In today's world of consumerism everyone appreciates a great deal. One option to obtain significant savings for your purchases is through Ev Federal Rebate Tax Forms. Ev Federal Rebate Tax Forms are an effective marketing tactic used by manufacturers and retailers for offering customers a percentage refund on purchases made after they have bought them. In this article, we'll examine the subject of Ev Federal Rebate Tax Forms and explore the nature of them about, how they work, and how you can maximise the value of these incentives.

Get Latest Ev Federal Rebate Tax Form Below

Ev Federal Rebate Tax Form

Ev Federal Rebate Tax Form -

Web 18 avr 2023 nbsp 0183 32 For a list of incentives by vehicle see Federal Tax Credits on FuelEconomy gov Vehicles Placed in Service on or After April 18 2023 For vehicles

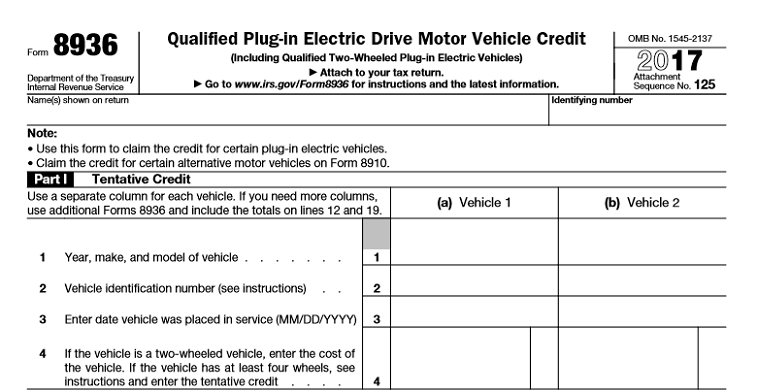

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

A Ev Federal Rebate Tax Form as it is understood in its simplest definition, is a payment to a consumer after they've bought a product or service. It's a very effective technique that companies use to attract buyers, increase sales and advertise specific products.

Types of Ev Federal Rebate Tax Form

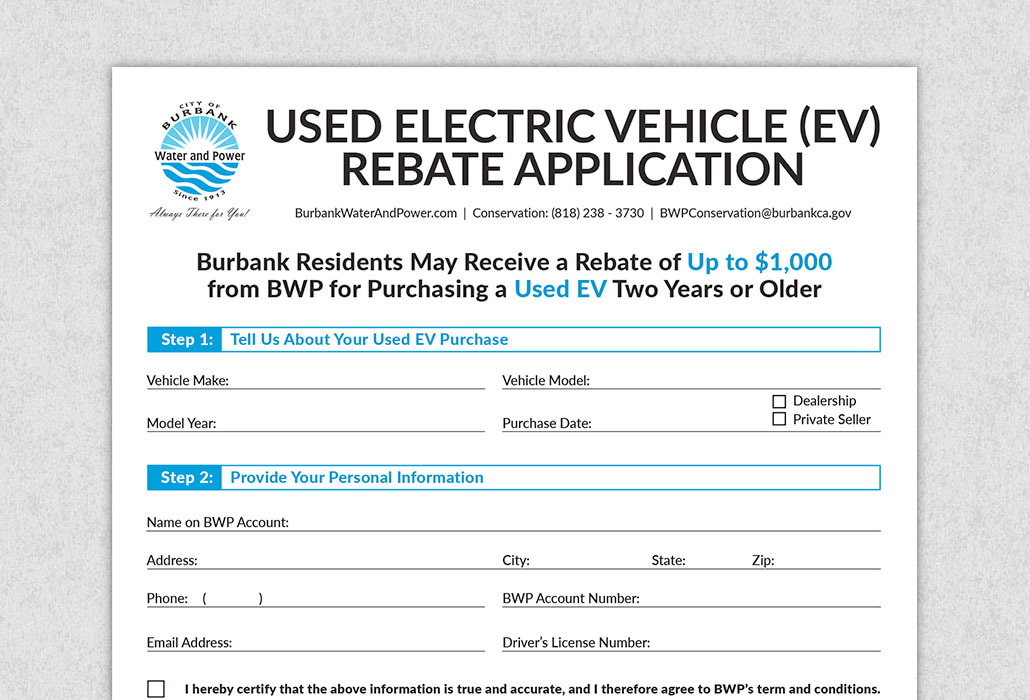

Used Electric Vehicle Rebate

Used Electric Vehicle Rebate

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying vehicle and are looking to claim the Qualified Plug In Electric Motor Vehicle Credit or Clean Vehicle Credit you ll use Form 8936 with your tax return TABLE OF CONTENTS What

Cash Ev Federal Rebate Tax Form

Cash Ev Federal Rebate Tax Form are a simple type of Ev Federal Rebate Tax Form. Customers receive a specific amount back in cash after purchasing a product. These are typically applied to expensive items such as electronics or appliances.

Mail-In Ev Federal Rebate Tax Form

Customers who want to receive mail-in Ev Federal Rebate Tax Form must provide their proof of purchase before receiving their reimbursement. They're a bit more complicated, but they can provide huge savings.

Instant Ev Federal Rebate Tax Form

Instant Ev Federal Rebate Tax Form apply at the point of sale, reducing the price of purchases immediately. Customers do not have to wait for savings through this kind of offer.

How Ev Federal Rebate Tax Form Work

P G And E Ev Rebate Printable Rebate Form

P G And E Ev Rebate Printable Rebate Form

Web 5 sept 2023 nbsp 0183 32 The EV tax credit income limit for married couples filing jointly is 300 000 And if you file as head of household and make more than 225 000 you also won t be

The Ev Federal Rebate Tax Form Process

The process generally involves a few steps

-

You purchase the item: First purchase the product exactly as you would normally.

-

Fill in this Ev Federal Rebate Tax Form template: You'll need to fill in some information, such as your address, name, and details about your purchase, in order in order to receive your Ev Federal Rebate Tax Form.

-

Submit the Ev Federal Rebate Tax Form According to the type of Ev Federal Rebate Tax Form there may be a requirement to either mail in a request form or send it via the internet.

-

Wait for approval: The business will look over your submission to determine if it's in compliance with the rules and regulations of the Ev Federal Rebate Tax Form.

-

Redeem your Ev Federal Rebate Tax Form After approval, you'll receive your cash back via check, prepaid card, or any other way specified in the offer.

Pros and Cons of Ev Federal Rebate Tax Form

Advantages

-

Cost savings Ev Federal Rebate Tax Form could significantly reduce the price you pay for a product.

-

Promotional Offers These deals encourage customers to test new products or brands.

-

Improve Sales Ev Federal Rebate Tax Form can help boost the company's sales as well as market share.

Disadvantages

-

Complexity Ev Federal Rebate Tax Form that are mail-in, in particular, can be cumbersome and take a long time to complete.

-

Extension Dates A lot of Ev Federal Rebate Tax Form have strict time limits for submission.

-

A risk of not being paid: Some customers may not get their Ev Federal Rebate Tax Form if they don't observe the rules precisely.

Download Ev Federal Rebate Tax Form

Download Ev Federal Rebate Tax Form

FAQs

1. Are Ev Federal Rebate Tax Form equivalent to discounts? Not at all, Ev Federal Rebate Tax Form provide a partial refund after the purchase whereas discounts will reduce their price at time of sale.

2. Do I have to use multiple Ev Federal Rebate Tax Form for the same product It's contingent upon the terms of Ev Federal Rebate Tax Form provides and the particular product's eligibility. Certain companies might allow it, while some won't.

3. What is the time frame to receive the Ev Federal Rebate Tax Form? The timing differs, but it can be anywhere from a few weeks up to a several months to receive a Ev Federal Rebate Tax Form.

4. Do I need to pay taxes of Ev Federal Rebate Tax Form amount? most instances, Ev Federal Rebate Tax Form amounts are not considered taxable income.

5. Do I have confidence in Ev Federal Rebate Tax Form offers from brands that aren't well-known It is essential to investigate and ensure that the brand offering the Ev Federal Rebate Tax Form is legitimate prior to making a purchase.

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

California s EV Rebate Changes A Good Model For The Federal EV Tax

Check more sample of Ev Federal Rebate Tax Form below

Top 19 Mor ev Application Form En Iyi 2022

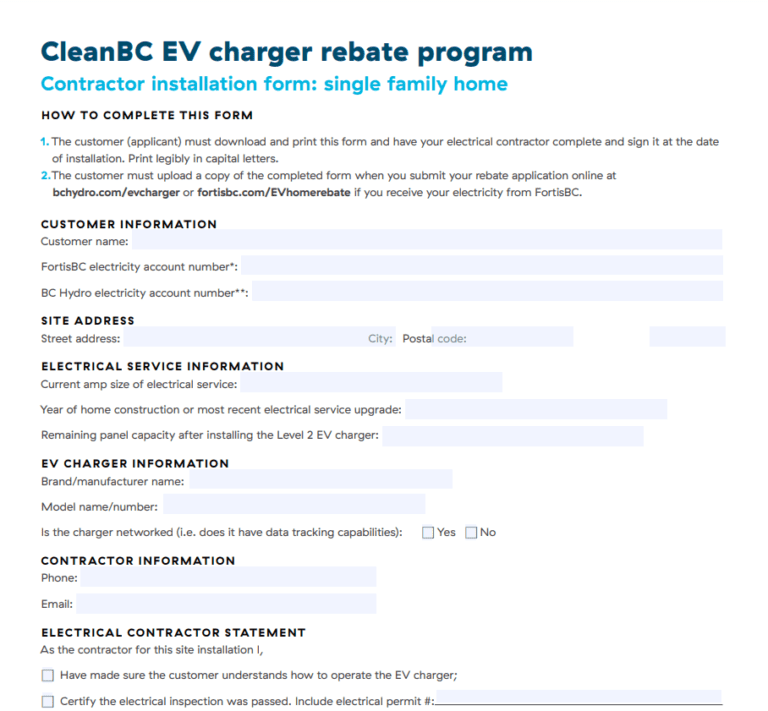

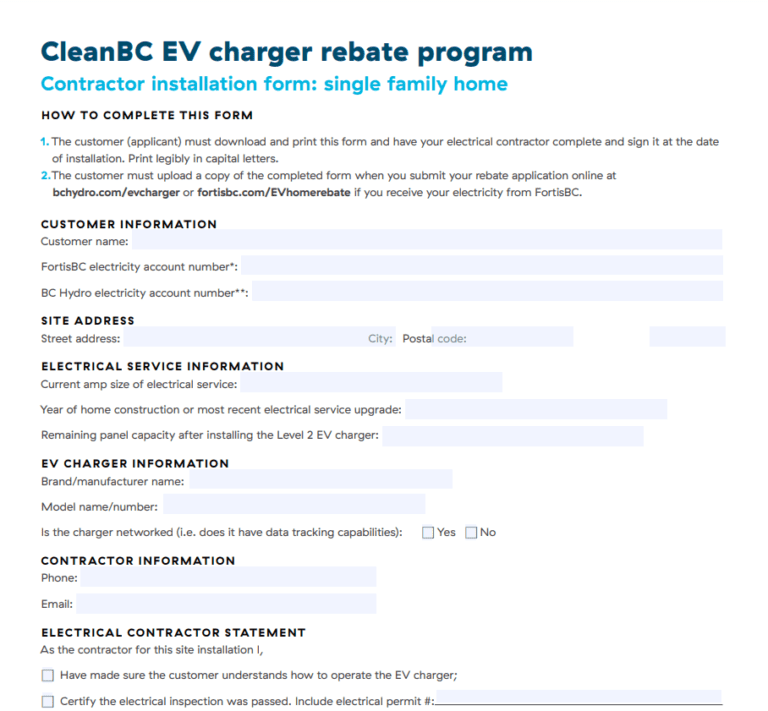

Ontario Ev Charger Rebate Form Printable Rebate Form

Ok Natural Gas Rebate Energy Fill Online Printable Fillable Blank

Electric Car Tax Rebate California ElectricCarTalk

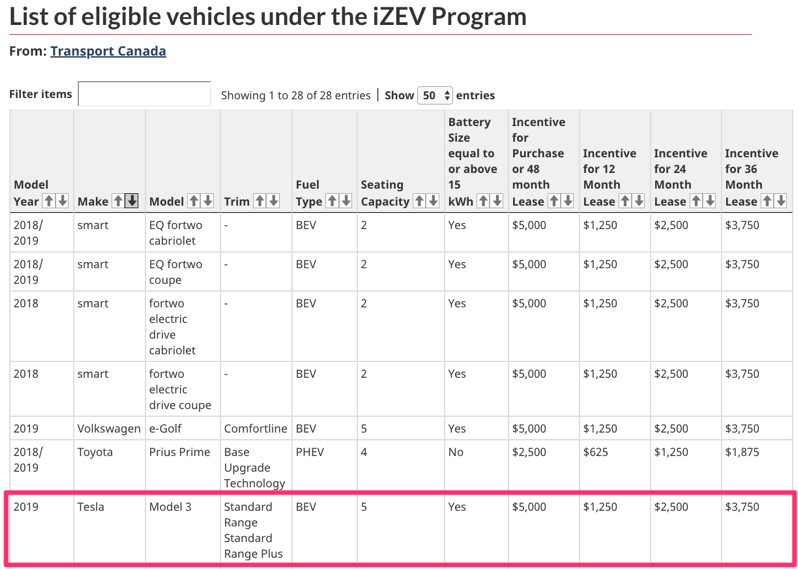

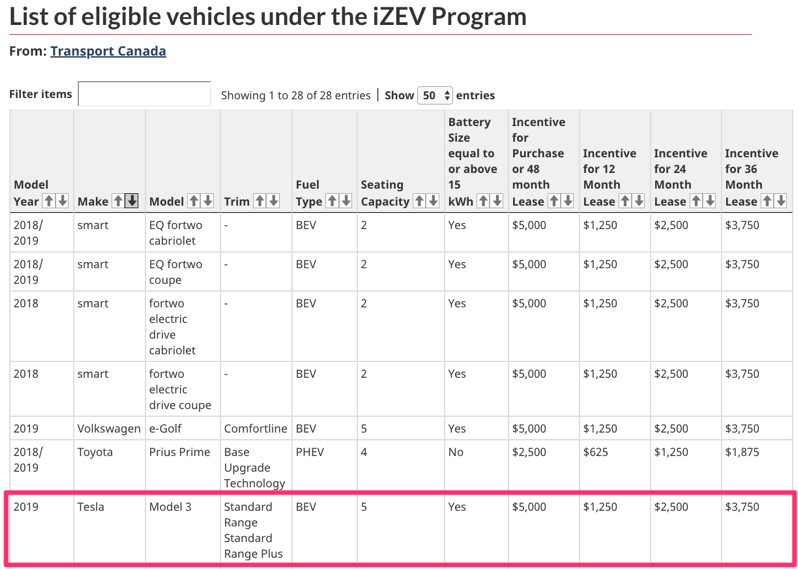

Surprise Tesla Model 3 Now Qualifies For 5 000 Federal Rebate In

Ev Car Tax Rebate Calculator 2022 Carrebate

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

Electric Car Tax Rebate California ElectricCarTalk

Ontario Ev Charger Rebate Form Printable Rebate Form

Surprise Tesla Model 3 Now Qualifies For 5 000 Federal Rebate In

Ev Car Tax Rebate Calculator 2022 Carrebate

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

Ev Federal Tax Credit Form FederalProTalk