Today, in a world that is driven by the consumer everyone enjoys a good bargain. One option to obtain significant savings on your purchases is through Child Tax Rebate Forms. Child Tax Rebate Forms can be a way of marketing employed by retailers and manufacturers to provide customers with a portion of a refund for their purchases after they've placed them. In this post, we'll dive into the world Child Tax Rebate Forms. We will explore what they are and how they operate, and ways to maximize the value of these incentives.

Get Latest Child Tax Rebate Form Below

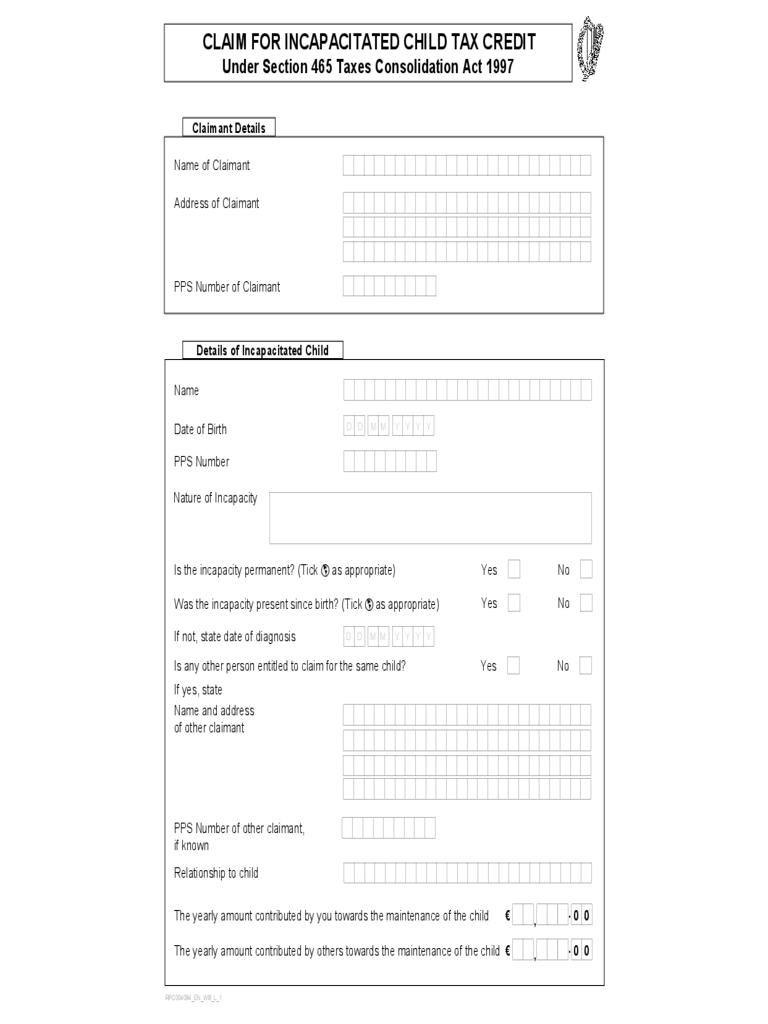

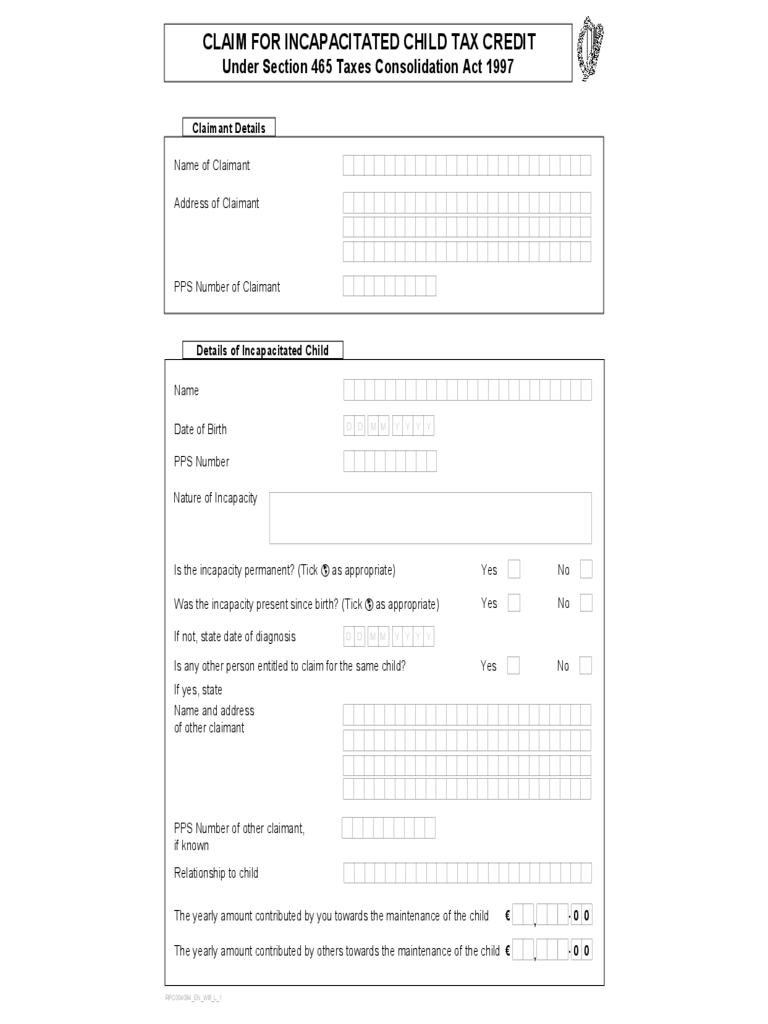

Child Tax Rebate Form

Child Tax Rebate Form -

Web File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit

Web You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if

A Child Tax Rebate Form at its most basic format, is a return to the customer who has purchased a particular product or service. It's a highly effective tool that businesses use to draw buyers, increase sales and also to advertise certain products.

Types of Child Tax Rebate Form

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Web Sign in here to view your 2022 Advance Child Tax Credit forms For questions or help filing your taxes visit GetYourRefund If you haven t filed yet this year you might be eligible to claim cash benefits Visit

Web Issue Provide an overview of the child tax rebate enacted in this year s budget act PA 22 118 167 411 Child Tax Rebate Overview The child tax rebate is a one time rebate of

Cash Child Tax Rebate Form

Cash Child Tax Rebate Form are probably the most simple kind of Child Tax Rebate Form. Clients receive a predetermined sum of money back when purchasing a item. They are typically used to purchase the most expensive products like electronics or appliances.

Mail-In Child Tax Rebate Form

Customers who want to receive mail-in Child Tax Rebate Form must provide proof of purchase in order to receive their money back. They are a bit more involved, but can result in substantial savings.

Instant Child Tax Rebate Form

Instant Child Tax Rebate Form are applied right at the point of sale, which reduces your purchase cost instantly. Customers don't need to wait for their savings with this type.

How Child Tax Rebate Form Work

Child Tax Credits Form 2 Free Templates In PDF Word Excel Download

Child Tax Credits Form 2 Free Templates In PDF Word Excel Download

Web 7 sept 2023 nbsp 0183 32 If you have a child under 18 years old you may be eligible for this tax free monthly payment Check out if you re eligible today Registered Education Savings Plan

The Child Tax Rebate Form Process

The process typically involves a few simple steps:

-

You purchase the item: First, you buy the product in the same way you would normally.

-

Fill in your Child Tax Rebate Form request form. You'll need provide certain information like your address, name, and the purchase details, in order in order to make a claim for your Child Tax Rebate Form.

-

Send in the Child Tax Rebate Form It is dependent on the kind of Child Tax Rebate Form, you may need to either mail in a request form or upload it online.

-

Wait for the company's approval: They will review your submission to confirm that it complies with the guidelines and conditions of the Child Tax Rebate Form.

-

Pay your Child Tax Rebate Form After being approved, you'll receive the refund either by check, prepaid card or another method as specified by the offer.

Pros and Cons of Child Tax Rebate Form

Advantages

-

Cost savings Child Tax Rebate Form can substantially cut the price you pay for products.

-

Promotional Deals The aim is to encourage customers to try out new products or brands.

-

Enhance Sales: Child Tax Rebate Form can boost a company's sales and market share.

Disadvantages

-

Complexity: Mail-in Child Tax Rebate Form, particularly may be lengthy and tedious.

-

Day of Expiration Some Child Tax Rebate Form have very strict deadlines for filing.

-

A risk of not being paid Customers may not get their Child Tax Rebate Form if they don't comply with the rules precisely.

Download Child Tax Rebate Form

Download Child Tax Rebate Form

FAQs

1. Are Child Tax Rebate Form equivalent to discounts? Not at all, Child Tax Rebate Form provide a partial refund upon purchase, while discounts reduce their price at moment of sale.

2. Are there multiple Child Tax Rebate Form I can get on the same product It is contingent on the conditions for the Child Tax Rebate Form deals and product's qualification. Certain companies might allow it, while some won't.

3. How long will it take to receive a Child Tax Rebate Form? The amount of time differs, but it can range from several weeks to few months for you to receive your Child Tax Rebate Form.

4. Do I have to pay tax on Child Tax Rebate Form amounts? In most circumstances, Child Tax Rebate Form amounts are not considered taxable income.

5. Should I be able to trust Child Tax Rebate Form offers from lesser-known brands It's important to do your research and verify that the organization that is offering the Child Tax Rebate Form has a good reputation prior to making purchases.

Child Tax Credits Form IRS Free Download

Child Care Rebate Application Form Edit Fill Sign Online Handypdf

Check more sample of Child Tax Rebate Form below

Child Tax Credit Form Free Download

Child Tax Credit Form Free Download

Child Tax Application Form Fill Out And Sign Printable PDF Template

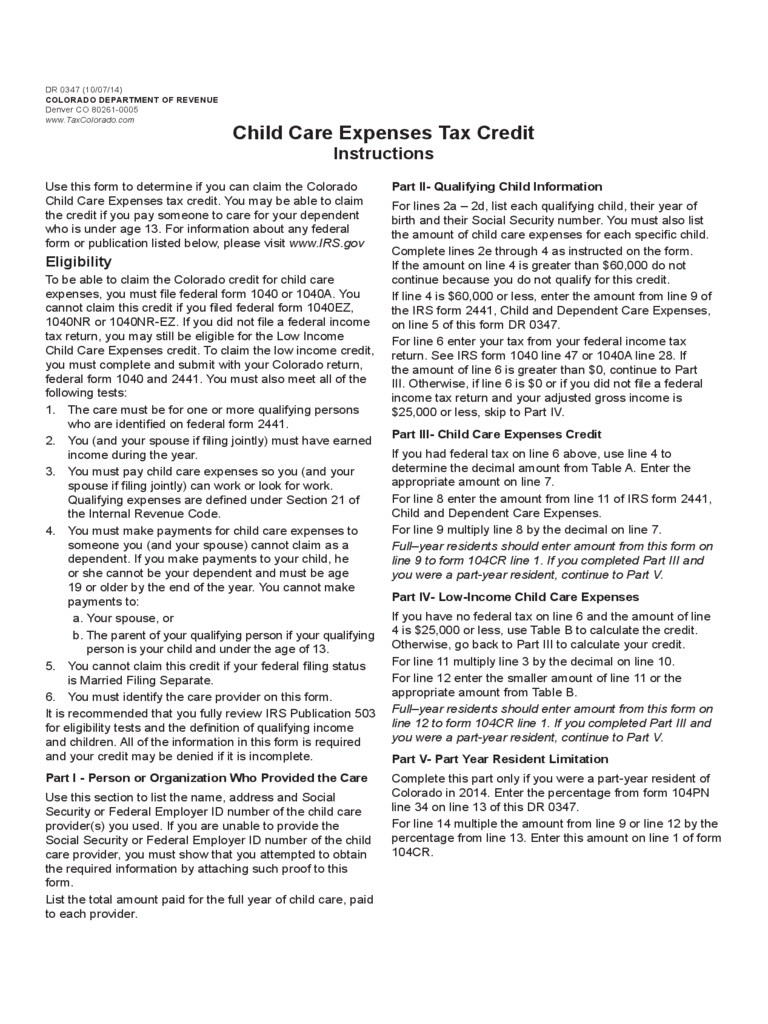

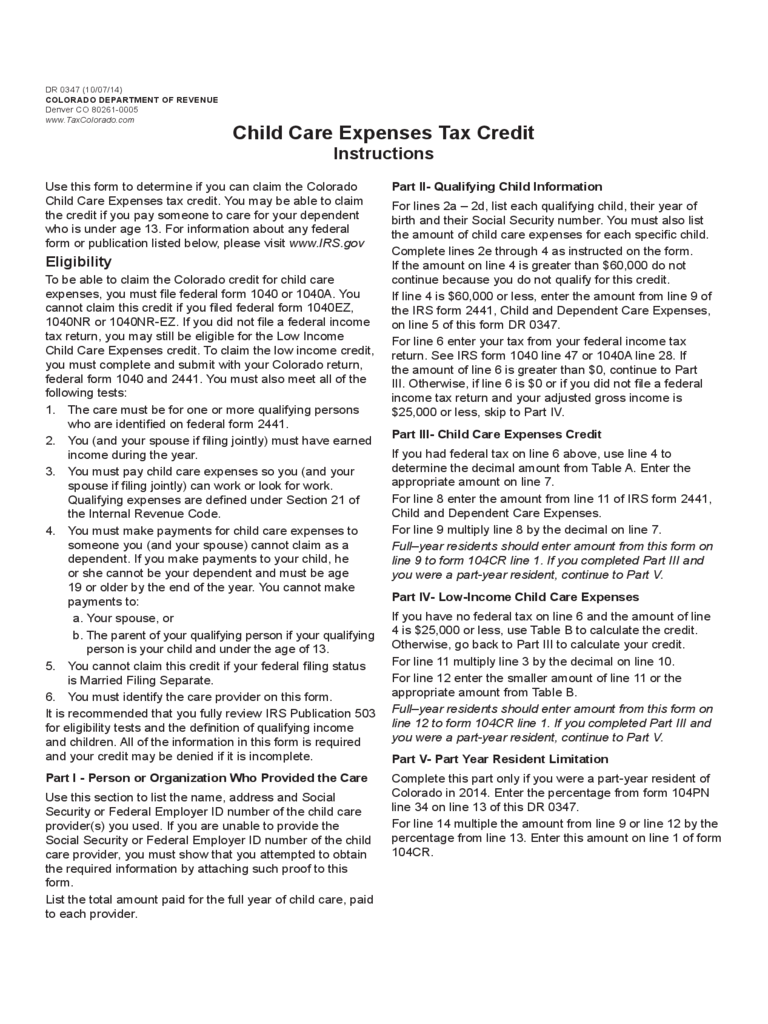

Child Care Expenses Tax Credit Colorado Free Download

Child Tax Credit 2019

8812 Worksheet

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

Web You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Web You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Child Care Expenses Tax Credit Colorado Free Download

Child Tax Credit Form Free Download

Child Tax Credit 2019

8812 Worksheet

2022 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

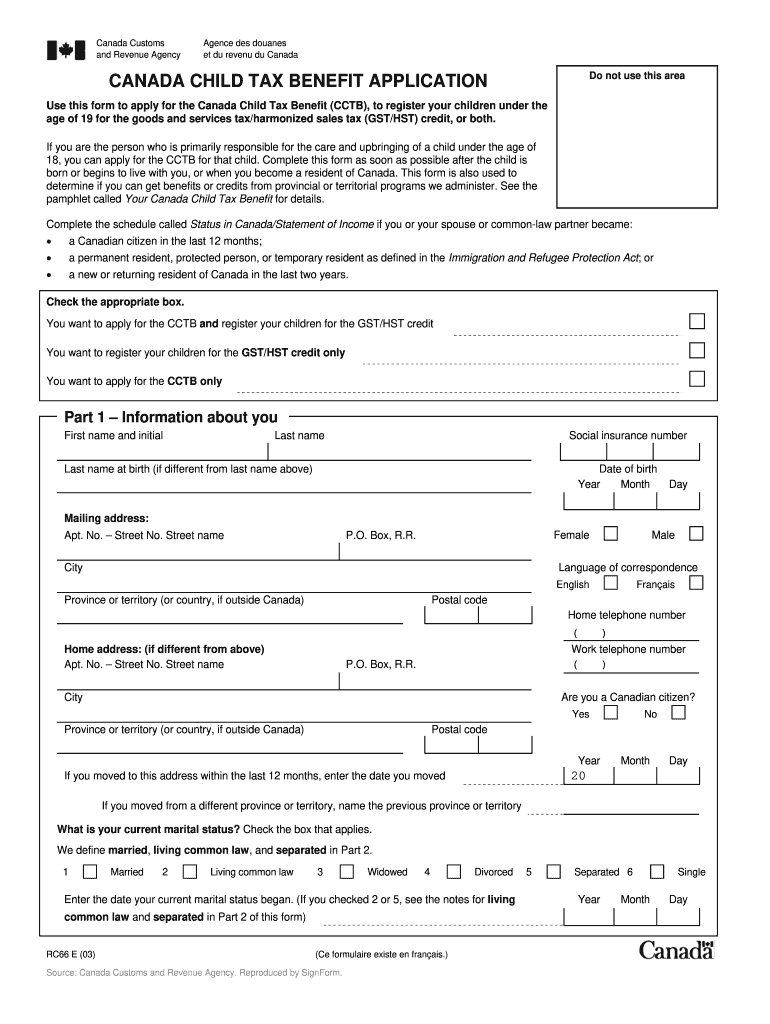

Child Tax Benefit Application Form Canada Free Download

Child Tax Benefit Application Form Canada Free Download

Insurance Definitions Pdf