In this modern-day world of consumers everyone is looking for a great deal. One way to gain significant savings on your purchases can be achieved through Ato Tax Rebate Forms. They are a form of marketing employed by retailers and manufacturers to provide customers with a partial return on their purchases once they have completed them. In this article, we'll explore the world of Ato Tax Rebate Forms, looking at what they are and how they function, and ways you can increase your savings by taking advantage of these cost-effective incentives.

Get Latest Ato Tax Rebate Form Below

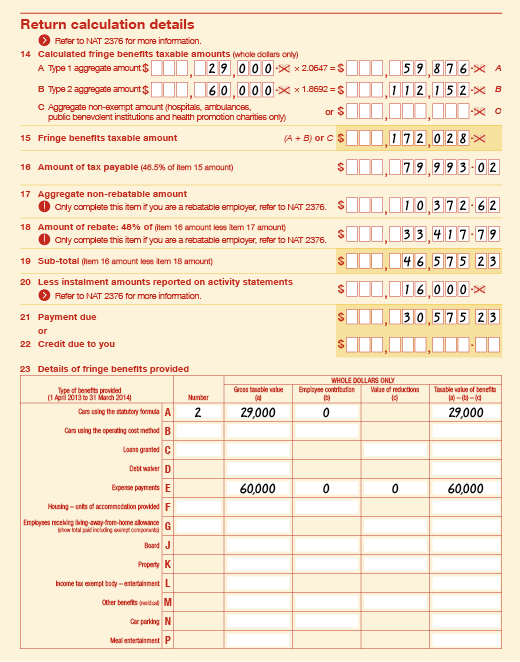

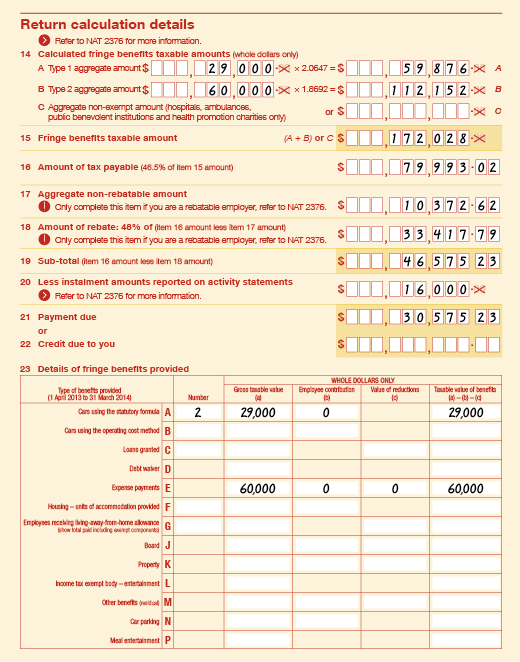

Ato Tax Rebate Form

Ato Tax Rebate Form -

Web 1 juil 2023 nbsp 0183 32 The Australian Government Rebate AGR on private health insurance is an amount the government may contribute towards your premium to make it more

Web Payment of wine equalisation tax rebate by New Zealand participant This form is to be used by New Zealand wine producers in applying for the Wine Equalisation Tax WET

A Ato Tax Rebate Form at its most basic model, refers to a partial refund given to a client after having purchased a item or service. It's a powerful method that businesses use to draw clients, increase sales or promote a specific product.

Types of Ato Tax Rebate Form

Ato Tax Return Form For 2013 Australia Instructions Working Examples

Ato Tax Return Form For 2013 Australia Instructions Working Examples

Web Medicare levy calculator The Medicare levy calculator allows you to estimate your Medicare levy for the past five income years taking into account any entitlement to a reduction or

Web 5 juil 2021 nbsp 0183 32 More than 10 million Australians will receive a 1080 government handout after filing their tax return in 2021 Parliament on Thursday passed the the Low and Middle

Cash Ato Tax Rebate Form

Cash Ato Tax Rebate Form are the most straightforward kind of Ato Tax Rebate Form. Customers receive a certain sum of money back when purchasing a item. They are typically used to purchase products that are expensive, such as electronics or appliances.

Mail-In Ato Tax Rebate Form

Mail-in Ato Tax Rebate Form require customers to provide the proof of purchase in order to receive their cash back. They're somewhat more complicated but could provide significant savings.

Instant Ato Tax Rebate Form

Instant Ato Tax Rebate Form are applied right at the point of sale, reducing the price of your purchase instantly. Customers do not have to wait around for savings in this manner.

How Ato Tax Rebate Form Work

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

The Ato Tax Rebate Form Process

The process generally involves a few simple steps

-

Buy the product: Firstly you buy the product like you normally do.

-

Fill out this Ato Tax Rebate Form Form: To claim the Ato Tax Rebate Form you'll have provide certain information including your name, address as well as the details of your purchase to apply for your Ato Tax Rebate Form.

-

Make sure you submit the Ato Tax Rebate Form In accordance with the kind of Ato Tax Rebate Form you could be required to submit a claim form to the bank or send it via the internet.

-

Wait for the company's approval: They will evaluate your claim to ensure it meets the refund's conditions and terms.

-

Accept your Ato Tax Rebate Form Once you've received your approval, the amount you receive will be whether via check, credit card, or a different method as specified by the offer.

Pros and Cons of Ato Tax Rebate Form

Advantages

-

Cost savings Ato Tax Rebate Form can dramatically lower the cost you pay for the item.

-

Promotional Offers Customers are enticed in trying new products or brands.

-

Accelerate Sales: Ato Tax Rebate Form can boost the company's sales as well as market share.

Disadvantages

-

Complexity The mail-in Ato Tax Rebate Form particularly may be lengthy and slow-going.

-

Extension Dates Many Ato Tax Rebate Form impose strict time limits for submission.

-

The risk of non-payment Certain customers could not receive their Ato Tax Rebate Form if they don't adhere to the requirements exactly.

Download Ato Tax Rebate Form

FAQs

1. Are Ato Tax Rebate Form similar to discounts? Not at all, Ato Tax Rebate Form provide some form of refund following the purchase, whereas discounts decrease the price of the purchase at the point of sale.

2. Do I have to use multiple Ato Tax Rebate Form on the same product? It depends on the terms of the Ato Tax Rebate Form promotions and on the products quality and eligibility. Certain companies might permit it, while some won't.

3. How long will it take to receive an Ato Tax Rebate Form? The amount of time will differ, but can take a couple of weeks or a several months to receive a Ato Tax Rebate Form.

4. Do I have to pay tax for Ato Tax Rebate Form amounts? In the majority of circumstances, Ato Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Ato Tax Rebate Form offers from brands that aren't well-known? It's essential to research and ensure that the brand offering the Ato Tax Rebate Form is reputable before making an acquisition.

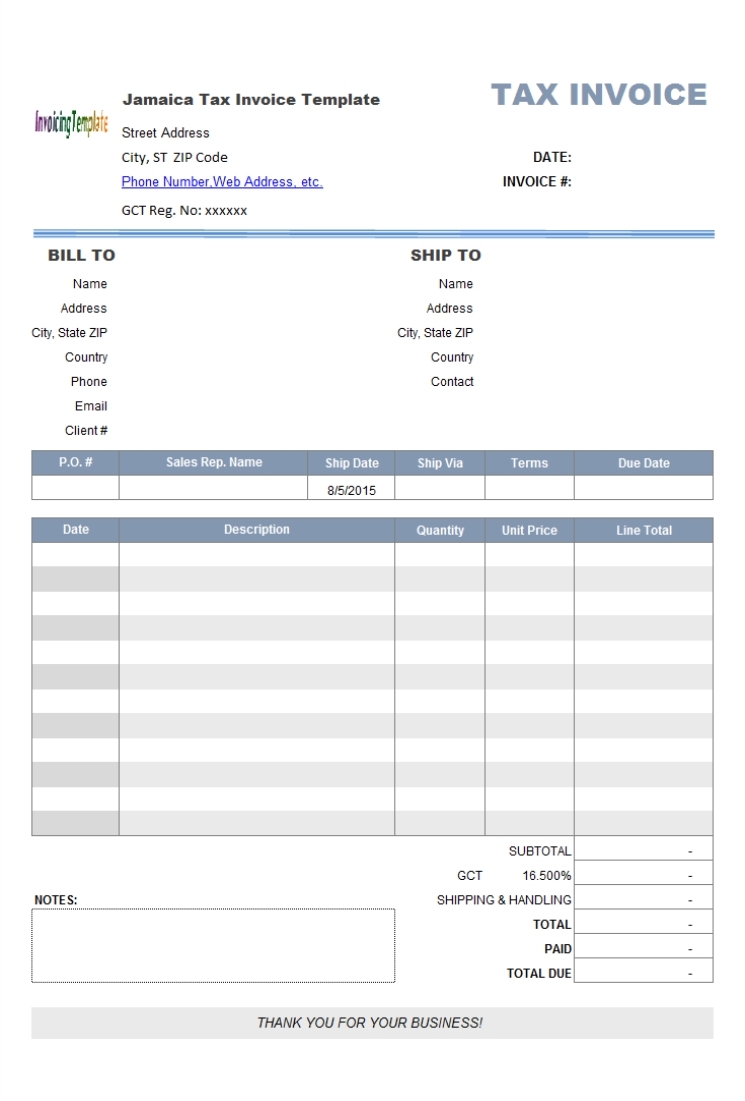

Ato Tax Invoice Template Invoice Complete

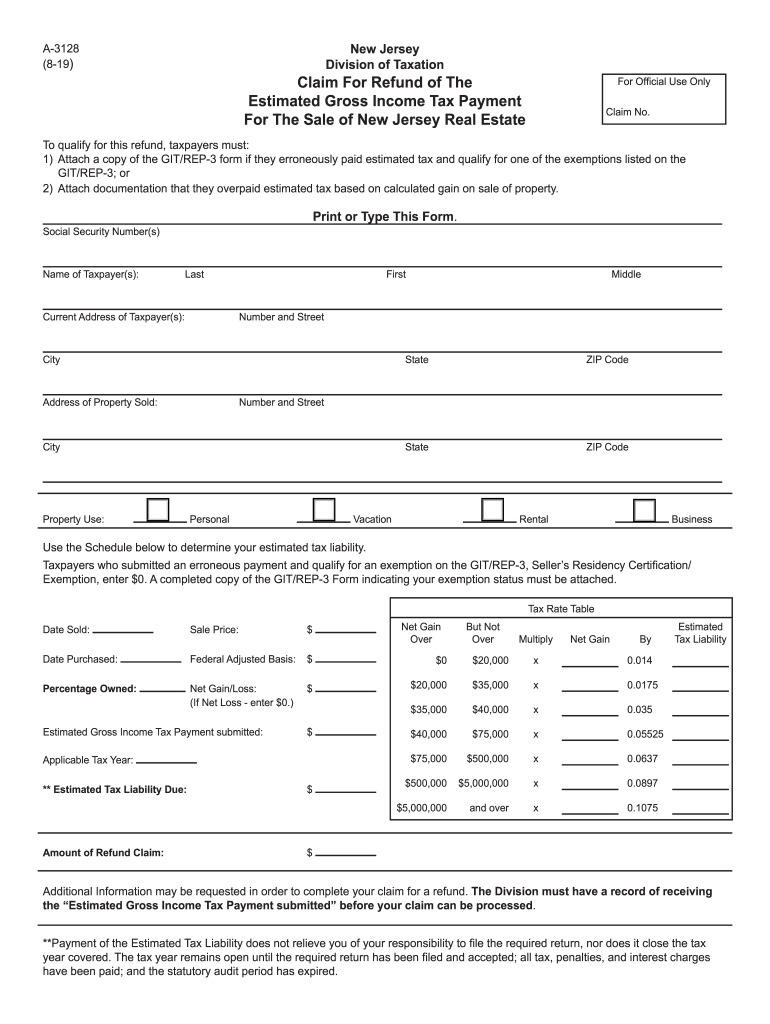

2019 Form NJ DoT A 3128 Fill Online Printable Fillable Blank PdfFiller

Check more sample of Ato Tax Rebate Form below

Ato Tax Invoices Invoice Template Ideas

P G And E Ev Rebate Printable Rebate Form

Main Page

Individual Tax Return Ato Individual Tax Return Form

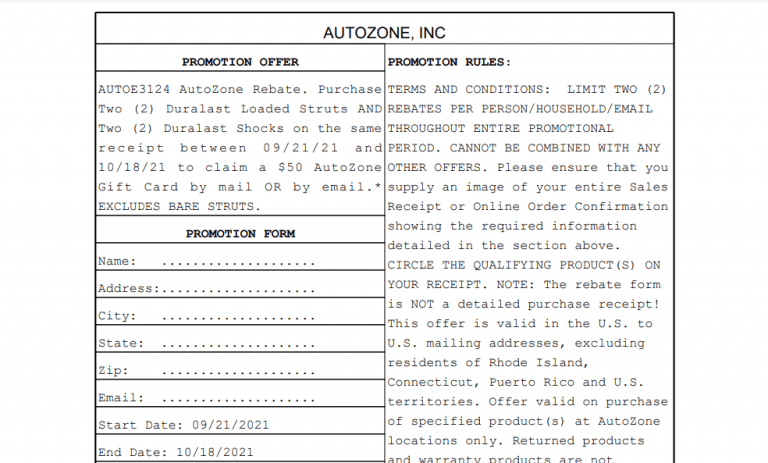

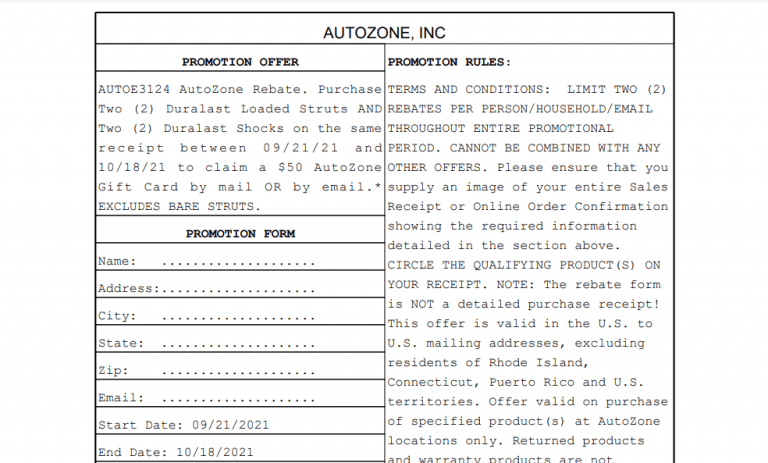

Autozone Rebate Receipt Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

https://www.ato.gov.au/Forms/?duration=2020/2021&sorttype=SortByTitle

Web Payment of wine equalisation tax rebate by New Zealand participant This form is to be used by New Zealand wine producers in applying for the Wine Equalisation Tax WET

https://www.ato.gov.au/Forms/Luxury-car-tax-refund---for-primary...

Web Use this form to claim a refund of luxury car tax LCT on an eligible vehicle being a four wheel drive or all wheel drive and is a passenger car with a ground clearance of at

Web Payment of wine equalisation tax rebate by New Zealand participant This form is to be used by New Zealand wine producers in applying for the Wine Equalisation Tax WET

Web Use this form to claim a refund of luxury car tax LCT on an eligible vehicle being a four wheel drive or all wheel drive and is a passenger car with a ground clearance of at

Individual Tax Return Ato Individual Tax Return Form

P G And E Ev Rebate Printable Rebate Form

Autozone Rebate Receipt Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Ato Withholding Tables 2017 Brokeasshome

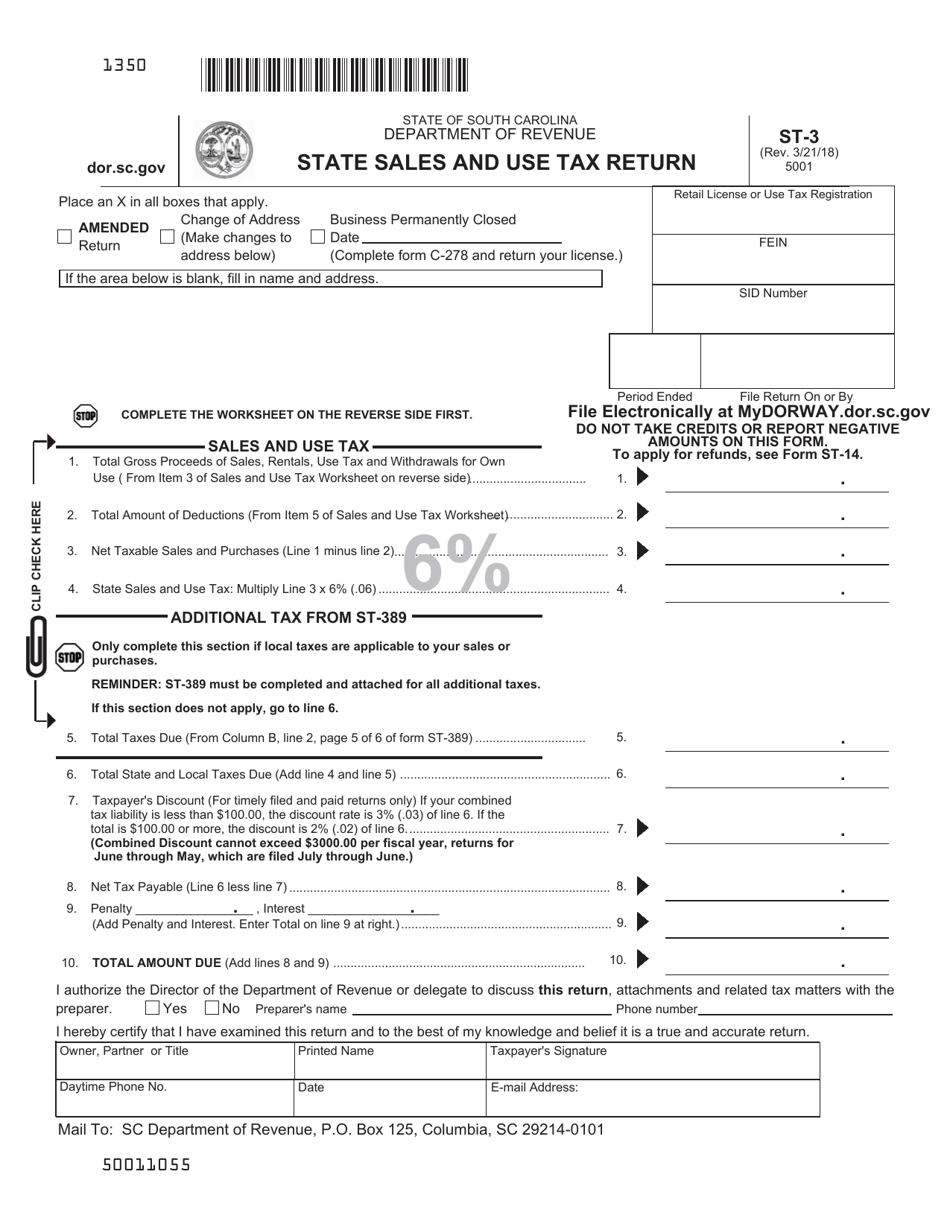

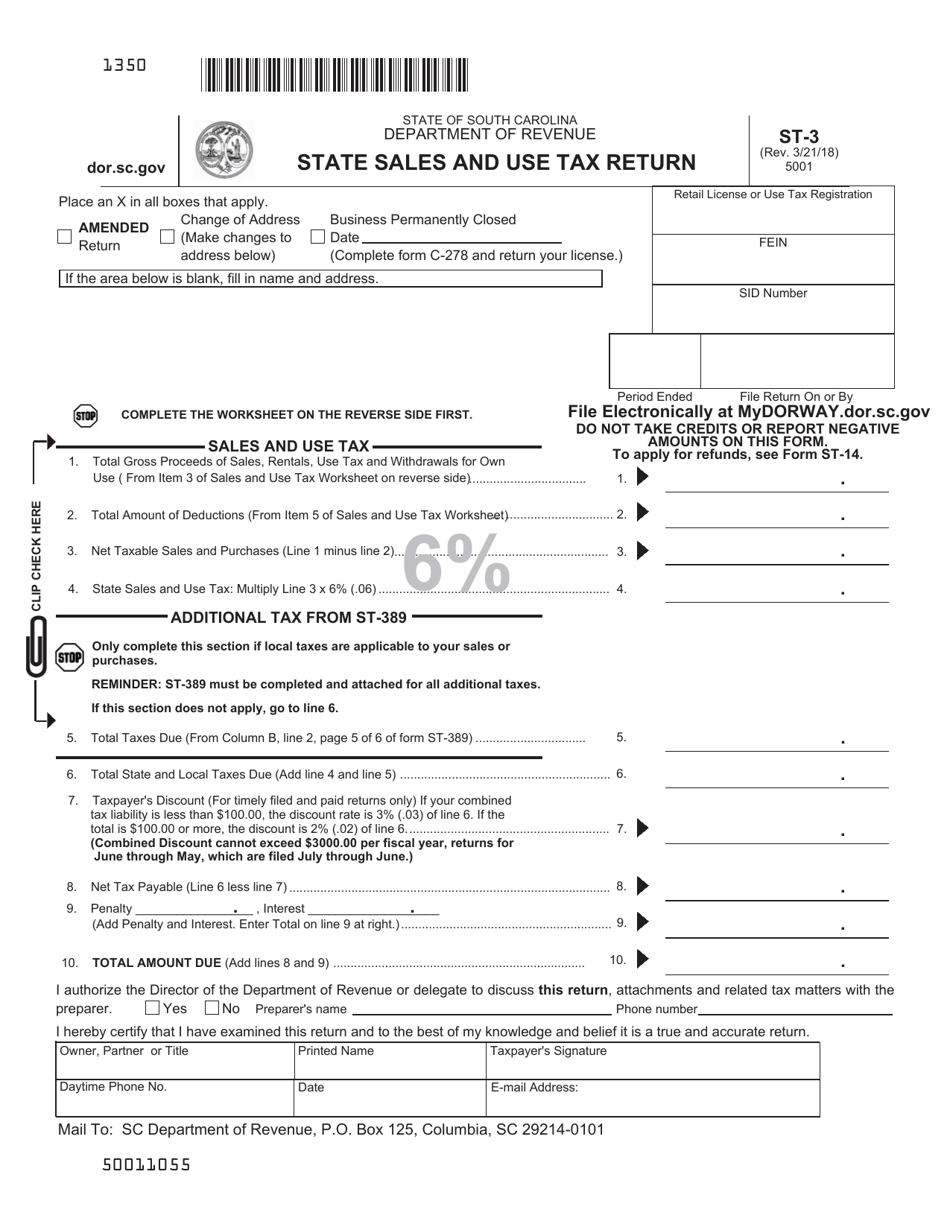

Sales And Use Tax Return Form St John The Baptist Parish Printable

Sales And Use Tax Return Form St John The Baptist Parish Printable

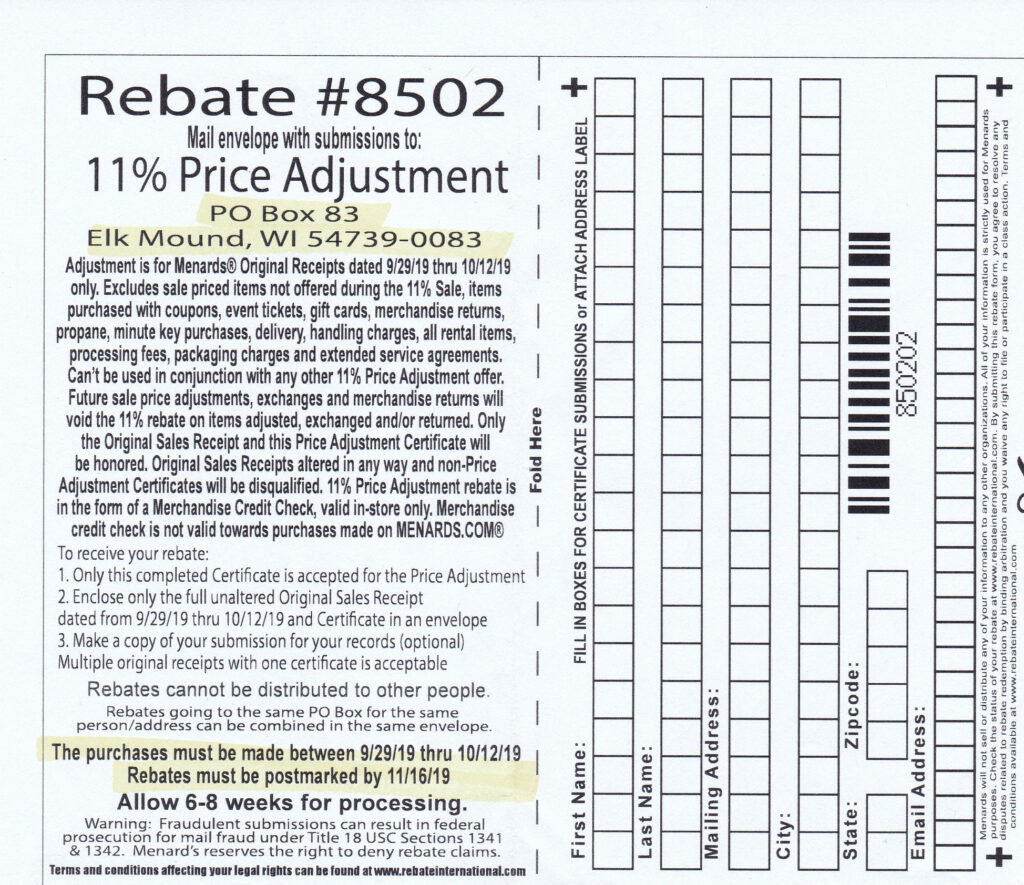

Menards Rebate Form 6564 MenardsRebate Form