In this day and age of consuming every person loves a great deal. One of the ways to enjoy significant savings on your purchases is through Cra Hst Rebate Form For Charitiess. The use of Cra Hst Rebate Form For Charitiess is a method that retailers and manufacturers use in order to offer customers a small refund on their purchases after they've placed them. In this article, we will go deeper into the realm of Cra Hst Rebate Form For Charitiess. We'll look at what they are and how they function, and ways to maximize your savings through these cost-effective incentives.

Get Latest Cra Hst Rebate Form For Charities Below

Cra Hst Rebate Form For Charities

Cra Hst Rebate Form For Charities -

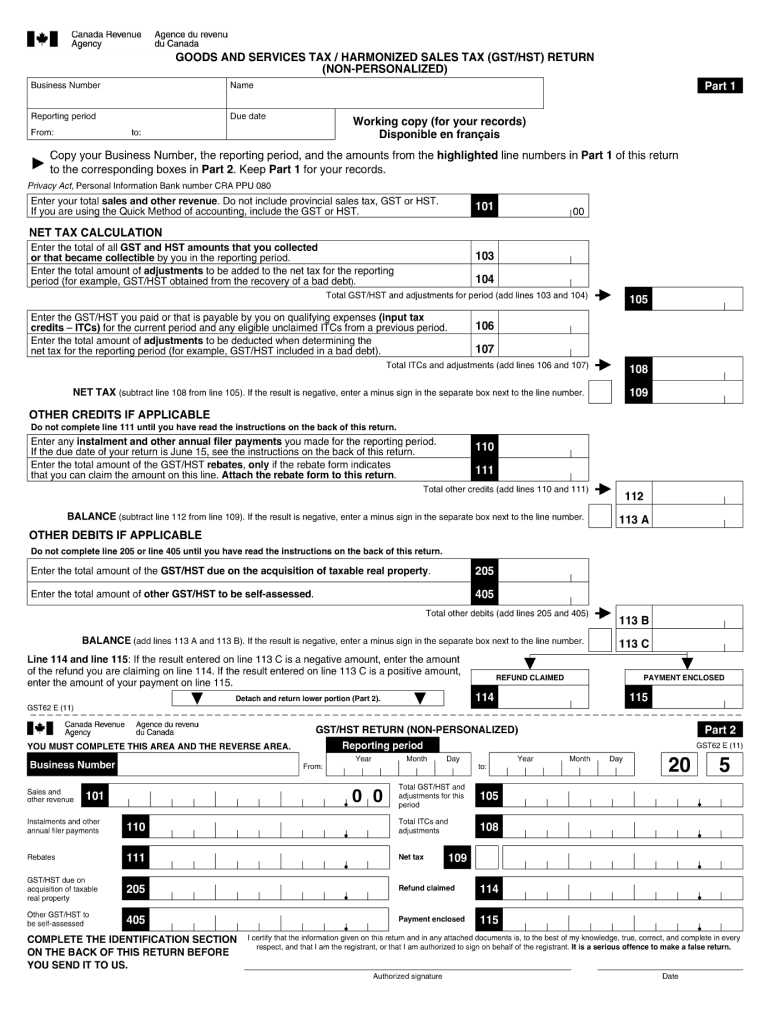

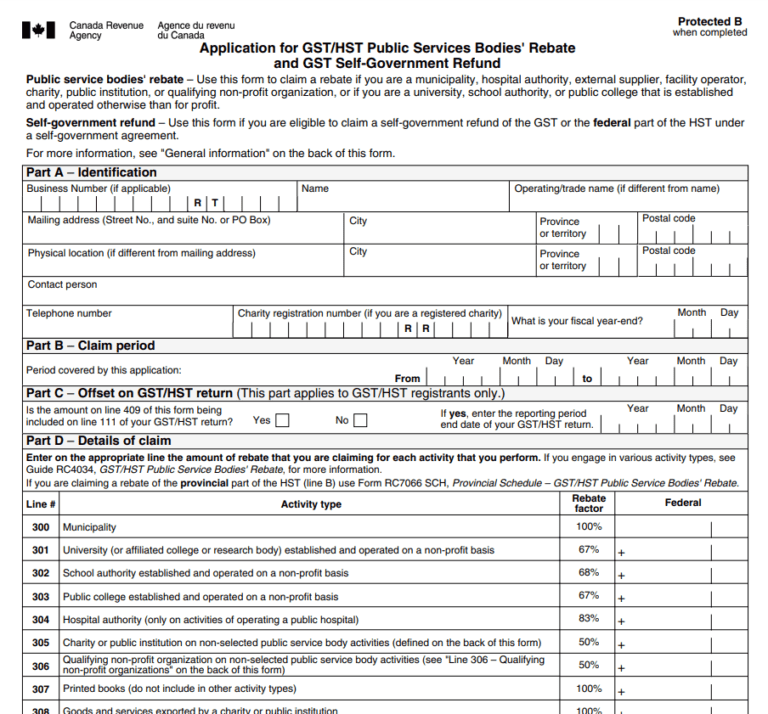

Web 1 juil 2010 nbsp 0183 32 A charity claims the PSB rebate for the GST and federal part of the HST by completing and filing Form GST66 Application for GST HST Public Service Bodies

Web 8 d 233 c 2021 nbsp 0183 32 GST66 Application for GST HST Public Service Bodies Rebate and GST Self Government Refund For best results download and open this form in Adobe Reader

A Cra Hst Rebate Form For Charities at its most basic form, is a refund given to a client after they've purchased a good or service. It's a highly effective tool that companies use to attract customers, increase sales and to promote certain products.

Types of Cra Hst Rebate Form For Charities

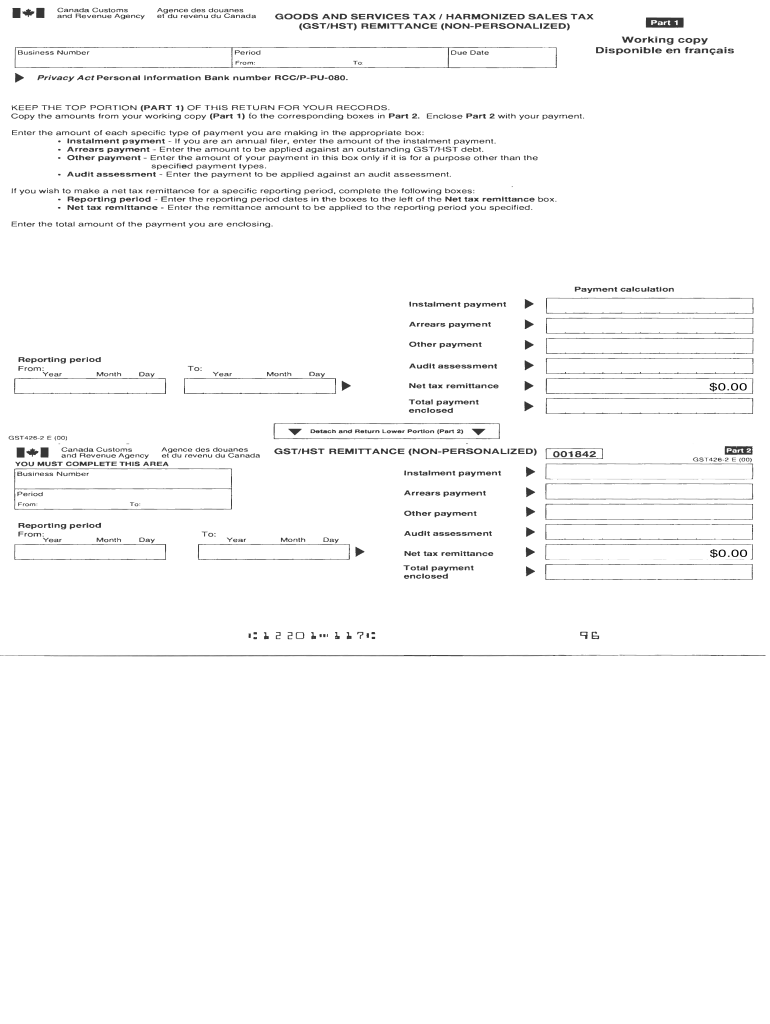

Hst Remittance Form Fill Out And Sign Printable PDF Template SignNow

Hst Remittance Form Fill Out And Sign Printable PDF Template SignNow

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

Web To apply for the rebate use Form GST189 General Application for Rebate of GST HST The form describes the documentation that is required to support your rebate claim For

Cash Cra Hst Rebate Form For Charities

Cash Cra Hst Rebate Form For Charities are a simple kind of Cra Hst Rebate Form For Charities. Customers are offered a certain amount of cash back after purchasing a item. This is often for products that are expensive, such as electronics or appliances.

Mail-In Cra Hst Rebate Form For Charities

Mail-in Cra Hst Rebate Form For Charities require consumers to send in their proof of purchase before receiving their refund. They're a bit more involved, but offer significant savings.

Instant Cra Hst Rebate Form For Charities

Instant Cra Hst Rebate Form For Charities are applied right at the moment of sale, cutting your purchase cost instantly. Customers do not have to wait long for savings by using this method.

How Cra Hst Rebate Form For Charities Work

HST Charity Rebate Form Ontario Auction Printable Rebate Form

HST Charity Rebate Form Ontario Auction Printable Rebate Form

Web A non registrant charity can file two PSB rebate applications per fiscal year and is subject to the same four year recovery timeline as charities which are registered The PSB rebate is restricted to 50 of the federal portion of the HST and 82 of the provincial portion of the HST in Ontario

The Cra Hst Rebate Form For Charities Process

The process generally involves a few steps:

-

Purchase the item: First you purchase the product like you normally do.

-

Fill out the Cra Hst Rebate Form For Charities paper: You'll have to give some specific information, such as your name, address along with the purchase details, to apply for your Cra Hst Rebate Form For Charities.

-

Send in the Cra Hst Rebate Form For Charities: Depending on the type of Cra Hst Rebate Form For Charities you could be required to mail a Cra Hst Rebate Form For Charities form in or send it via the internet.

-

Wait for the company's approval: They will go through your application to make sure that it's in accordance with the Cra Hst Rebate Form For Charities's terms and conditions.

-

Enjoy your Cra Hst Rebate Form For Charities After you've been approved, you'll receive your refund using a check or prepaid card, or any other method specified by the offer.

Pros and Cons of Cra Hst Rebate Form For Charities

Advantages

-

Cost Savings Cra Hst Rebate Form For Charities can substantially lower the cost you pay for a product.

-

Promotional Offers Incentivize customers to experiment with new products, or brands.

-

Help to Increase Sales Reward programs can boost sales for a company and also increase market share.

Disadvantages

-

Complexity Pay-in Cra Hst Rebate Form For Charities via mail, particularly difficult and long-winded.

-

Day of Expiration Many Cra Hst Rebate Form For Charities are subject to specific deadlines for submission.

-

Risque of Non-Payment Some customers might lose their Cra Hst Rebate Form For Charities in the event that they don't adhere to the requirements exactly.

Download Cra Hst Rebate Form For Charities

Download Cra Hst Rebate Form For Charities

FAQs

1. Are Cra Hst Rebate Form For Charities similar to discounts? No, Cra Hst Rebate Form For Charities require an amount of money that is refunded after the purchase, while discounts reduce your purchase cost at moment of sale.

2. Can I make use of multiple Cra Hst Rebate Form For Charities for the same product It's dependent on the terms applicable to Cra Hst Rebate Form For Charities offered and product's potential eligibility. Certain companies might allow it, but others won't.

3. How long does it take to get the Cra Hst Rebate Form For Charities? The period is variable, however it can take anywhere from a couple of weeks to a couple of months to receive your Cra Hst Rebate Form For Charities.

4. Do I need to pay tax on Cra Hst Rebate Form For Charities montants? the majority of situations, Cra Hst Rebate Form For Charities amounts are not considered taxable income.

5. Should I be able to trust Cra Hst Rebate Form For Charities deals from lesser-known brands You must research and verify that the organization providing the Cra Hst Rebate Form For Charities is reliable prior to making an investment.

Cra Hst Efile

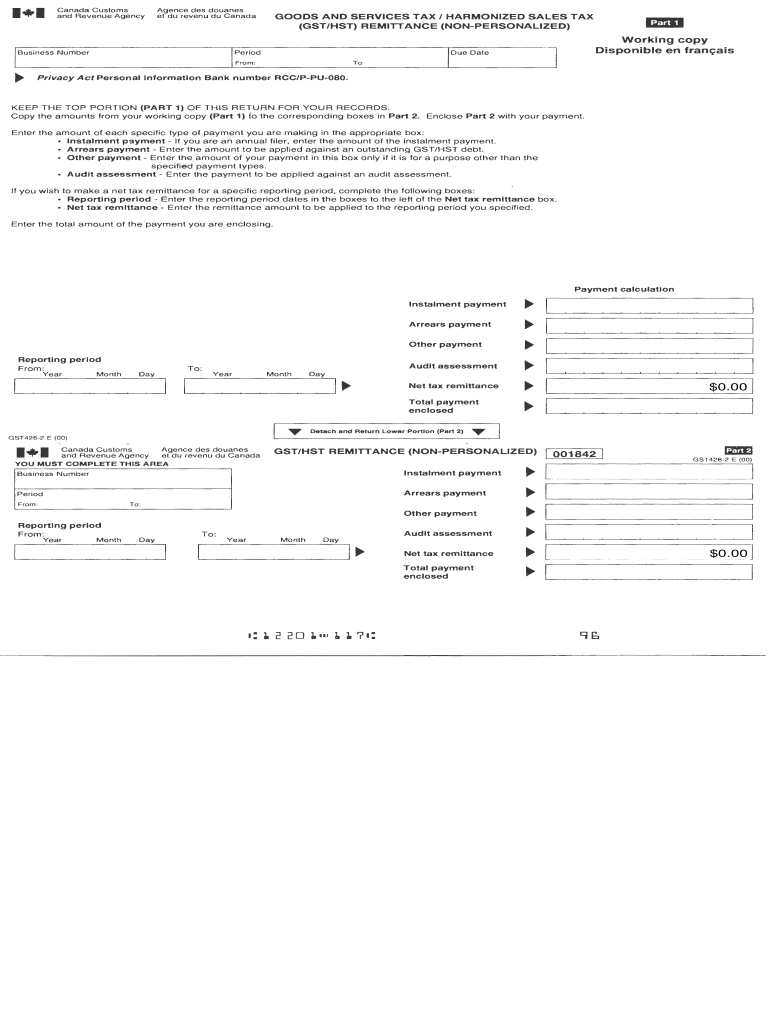

Fillable Hst Form Printable Form Templates And Letter

Check more sample of Cra Hst Rebate Form For Charities below

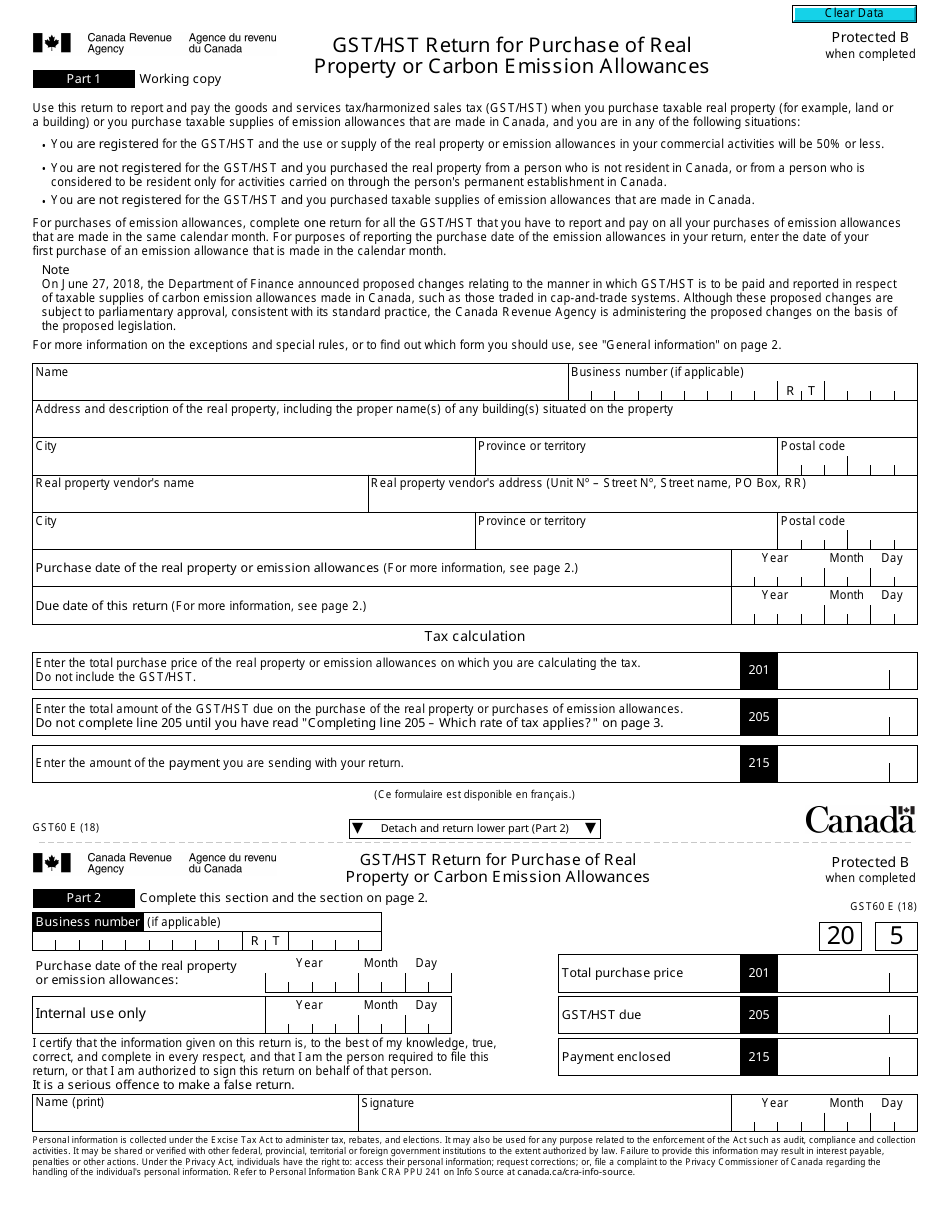

Form GST60 Fill Out Sign Online And Download Fillable PDF Canada

2010 Form Canada GST66 E Fill Online Printable Fillable Blank

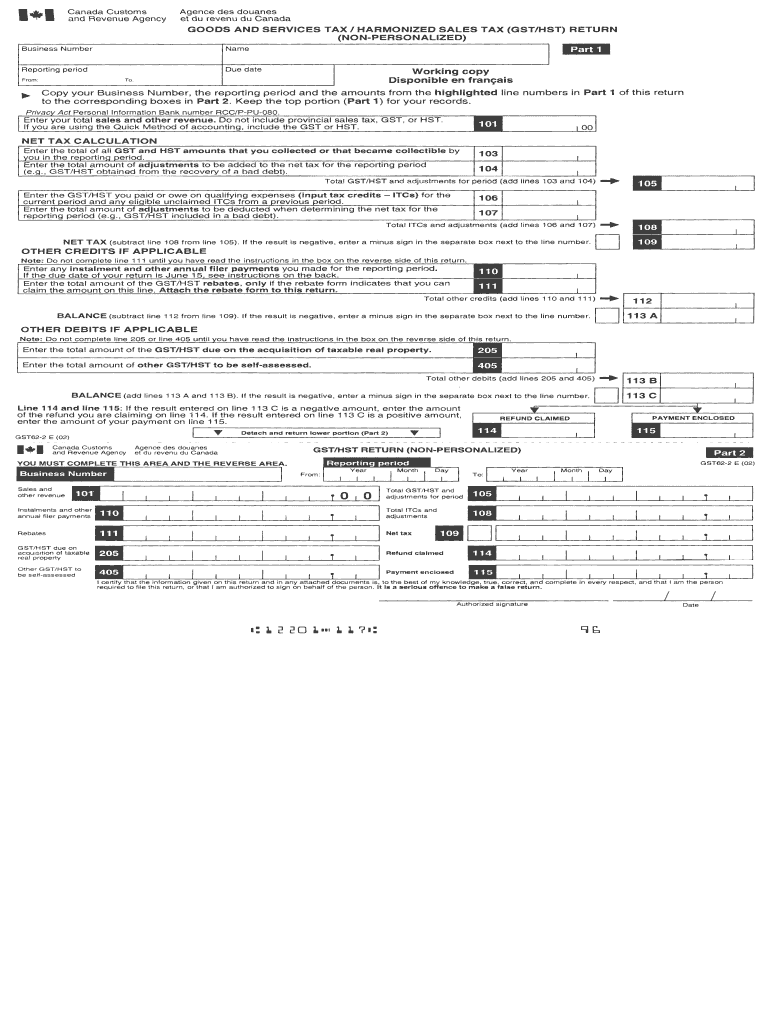

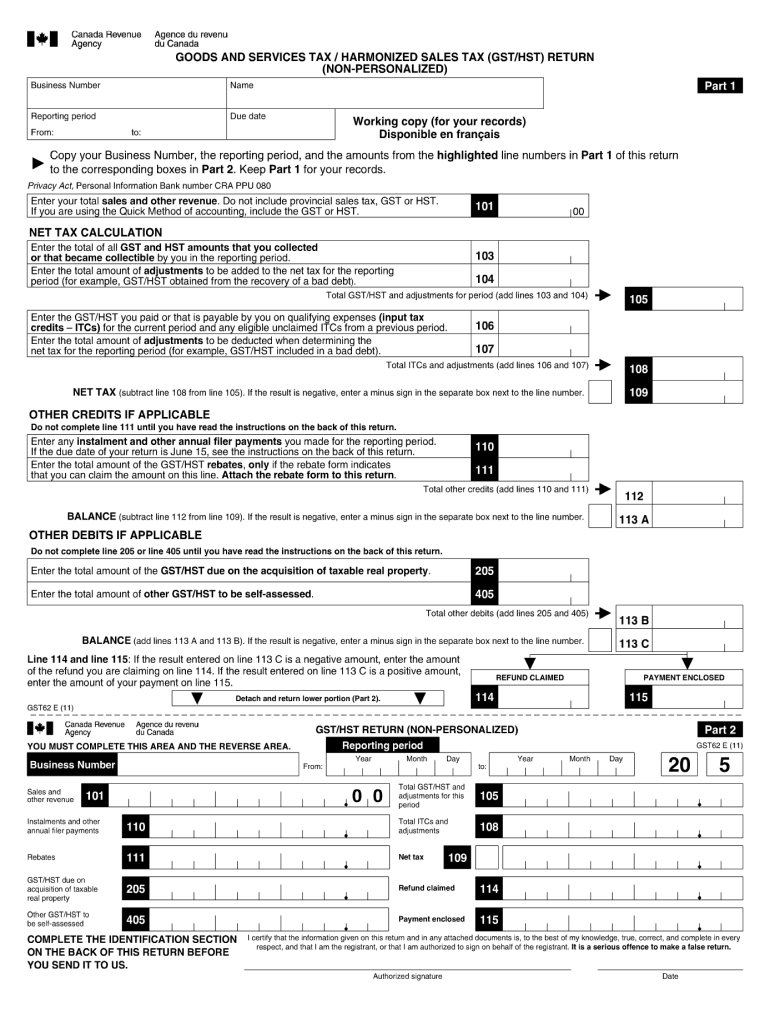

Changes To The GST HST Return DJB Chartered Professional Accountants

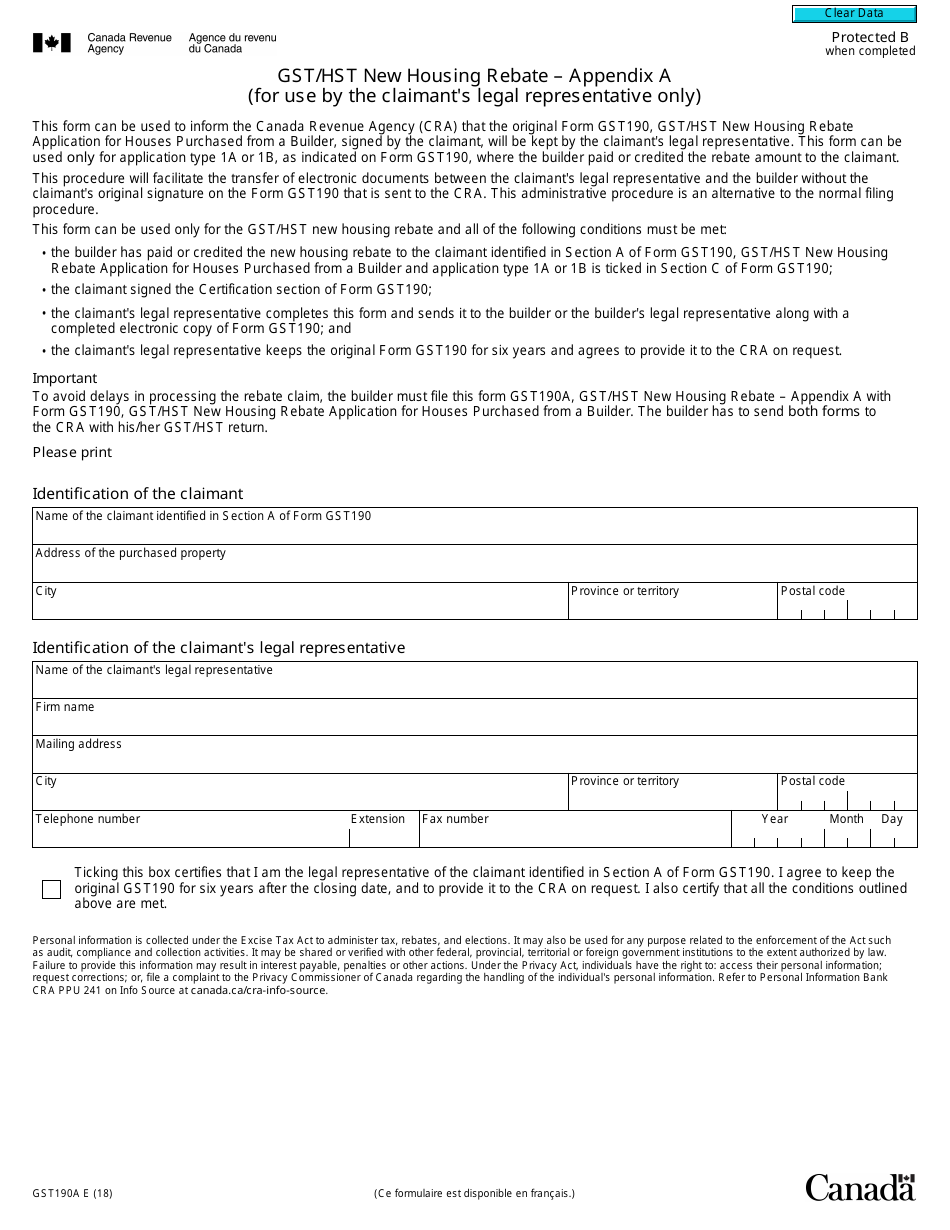

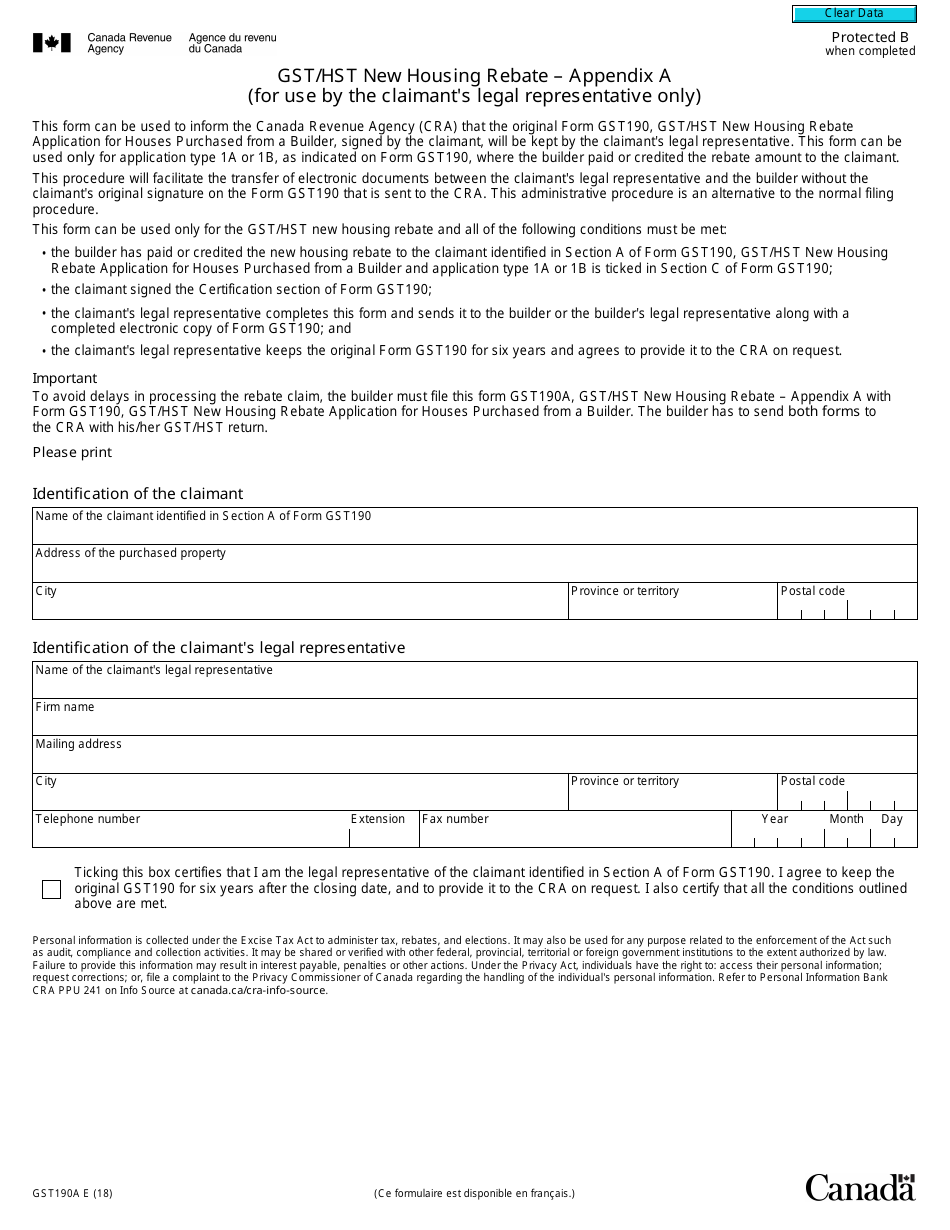

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

Artist Producer Resource GST And HST

Cra Business Gst Return Form Charles Leal s Template

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web 8 d 233 c 2021 nbsp 0183 32 GST66 Application for GST HST Public Service Bodies Rebate and GST Self Government Refund For best results download and open this form in Adobe Reader

https://www.canada.ca/.../gi-066/a-charity-completes-gst-hst-return.html

Web For more information see Guide RC4034 GST HST Public Service Bodies Rebate If a charity that is a registrant wants to use its PSB rebate to reduce any amount it owes on

Web 8 d 233 c 2021 nbsp 0183 32 GST66 Application for GST HST Public Service Bodies Rebate and GST Self Government Refund For best results download and open this form in Adobe Reader

Web For more information see Guide RC4034 GST HST Public Service Bodies Rebate If a charity that is a registrant wants to use its PSB rebate to reduce any amount it owes on

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

2010 Form Canada GST66 E Fill Online Printable Fillable Blank

Artist Producer Resource GST And HST

Cra Business Gst Return Form Charles Leal s Template

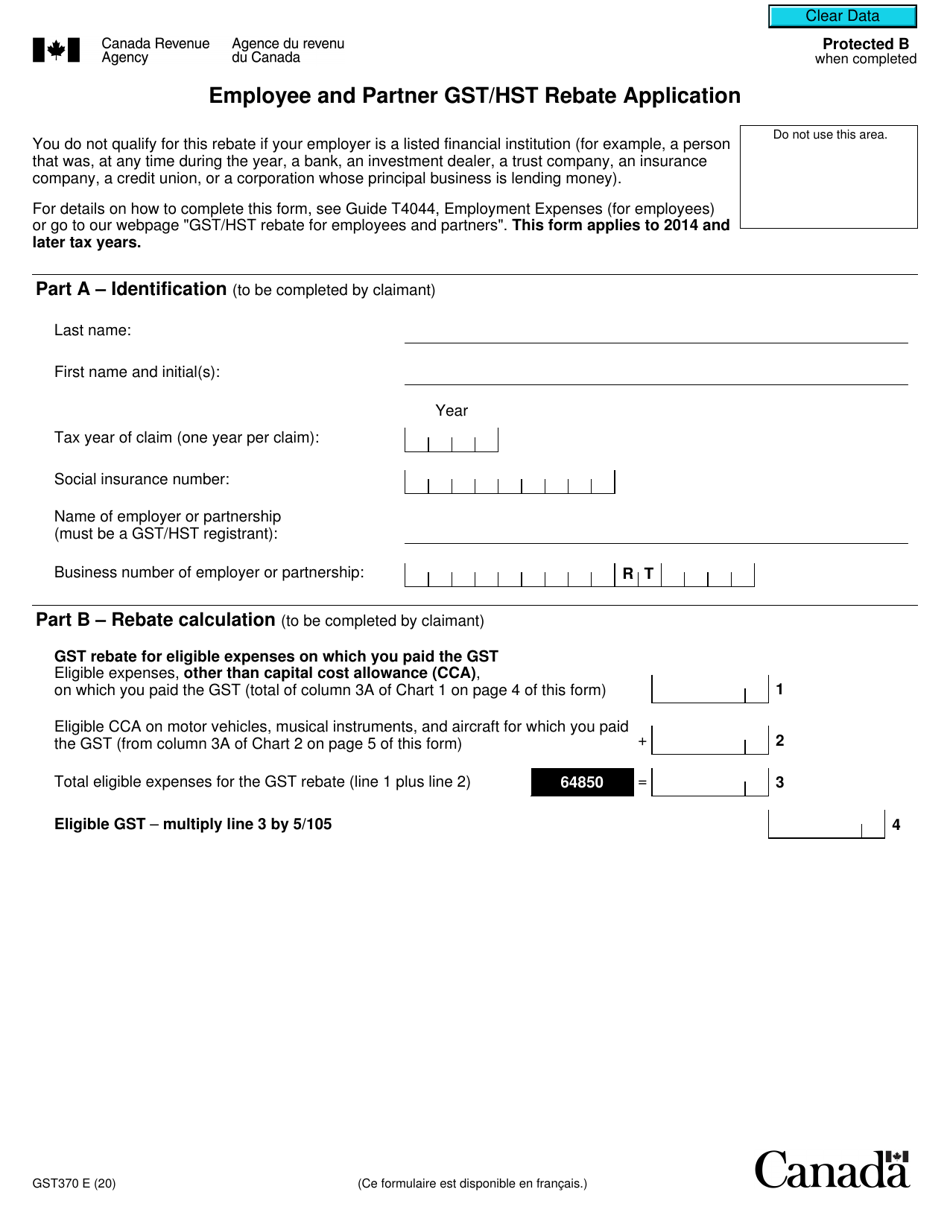

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

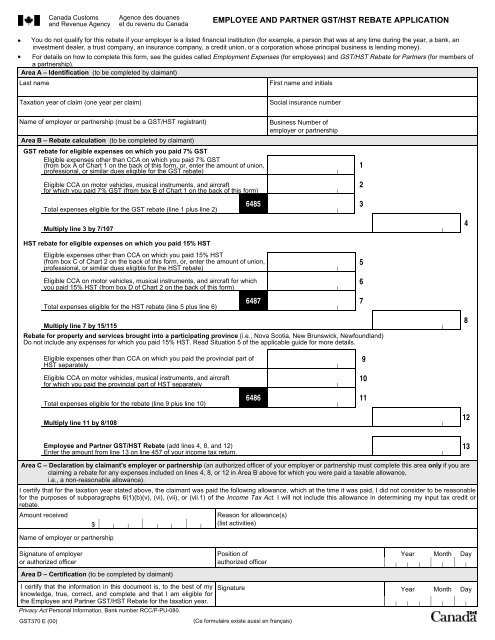

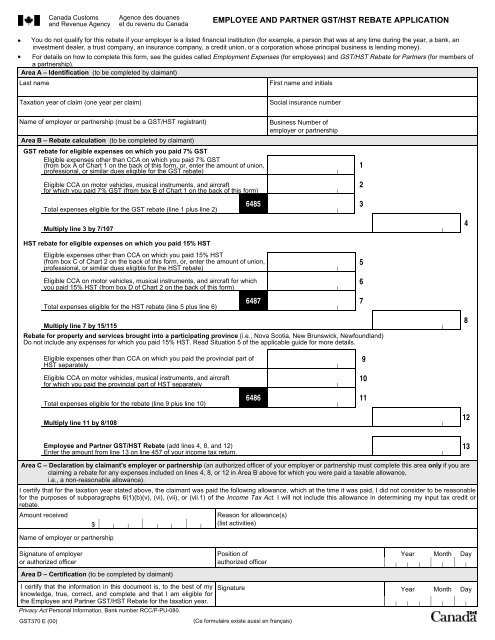

GST370 Employee And Partner GST HST Rebate Application

GST370 Employee And Partner GST HST Rebate Application

Cra Business Gst Return Form Charles Leal s Template