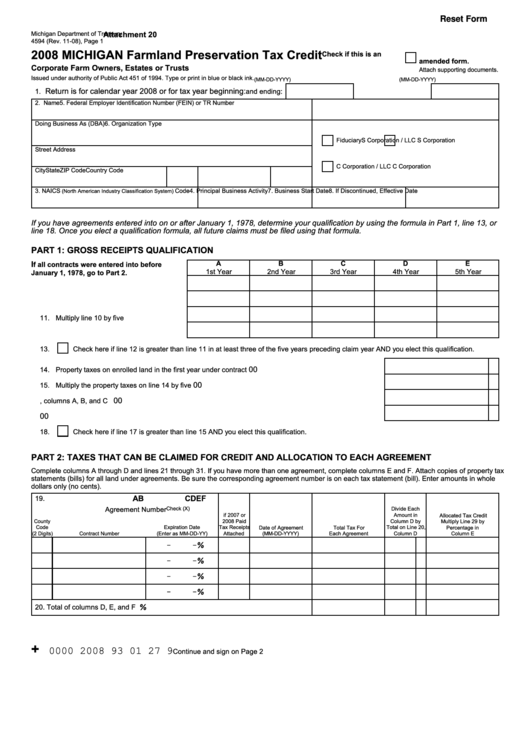

2020 2022 Form MI DoT 4594 Fill Online Printable Fillable Blank

Notices Oak Lake RM Of Sifton

Farmland Rebate Food Service Corporate Promotion Farmland

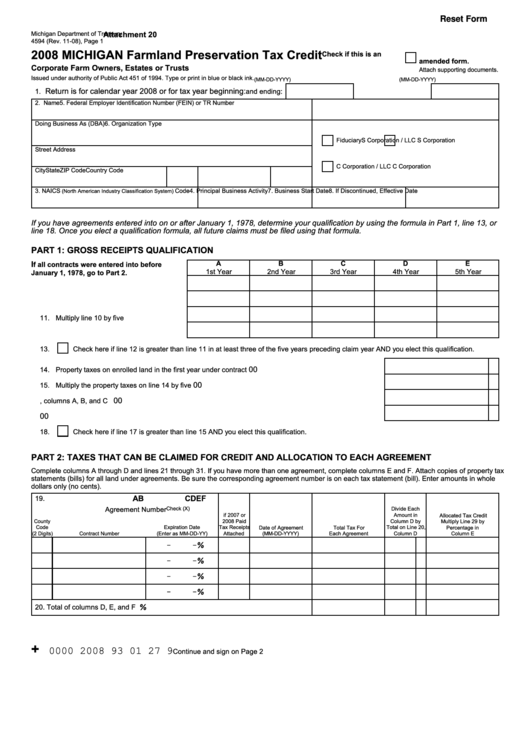

Fillable Form 4594 Michigan Farmland Preservation Tax Credit 2008

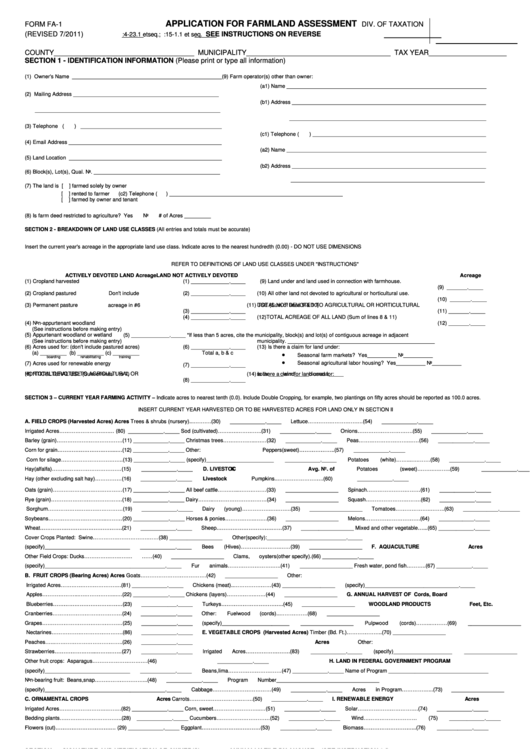

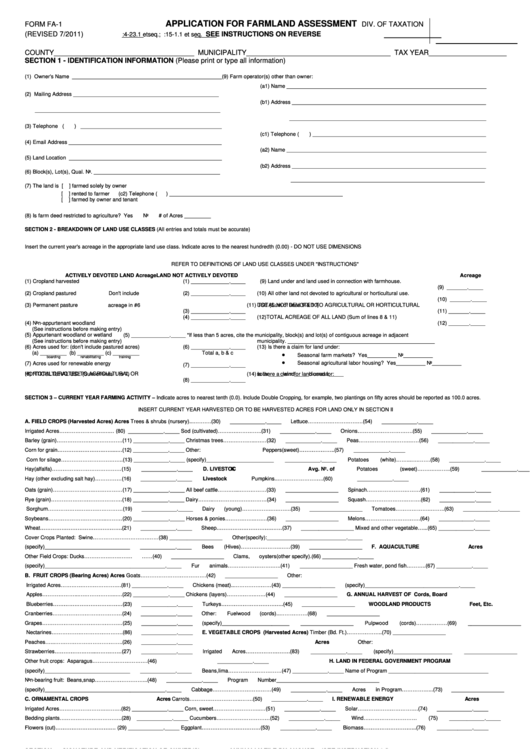

Fillable Form Fa 1 Application For Farmland Assessment Printable Pdf

https://www.masc.mb.ca/masc.nsf/program_f…

Web Note The deadline to apply for the 2022 rebate and prior years has now passed If you have not previously applied for a rebate you must request a current year application form Please contact a if you would like a 2023

https://www.masc.mb.ca/masc.nsf/faqs_fstr.pdf

Web Do I need to apply for my Farmland School Tax Rebate Yes You must apply each year and applications must be received by Manitoba Agricultural Services Corporation

Web Note The deadline to apply for the 2022 rebate and prior years has now passed If you have not previously applied for a rebate you must request a current year application form Please contact a if you would like a 2023

Web Do I need to apply for my Farmland School Tax Rebate Yes You must apply each year and applications must be received by Manitoba Agricultural Services Corporation

Farmland Rebate Food Service Corporate Promotion Farmland

2020 2022 Form MI DoT 4594 Fill Online Printable Fillable Blank

Fillable Form 4594 Michigan Farmland Preservation Tax Credit 2008

Fillable Form Fa 1 Application For Farmland Assessment Printable Pdf

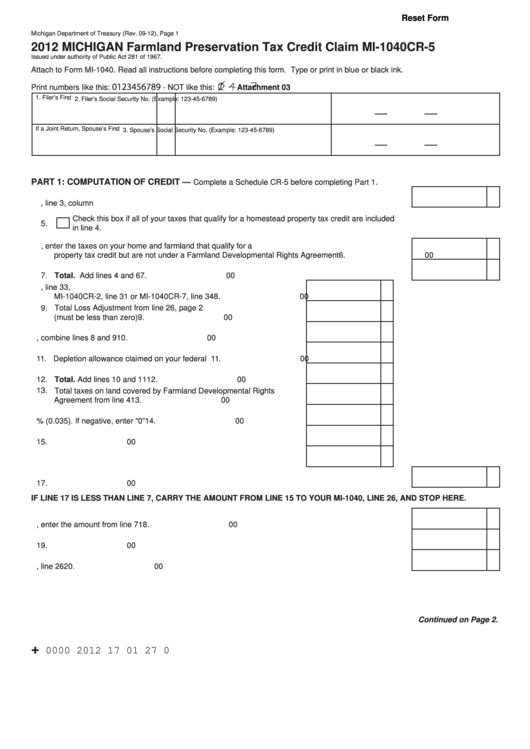

Fillable Form Mi 1040cr 5 Michigan Farmland Preservation Tax Credit

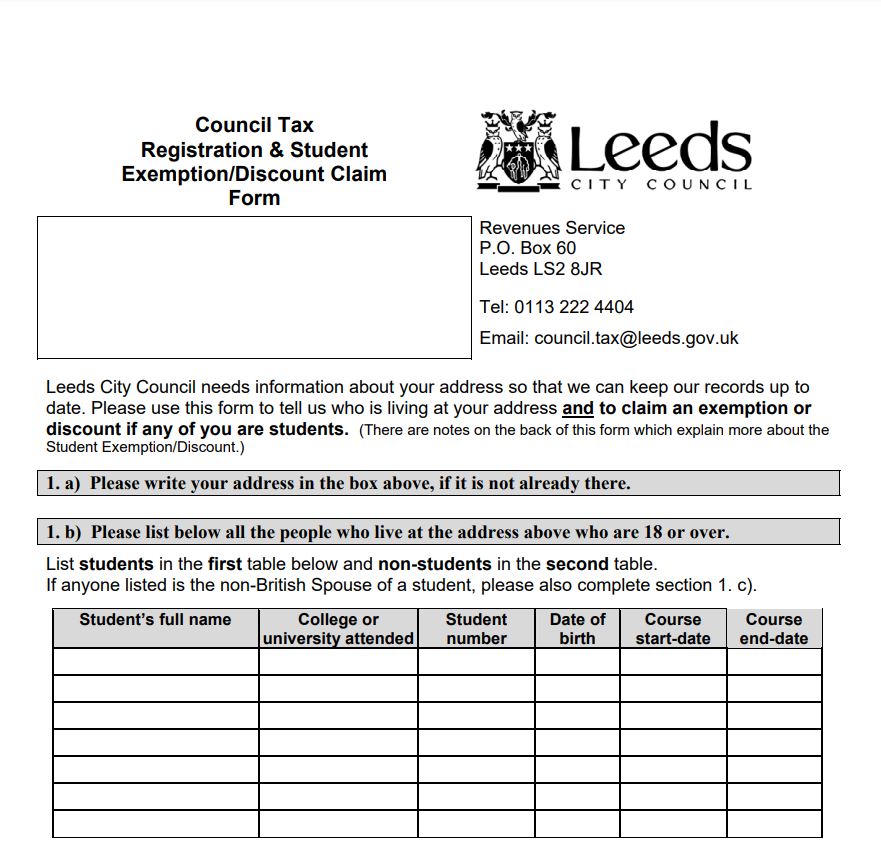

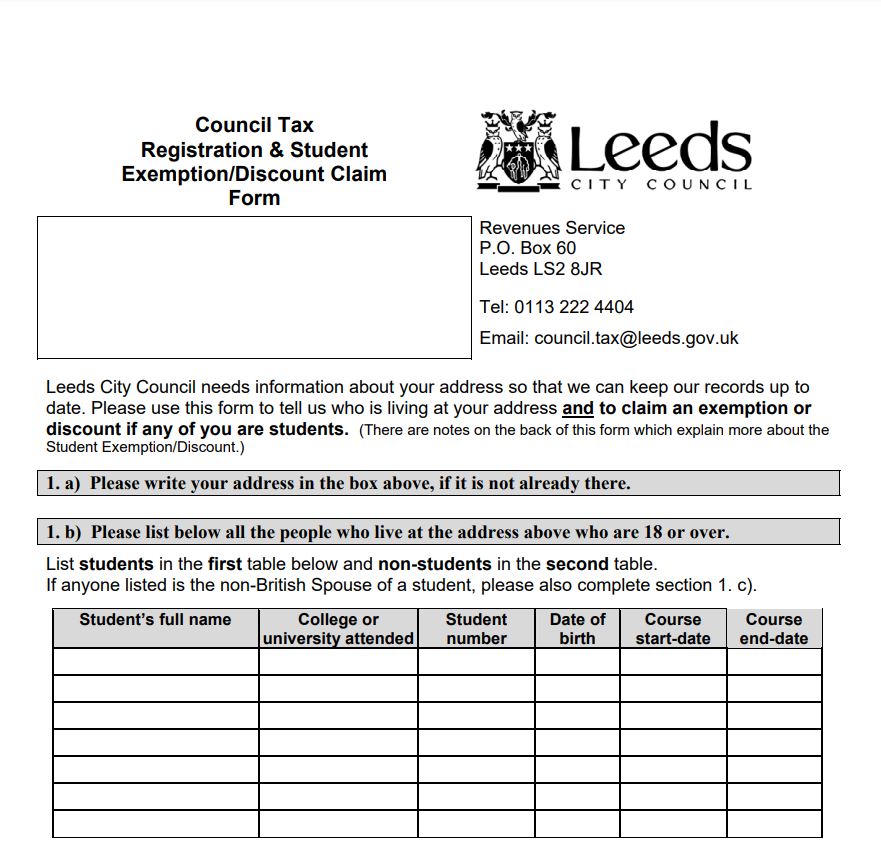

Leeds Council Printable Rebate Form

Leeds Council Printable Rebate Form

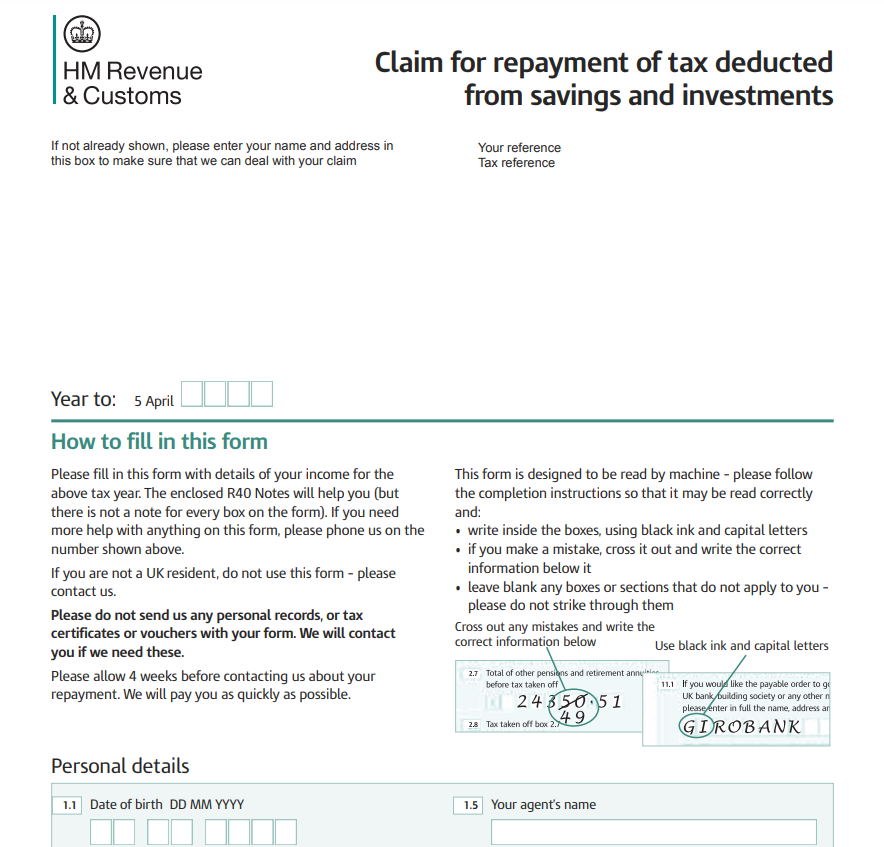

Ppi Tax Rebate Form Amount Printable Rebate Form