In our current world of high-end consumer goods everybody loves a good bargain. One way to earn substantial savings on your purchases can be achieved through Ev Tax Rebate Forms. Ev Tax Rebate Forms are a marketing strategy employed by retailers and manufacturers in order to offer customers a small payment on their purchases, after they have completed them. In this article, we will look into the world of Ev Tax Rebate Forms, examining the nature of them their purpose, how they function and how to maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Ev Tax Rebate Form Below

Ev Tax Rebate Form

Ev Tax Rebate Form -

Web 5 sept 2023 nbsp 0183 32 CLAIMING THE EV TAX CREDIT How to claim the EV tax credit on your return To claim the EV tax credit you file IRS Form 8936 with your federal income tax

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

A Ev Tax Rebate Form, in its simplest description, is a reimbursement to a buyer after purchasing a certain product or service. It's a highly effective tool employed by companies to draw customers, increase sales, and also to advertise certain products.

Types of Ev Tax Rebate Form

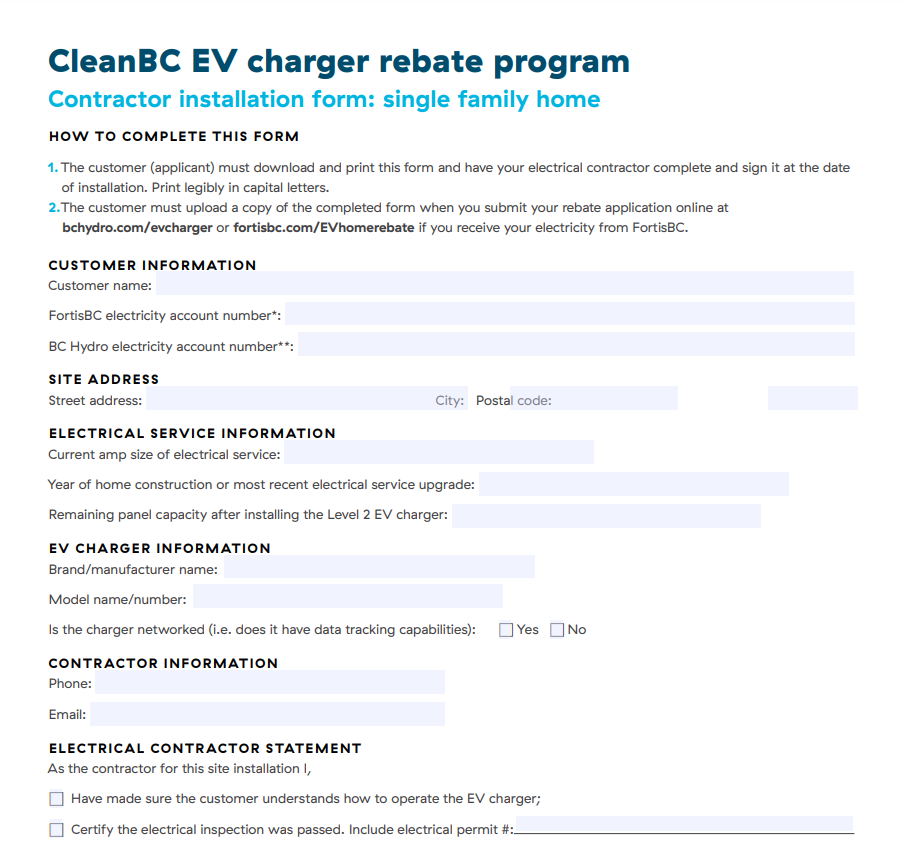

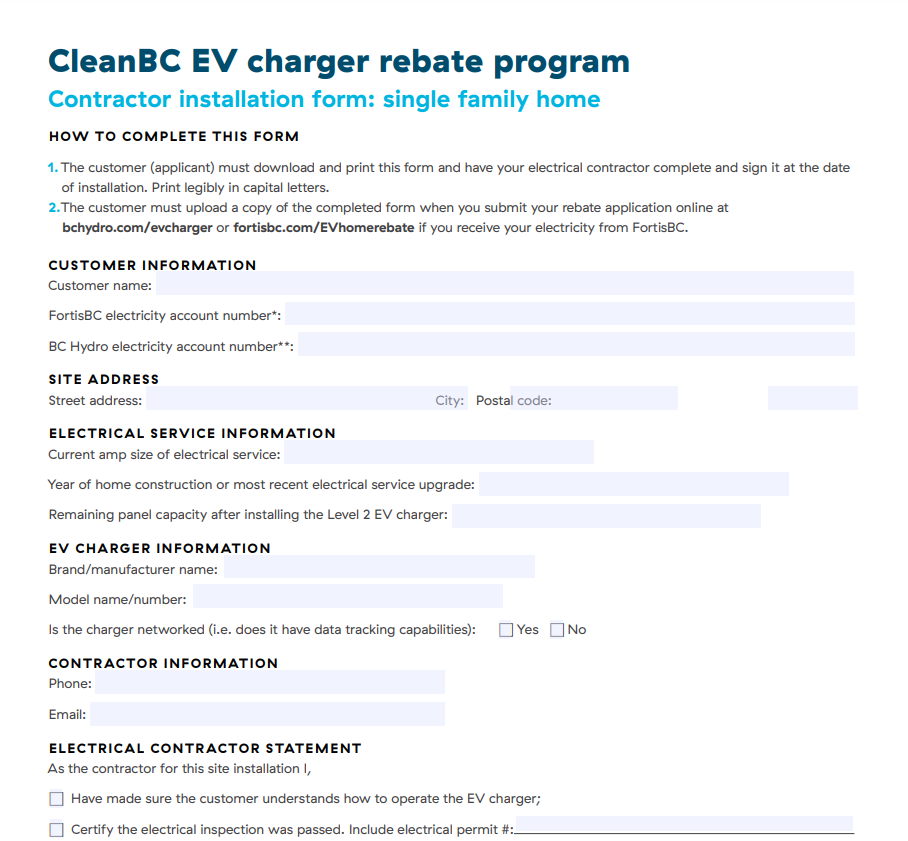

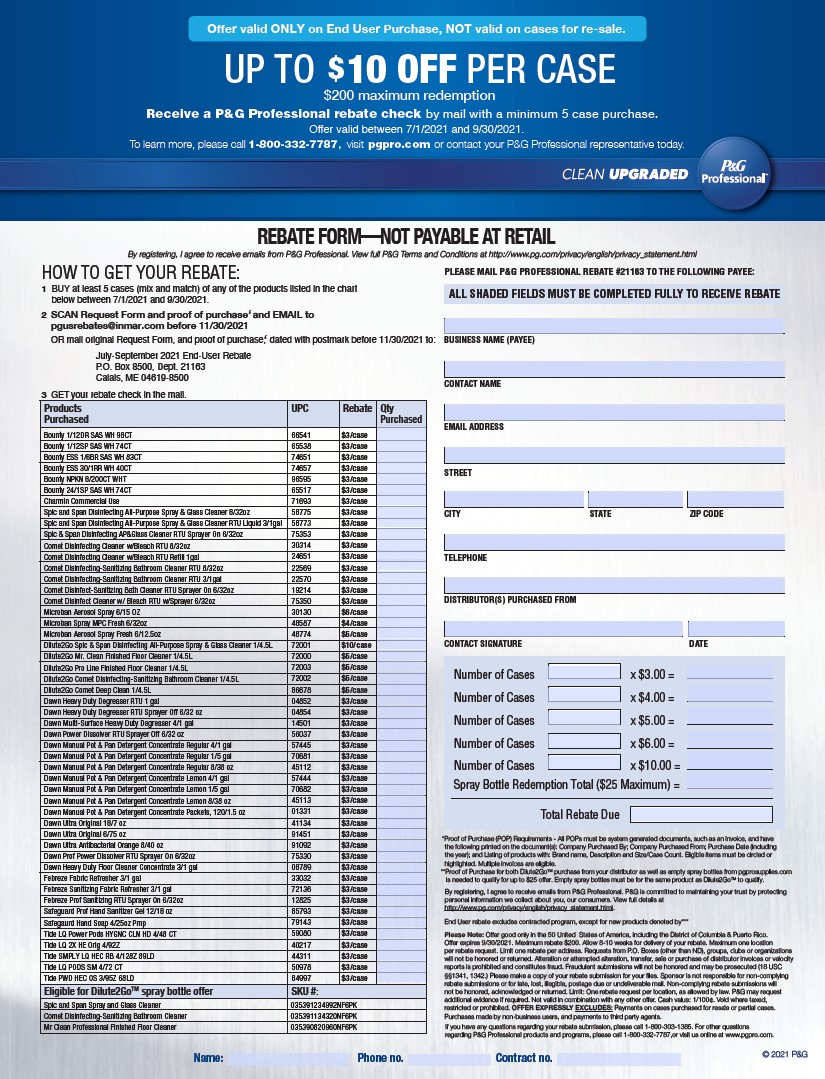

P G And E Ev Rebate Printable Rebate Form

P G And E Ev Rebate Printable Rebate Form

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Cash Ev Tax Rebate Form

Cash Ev Tax Rebate Form are the most straightforward kind of Ev Tax Rebate Form. Customers receive a specific amount of money back after buying a product. These are typically for high-ticket items like electronics or appliances.

Mail-In Ev Tax Rebate Form

Mail-in Ev Tax Rebate Form require customers to submit the proof of purchase to be eligible for their money back. They're longer-lasting, however they offer substantial savings.

Instant Ev Tax Rebate Form

Instant Ev Tax Rebate Form are applied at the moment of sale, cutting the purchase cost immediately. Customers don't need to wait for their savings when they purchase this type of Ev Tax Rebate Form.

How Ev Tax Rebate Form Work

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Web 17 janv 2023 nbsp 0183 32 Next buyers need to file the appropriate tax form Form 8936 to claim the EV tax credit during the year the EV is put into service this can be an important distinction if you sign a contract for purchase in

The Ev Tax Rebate Form Process

It usually consists of a few simple steps

-

Buy the product: At first you purchase the product the way you normally do.

-

Fill out your Ev Tax Rebate Form application: In order to claim your Ev Tax Rebate Form, you'll have be able to provide a few details including your address, name, and the purchase details, in order to be eligible for a Ev Tax Rebate Form.

-

Submit the Ev Tax Rebate Form If you want to submit the Ev Tax Rebate Form, based on the kind of Ev Tax Rebate Form you might need to mail in a form or upload it online.

-

Wait for approval: The company will scrutinize your submission to determine if it's in compliance with the terms and conditions of the Ev Tax Rebate Form.

-

Take advantage of your Ev Tax Rebate Form Once it's approved, you'll receive your money back, whether via check, credit card, or other method specified by the offer.

Pros and Cons of Ev Tax Rebate Form

Advantages

-

Cost savings Ev Tax Rebate Form could significantly reduce the price you pay for products.

-

Promotional Offers These promotions encourage consumers in trying new products or brands.

-

Improve Sales Ev Tax Rebate Form are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity In particular, mail-in Ev Tax Rebate Form particularly they can be time-consuming and demanding.

-

Extension Dates Many Ev Tax Rebate Form are subject to strict time limits for submission.

-

Risque of Non-Payment Some customers might not receive Ev Tax Rebate Form if they do not adhere to the guidelines precisely.

Download Ev Tax Rebate Form

FAQs

1. Are Ev Tax Rebate Form similar to discounts? No, Ev Tax Rebate Form require an amount of money that is refunded after the purchase, and discounts are a reduction of your purchase cost at moment of sale.

2. Are there Ev Tax Rebate Form that can be used for the same product It's contingent upon the conditions in the Ev Tax Rebate Form offered and product's acceptance. Certain businesses may allow it, but others won't.

3. How long does it take to receive an Ev Tax Rebate Form? The timing differs, but could be anywhere from a few weeks up to a few months before you receive your Ev Tax Rebate Form.

4. Do I need to pay tax with respect to Ev Tax Rebate Form amounts? In most instances, Ev Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Ev Tax Rebate Form offers from brands that aren't well-known? It's essential to research and verify that the organization which is providing the Ev Tax Rebate Form is reputable before making an acquisition.

Ev New Jersey Rebate Printable Rebate Form

Turbo Tax Rebate Info Questions Tesla Motors Club

Check more sample of Ev Tax Rebate Form below

Top 19 Mor ev Application Form En Iyi 2022

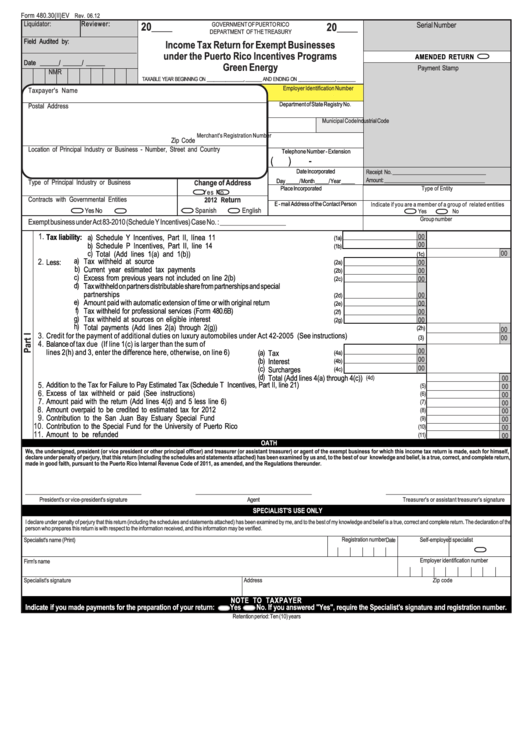

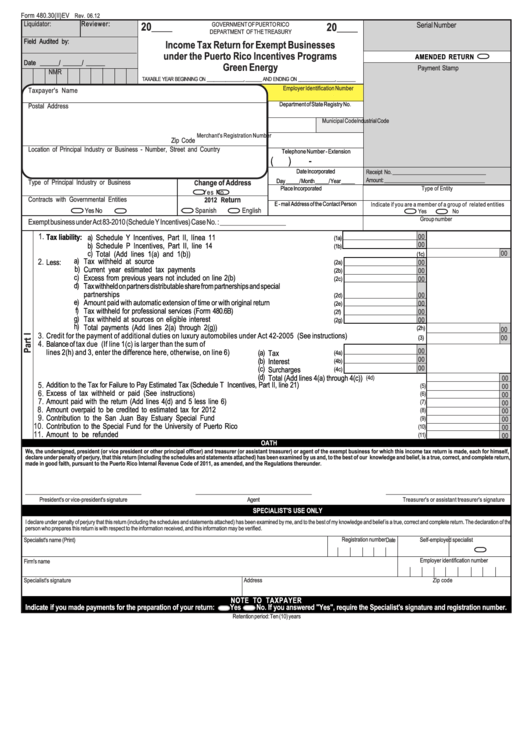

Form 480 30 Ii ev Income Tax Return For Exempt Businesses Under The

California s EV Rebate Changes A Good Model For The Federal EV Tax

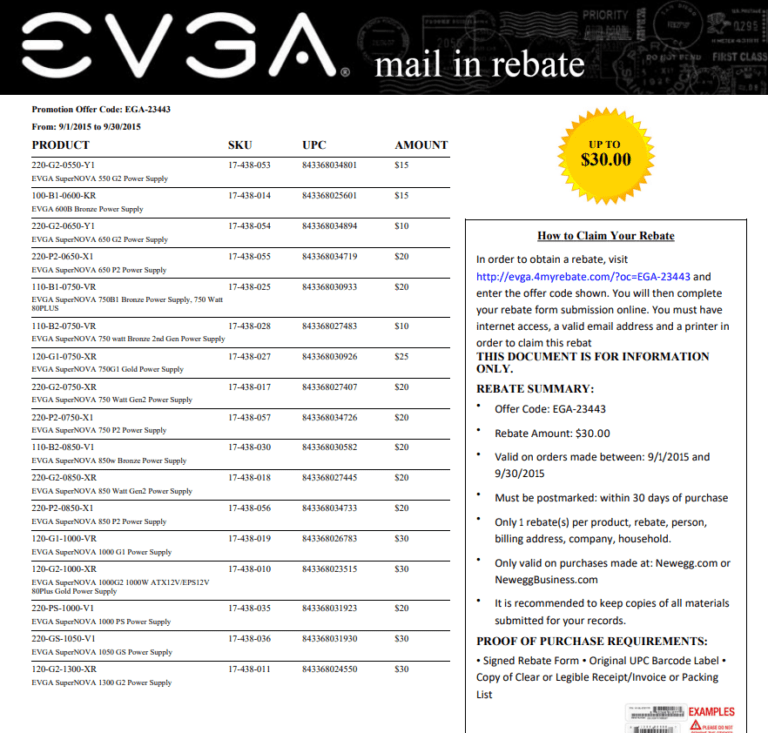

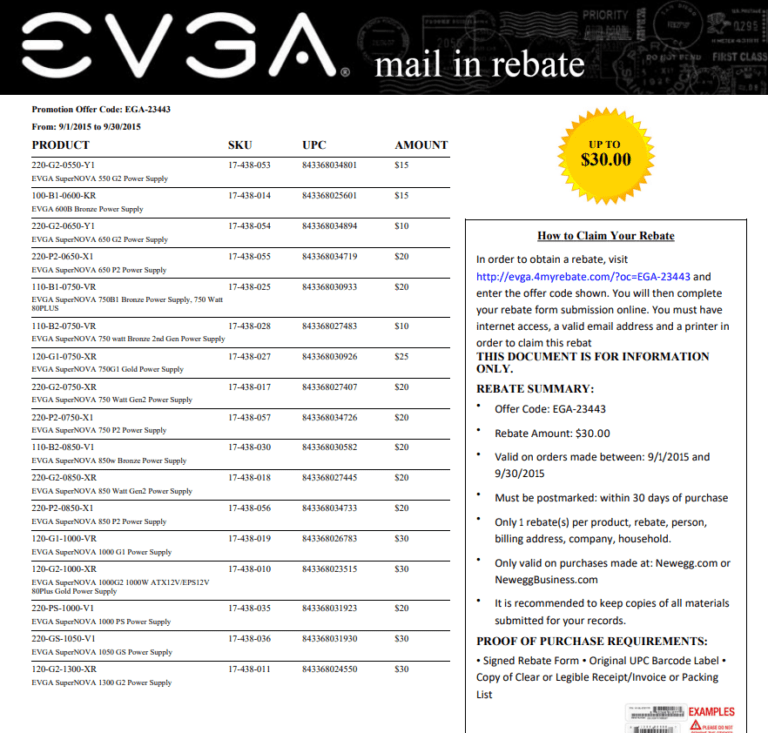

Evga Rebate Form Printable Rebate Form

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

Ouc Energy Rebates Fill Online Printable Fillable Blank PdfFiller

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

https://www.irs.gov/pub/irs-pdf/f8834.pdf

Web Line 1 Enter the qualified electric vehicle passive activity credits allowed for your current tax year from Form 8582 CR Passive Activity Credit Limitations for individuals estates

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Web Line 1 Enter the qualified electric vehicle passive activity credits allowed for your current tax year from Form 8582 CR Passive Activity Credit Limitations for individuals estates

Evga Rebate Form Printable Rebate Form

Form 480 30 Ii ev Income Tax Return For Exempt Businesses Under The

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

Ouc Energy Rebates Fill Online Printable Fillable Blank PdfFiller

Tesla Model 3 US Federal EV Tax Credit Update CleanTechnica

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

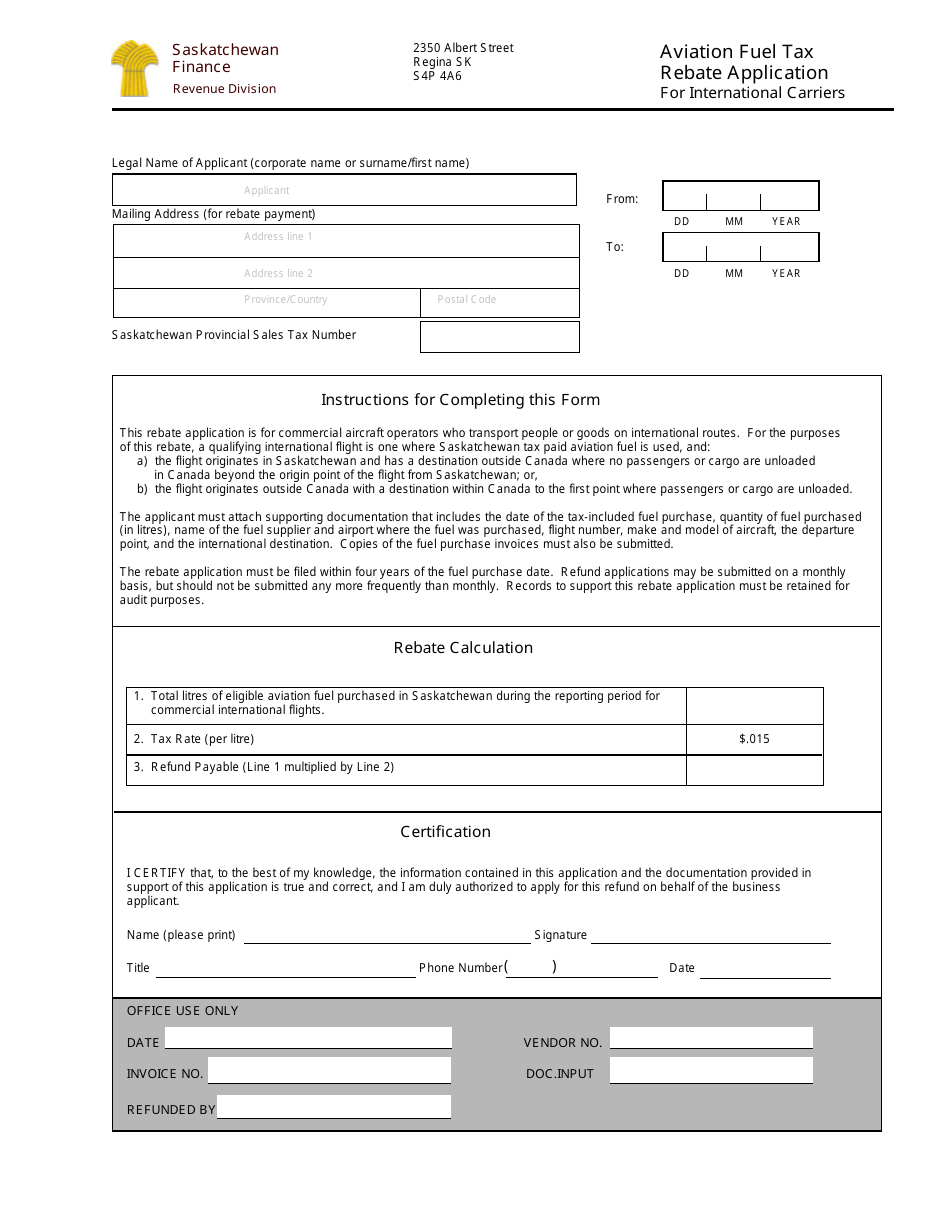

Saskatchewan Canada Aviation Fuel Tax Rebate Application For