In this day and age of consuming everyone appreciates a great deal. One method of gaining significant savings when you shop is with Canada Revenue Agency Electronic Rebate Formss. The use of Canada Revenue Agency Electronic Rebate Formss is a method that retailers and manufacturers use to provide customers with a partial refund for their purchases after they've taken them. In this article, we'll explore the world of Canada Revenue Agency Electronic Rebate Formss and explore the nature of them as well as how they work as well as ways to maximize your savings with these cost-effective incentives.

Get Latest Canada Revenue Agency Electronic Rebate Forms Below

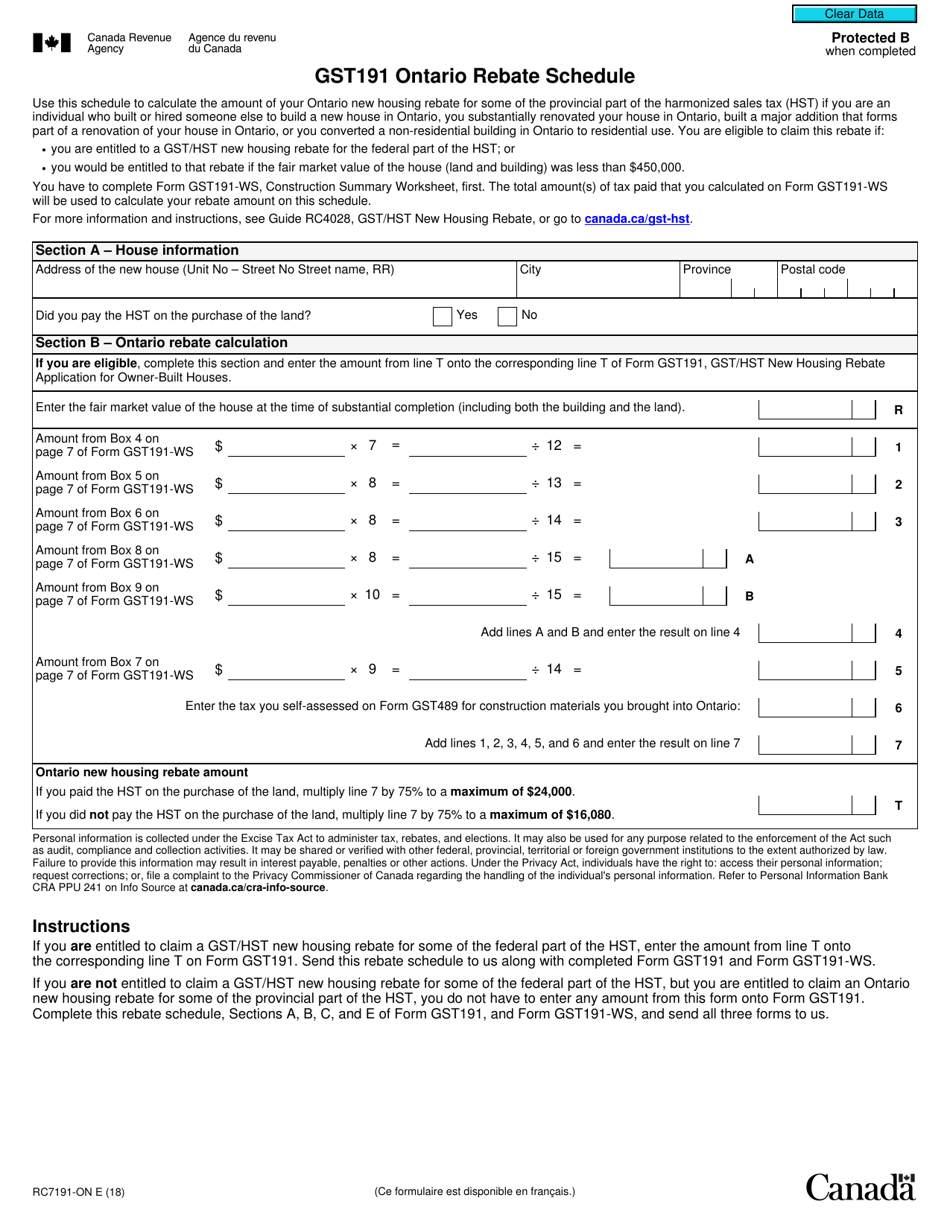

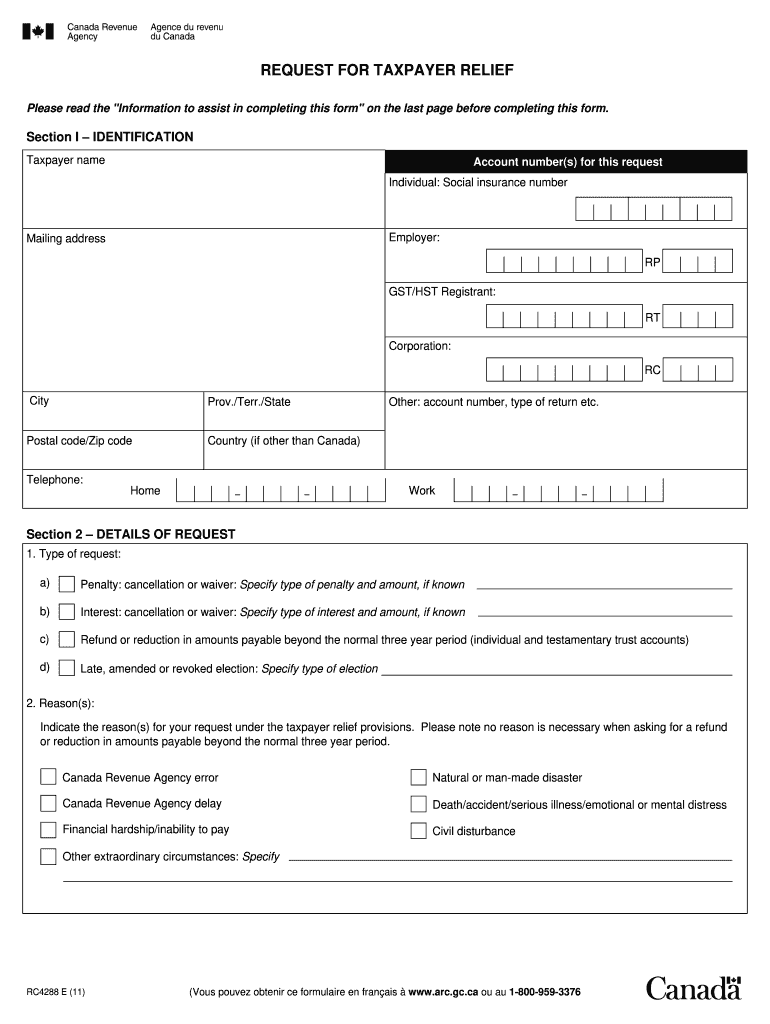

Canada Revenue Agency Electronic Rebate Forms

Canada Revenue Agency Electronic Rebate Forms -

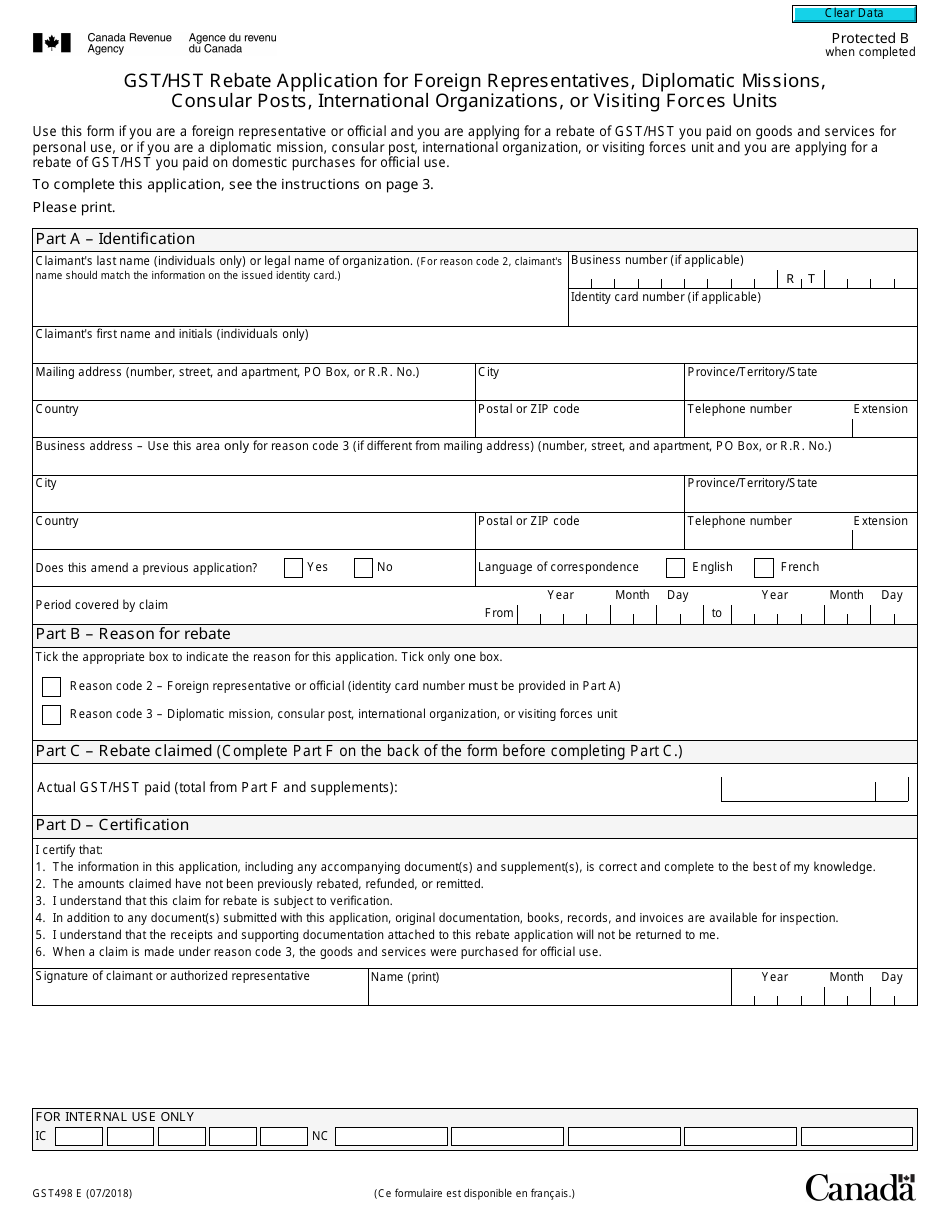

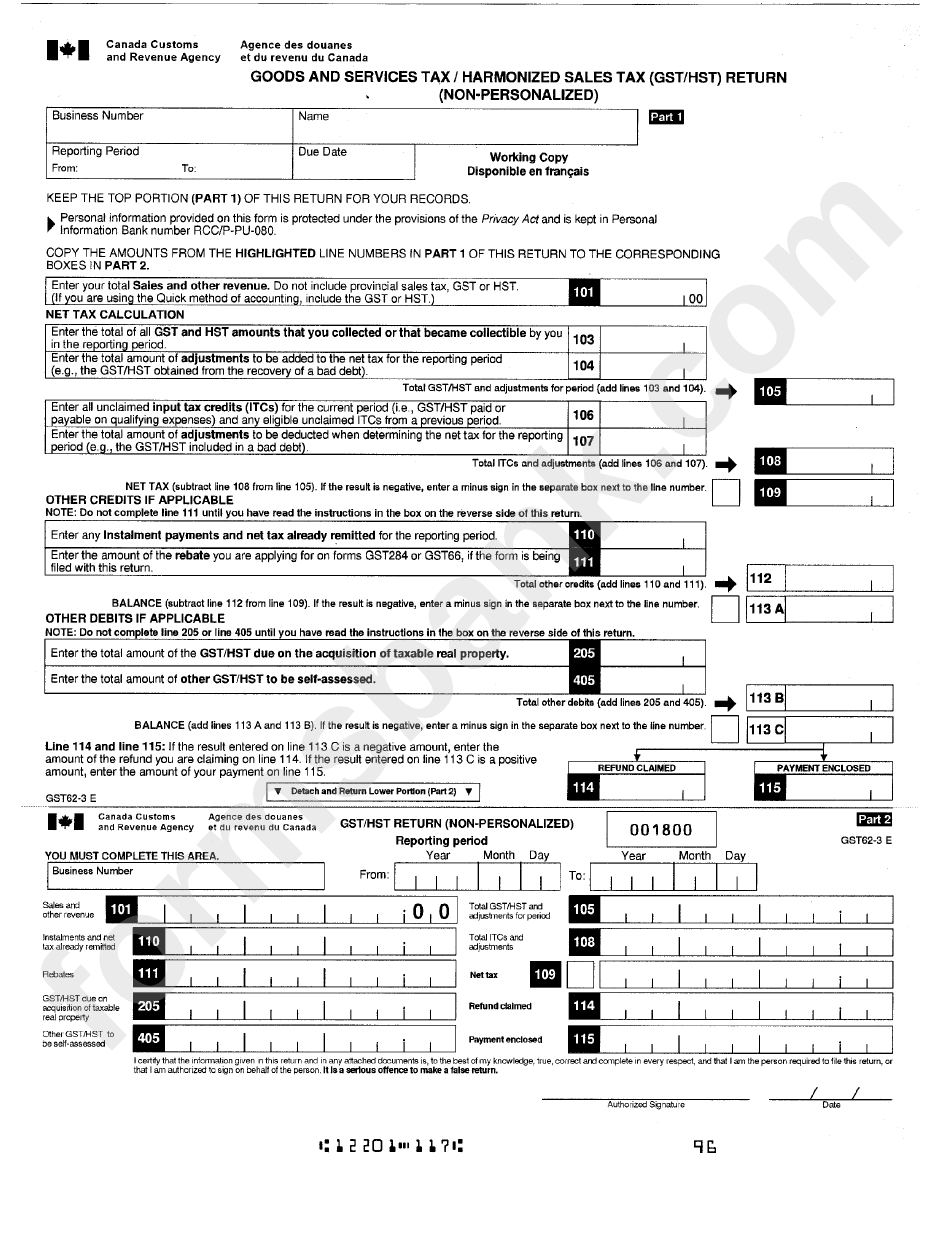

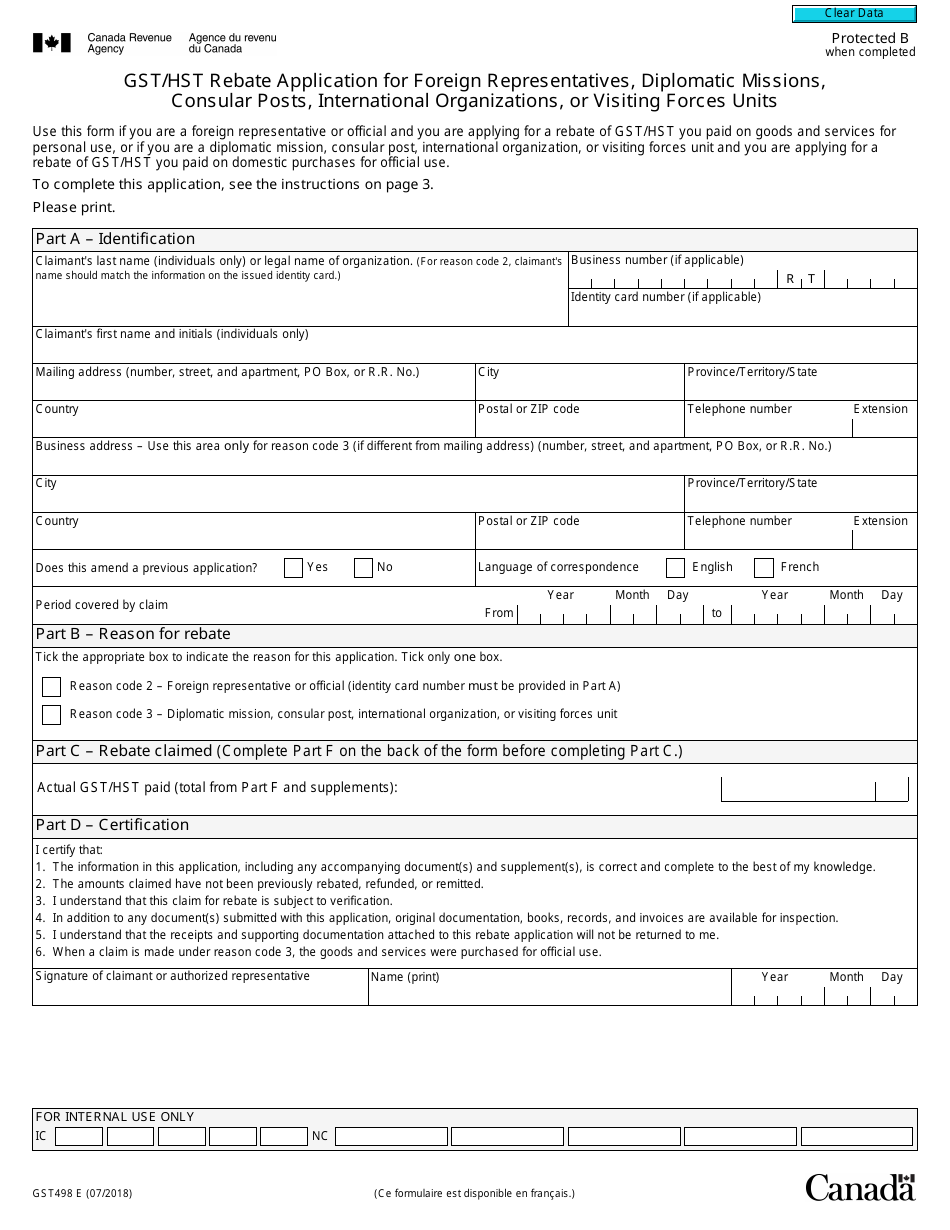

Web 2023 09 26 GST HST NETFILE is an Internet based filing service that allows registrants to file their goods and services tax harmonized sales tax GST HST returns and eligible

Web Forms GST66 Application for GST HST Public Service Bodies Rebate and GST Self Government Refund can be sent to us quickly and easily using our web form Please

A Canada Revenue Agency Electronic Rebate Forms the simplest model, refers to a partial reimbursement to a buyer after they have purchased a product or service. It's a powerful method employed by companies to attract customers, boost sales, and also to advertise certain products.

Types of Canada Revenue Agency Electronic Rebate Forms

Landbap Blog

Landbap Blog

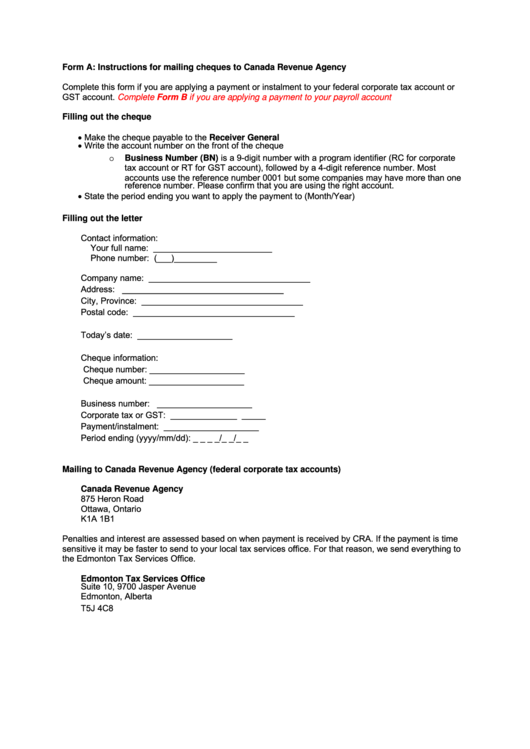

Web Vouchers and forms that provide information on applying payments and how to calculate the amount Customized forms List of customized forms that require approval as per

Web 1142 Zeilen nbsp 0183 32 Electronic Payment Adjustment Form 2017 08 31 RC64 Children s Special Allowances 2023 07 04 RC65 Marital Status Change 2023 07 04 RC66SCH Status

Cash Canada Revenue Agency Electronic Rebate Forms

Cash Canada Revenue Agency Electronic Rebate Forms are the simplest type of Canada Revenue Agency Electronic Rebate Forms. Clients receive a predetermined amount of money after buying a product. These are usually used for large-ticket items such as electronics and appliances.

Mail-In Canada Revenue Agency Electronic Rebate Forms

Mail-in Canada Revenue Agency Electronic Rebate Forms require customers to send in an evidence of purchase for their reimbursement. They're more complicated but could provide substantial savings.

Instant Canada Revenue Agency Electronic Rebate Forms

Instant Canada Revenue Agency Electronic Rebate Forms are applied right at the point of sale, and can reduce your purchase cost instantly. Customers don't need to wait around for savings by using this method.

How Canada Revenue Agency Electronic Rebate Forms Work

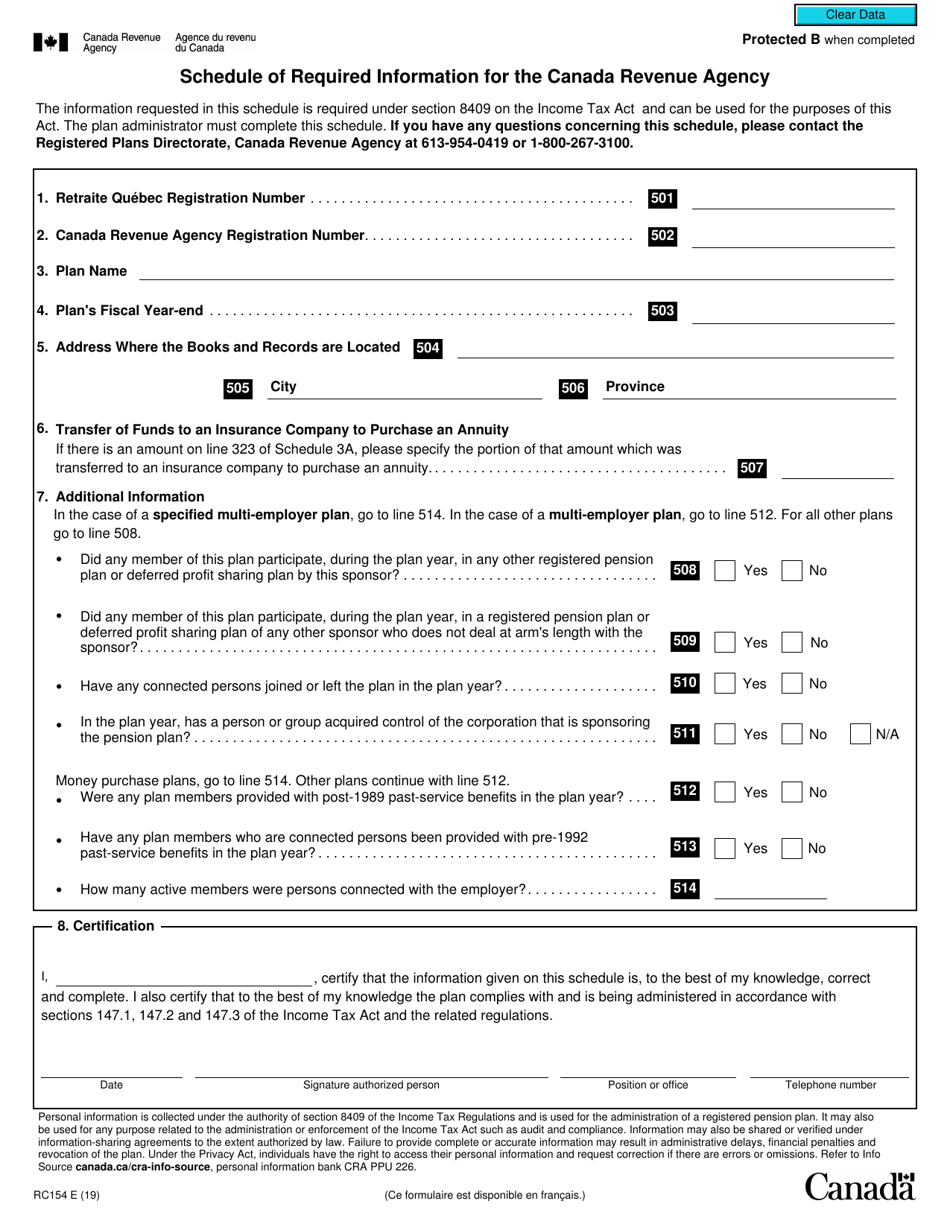

Form RC154 Download Fillable PDF Or Fill Online Schedule Of Required

Form RC154 Download Fillable PDF Or Fill Online Schedule Of Required

Web 30 Nov 2022 nbsp 0183 32 You can view this form in PDF t183 22e pdf PDF fillable saveable t183 fill 22e pdf Last update 2022 11 30 Report a problem on this page Date modified 2022

The Canada Revenue Agency Electronic Rebate Forms Process

The procedure typically consists of a few easy steps:

-

Then, you purchase the product purchase the product as you normally would.

-

Complete the Canada Revenue Agency Electronic Rebate Forms form: You'll need to supply some details, such as your name, address and purchase details in order to submit your Canada Revenue Agency Electronic Rebate Forms.

-

Complete the Canada Revenue Agency Electronic Rebate Forms depending on the type of Canada Revenue Agency Electronic Rebate Forms you will need to mail a Canada Revenue Agency Electronic Rebate Forms form in or submit it online.

-

Wait for the company's approval: They will go through your application to confirm that it complies with the terms and conditions of the Canada Revenue Agency Electronic Rebate Forms.

-

Accept your Canada Revenue Agency Electronic Rebate Forms: Once approved, the amount you receive will be either through check, prepaid card, or other procedure specified by the deal.

Pros and Cons of Canada Revenue Agency Electronic Rebate Forms

Advantages

-

Cost Savings Canada Revenue Agency Electronic Rebate Forms can dramatically cut the price you pay for the item.

-

Promotional Deals: They encourage customers to try out new products or brands.

-

Help to Increase Sales Canada Revenue Agency Electronic Rebate Forms can increase the sales of a company as well as its market share.

Disadvantages

-

Complexity mail-in Canada Revenue Agency Electronic Rebate Forms in particular may be lengthy and slow-going.

-

Deadlines for Expiration Many Canada Revenue Agency Electronic Rebate Forms have certain deadlines for submitting.

-

Risk of Non-Payment Customers may not be able to receive their Canada Revenue Agency Electronic Rebate Forms if they do not follow the rules exactly.

Download Canada Revenue Agency Electronic Rebate Forms

Download Canada Revenue Agency Electronic Rebate Forms

FAQs

1. Are Canada Revenue Agency Electronic Rebate Forms the same as discounts? No, Canada Revenue Agency Electronic Rebate Forms are only a partial reimbursement following the purchase, but discounts can reduce the purchase price at time of sale.

2. Are there any Canada Revenue Agency Electronic Rebate Forms that I can use on the same product The answer is dependent on the terms on the Canada Revenue Agency Electronic Rebate Forms promotions and on the products potential eligibility. Certain companies might permit it, but some will not.

3. How long will it take to get an Canada Revenue Agency Electronic Rebate Forms? The duration will differ, but can take several weeks to a several months to receive a Canada Revenue Agency Electronic Rebate Forms.

4. Do I have to pay taxes regarding Canada Revenue Agency Electronic Rebate Forms sums? most cases, Canada Revenue Agency Electronic Rebate Forms amounts are not considered to be taxable income.

5. Do I have confidence in Canada Revenue Agency Electronic Rebate Forms offers from brands that aren't well-known You must research and ensure that the brand offering the Canada Revenue Agency Electronic Rebate Forms is trustworthy prior to making purchases.

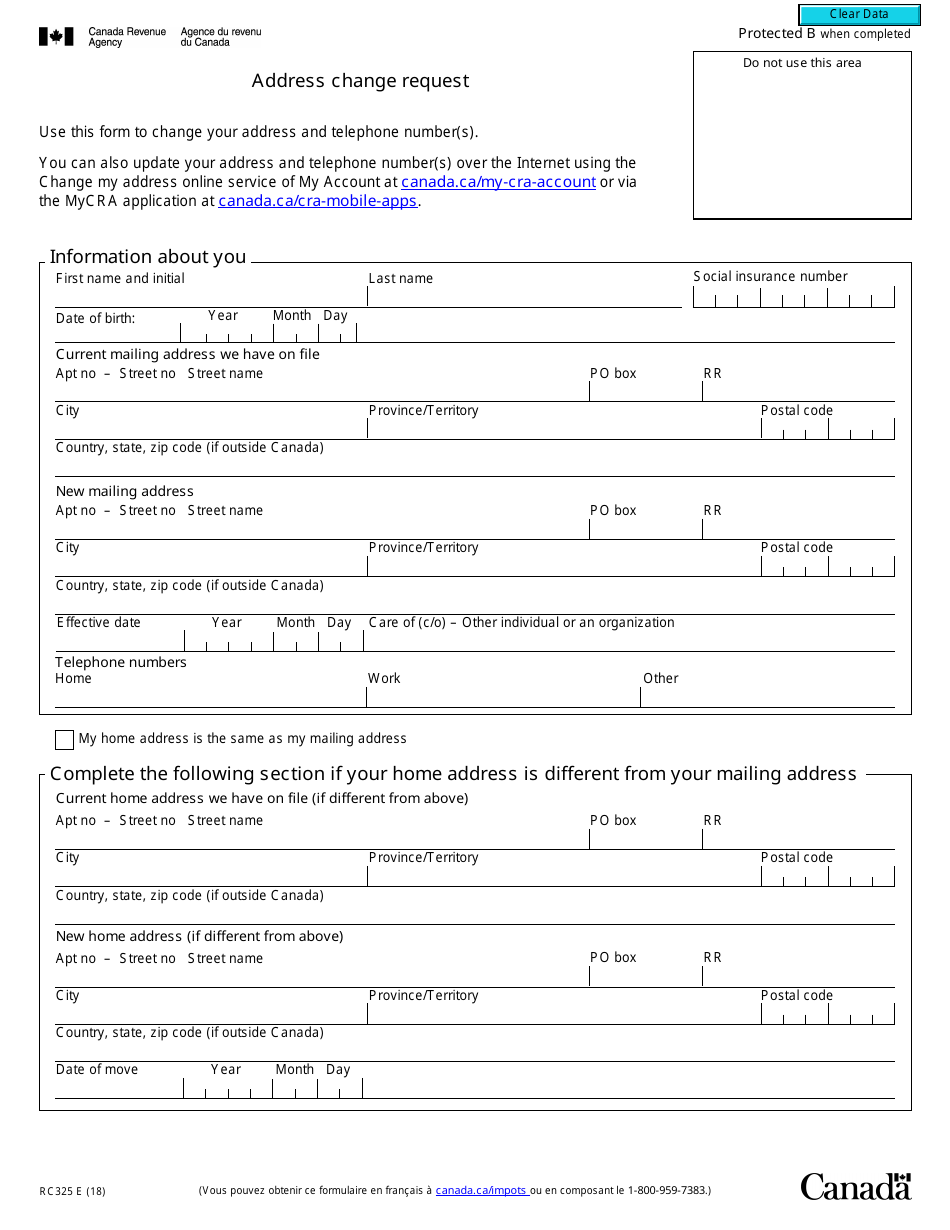

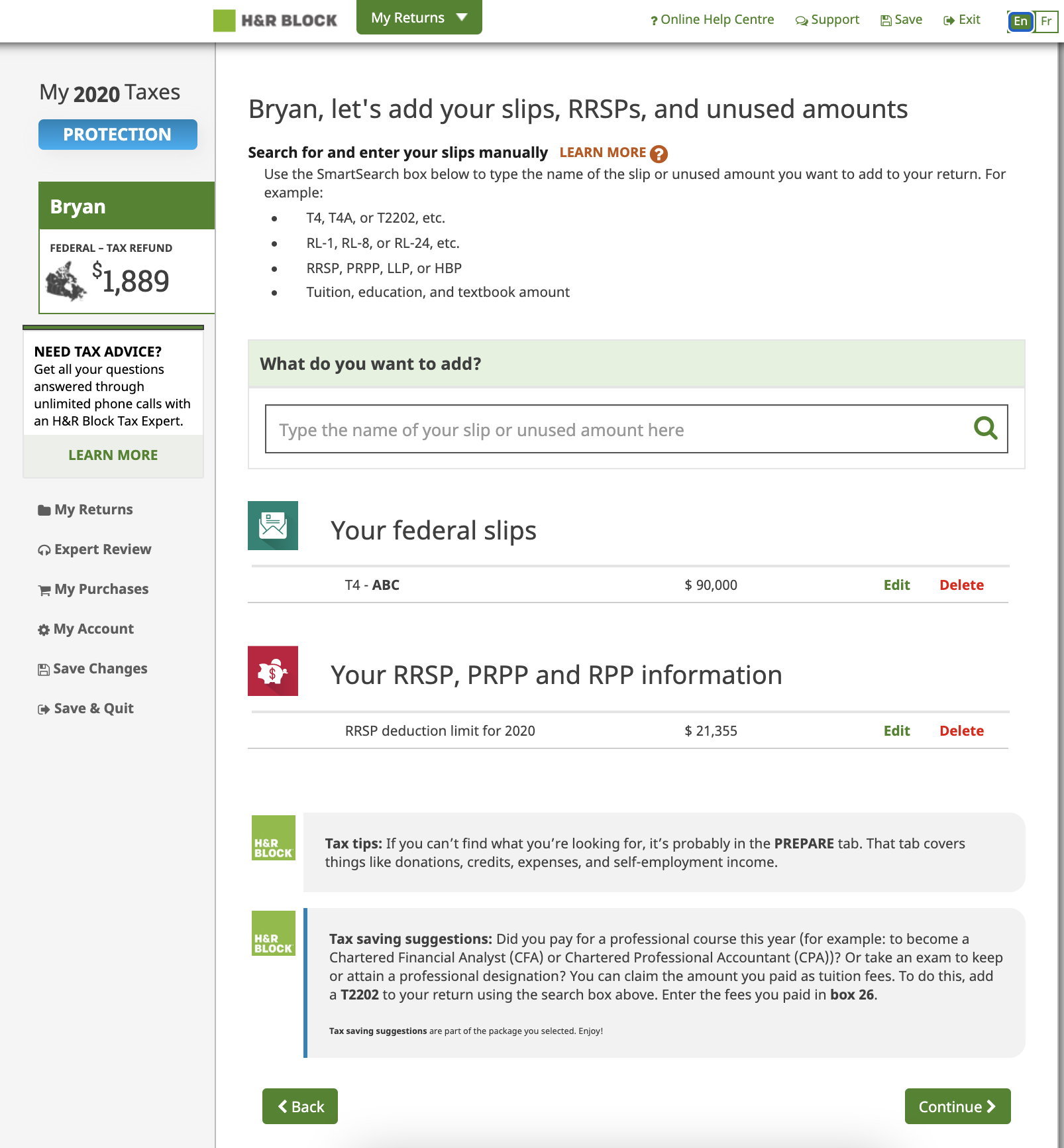

Canada Revenue Agency T4e Kasapeden

Canada Revenue Agency Forms Boyscaqwe

Check more sample of Canada Revenue Agency Electronic Rebate Forms below

Fillable Canada Revenue Agency Forms Printable Pdf Download

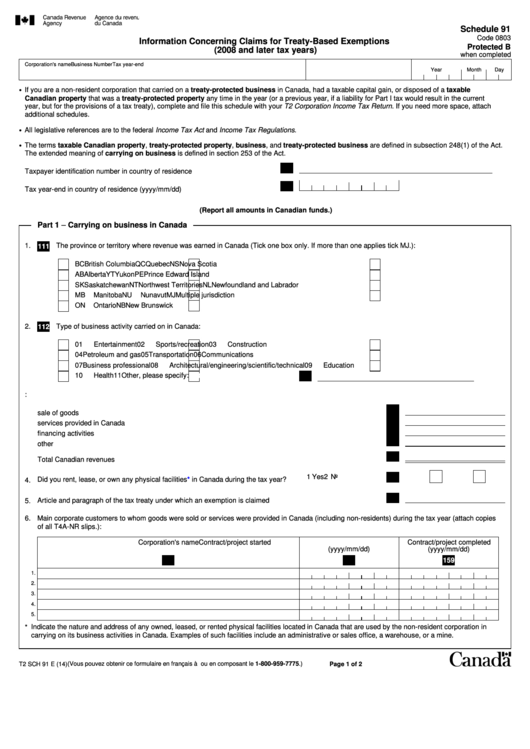

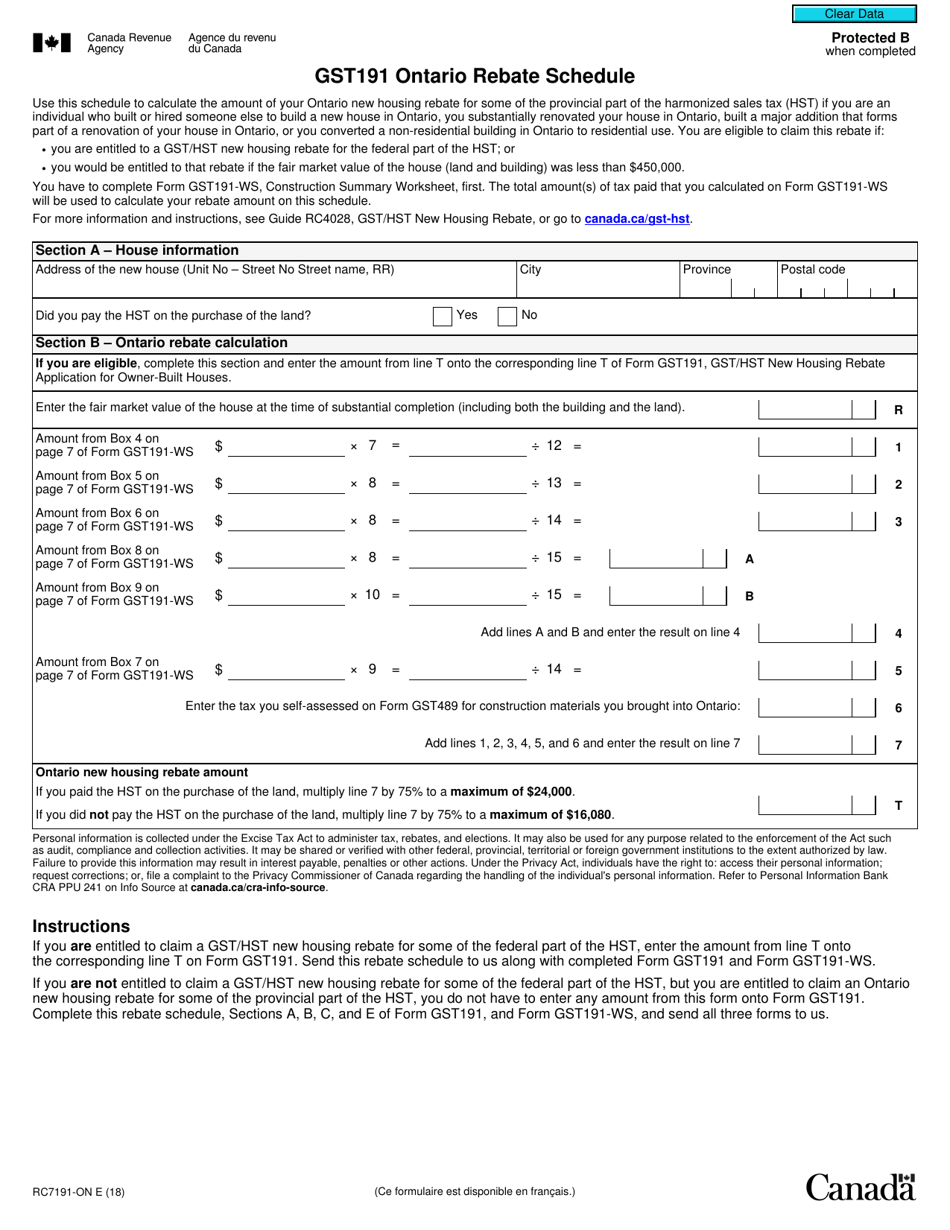

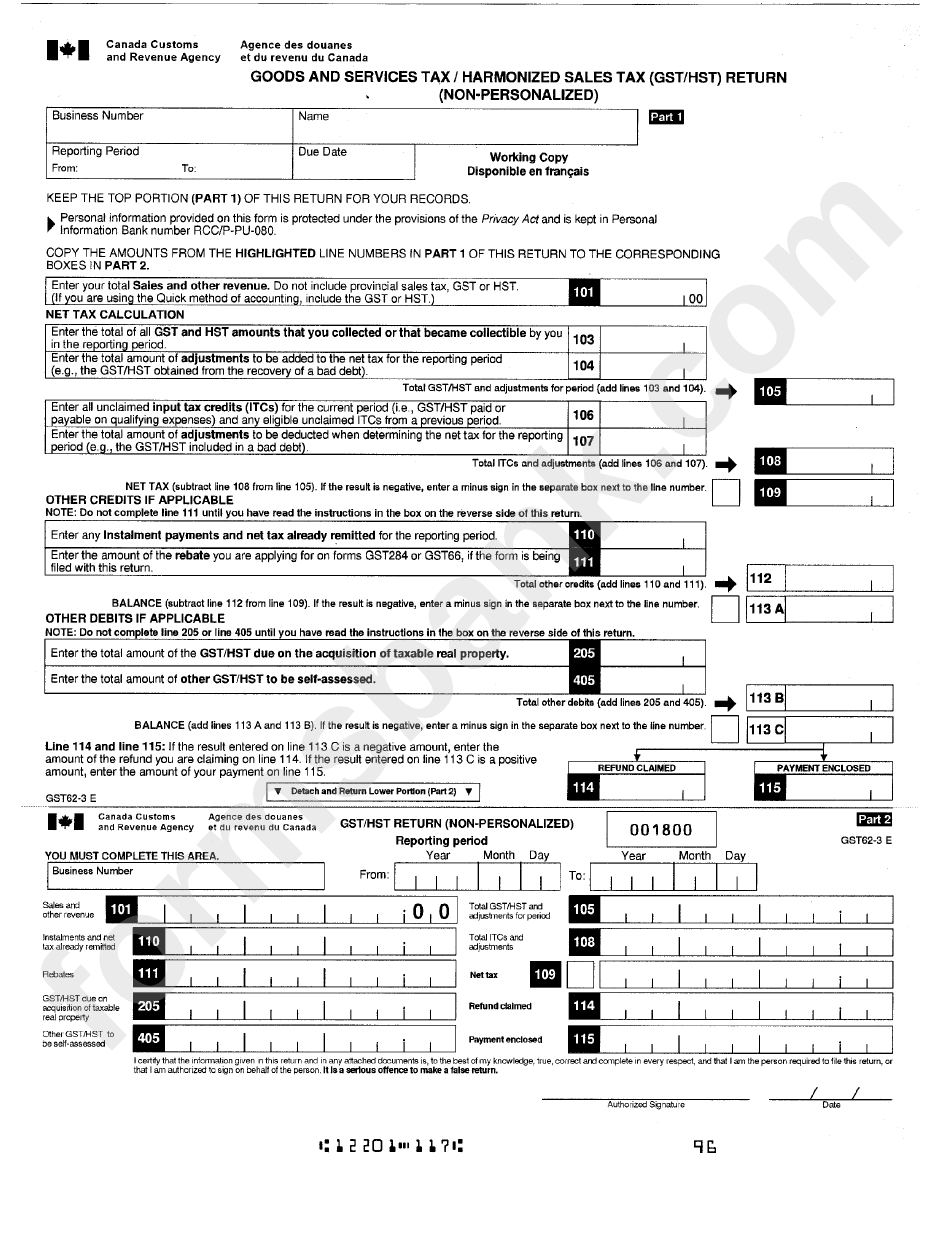

Form Gst62 3 E Goods And Services Tax harmonized Sales Tax Gst hst

Canada Revenue Agency Forms Charterfecol

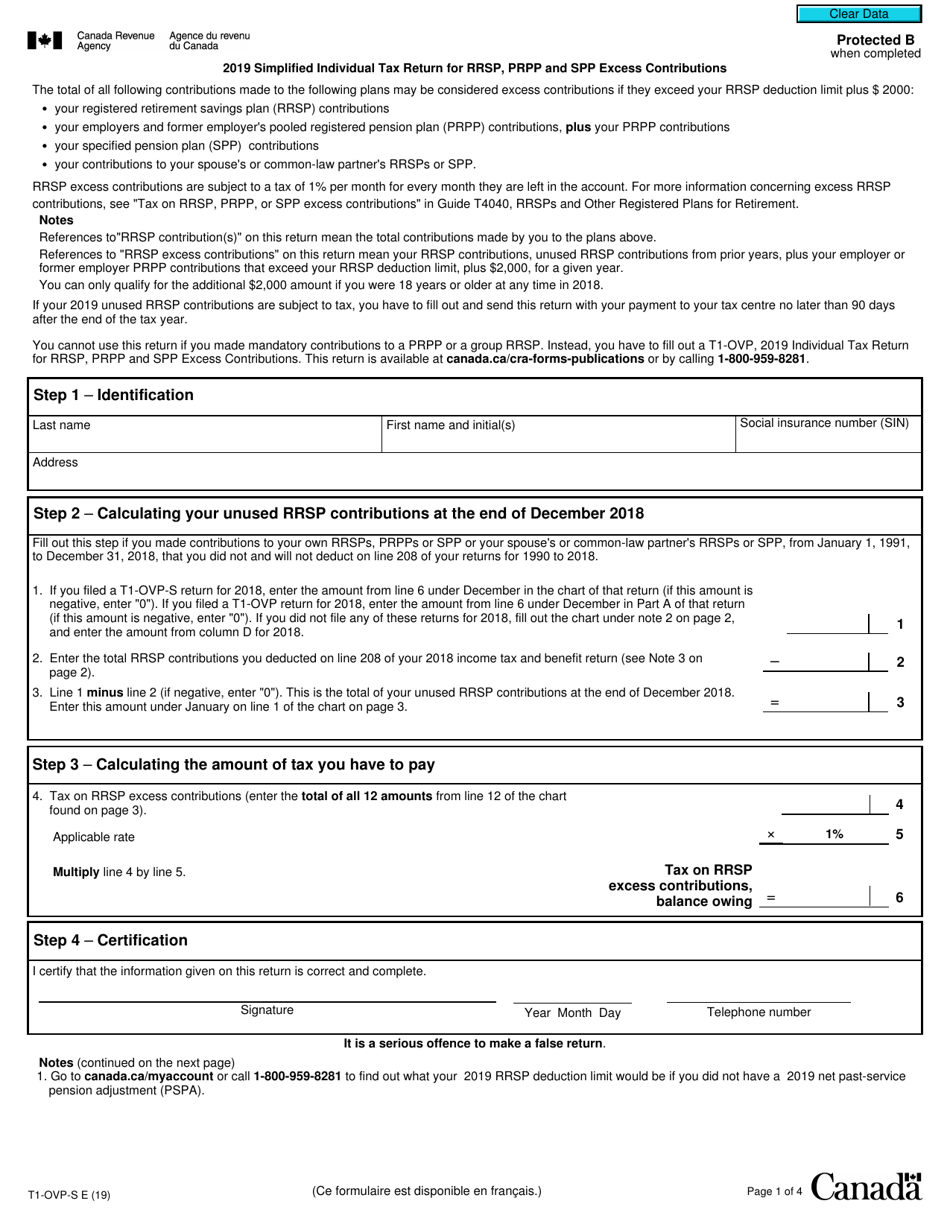

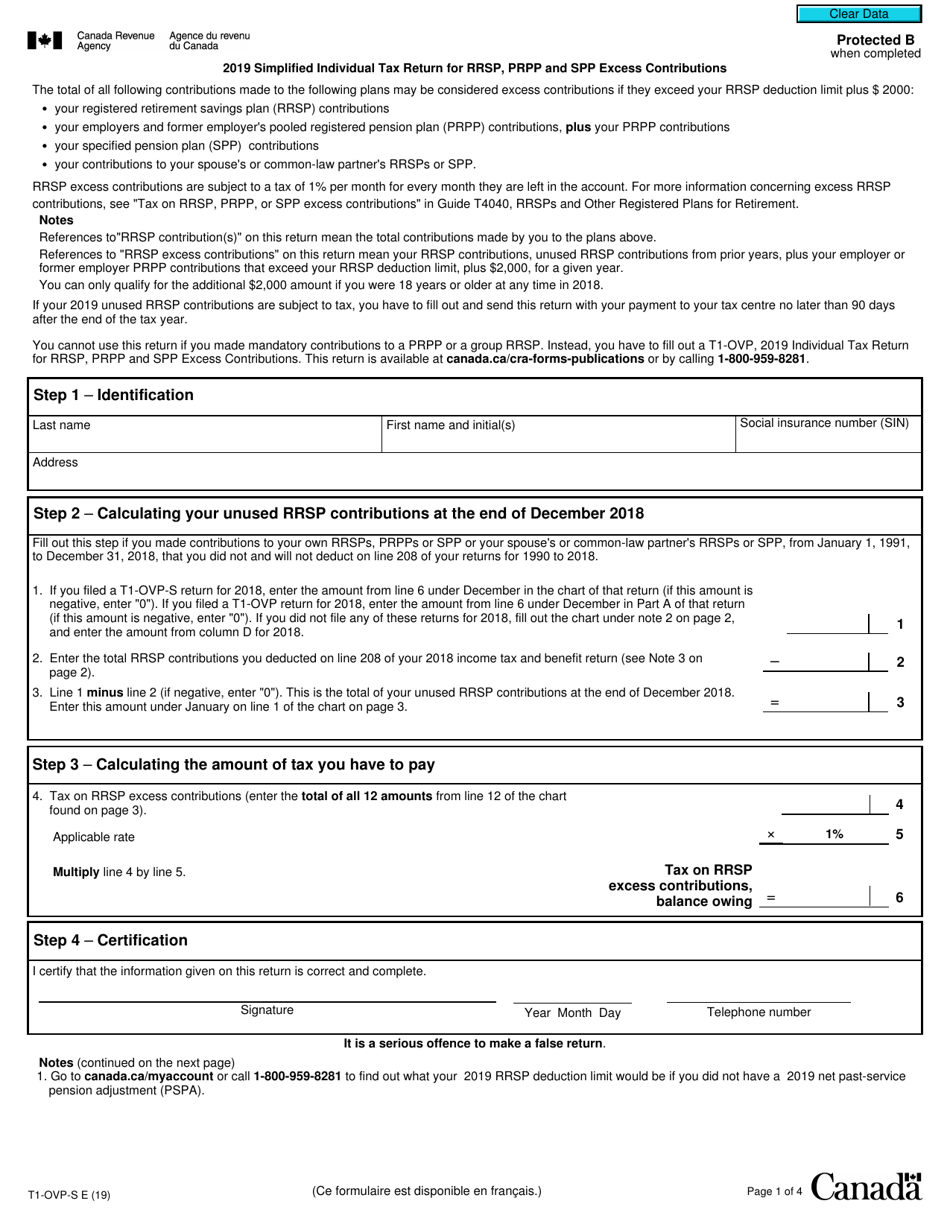

Form T1 OVP S Download Fillable PDF Or Fill Online Simplified

Canada Revenue Agency Forms 2016 Vanpsado

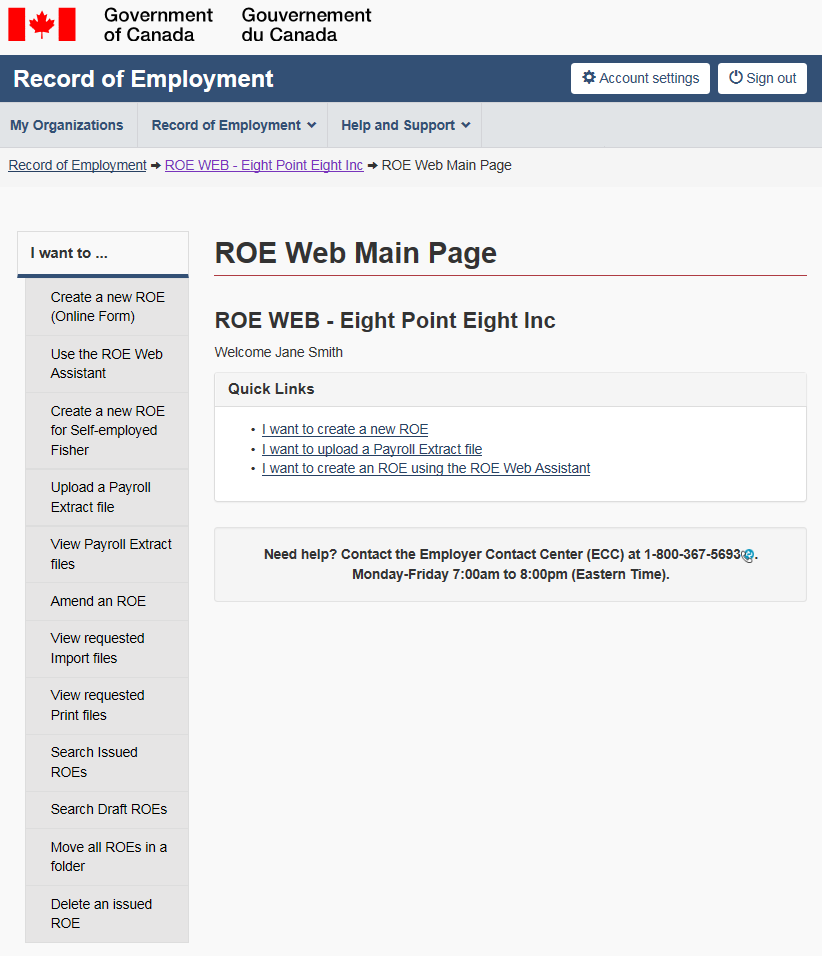

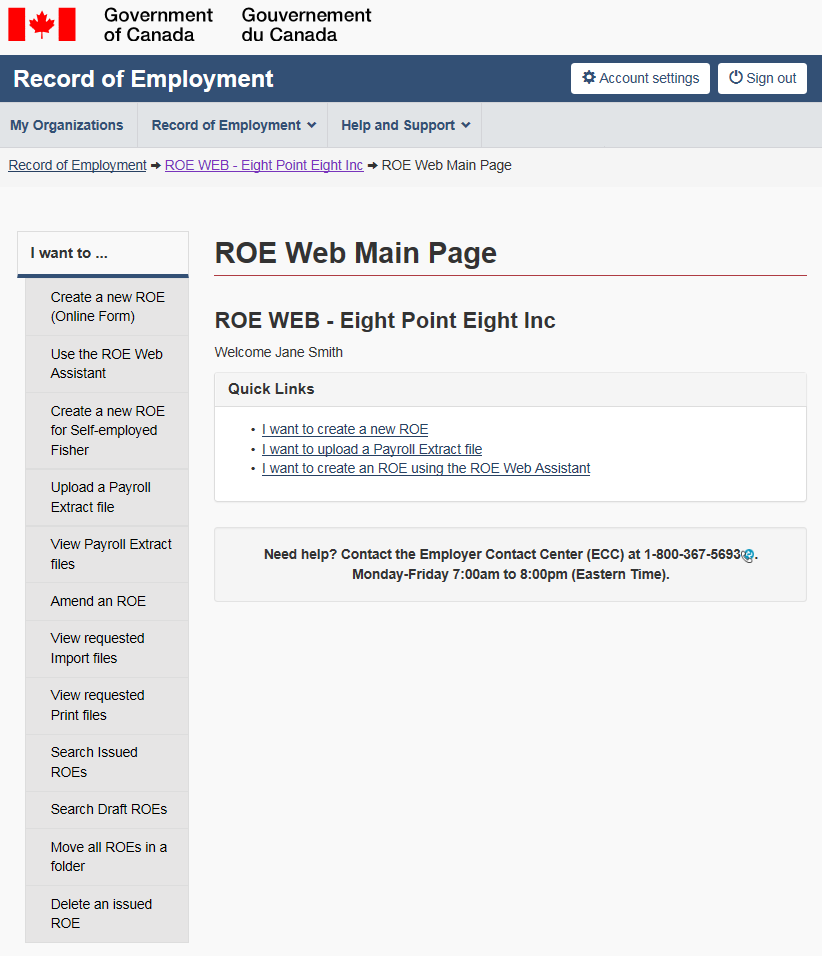

Canada Revenue Agency Roe Forms Kasapcampaign

https://www.canada.ca/en/revenue-agency/services/e-services/digital...

Web Forms GST66 Application for GST HST Public Service Bodies Rebate and GST Self Government Refund can be sent to us quickly and easily using our web form Please

https://www.canada.ca/en/revenue-agency/services/e-services/digital...

Web File a rebate The quot File a rebate quot service allows you to electronically file an application for the GST HST rebates listed below On the selection page select the rebate type you

Web Forms GST66 Application for GST HST Public Service Bodies Rebate and GST Self Government Refund can be sent to us quickly and easily using our web form Please

Web File a rebate The quot File a rebate quot service allows you to electronically file an application for the GST HST rebates listed below On the selection page select the rebate type you

Form T1 OVP S Download Fillable PDF Or Fill Online Simplified

Form Gst62 3 E Goods And Services Tax harmonized Sales Tax Gst hst

Canada Revenue Agency Forms 2016 Vanpsado

Canada Revenue Agency Roe Forms Kasapcampaign

Canada Revenue Agency Forms 2016 Vseragz

Canada Revenue Agency Forms 2016 Vanpsado

Canada Revenue Agency Forms 2016 Vanpsado

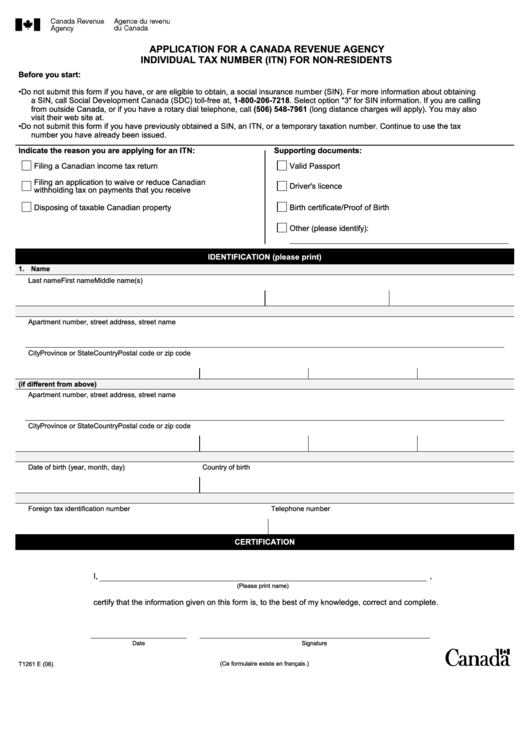

Application For A Canada Revenue Agency Individual Tax Number Printable