In the modern world of consumerization every person loves a great deal. One option to obtain significant savings in your purchase is through Electric Vehicle Tax Rebate Forms. Electric Vehicle Tax Rebate Forms are marketing strategies employed by retailers and manufacturers to offer consumers a partial cash back on their purchases once they have made them. In this article, we will dive into the world Electric Vehicle Tax Rebate Forms. We'll look at the nature of them and how they function, and how you can maximize your savings via these cost-effective incentives.

Get Latest Electric Vehicle Tax Rebate Form Below

Electric Vehicle Tax Rebate Form

Electric Vehicle Tax Rebate Form -

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

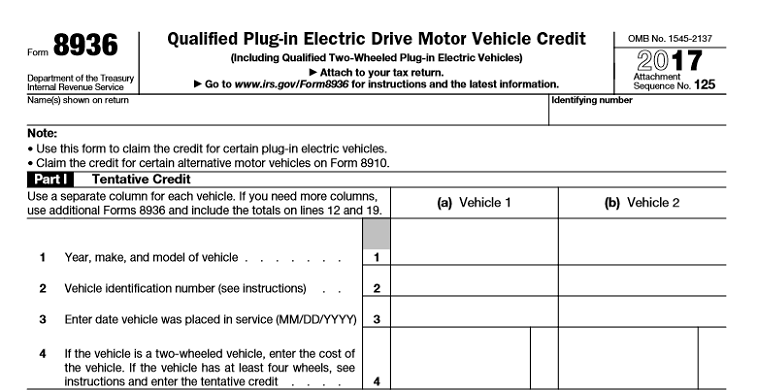

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

A Electric Vehicle Tax Rebate Form is, in its most basic form, is a cash refund provided to customers after having purchased a item or service. It's a very effective technique used by businesses to attract customers, boost sales, and even promote certain products.

Types of Electric Vehicle Tax Rebate Form

Virginia Electric Vehicle Tax Credit 2020 So Beautifully Record Efecto

Virginia Electric Vehicle Tax Credit 2020 So Beautifully Record Efecto

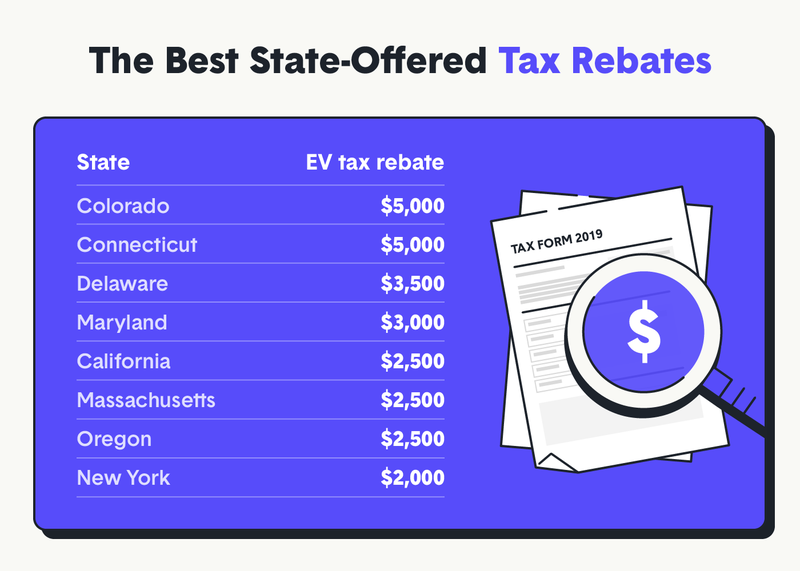

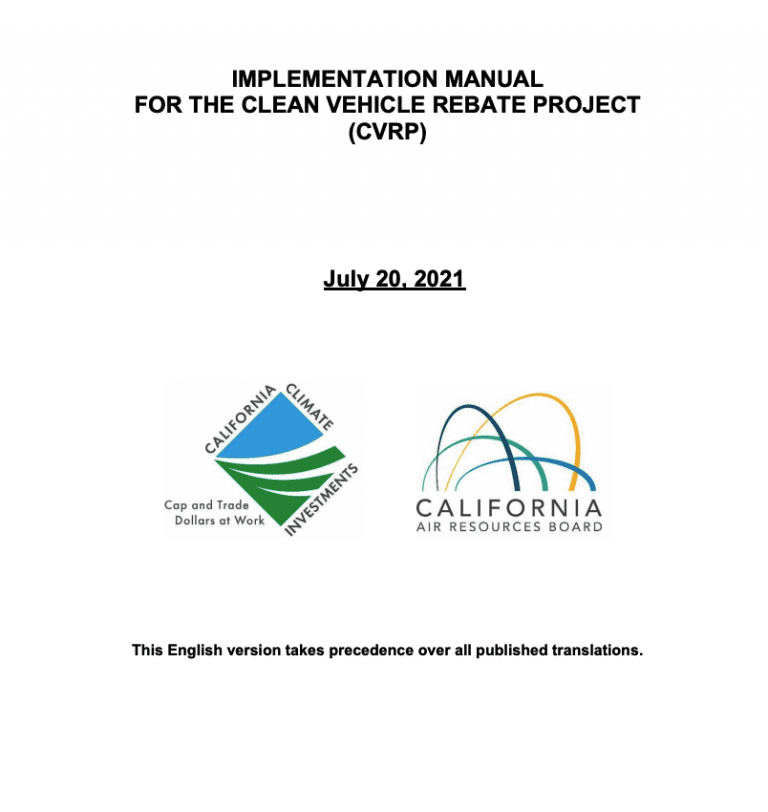

Web Several government entities and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate or a tax credit Rebates can be claimed at

Web Sept 9 is World EV Day now in its fourth year While auto companies will probably announce new incentives to encourage people to buy electric vehicles one of the best

Cash Electric Vehicle Tax Rebate Form

Cash Electric Vehicle Tax Rebate Form are the most straightforward type of Electric Vehicle Tax Rebate Form. Clients receive a predetermined amount back in cash after purchasing a item. They are typically used to purchase big-ticket items, like electronics and appliances.

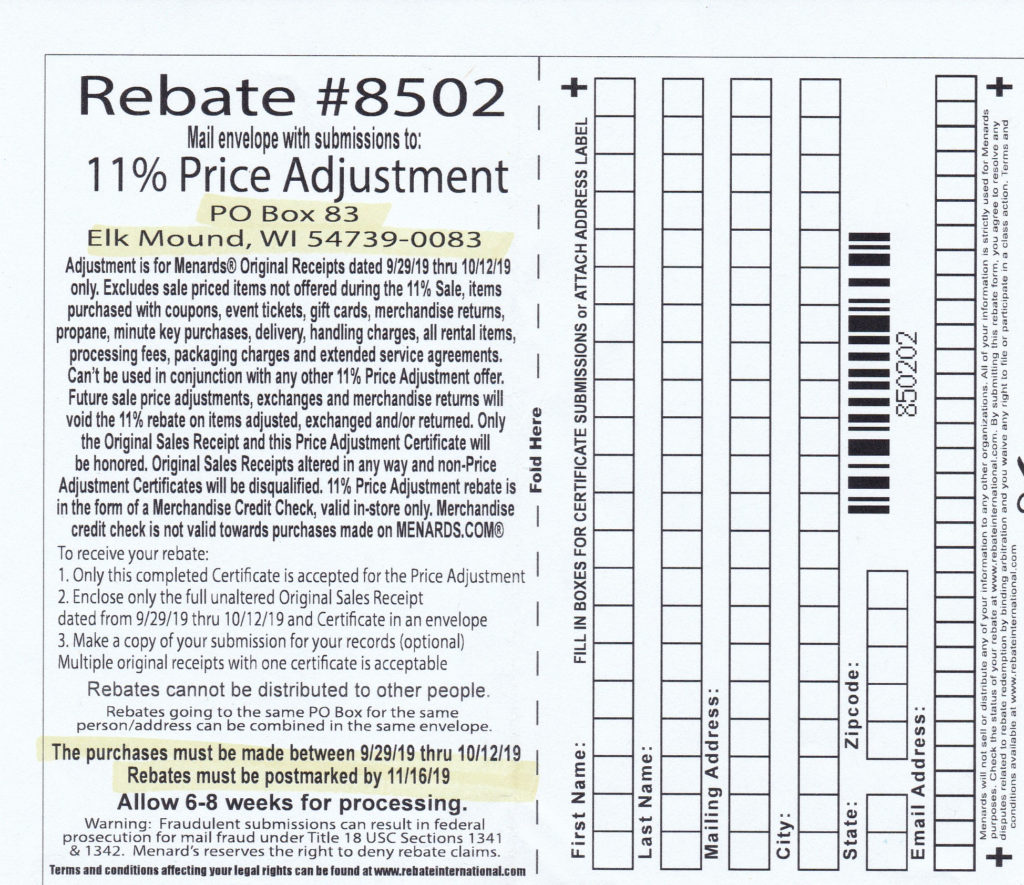

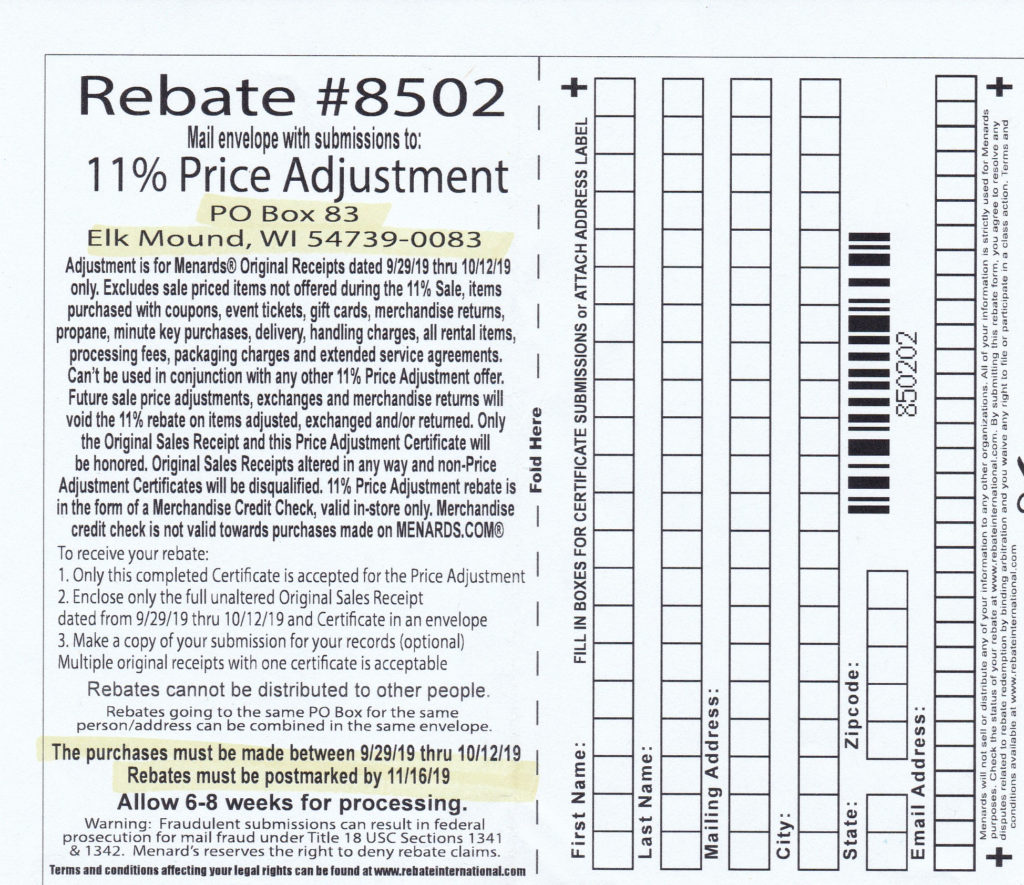

Mail-In Electric Vehicle Tax Rebate Form

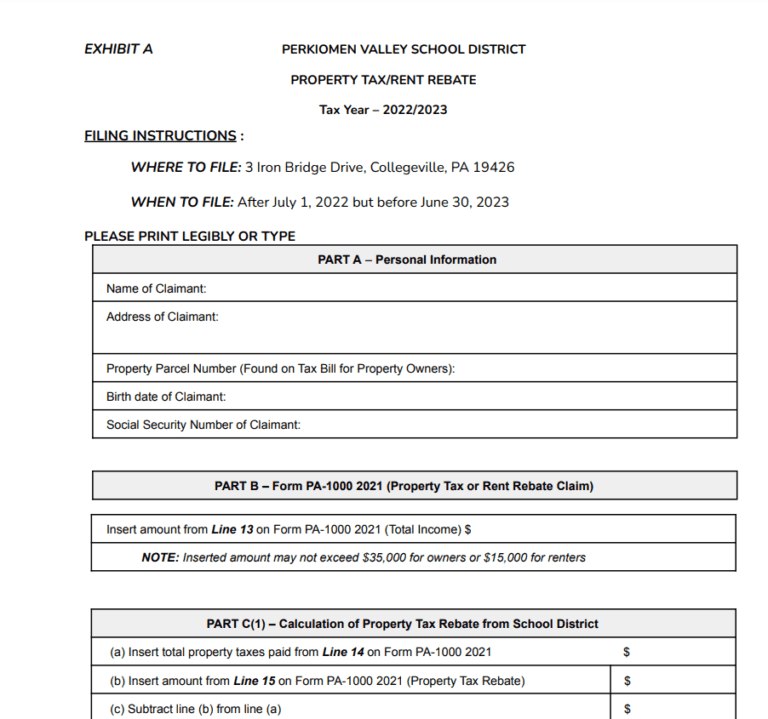

Mail-in Electric Vehicle Tax Rebate Form demand that customers submit evidence of purchase to get their refund. They are a bit more involved, but can result in huge savings.

Instant Electric Vehicle Tax Rebate Form

Instant Electric Vehicle Tax Rebate Form are applied right at the point of sale, reducing the price of your purchase instantly. Customers don't need to wait for their savings in this manner.

How Electric Vehicle Tax Rebate Form Work

Electric Vehicle With Most Federal Rebate ElectricRebate

Electric Vehicle With Most Federal Rebate ElectricRebate

Web 7 janv 2023 nbsp 0183 32 Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But

The Electric Vehicle Tax Rebate Form Process

The process typically involves few easy steps:

-

You purchase the item: First you purchase the product just like you normally would.

-

Fill in this Electric Vehicle Tax Rebate Form forms: The Electric Vehicle Tax Rebate Form form will need to supply some details including your name, address along with the purchase details, in order to make a claim for your Electric Vehicle Tax Rebate Form.

-

Send in the Electric Vehicle Tax Rebate Form depending on the nature of Electric Vehicle Tax Rebate Form, you may need to fill out a paper form or send it via the internet.

-

Wait until the company approves: The company will review your submission to verify that it is compliant with the requirements of the Electric Vehicle Tax Rebate Form.

-

Accept your Electric Vehicle Tax Rebate Form After you've been approved, the amount you receive will be whether via check, credit card, or any other method as specified by the offer.

Pros and Cons of Electric Vehicle Tax Rebate Form

Advantages

-

Cost savings The use of Electric Vehicle Tax Rebate Form can greatly reduce the price you pay for the item.

-

Promotional Offers The aim is to encourage customers to try new items or brands.

-

Accelerate Sales Electric Vehicle Tax Rebate Form are a great way to boost sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Electric Vehicle Tax Rebate Form in particular the case of HTML0, can be a hassle and tedious.

-

Extension Dates Most Electric Vehicle Tax Rebate Form come with certain deadlines for submitting.

-

Risk of Not Being Paid: Some customers may not receive their Electric Vehicle Tax Rebate Form if they don't adhere to the rules exactly.

Download Electric Vehicle Tax Rebate Form

Download Electric Vehicle Tax Rebate Form

FAQs

1. Are Electric Vehicle Tax Rebate Form similar to discounts? No, Electric Vehicle Tax Rebate Form are a partial refund upon purchase whereas discounts will reduce prices at time of sale.

2. Are there Electric Vehicle Tax Rebate Form that can be used on the same item The answer is dependent on the conditions that apply to the Electric Vehicle Tax Rebate Form offer and also the item's ability to qualify. Certain companies may permit it, while some won't.

3. How long does it take to get the Electric Vehicle Tax Rebate Form? The time frame is different, but it could range from several weeks to few months to get your Electric Vehicle Tax Rebate Form.

4. Do I need to pay tax upon Electric Vehicle Tax Rebate Form sums? most situations, Electric Vehicle Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Electric Vehicle Tax Rebate Form deals from lesser-known brands You must research and ensure that the business providing the Electric Vehicle Tax Rebate Form is reputable prior making purchases.

Tax Credits For Electric Vehicles TaxProAdvice

How To Get An Electric Vehicle Rebate For Your Golf Cart The Annika

Check more sample of Electric Vehicle Tax Rebate Form below

Electric Vehicles Trucks SUVs To Qualify For Rebate CTV News

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Politics Be Damned Electric Cars Aren t Really So Polarizing

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 Printable

Delaware Electric Car Tax Rebate Printable Rebate Form

Pennsylvania Offering Up To 3 000 In Electric vehicle Rebates Through

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web How to Claim the Credit To claim the credit file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Web How to Claim the Credit To claim the credit file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 Printable

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Delaware Electric Car Tax Rebate Printable Rebate Form

Pennsylvania Offering Up To 3 000 In Electric vehicle Rebates Through

California Electric Car Rebate 2022 Printable Rebate Form

Electric Vehicle Infrastructure Rebate Act Of 2021 H R 2948

Electric Vehicle Infrastructure Rebate Act Of 2021 H R 2948

Electric Car Tax Credit 2022 Electric Car Tax Credits What s Available