In the modern world of consumerization everyone enjoys a good bargain. One of the ways to enjoy substantial savings in your purchase is through Do I Report Dic On The Land Tax Rebate Forms. They are a form of marketing that retailers and manufacturers use in order to offer customers a small refund for their purchases after they've done so. In this article, we will investigate the world of Do I Report Dic On The Land Tax Rebate Forms, looking at what they are about, how they work, and how you can maximize your savings through these efficient incentives.

Get Latest Do I Report Dic On The Land Tax Rebate Form Below

Do I Report Dic On The Land Tax Rebate Form

Do I Report Dic On The Land Tax Rebate Form -

Web The Disabled Veterans Exemption reduces the land tax coverage on one principal space of residence of qualified veterans who due to a service connected injury or

Web 4 juin 2019 nbsp 0183 32 1 Best answer If you re referring to Dependency and Indemnity Compensation the monthly benefit paid to eligible survivors of military service members who died in the

A Do I Report Dic On The Land Tax Rebate Form in its simplest type, is a return to the customer when they purchase a product or service. It's a powerful instrument that businesses use to draw clients, increase sales and advertise specific products.

Types of Do I Report Dic On The Land Tax Rebate Form

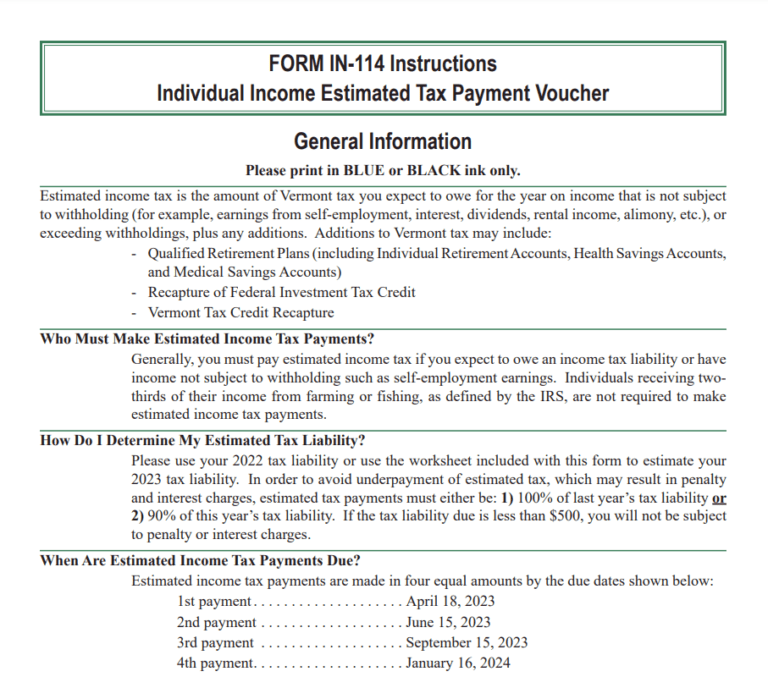

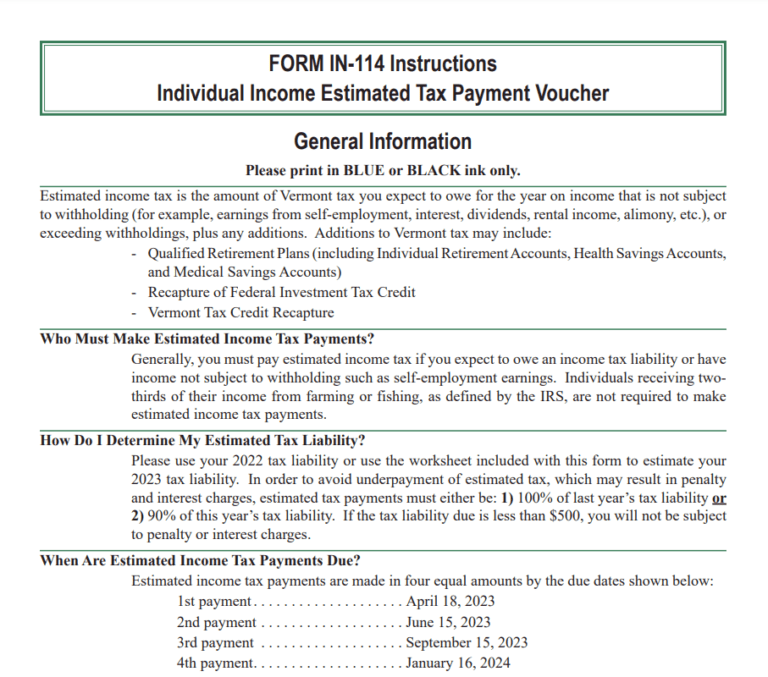

Vermont Tax Rebate 2023 Printable Rebate Form

Vermont Tax Rebate 2023 Printable Rebate Form

Web Tax Code Section 11 131 requires an exemption of the total appraised value of granges of Texas veterans who maintained 100 percent reimbursement of aforementioned U S

Web Filing Requirements Land own are did required to file a claim One county auditor determines that amount of credit anwendbarkeit to each tract of land Form No form is

Cash Do I Report Dic On The Land Tax Rebate Form

Cash Do I Report Dic On The Land Tax Rebate Form are the simplest kind of Do I Report Dic On The Land Tax Rebate Form. Customers receive a specific sum of money back when purchasing a product. These are often used for costly items like electronics or appliances.

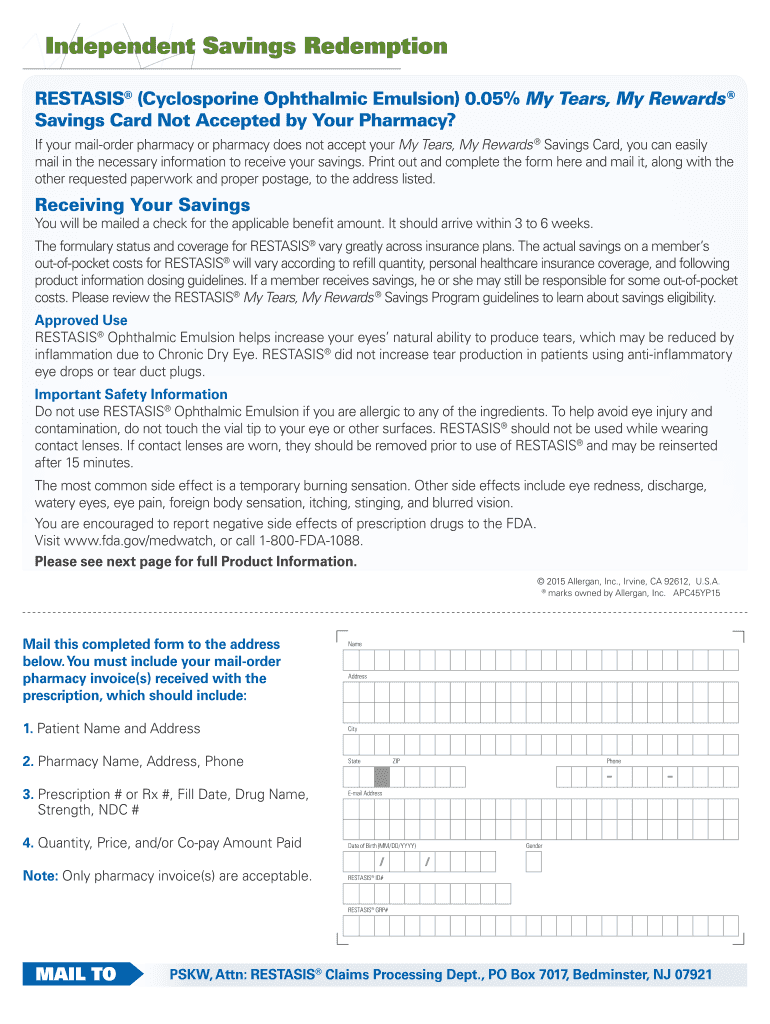

Mail-In Do I Report Dic On The Land Tax Rebate Form

Mail-in Do I Report Dic On The Land Tax Rebate Form require consumers to provide the proof of purchase in order to receive the refund. They're a bit more involved but can offer huge savings.

Instant Do I Report Dic On The Land Tax Rebate Form

Instant Do I Report Dic On The Land Tax Rebate Form apply at the point of sale, and can reduce prices immediately. Customers don't need to wait until they can save in this manner.

How Do I Report Dic On The Land Tax Rebate Form Work

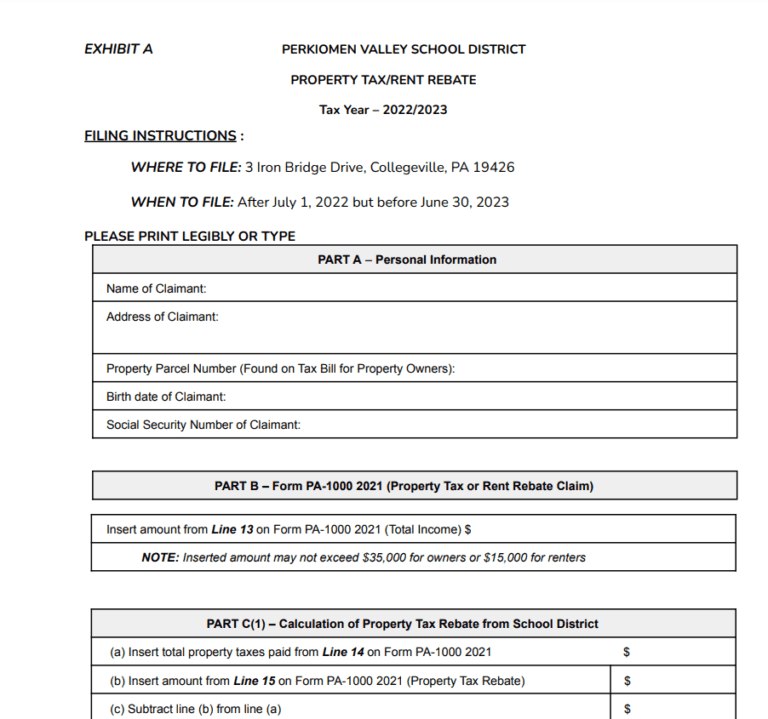

Carbon Tax Rebate 2022 Printable Rebate Form

Carbon Tax Rebate 2022 Printable Rebate Form

Web The Disabled Veterans Exemption reduces the property burden obligation on the principal place of residence of qualified veterans who due to a service connected

The Do I Report Dic On The Land Tax Rebate Form Process

It usually consists of a few easy steps:

-

Buy the product: Firstly make sure you purchase the product exactly as you would normally.

-

Complete your Do I Report Dic On The Land Tax Rebate Form request form. You'll have submit some information, such as your name, address, and the purchase details, in order in order to make a claim for your Do I Report Dic On The Land Tax Rebate Form.

-

To submit the Do I Report Dic On The Land Tax Rebate Form depending on the type of Do I Report Dic On The Land Tax Rebate Form there may be a requirement to fill out a form and mail it in or send it via the internet.

-

Wait until the company approves: The company will go through your application to verify that it is compliant with the Do I Report Dic On The Land Tax Rebate Form's terms and conditions.

-

Receive your Do I Report Dic On The Land Tax Rebate Form: Once approved, you'll get your refund, either through check, prepaid card, or a different method that is specified in the offer.

Pros and Cons of Do I Report Dic On The Land Tax Rebate Form

Advantages

-

Cost Savings Do I Report Dic On The Land Tax Rebate Form can dramatically reduce the cost for an item.

-

Promotional Offers Customers are enticed in trying new products or brands.

-

Accelerate Sales: Do I Report Dic On The Land Tax Rebate Form can boost the company's sales as well as market share.

Disadvantages

-

Complexity Mail-in Do I Report Dic On The Land Tax Rebate Form in particular they can be time-consuming and time-consuming.

-

Day of Expiration Many Do I Report Dic On The Land Tax Rebate Form have very strict deadlines for filing.

-

Risk of Not Being Paid Some customers might not receive Do I Report Dic On The Land Tax Rebate Form if they don't comply with the rules precisely.

Download Do I Report Dic On The Land Tax Rebate Form

Download Do I Report Dic On The Land Tax Rebate Form

FAQs

1. Are Do I Report Dic On The Land Tax Rebate Form the same as discounts? No, Do I Report Dic On The Land Tax Rebate Form offer some form of refund following the purchase, but discounts can reduce the cost of purchase at point of sale.

2. Are there multiple Do I Report Dic On The Land Tax Rebate Form I can get on the same product The answer is dependent on the conditions of Do I Report Dic On The Land Tax Rebate Form is offered as well as the merchandise's ability to qualify. Certain companies may permit it, but others won't.

3. How long does it take to get the Do I Report Dic On The Land Tax Rebate Form? The length of time differs, but could take anywhere from a couple of weeks to a few months before you receive your Do I Report Dic On The Land Tax Rebate Form.

4. Do I have to pay taxes of Do I Report Dic On The Land Tax Rebate Form funds? the majority of circumstances, Do I Report Dic On The Land Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Do I Report Dic On The Land Tax Rebate Form offers from lesser-known brands You must research and confirm that the company that is offering the Do I Report Dic On The Land Tax Rebate Form is reputable prior making an investment.

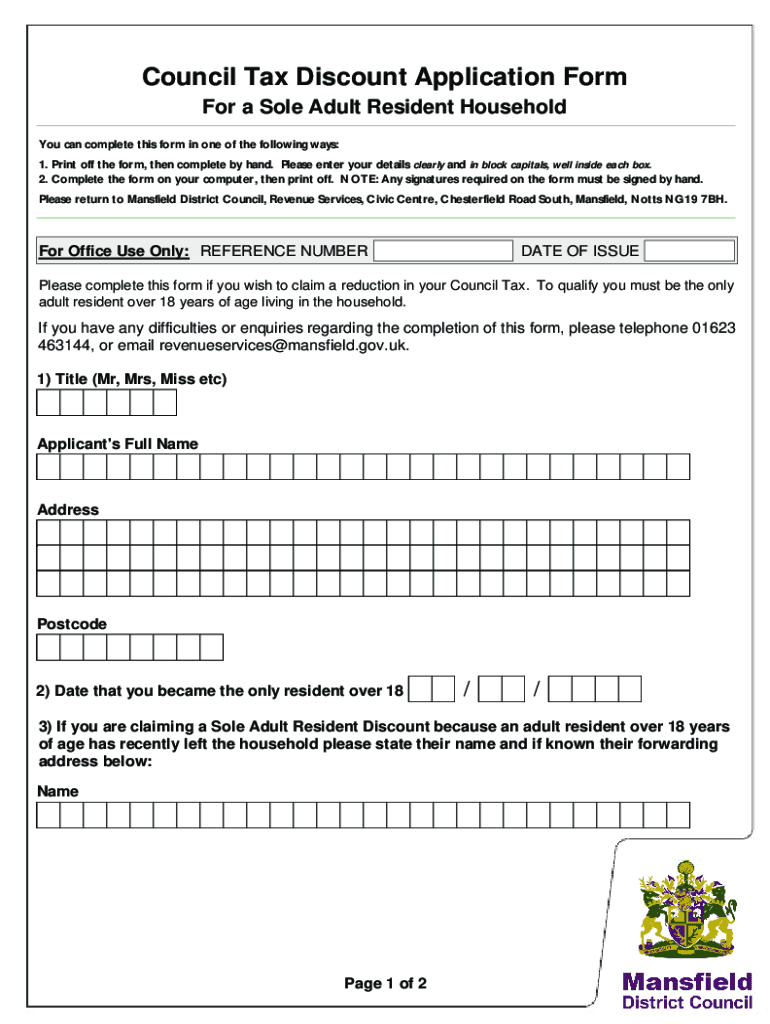

Rebate Form Template Fill Out And Sign Printable PDF Template SignNow

Rent Rebate Tax Form Missouri Printable Rebate Form

Check more sample of Do I Report Dic On The Land Tax Rebate Form below

Georgia Income Tax Rebate 2023 Printable Rebate Form

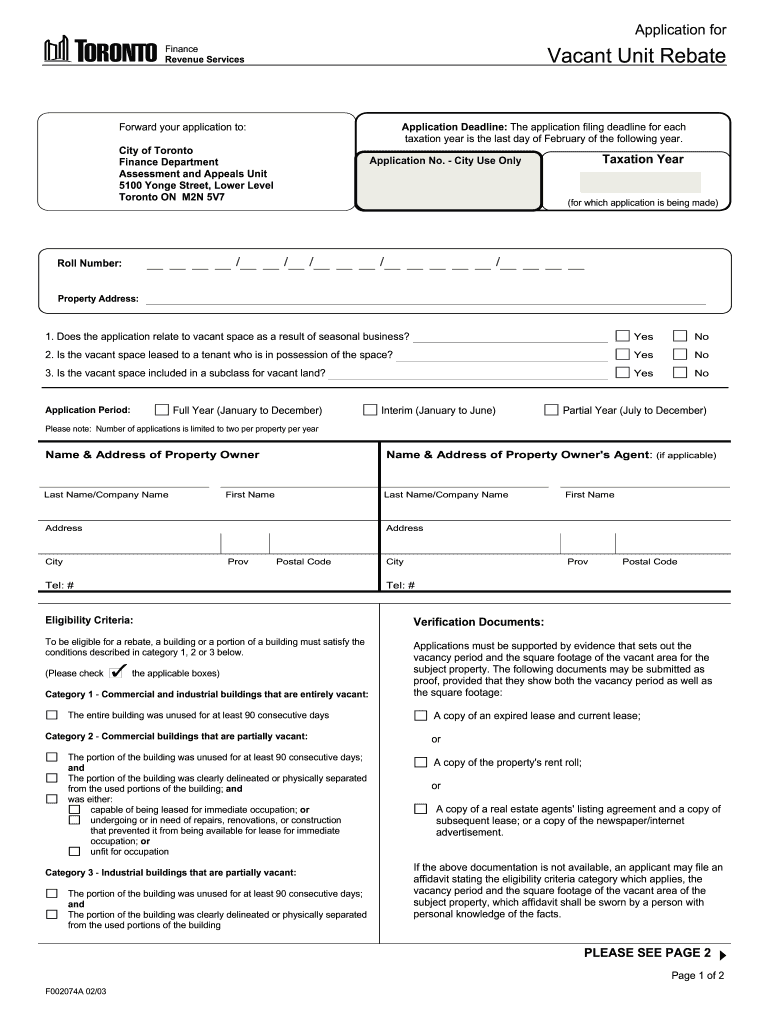

Application For Rebate Of Property Taxes Niagara Falls Ontario

Rebate Form Fill And Sign Printable Template Online US Legal Forms

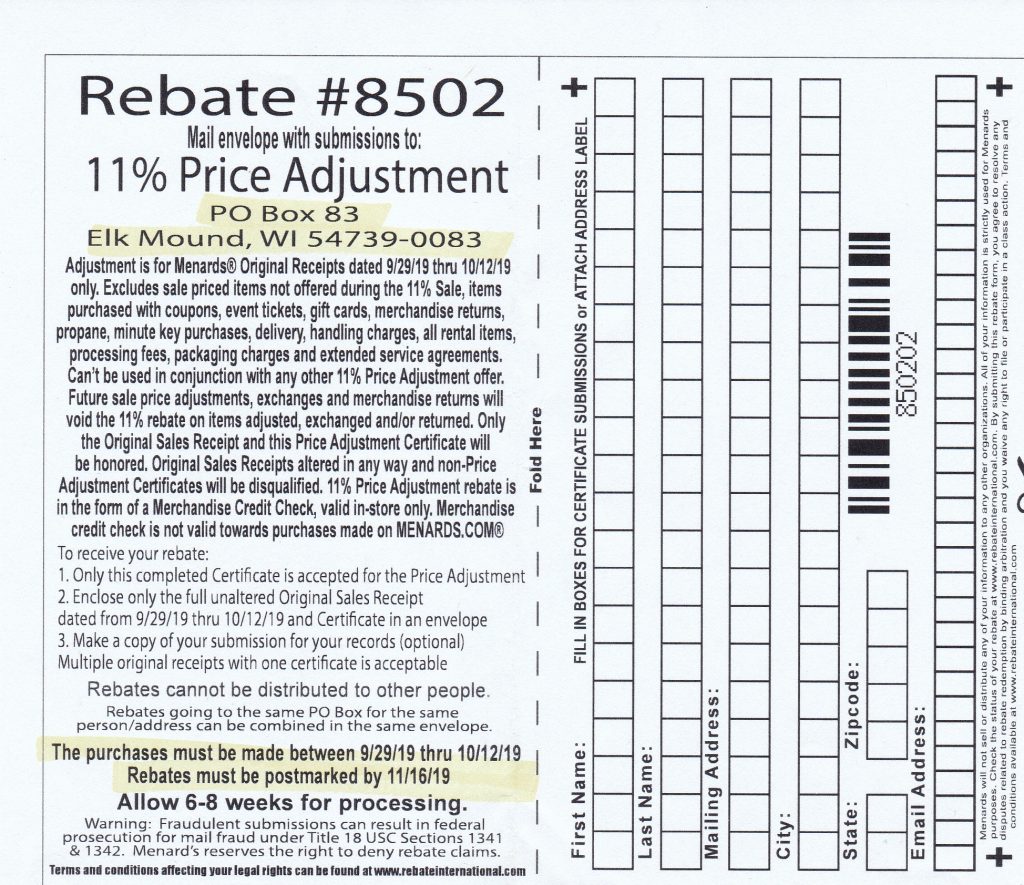

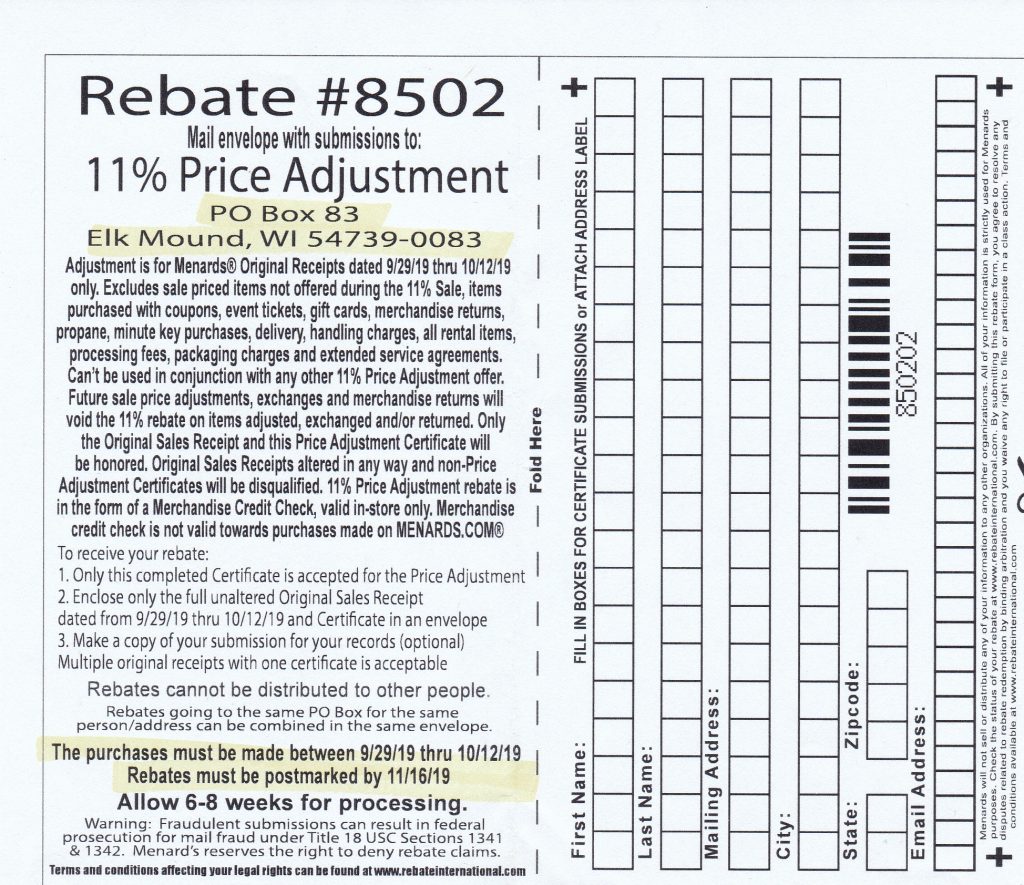

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

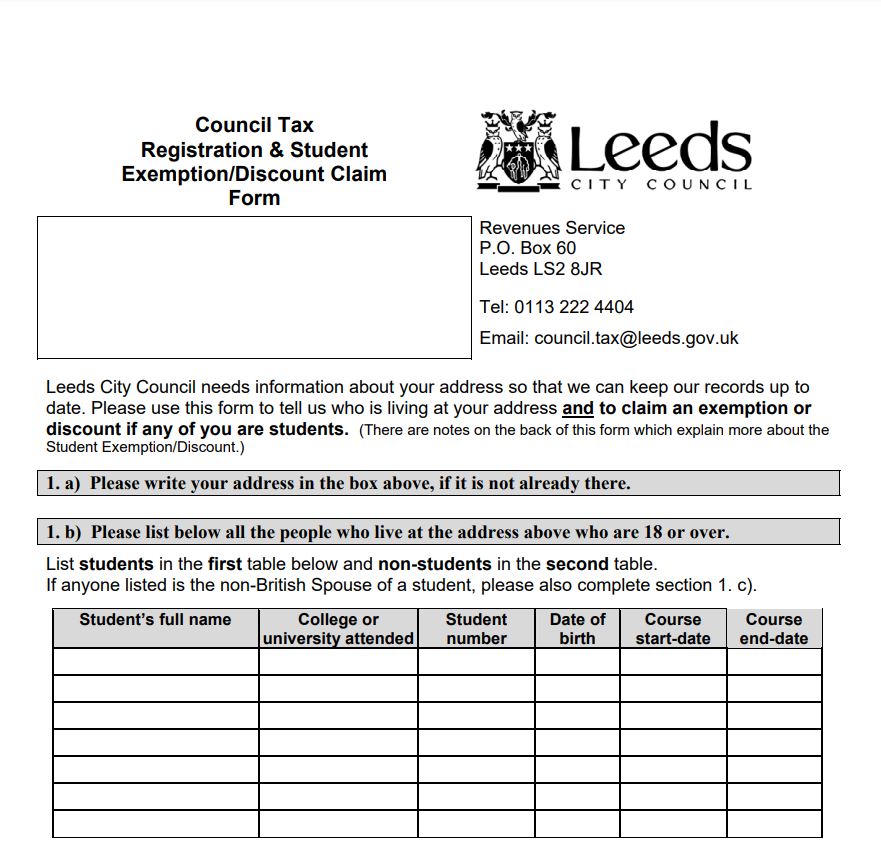

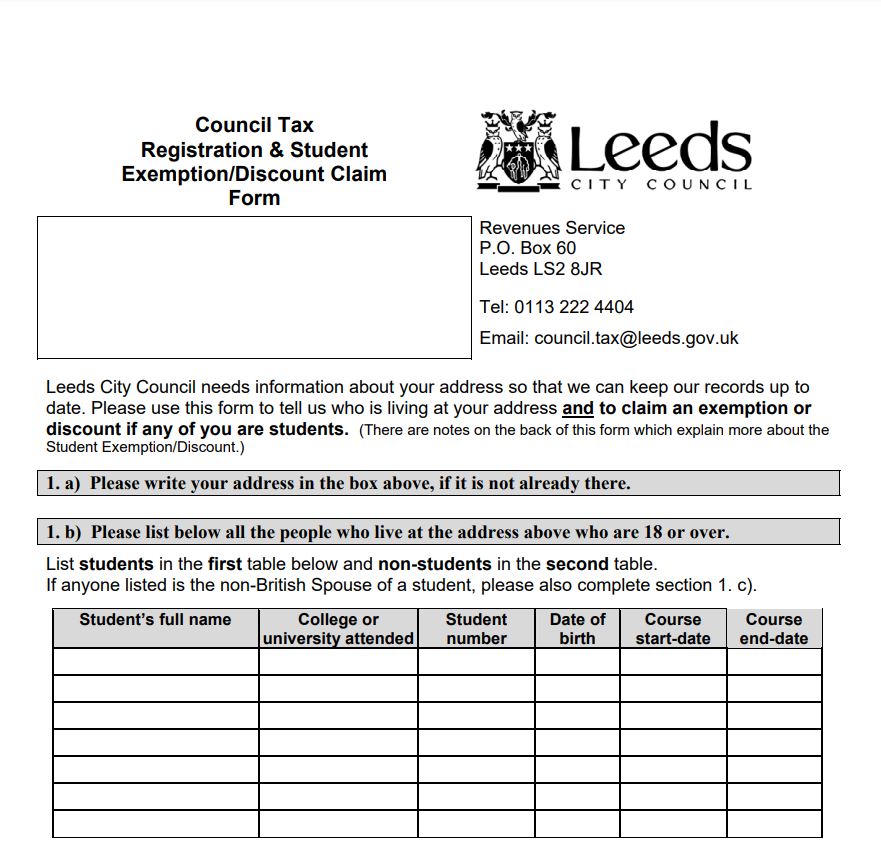

Leeds Council Printable Rebate Form

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

https://ttlc.intuit.com/community/taxes/discussion/where-do-i-add-dic...

Web 4 juin 2019 nbsp 0183 32 1 Best answer If you re referring to Dependency and Indemnity Compensation the monthly benefit paid to eligible survivors of military service members who died in the

https://rezistyle.com/do-i-report-dic-on-the-land-tax-rebate-form

Web The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence the qualified veterans who amount to a service connected injure or sick have

Web 4 juin 2019 nbsp 0183 32 1 Best answer If you re referring to Dependency and Indemnity Compensation the monthly benefit paid to eligible survivors of military service members who died in the

Web The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence the qualified veterans who amount to a service connected injure or sick have

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

Application For Rebate Of Property Taxes Niagara Falls Ontario

Leeds Council Printable Rebate Form

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Scottish Council Tax Rebates Fill Online Printable Fillable Blank

2021 Illinois Property Tax Rebate Printable Rebate Form

2021 Illinois Property Tax Rebate Printable Rebate Form

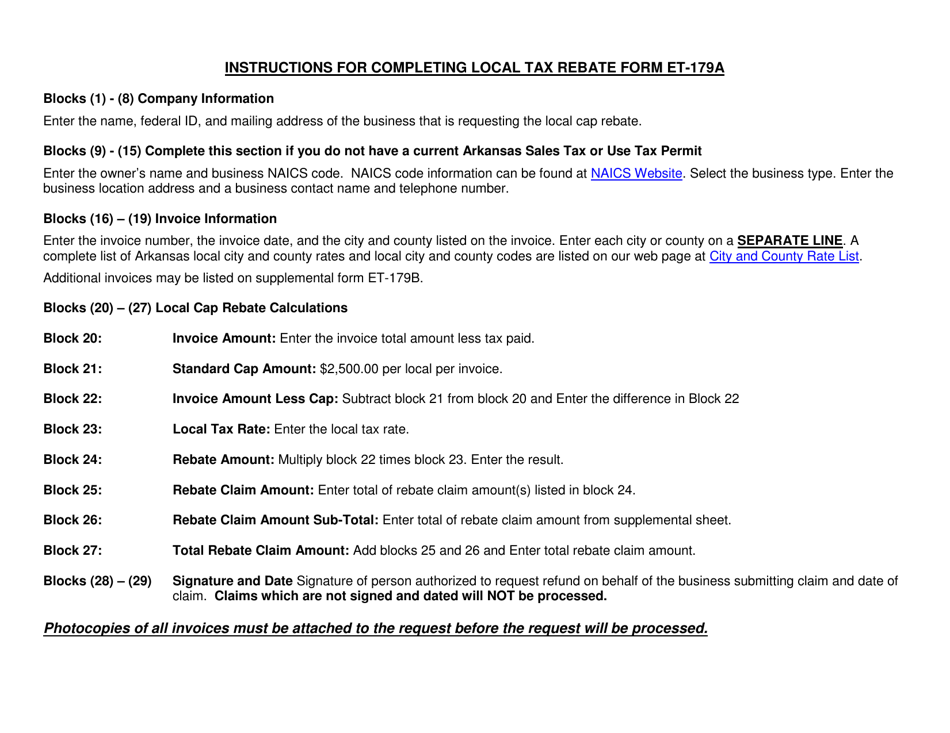

Form ET 179A Fill Out Sign Online And Download Fillable PDF