In the modern world of consumerization everybody loves a good deal. One way to score significant savings when you shop is with Cis Tax Rebate Forms. Cis Tax Rebate Forms are marketing strategies used by manufacturers and retailers to provide customers with a portion of a refund on purchases made after they have purchased them. In this article, we'll dive into the world Cis Tax Rebate Forms, exploring what they are and how they work and how you can make the most of your savings through these efficient incentives.

Get Latest Cis Tax Rebate Form Below

Cis Tax Rebate Form

Cis Tax Rebate Form - Cis Tax Return Form, Cis Tax Deduction Form, How Do I Claim My Cis Refund From Hmrc, What Is A Corporate Tax Rebate, How Do I Claim My Cis Refund Online

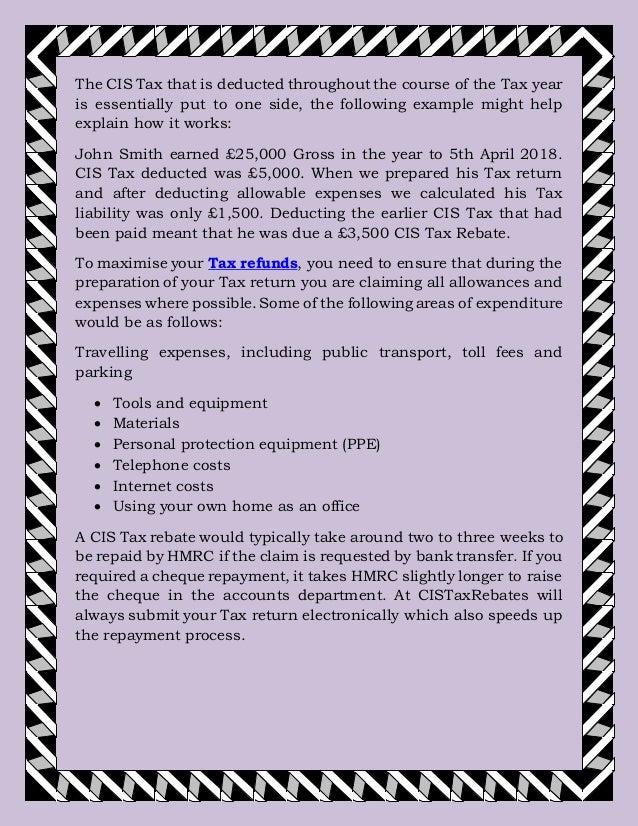

Web 9 mars 2023 nbsp 0183 32 The average tax rebate for CIS workers in the UK is 163 1453 so it s worth finding out what you re owed We will help you claim your CIS tax rebate as well as relief

Web 20 juil 2017 nbsp 0183 32 Guidance Claim a refund of Construction Industry Scheme deductions if you re a limited company or an agent Get a refund of your Construction Industry Scheme

A Cis Tax Rebate Form in its most basic version, is an ad-hoc refund that a client receives after they have purchased a product or service. It's a powerful instrument employed by companies to attract buyers, increase sales as well as promote particular products.

Types of Cis Tax Rebate Form

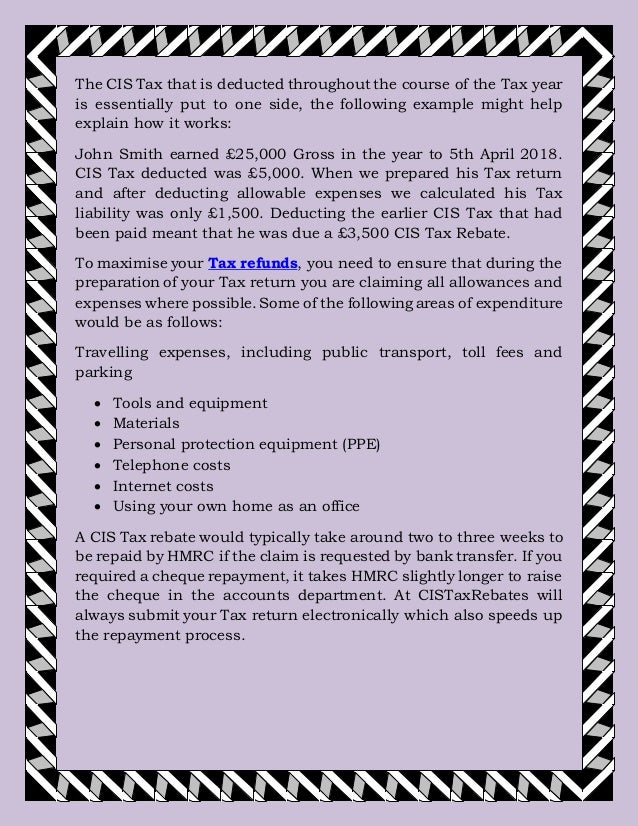

Cis Tax Rebates

Cis Tax Rebates

Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The

Web Totalpayment exclusive of VAT 600 Lesscost of materials exclusive of VAT 200 Amountliable to deduction 400 Amountdeducted at 20 80 Netpayment to

Cash Cis Tax Rebate Form

Cash Cis Tax Rebate Form are the simplest kind of Cis Tax Rebate Form. Customers receive a specific amount of cash back after purchasing a item. These are usually used for costly items like electronics or appliances.

Mail-In Cis Tax Rebate Form

Mail-in Cis Tax Rebate Form require consumers to send in evidence of purchase to get their refund. They're somewhat more involved, however they can yield substantial savings.

Instant Cis Tax Rebate Form

Instant Cis Tax Rebate Form will be applied at point of sale. They reduce the cost of purchase immediately. Customers don't need to wait until they can save by using this method.

How Cis Tax Rebate Form Work

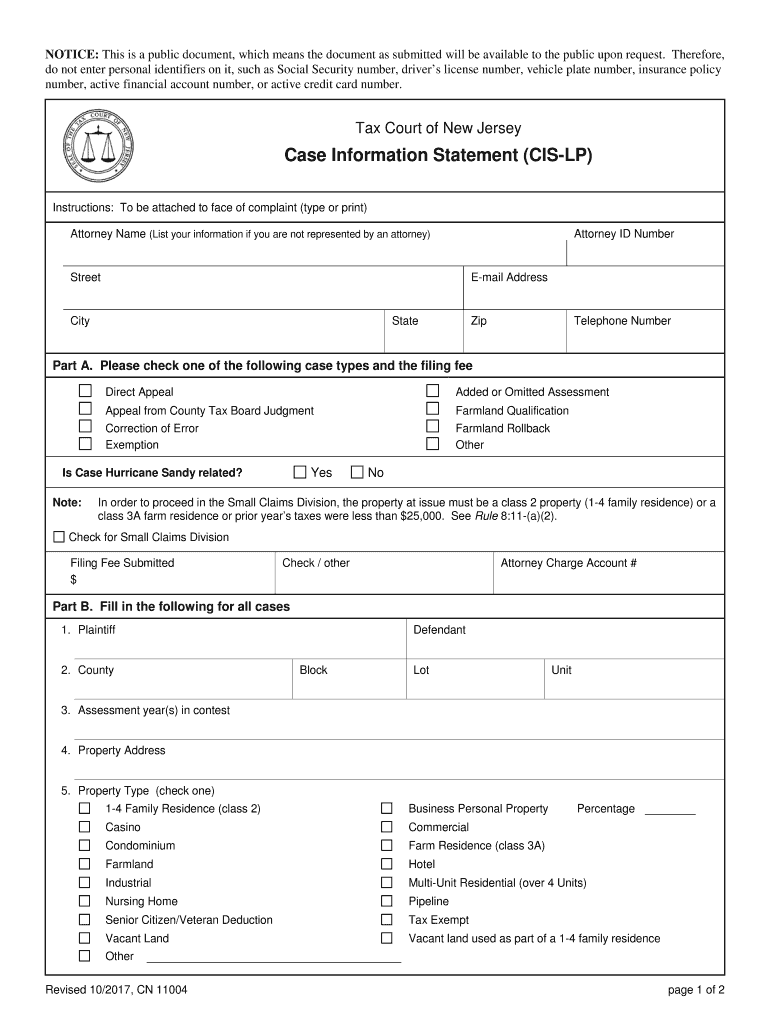

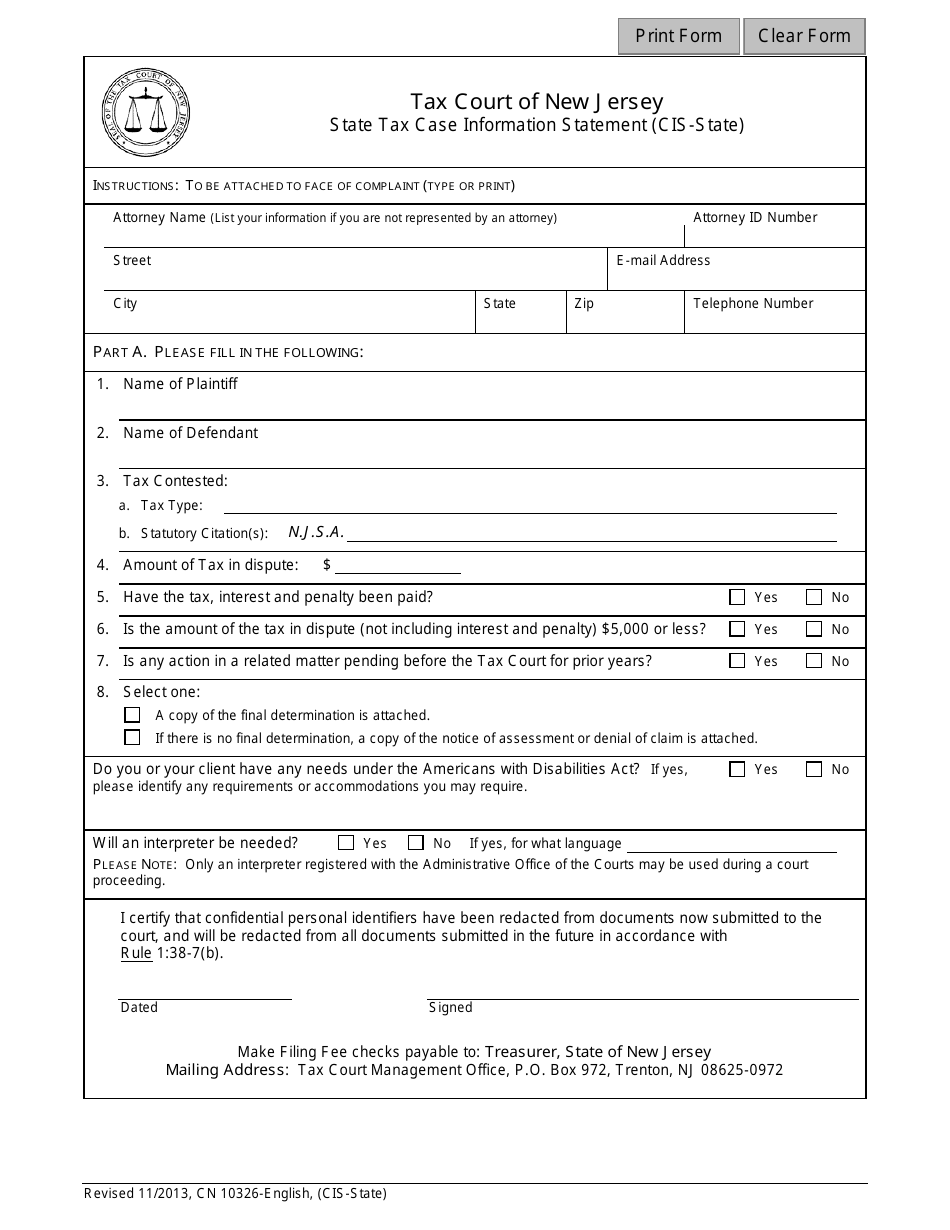

NJ CN 11004 CIS LP 2017 Complete Legal Document Online US Legal Forms

NJ CN 11004 CIS LP 2017 Complete Legal Document Online US Legal Forms

Web 25 mars 2022 nbsp 0183 32 25th Mar 2022 If any of your clients are self employed workers in the construction industry it s well worth brushing up your knowledge around the Construction

The Cis Tax Rebate Form Process

The procedure typically consists of a few steps:

-

Buy the product: Firstly make sure you purchase the product as you normally would.

-

Fill in the Cis Tax Rebate Form Form: To claim the Cis Tax Rebate Form you'll need to provide some data, such as your name, address, and details about your purchase, in order to receive your Cis Tax Rebate Form.

-

Submit the Cis Tax Rebate Form According to the type of Cis Tax Rebate Form you might need to submit a form by mail or send it via the internet.

-

Wait for approval: The business will look over your submission for compliance with reimbursement's terms and condition.

-

Accept your Cis Tax Rebate Form After you've been approved, you'll be able to receive your reimbursement, using a check or prepaid card, or another method that is specified in the offer.

Pros and Cons of Cis Tax Rebate Form

Advantages

-

Cost savings Cis Tax Rebate Form can dramatically reduce the price you pay for the item.

-

Promotional Deals They encourage customers to try new items or brands.

-

Increase Sales Cis Tax Rebate Form can increase the sales of a business and increase its market share.

Disadvantages

-

Complexity In particular, mail-in Cis Tax Rebate Form in particular could be cumbersome and costly.

-

Day of Expiration Many Cis Tax Rebate Form have specific deadlines for submission.

-

Risk of Not Being Paid Some customers might have their Cis Tax Rebate Form delayed if they don't adhere to the requirements precisely.

Download Cis Tax Rebate Form

FAQs

1. Are Cis Tax Rebate Form the same as discounts? No, Cis Tax Rebate Form require a partial refund after the purchase, while discounts lower prices at time of sale.

2. Are there any Cis Tax Rebate Form that I can use on the same product? It depends on the terms and conditions of Cis Tax Rebate Form provides and the particular product's quality and eligibility. Certain companies may permit this, whereas others will not.

3. How long will it take to receive a Cis Tax Rebate Form? The timing varies, but it can be anywhere from a few weeks up to a few months to get your Cis Tax Rebate Form.

4. Do I have to pay tax in relation to Cis Tax Rebate Form amounts? In the majority of instances, Cis Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Cis Tax Rebate Form offers from brands that aren't well-known It is essential to investigate and make sure that the company offering the Cis Tax Rebate Form has a good reputation prior to making an acquisition.

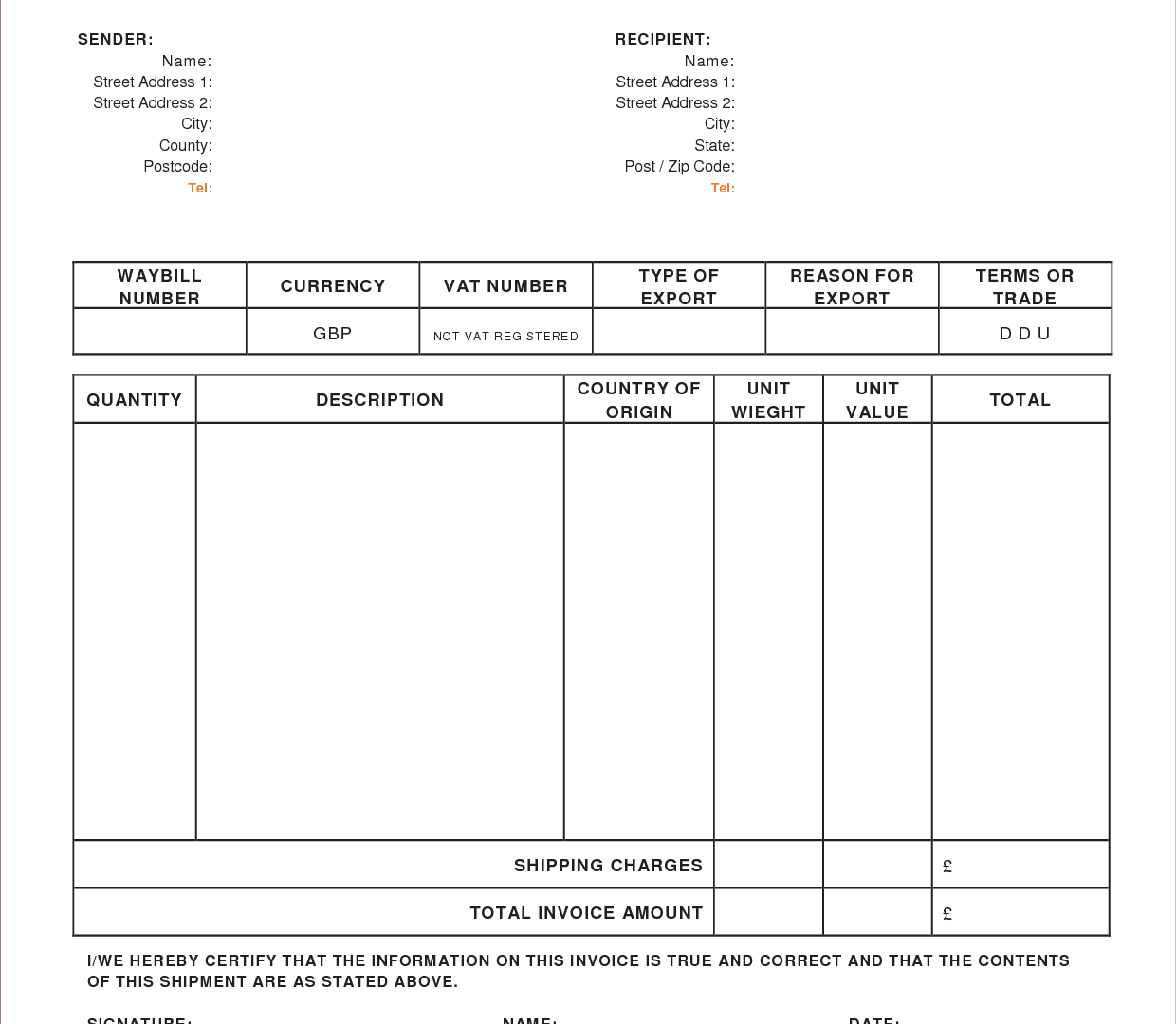

Original Cis Receipt Template Beautiful Receipt Templates

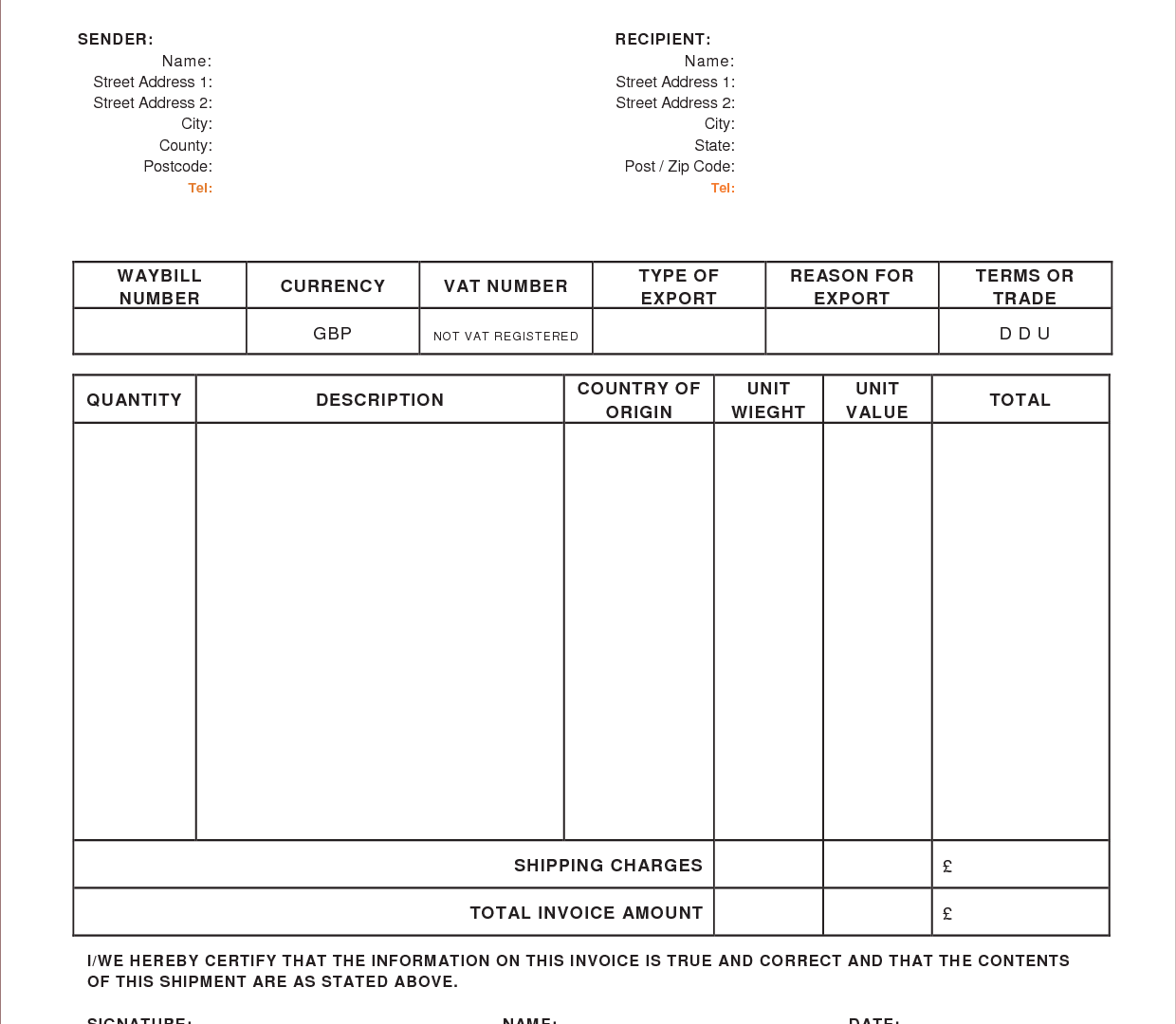

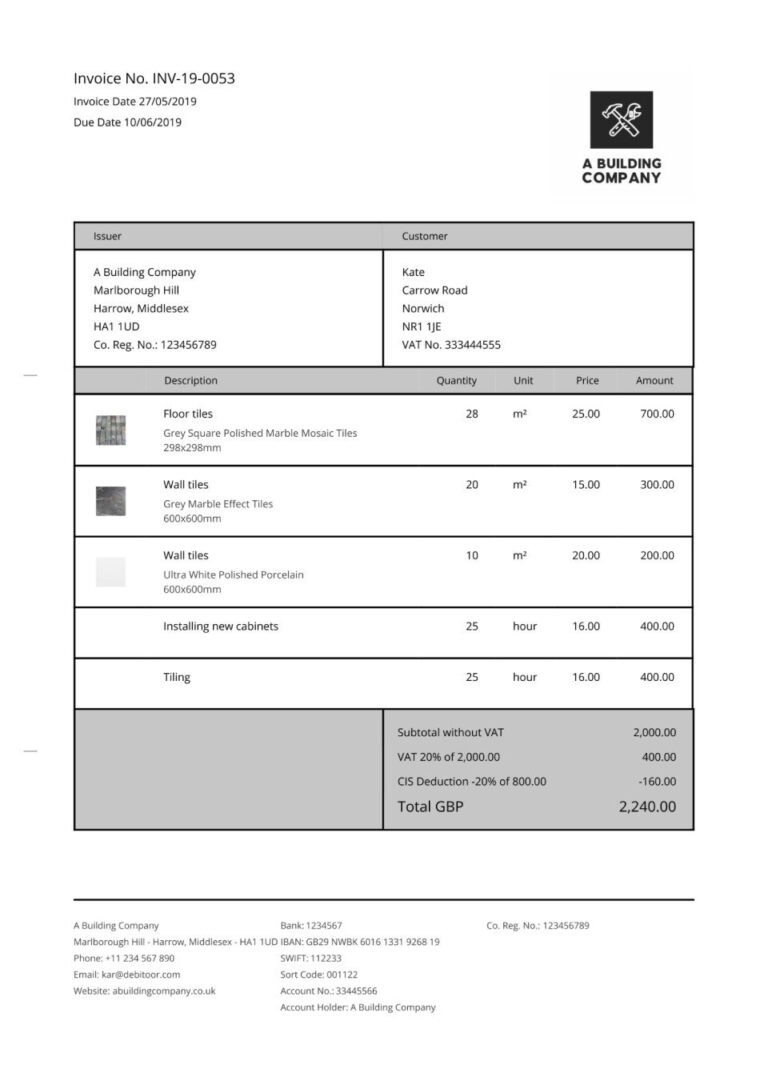

Cis Invoice Template Subcontractor

Check more sample of Cis Tax Rebate Form below

Cis Form Fillable Printable Forms Free Online

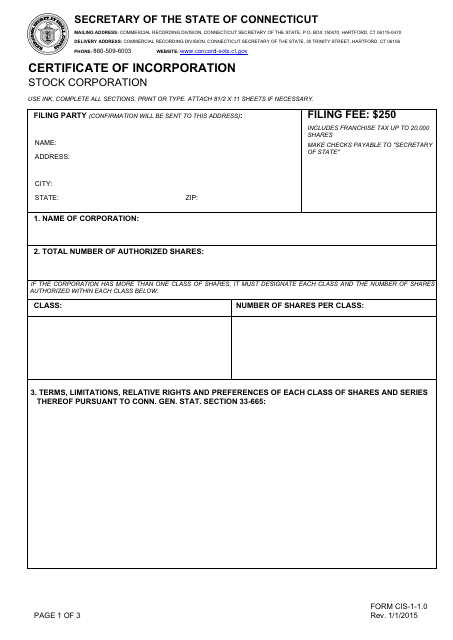

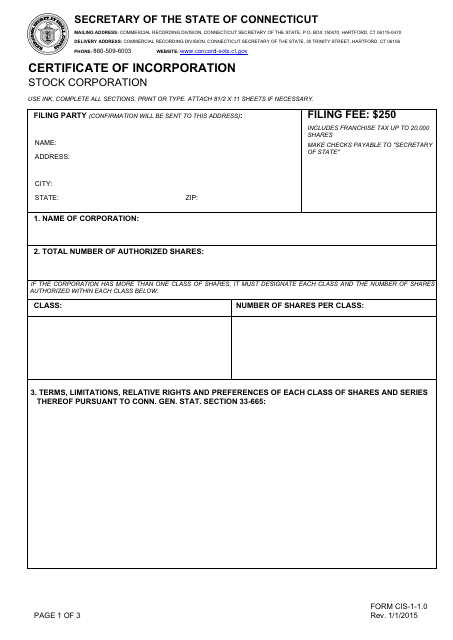

Form CIS 1 1 0 Download Fillable PDF Or Fill Online Certificate Of

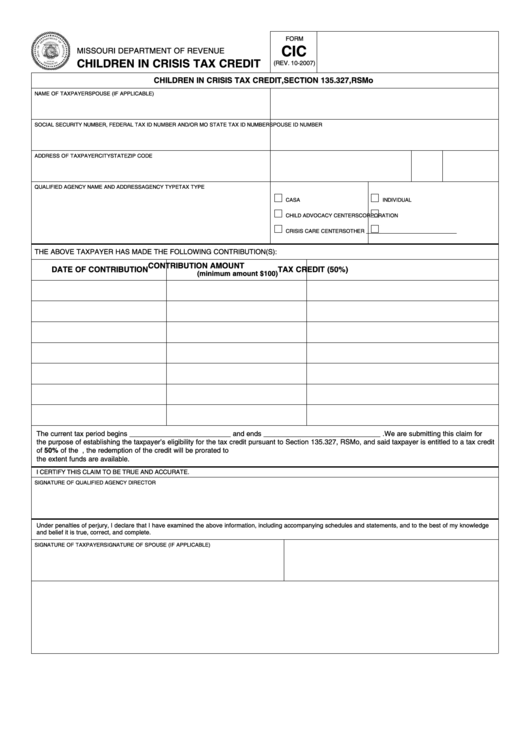

Fillable Form Cic Children In Crisis Tax Credit Printable Pdf Download

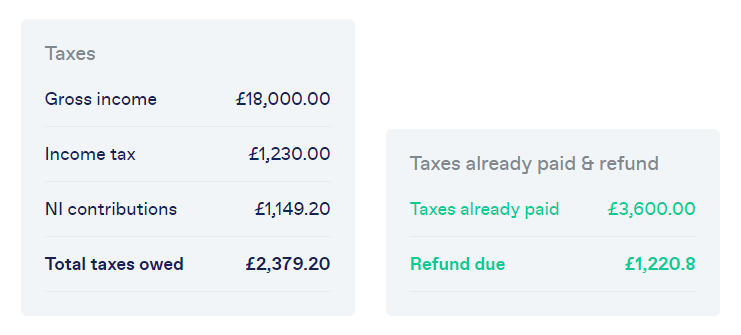

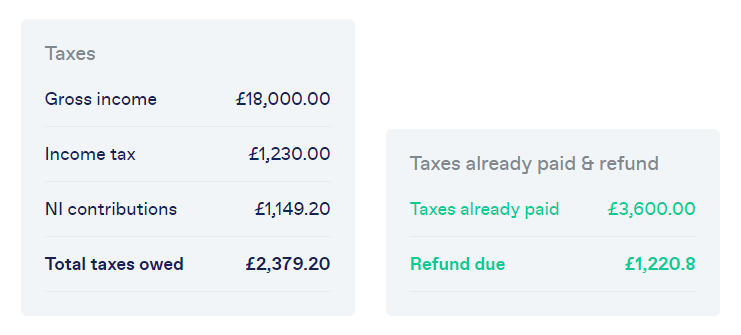

How Does The Construction Industry Scheme CIS Work TaxScouts

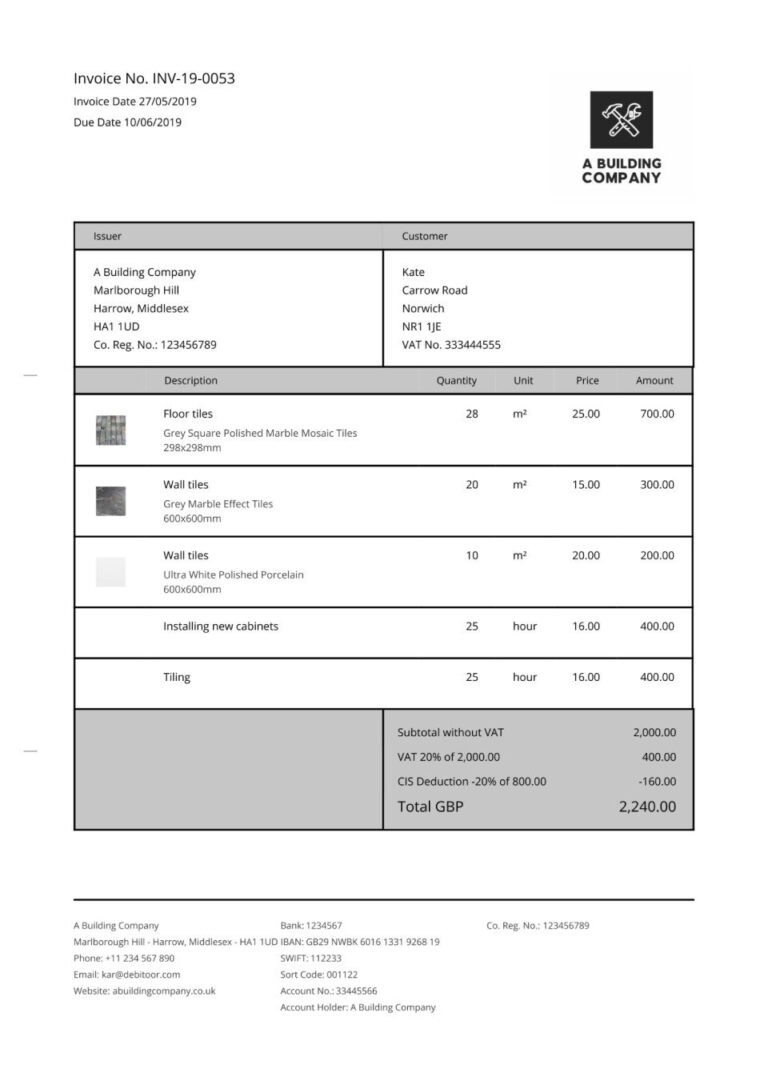

Invoice Templates For Cis Subcontractors Debitoor With Regard To Hmrc

Cis Invoice Template Subcontractor

https://www.gov.uk/guidance/claim-a-refund-of-construction-industry...

Web 20 juil 2017 nbsp 0183 32 Guidance Claim a refund of Construction Industry Scheme deductions if you re a limited company or an agent Get a refund of your Construction Industry Scheme

https://www.litrg.org.uk/tax-guides/tax-basics/how-do-i-claim-tax-back/...

Web 6 avr 2023 nbsp 0183 32 Registered CIS workers receive their payments net of 20 tax If a subcontractor is unregistered they will receive their payment net of 30 tax It is also

Web 20 juil 2017 nbsp 0183 32 Guidance Claim a refund of Construction Industry Scheme deductions if you re a limited company or an agent Get a refund of your Construction Industry Scheme

Web 6 avr 2023 nbsp 0183 32 Registered CIS workers receive their payments net of 20 tax If a subcontractor is unregistered they will receive their payment net of 30 tax It is also

How Does The Construction Industry Scheme CIS Work TaxScouts

Form CIS 1 1 0 Download Fillable PDF Or Fill Online Certificate Of

Invoice Templates For Cis Subcontractors Debitoor With Regard To Hmrc

Cis Invoice Template Subcontractor

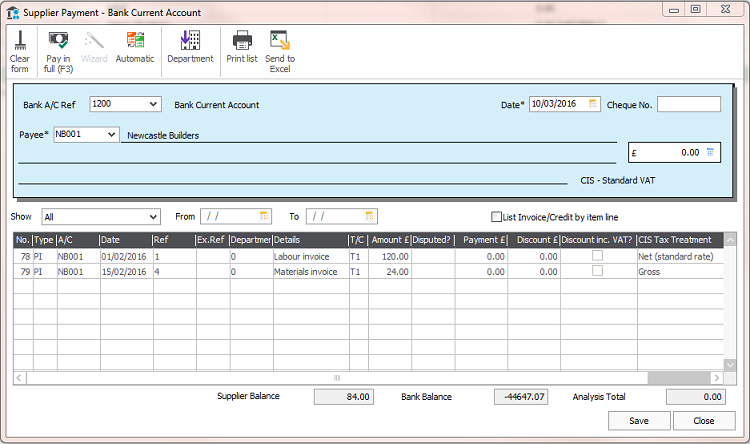

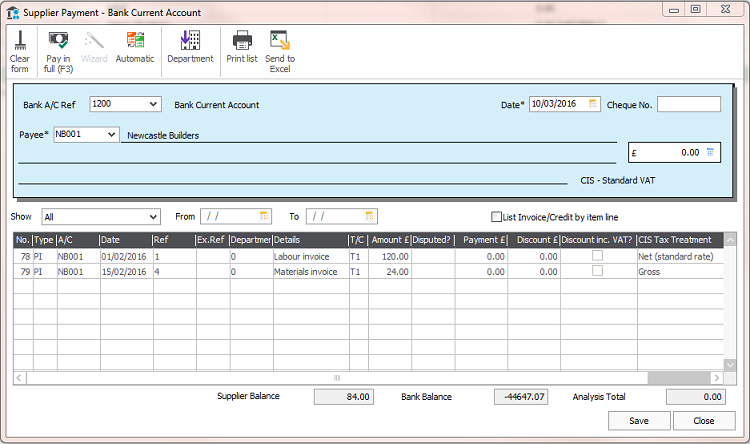

CIS Help And User Guide Sage 200 Sicon Ltd

CIS Contractor How To File CIS Return Online Accountant s Notes

CIS Contractor How To File CIS Return Online Accountant s Notes

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting