Today, in a world that is driven by the consumer everyone enjoys a good bargain. One way to gain substantial savings on your purchases is through Energy Tax Rebate Forms. Energy Tax Rebate Forms are a strategy for marketing that retailers and manufacturers use to offer customers a partial cash back on their purchases once they have purchased them. In this article, we'll investigate the world of Energy Tax Rebate Forms, exploring the nature of them about, how they work, and the best way to increase the value of these incentives.

Get Latest Energy Tax Rebate Form Below

Energy Tax Rebate Form

Energy Tax Rebate Form - Energy Tax Credit Form, Energy Tax Credit Form 5695 Instructions, Energy Tax Credit Form 2022, Council Tax Energy Rebate Form, Energy Star Tax Credit Form 2023, Clean Energy Tax Credit Form, Are Energy Rebates Taxable, Can I Claim Energy Tax Credit, What Is Energy Rebate, How Do I Claim Residential Energy Tax Credit

Web Energy Related Credits and Deductions Alternative fuel vehicle refueling property credit added June 22 2023 Credit for Electricity Produced from Certain Renewable

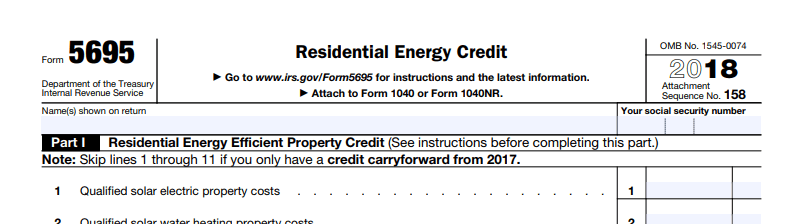

Web 17 f 233 vr 2023 nbsp 0183 32 Home Forms and Instructions About Form 5695 Residential Energy Credits Use Form 5695 to figure and take your residential energy credits The

A Energy Tax Rebate Form at its most basic form, is a partial refund to a purchaser after purchasing a certain product or service. It's an effective way that companies use to attract buyers, increase sales or promote a specific product.

Types of Energy Tax Rebate Form

Form 5695 Residential Energy Credits 2014 Free Download

Form 5695 Residential Energy Credits 2014 Free Download

Web Support for energy bills the council tax rebate 2022 23 billing authority guidance Updated 16 March 2022 Applies to England 1 This guidance is issued by the Secretary

Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help

Cash Energy Tax Rebate Form

Cash Energy Tax Rebate Form are by far the easiest kind of Energy Tax Rebate Form. Customers are offered a certain amount of money when buying a product. These are often used for more expensive items such electronics or appliances.

Mail-In Energy Tax Rebate Form

Mail-in Energy Tax Rebate Form demand that customers send in their proof of purchase before receiving the refund. They're somewhat more involved, but can result in significant savings.

Instant Energy Tax Rebate Form

Instant Energy Tax Rebate Form are applied at the moment of sale, cutting prices immediately. Customers do not have to wait around for savings with this type.

How Energy Tax Rebate Form Work

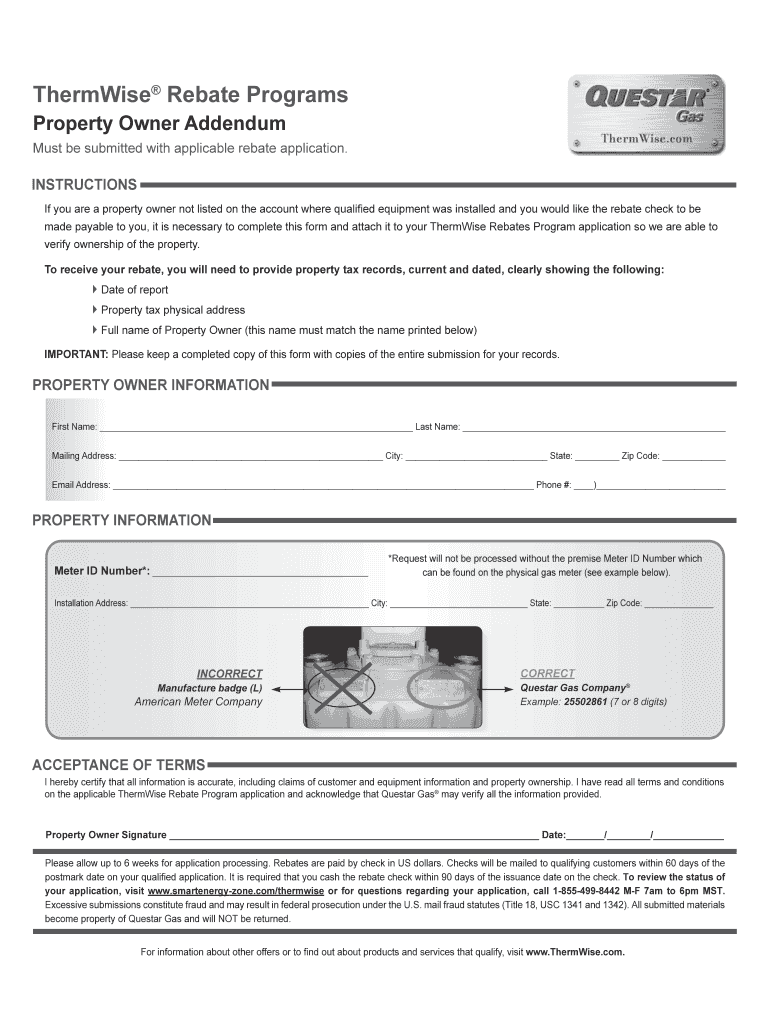

Questar Gas Rebates Form Fill Out And Sign Printable PDF Template

Questar Gas Rebates Form Fill Out And Sign Printable PDF Template

Web 26 juil 2023 nbsp 0183 32 Home Energy Tax Credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and

The Energy Tax Rebate Form Process

The process usually involves a few simple steps

-

When you buy the product make sure you purchase the product in the same way you would normally.

-

Fill in your Energy Tax Rebate Form Form: To claim the Energy Tax Rebate Form you'll need to give some specific information like your name, address, and purchase information, to apply for your Energy Tax Rebate Form.

-

Submit the Energy Tax Rebate Form If you want to submit the Energy Tax Rebate Form, based on the nature of Energy Tax Rebate Form the recipient may be required to fill out a paper form or make it available online.

-

Wait for approval: The business will review your submission to confirm that it complies with the guidelines and conditions of the Energy Tax Rebate Form.

-

Pay your Energy Tax Rebate Form After you've been approved, you'll receive a refund whether via check, credit card or through a different option as per the terms of the offer.

Pros and Cons of Energy Tax Rebate Form

Advantages

-

Cost Savings A Energy Tax Rebate Form can significantly reduce the cost for an item.

-

Promotional Deals they encourage their customers to test new products or brands.

-

Increase Sales Energy Tax Rebate Form can increase companies' sales and market share.

Disadvantages

-

Complexity mail-in Energy Tax Rebate Form particularly, can be cumbersome and tedious.

-

Expiration Dates Some Energy Tax Rebate Form have specific deadlines for submission.

-

The risk of non-payment Some customers might have their Energy Tax Rebate Form delayed if they don't observe the rules precisely.

Download Energy Tax Rebate Form

Download Energy Tax Rebate Form

FAQs

1. Are Energy Tax Rebate Form equivalent to discounts? No, Energy Tax Rebate Form involve a partial refund upon purchase, but discounts can reduce the price of the purchase at the time of sale.

2. Are there multiple Energy Tax Rebate Form I can get for the same product This is dependent on conditions on the Energy Tax Rebate Form deals and product's admissibility. Some companies will allow it, while other companies won't.

3. What is the time frame to receive the Energy Tax Rebate Form? The time frame will vary, but it may last from a few weeks until a few months for you to receive your Energy Tax Rebate Form.

4. Do I need to pay taxes of Energy Tax Rebate Form the amount? the majority of cases, Energy Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Energy Tax Rebate Form deals from lesser-known brands Do I need to conduct a thorough research and ensure that the brand offering the Energy Tax Rebate Form is reliable prior to making a purchase.

The Declining Federal Solar Tax Credit And Top Things To Know For 2019

Form 5695 Instructions Information On IRS Form 5695

Check more sample of Energy Tax Rebate Form below

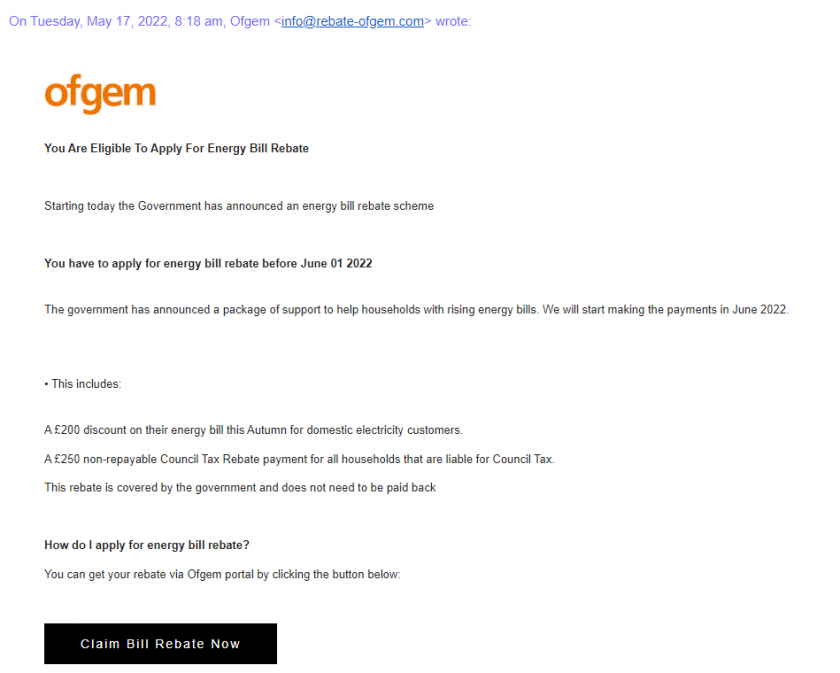

Scam Ofgem Email Is Luring Victims With Fake Energy Refunds Warns Which

Fillable Pa 40 Fill Out Sign Online DocHub

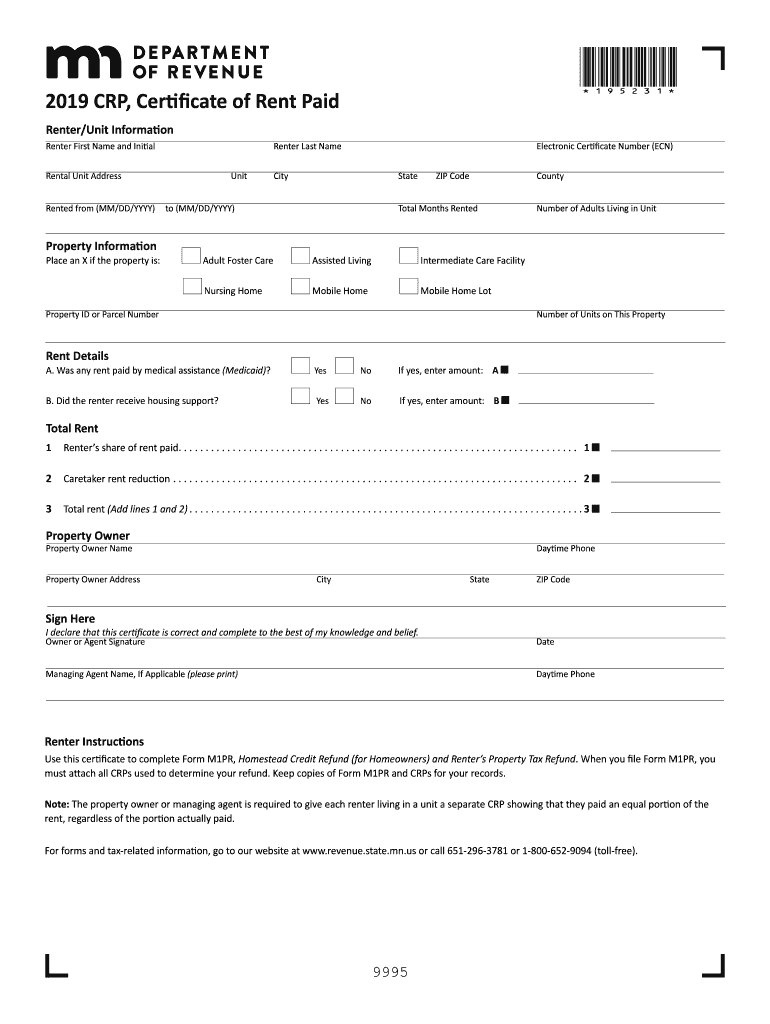

Crp Forms For 2018 Fill Out Sign Online DocHub

Renters Rebate Sample Form Free Download

Illinois Unemployment 941x Fill Out Sign Online DocHub

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

https://www.irs.gov/forms-pubs/about-form-5695

Web 17 f 233 vr 2023 nbsp 0183 32 Home Forms and Instructions About Form 5695 Residential Energy Credits Use Form 5695 to figure and take your residential energy credits The

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 17 f 233 vr 2023 nbsp 0183 32 Home Forms and Instructions About Form 5695 Residential Energy Credits Use Form 5695 to figure and take your residential energy credits The

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Renters Rebate Sample Form Free Download

Fillable Pa 40 Fill Out Sign Online DocHub

Illinois Unemployment 941x Fill Out Sign Online DocHub

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

Pa Rent Rebate Form Fill Out Sign Online DocHub

Free Printable Menards Coupons 2020 Semashow

Free Printable Menards Coupons 2020 Semashow

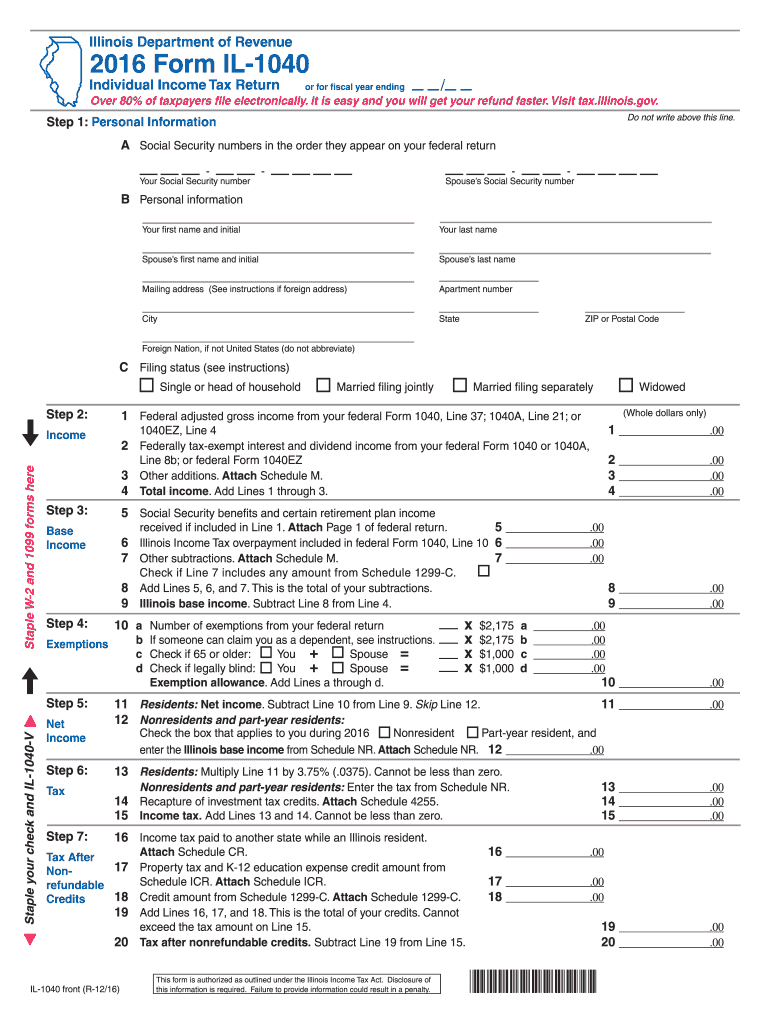

Illinois Form Tax 2016 Fill Out Sign Online DocHub