In this modern-day world of consumers everyone appreciates a great bargain. One of the ways to enjoy substantial savings on your purchases is through California Rebate For Plug In Hybrid Tax Forms. California Rebate For Plug In Hybrid Tax Forms are a marketing strategy that retailers and manufacturers use in order to offer customers a small reimbursement on their purchases following the time they've placed them. In this post, we'll investigate the world of California Rebate For Plug In Hybrid Tax Forms, looking at what they are what they are, how they function, and how to maximize your savings using these low-cost incentives.

Get Latest California Rebate For Plug In Hybrid Tax Form Below

California Rebate For Plug In Hybrid Tax Form

California Rebate For Plug In Hybrid Tax Form -

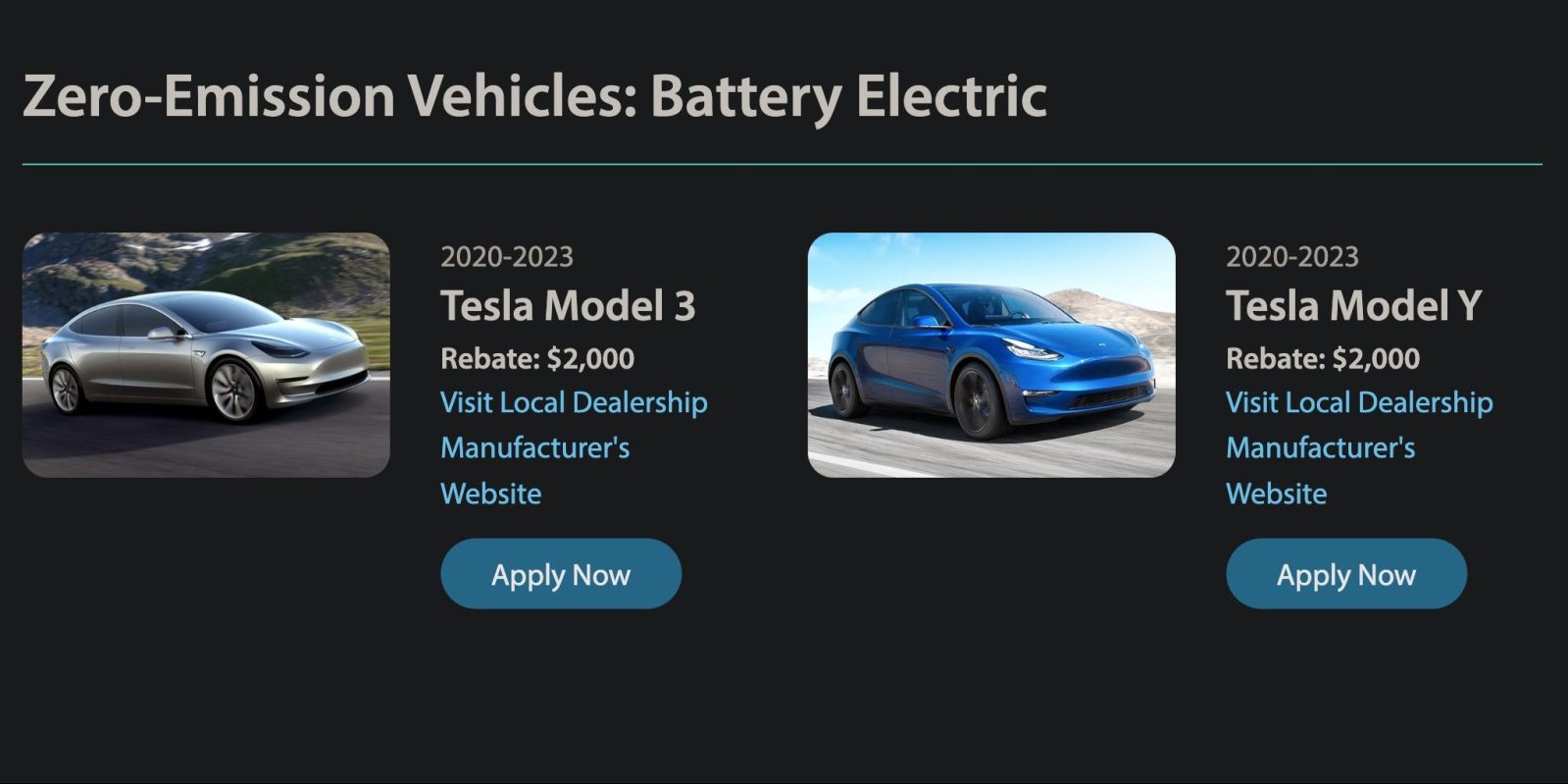

Web Effective August 15 2023 Increased Rebate recipients will receive an additional 2 000 EV Charging Card Are you eligible for a CVRP rebate Find out here You can also learn

Web Visit the program website to view the eligibility requirements Hydrogen Fuel Cell Vehicle rebate 4 500 Battery Electric Vehicle rebate 2 000 Plug in Hybrid Electric Vehicle

A California Rebate For Plug In Hybrid Tax Form in its most basic model, refers to a partial payment to a consumer after purchasing a certain product or service. It's a very effective technique that businesses use to draw buyers, increase sales and promote specific products.

Types of California Rebate For Plug In Hybrid Tax Form

Rebates For Hybrid Cars California 2023 Carrebate

Rebates For Hybrid Cars California 2023 Carrebate

Web Rebates are processed on a first come first served basis and issued to eligible applicants in a single payment Delays beyond normal processing times may occur To apply for a

Web What are the requirements for the EV tax credit The Inflation Reduction Act made several major changes to the tax credit There is a price cap on qualifying EVs For passenger

Cash California Rebate For Plug In Hybrid Tax Form

Cash California Rebate For Plug In Hybrid Tax Form are the most straightforward type of California Rebate For Plug In Hybrid Tax Form. Customers are offered a certain amount of money back upon purchasing a particular item. This is often for products that are expensive, such as electronics or appliances.

Mail-In California Rebate For Plug In Hybrid Tax Form

Mail-in California Rebate For Plug In Hybrid Tax Form require the customer to provide an evidence of purchase for their refund. They're a bit more complicated but could provide huge savings.

Instant California Rebate For Plug In Hybrid Tax Form

Instant California Rebate For Plug In Hybrid Tax Form apply at the points of sale. This reduces the price of purchases immediately. Customers don't need to wait for their savings with this type.

How California Rebate For Plug In Hybrid Tax Form Work

Hybrid EV Tax Incentives In CA Community Chevrolet BURBANK

Hybrid EV Tax Incentives In CA Community Chevrolet BURBANK

Web 20 janv 2023 nbsp 0183 32 150 000 single filers 204 000 main income earner 300 000 joint filers Battery electric vehicles and plug in hybrid vehicles qualify for the Clean Air Vehicle

The California Rebate For Plug In Hybrid Tax Form Process

The process typically comprises a couple of steps that are easy to follow:

-

When you buy the product you purchase the item like you would normally.

-

Complete this California Rebate For Plug In Hybrid Tax Form application: In order to claim your California Rebate For Plug In Hybrid Tax Form, you'll need to provide some information, such as your address, name, and purchase details in order to submit your California Rebate For Plug In Hybrid Tax Form.

-

Submit the California Rebate For Plug In Hybrid Tax Form According to the type of California Rebate For Plug In Hybrid Tax Form, you may need to submit a form by mail or upload it online.

-

Wait for the company's approval: They is going to review your entry to confirm that it complies with the refund's conditions and terms.

-

Redeem your California Rebate For Plug In Hybrid Tax Form After you've been approved, you'll receive your money back, in the form of a check, prepaid card, or another method specified by the offer.

Pros and Cons of California Rebate For Plug In Hybrid Tax Form

Advantages

-

Cost Savings California Rebate For Plug In Hybrid Tax Form could significantly reduce the price you pay for the product.

-

Promotional Offers They encourage customers to test new products or brands.

-

Improve Sales California Rebate For Plug In Hybrid Tax Form can enhance an organization's sales and market share.

Disadvantages

-

Complexity In particular, mail-in California Rebate For Plug In Hybrid Tax Form in particular is a time-consuming process and slow-going.

-

Extension Dates Many California Rebate For Plug In Hybrid Tax Form are subject to deadlines for submission.

-

The risk of non-payment Certain customers could have their California Rebate For Plug In Hybrid Tax Form delayed if they don't adhere to the requirements precisely.

Download California Rebate For Plug In Hybrid Tax Form

Download California Rebate For Plug In Hybrid Tax Form

FAQs

1. Are California Rebate For Plug In Hybrid Tax Form similar to discounts? No, California Rebate For Plug In Hybrid Tax Form are a partial refund upon purchase, while discounts reduce prices at moment of sale.

2. Are there California Rebate For Plug In Hybrid Tax Form that can be used on the same item It's contingent upon the terms that apply to the California Rebate For Plug In Hybrid Tax Form promotions and on the products quality and eligibility. Certain companies may permit it, while others won't.

3. How long will it take to get the California Rebate For Plug In Hybrid Tax Form? The timing varies, but it can last from a few weeks until a several months to receive a California Rebate For Plug In Hybrid Tax Form.

4. Do I have to pay taxes on California Rebate For Plug In Hybrid Tax Form amounts? In most circumstances, California Rebate For Plug In Hybrid Tax Form amounts are not considered taxable income.

5. Can I trust California Rebate For Plug In Hybrid Tax Form offers from brands that aren't well-known It's crucial to research and confirm that the brand which is providing the California Rebate For Plug In Hybrid Tax Form is legitimate prior to making the purchase.

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

Southern California Edison Rebates For Electric Cars 2023 Carrebate

Check more sample of California Rebate For Plug In Hybrid Tax Form below

Federal Plug In Hybrid Rebate Used Cars 2023 Carrebate

10 Electric And Plug in Hybrid Cars That Qualify For 7 500 Tax Cut

California Rebates For Hybrid Electric Cars Restricted After Plan

Tesla Model Y 3 Eligible For 2 000 California Rebate After Price

Rebates For Hybrid Cars In California 2023 Carrebate

California May Start Offering Point of sale Plug in Rebates Autoblog

https://driveclean.ca.gov/node/919735

Web Visit the program website to view the eligibility requirements Hydrogen Fuel Cell Vehicle rebate 4 500 Battery Electric Vehicle rebate 2 000 Plug in Hybrid Electric Vehicle

https://cleanvehiclerebate.org/en/cvrp-info

Web The Clean Vehicle Rebate Project CVRP promotes clean vehicle adoption in California by offering rebates from 1 000 to 7 500 for the purchase or lease of new eligible zero

Web Visit the program website to view the eligibility requirements Hydrogen Fuel Cell Vehicle rebate 4 500 Battery Electric Vehicle rebate 2 000 Plug in Hybrid Electric Vehicle

Web The Clean Vehicle Rebate Project CVRP promotes clean vehicle adoption in California by offering rebates from 1 000 to 7 500 for the purchase or lease of new eligible zero

Tesla Model Y 3 Eligible For 2 000 California Rebate After Price

10 Electric And Plug in Hybrid Cars That Qualify For 7 500 Tax Cut

Rebates For Hybrid Cars In California 2023 Carrebate

California May Start Offering Point of sale Plug in Rebates Autoblog

Rebate For Hybrid Car 2023 Carrebate

Understanding The Changes To California Plug In And Electric Vehicle

Understanding The Changes To California Plug In And Electric Vehicle

California Plug In Rebate Lowering MSRP Cap On Electric Cars CarsDirect