In the modern world of consumerization we all love a good deal. One of the ways to enjoy significant savings on your purchases is through Arkansas Sales Tax Rebate Forms. Arkansas Sales Tax Rebate Forms are marketing strategies used by manufacturers and retailers to provide customers with a portion of a payment on their purchases, after they've bought them. In this post, we'll explore the world of Arkansas Sales Tax Rebate Forms, examining the nature of them what they are, how they function, and how you can maximise your savings via these cost-effective incentives.

Get Latest Arkansas Sales Tax Rebate Form Below

Arkansas Sales Tax Rebate Form

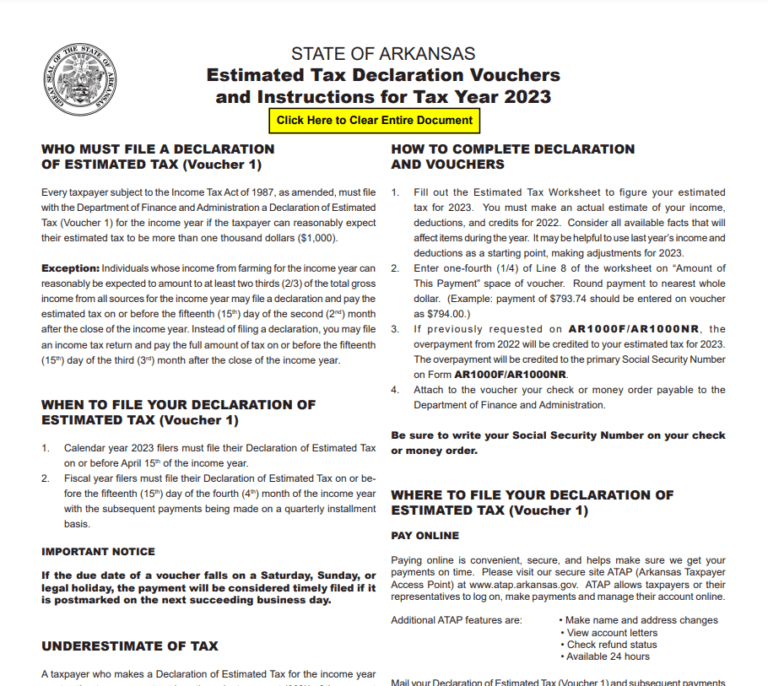

Arkansas Sales Tax Rebate Form - Arkansas Sales Tax Rebate Form, Arkansas Sales Tax Credit Form, Arkansas Sales Tax Return Form, Arkansas State Tax Return Form, Arkansas Sales Tax Refund Claim Form, How To Register For Sales Tax In Arkansas

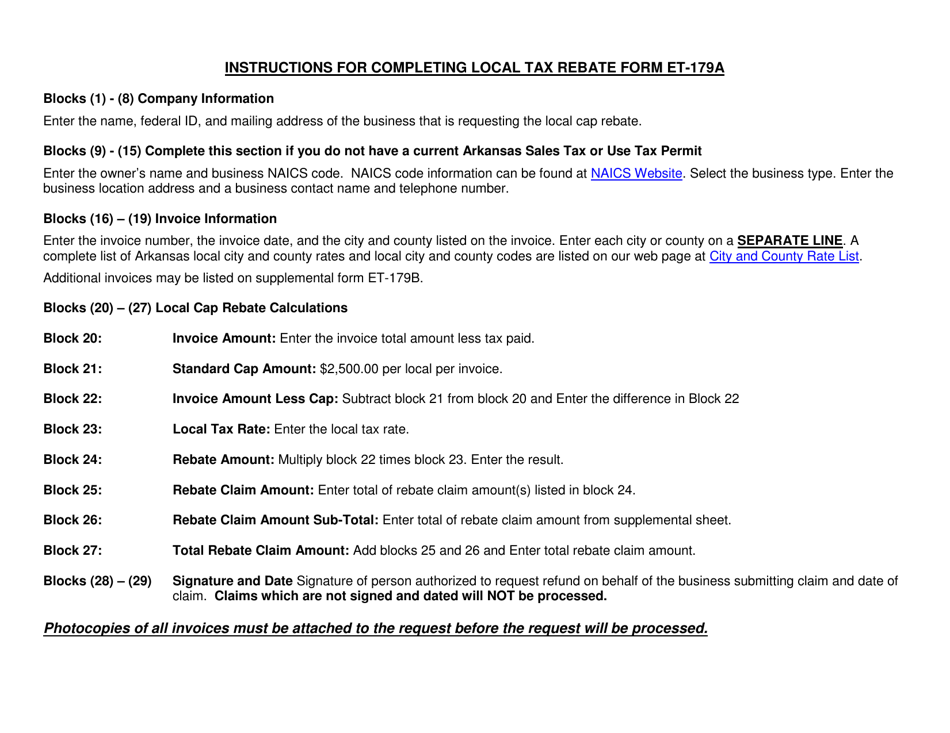

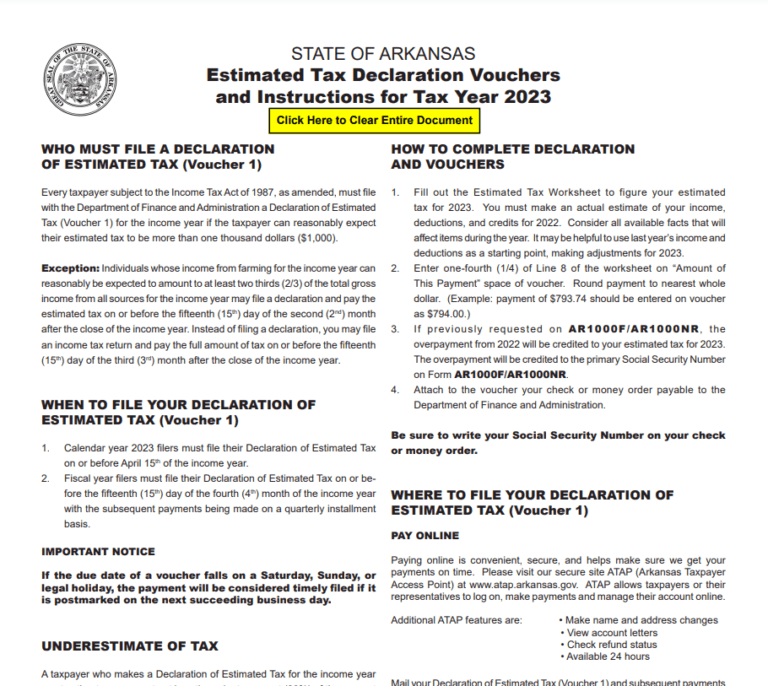

Web Above Enter this amount in Block 26 on Form ET 179A Local Tax Rebate Supplemental Sheet Form ET 179B Title Rebate Form xls Author ST6 Created Date 12 27 2007

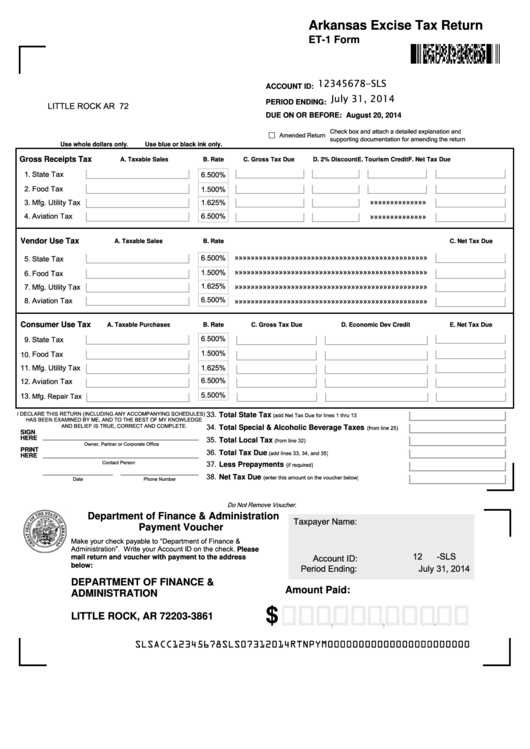

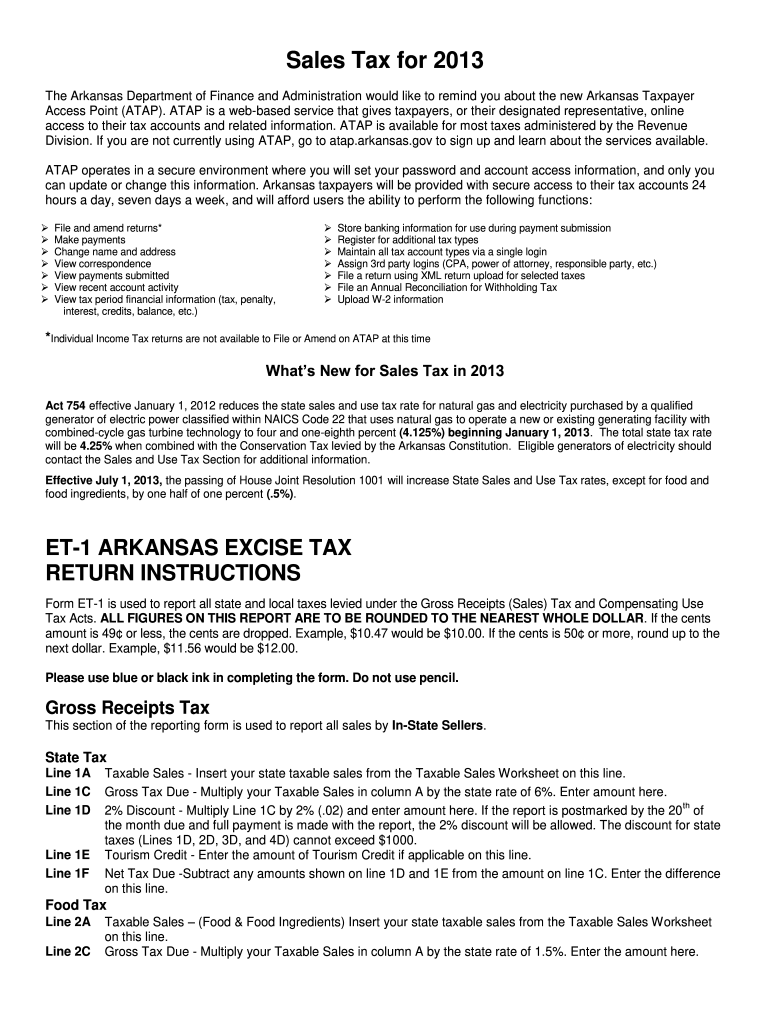

Web The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return ET 1 forms to taxpayers Contact 501 682 7104 to request ET 1 forms and the

A Arkansas Sales Tax Rebate Form is, in its most basic form, is a payment to a consumer after they've bought a product or service. It's an effective method that companies use to attract customers, boost sales, and to promote certain products.

Types of Arkansas Sales Tax Rebate Form

Arkansas Resale Certificate PDF Form Fill Out And Sign Printable PDF

Arkansas Resale Certificate PDF Form Fill Out And Sign Printable PDF

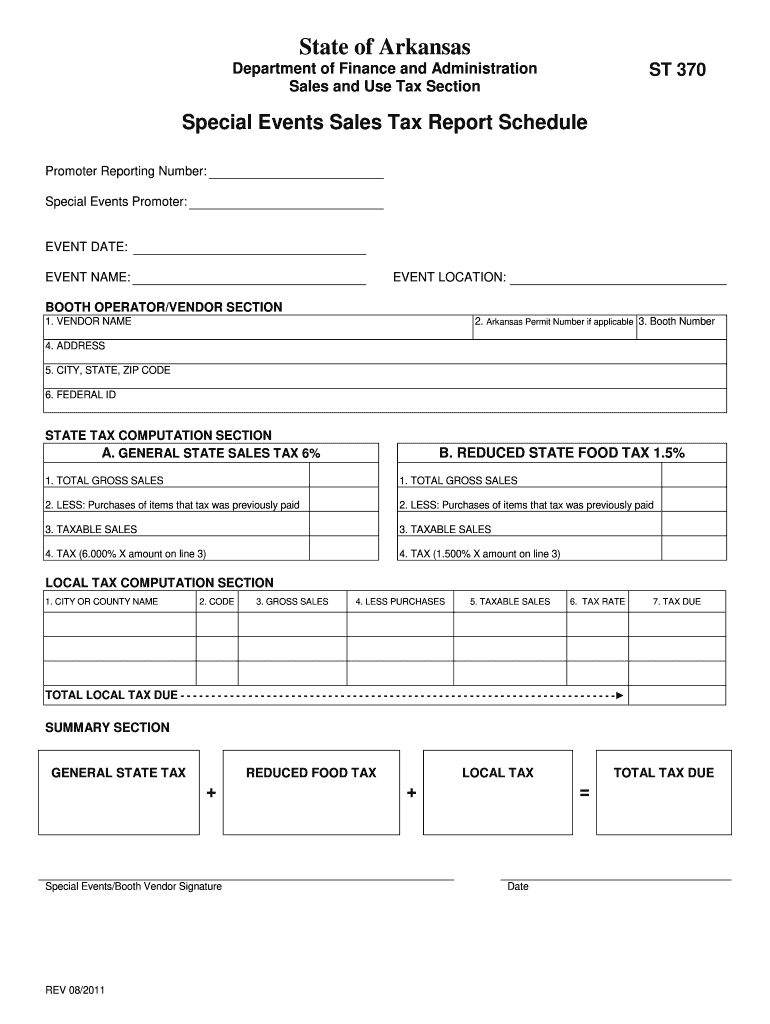

Web 22 f 233 vr 2020 nbsp 0183 32 file a sales or use tax return as provided in GR 92 C 1 may file a claim for a credit or rebate with the Director a In order to request a refund of the local sales and

Web The state of Arkansas has historically capped local sales tax paid to suppliers on business purchases with invoices exceeding 2 500 In recent years the state reduced the statute

Cash Arkansas Sales Tax Rebate Form

Cash Arkansas Sales Tax Rebate Form is the most basic type of Arkansas Sales Tax Rebate Form. Customers receive a specific amount of money when purchasing a item. These are typically for products that are expensive, such as electronics or appliances.

Mail-In Arkansas Sales Tax Rebate Form

Mail-in Arkansas Sales Tax Rebate Form require customers to present proof of purchase to receive the money. They are a bit more involved but offer substantial savings.

Instant Arkansas Sales Tax Rebate Form

Instant Arkansas Sales Tax Rebate Form will be applied at point of sale. They reduce prices immediately. Customers don't have to wait until they can save through this kind of offer.

How Arkansas Sales Tax Rebate Form Work

Arkansas Form Tax Fill Out And Sign Printable PDF Template SignNow

Arkansas Form Tax Fill Out And Sign Printable PDF Template SignNow

Web The first option which provides for a refund of one percentage point 1 of the 5 875 sales and taxes levied under 167 167 26 52 301 26 52 302 26 53 106 and 26 53 107 may

The Arkansas Sales Tax Rebate Form Process

The process usually involves a few simple steps

-

Purchase the product: First purchase the product in the same way you would normally.

-

Complete your Arkansas Sales Tax Rebate Form forms: The Arkansas Sales Tax Rebate Form form will have to fill in some information including your name, address, and purchase details, in order to get your Arkansas Sales Tax Rebate Form.

-

To submit the Arkansas Sales Tax Rebate Form Based on the nature of Arkansas Sales Tax Rebate Form you will need to fill out a form and mail it in or upload it online.

-

Wait for approval: The company will examine your application to determine if it's in compliance with the terms and conditions of the Arkansas Sales Tax Rebate Form.

-

You will receive your Arkansas Sales Tax Rebate Form Once you've received your approval, you'll receive your money back, either by check, prepaid card, or another method that is specified in the offer.

Pros and Cons of Arkansas Sales Tax Rebate Form

Advantages

-

Cost Savings Arkansas Sales Tax Rebate Form can substantially reduce the cost for an item.

-

Promotional Deals they encourage their customers to try out new products or brands.

-

Improve Sales Arkansas Sales Tax Rebate Form can help boost an organization's sales and market share.

Disadvantages

-

Complexity mail-in Arkansas Sales Tax Rebate Form in particular is a time-consuming process and time-consuming.

-

End Dates Most Arkansas Sales Tax Rebate Form come with specific deadlines for submission.

-

Risk of not receiving payment: Some customers may not be able to receive their Arkansas Sales Tax Rebate Form if they do not follow the rules exactly.

Download Arkansas Sales Tax Rebate Form

Download Arkansas Sales Tax Rebate Form

FAQs

1. Are Arkansas Sales Tax Rebate Form equivalent to discounts? No, Arkansas Sales Tax Rebate Form offer a partial refund after the purchase, but discounts can reduce their price at moment of sale.

2. Do I have to use multiple Arkansas Sales Tax Rebate Form on the same product This depends on the conditions in the Arkansas Sales Tax Rebate Form offers and the product's qualification. Some companies will allow it, while others won't.

3. What is the time frame to receive a Arkansas Sales Tax Rebate Form? The length of time will vary, but it may take several weeks to a few months for you to receive your Arkansas Sales Tax Rebate Form.

4. Do I have to pay taxes for Arkansas Sales Tax Rebate Form funds? the majority of situations, Arkansas Sales Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Arkansas Sales Tax Rebate Form offers from brands that aren't well-known? It's essential to research and verify that the organization which is providing the Arkansas Sales Tax Rebate Form is reputable before making any purchase.

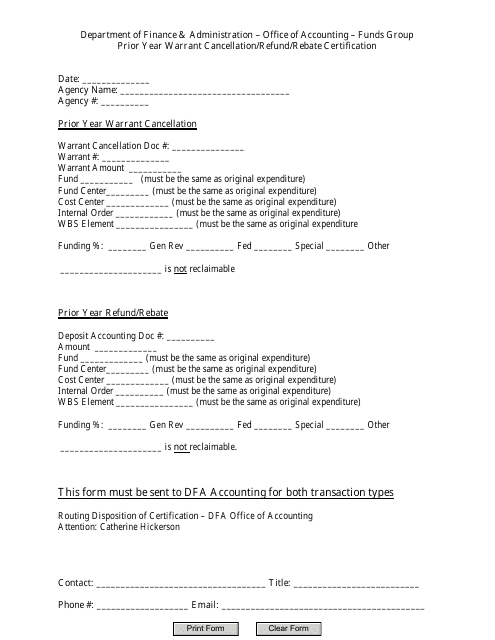

Arkansas Prior Year Warrant Cancellation Refund Rebate Certification

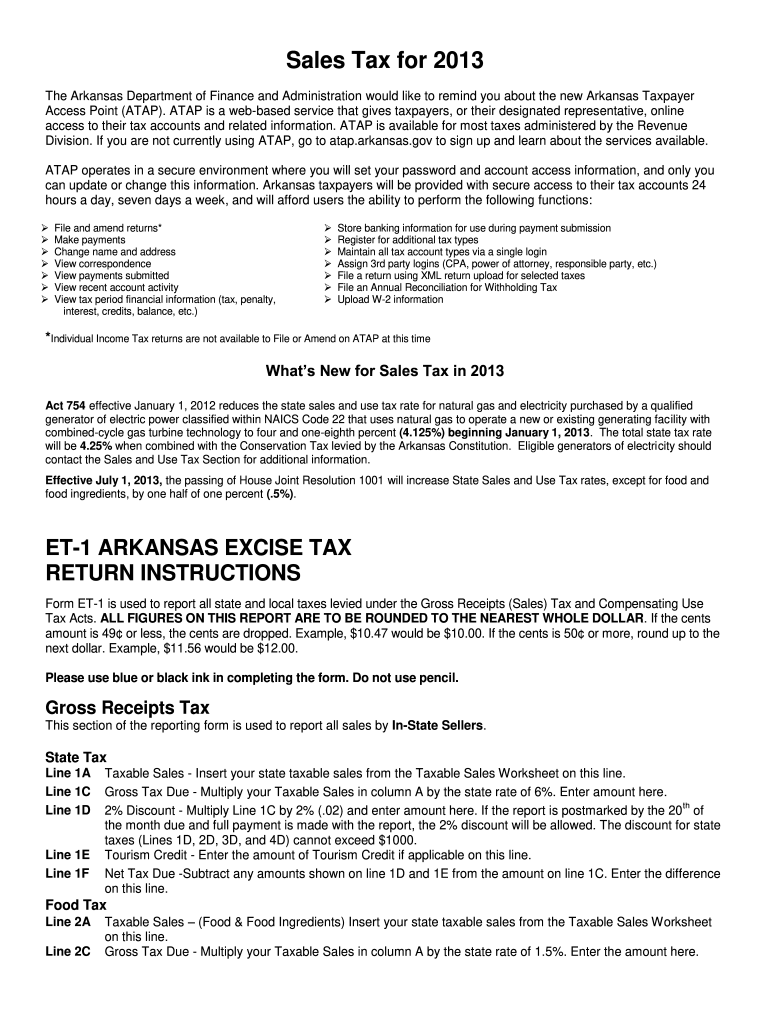

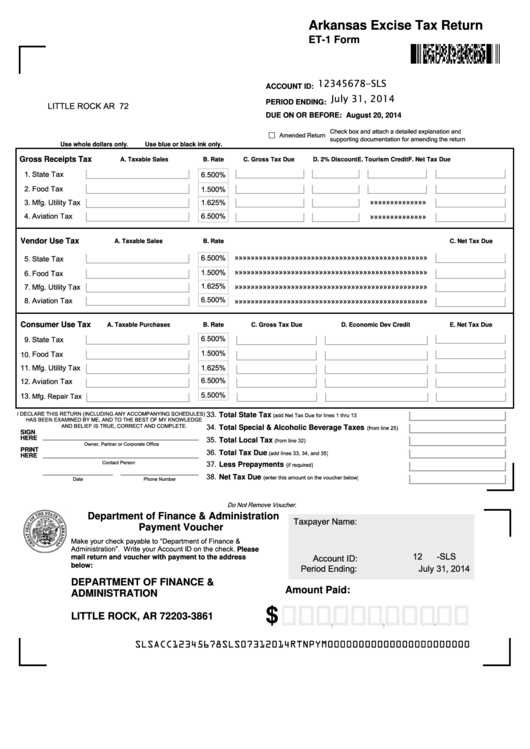

Arkansas Excise Tax Return Et 1 Form Fill Out Sign Online DocHub

Check more sample of Arkansas Sales Tax Rebate Form below

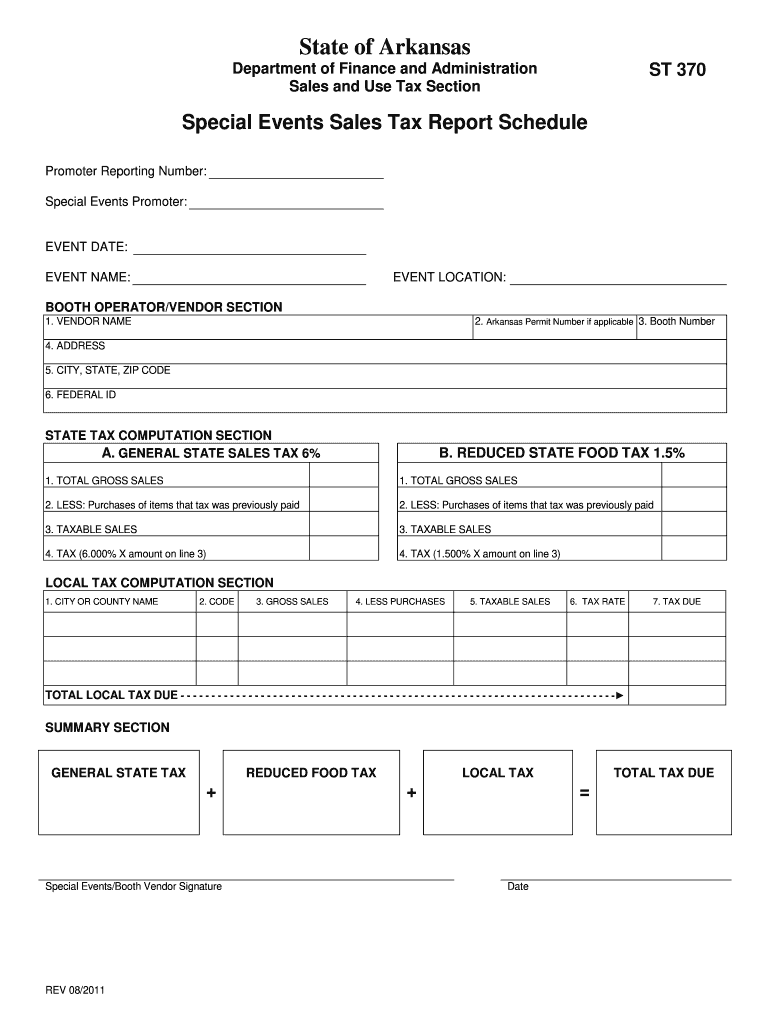

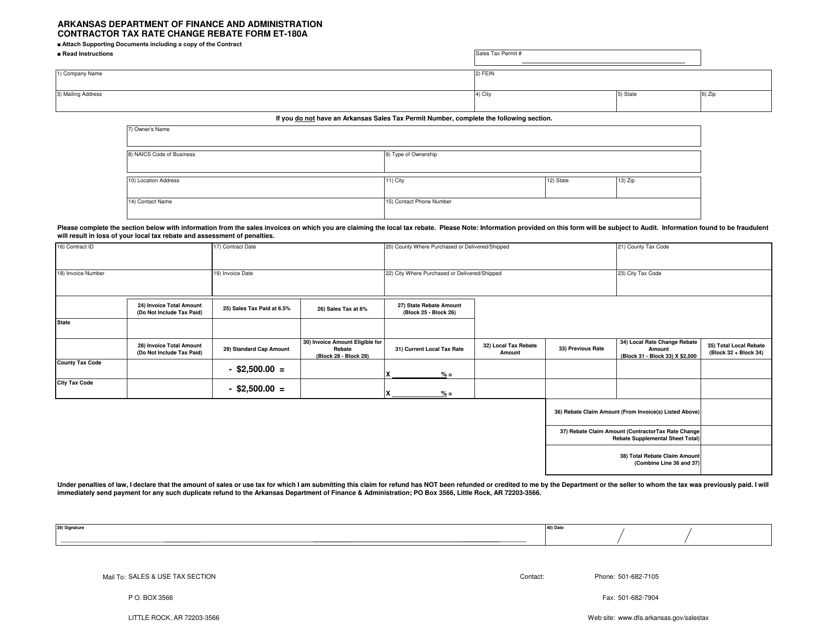

Form ET 179A Fill Out Sign Online And Download Fillable PDF

Fillable Form Et 1 Arkansas Excise Tax Return Printable Pdf Download

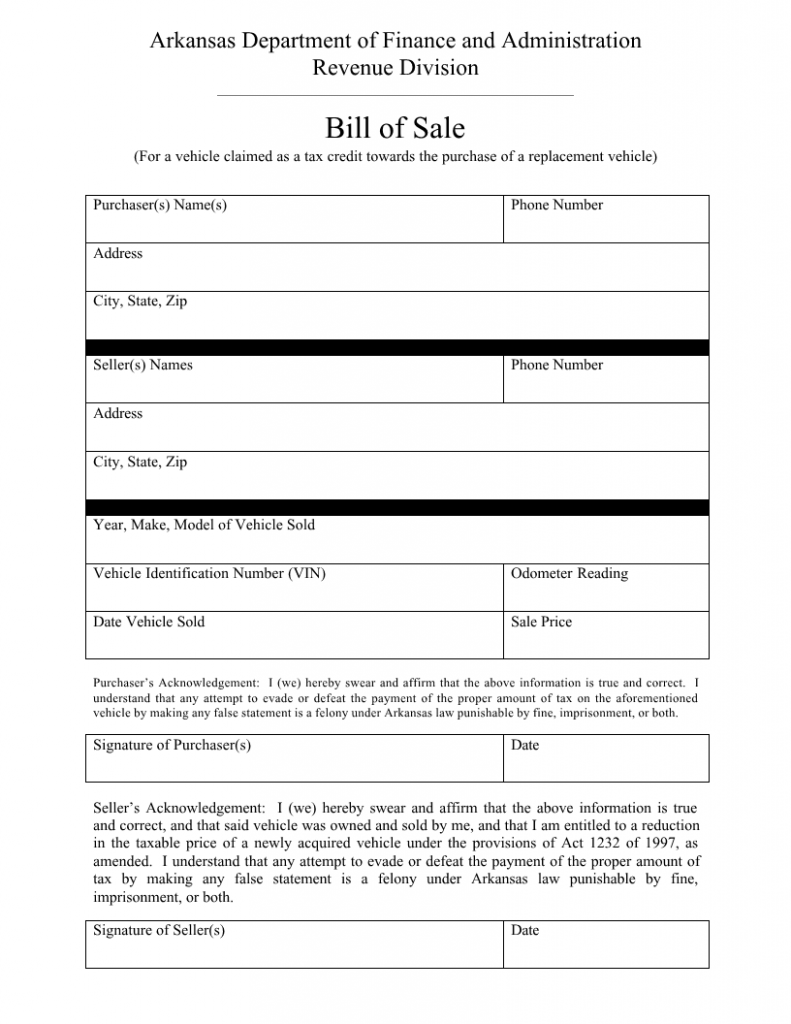

Free Arkansas Tax Credit Vehicle Bill Of Sale Form Download PDF Word

Arkansas Et 1 Form Pdf Fill Out Sign Online DocHub

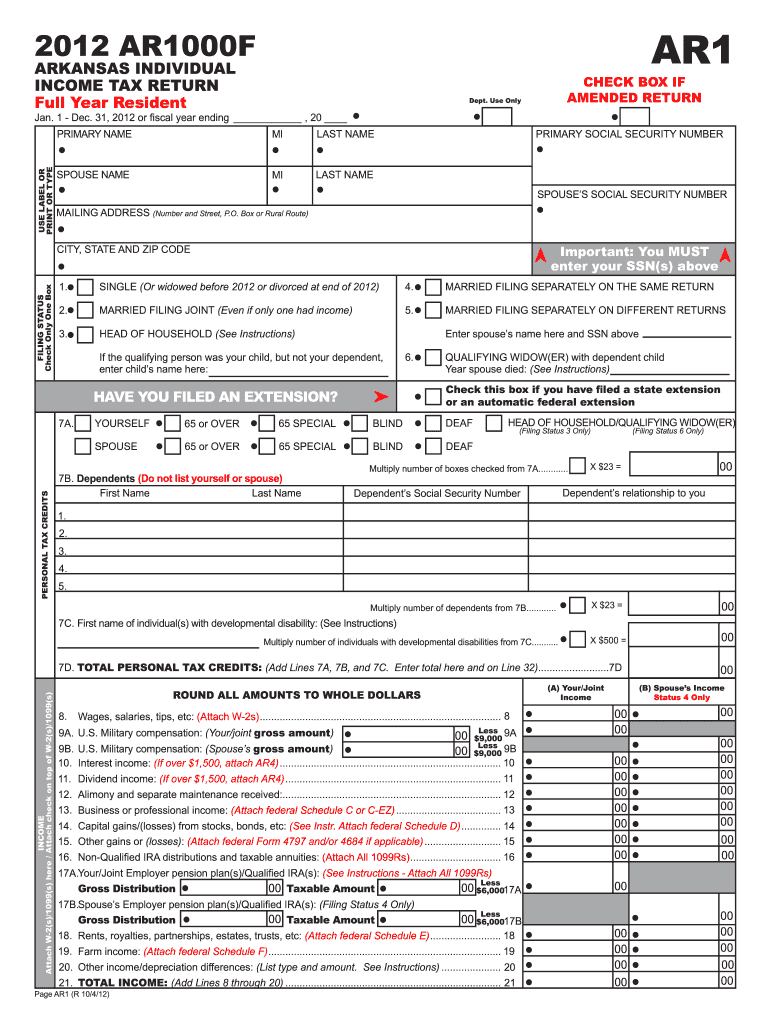

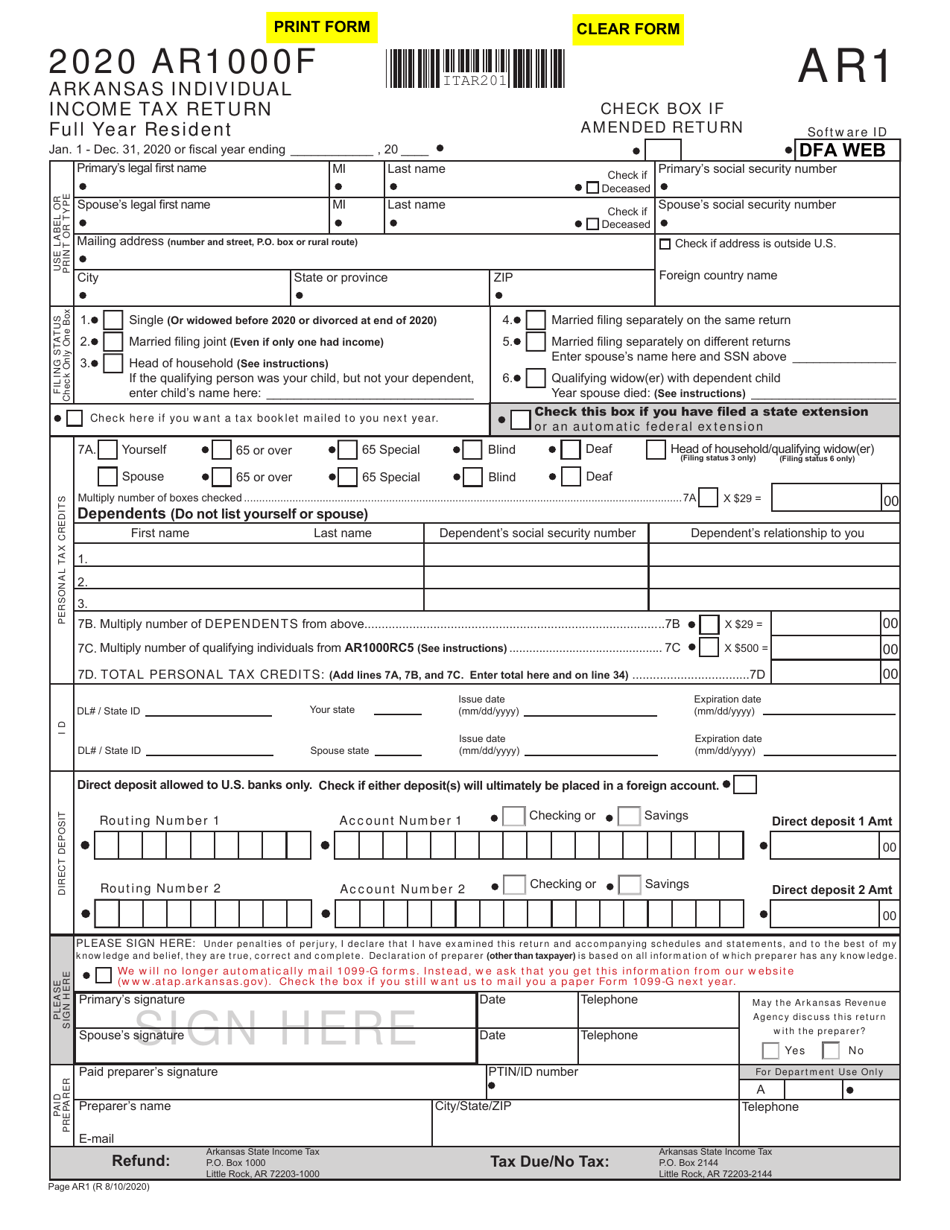

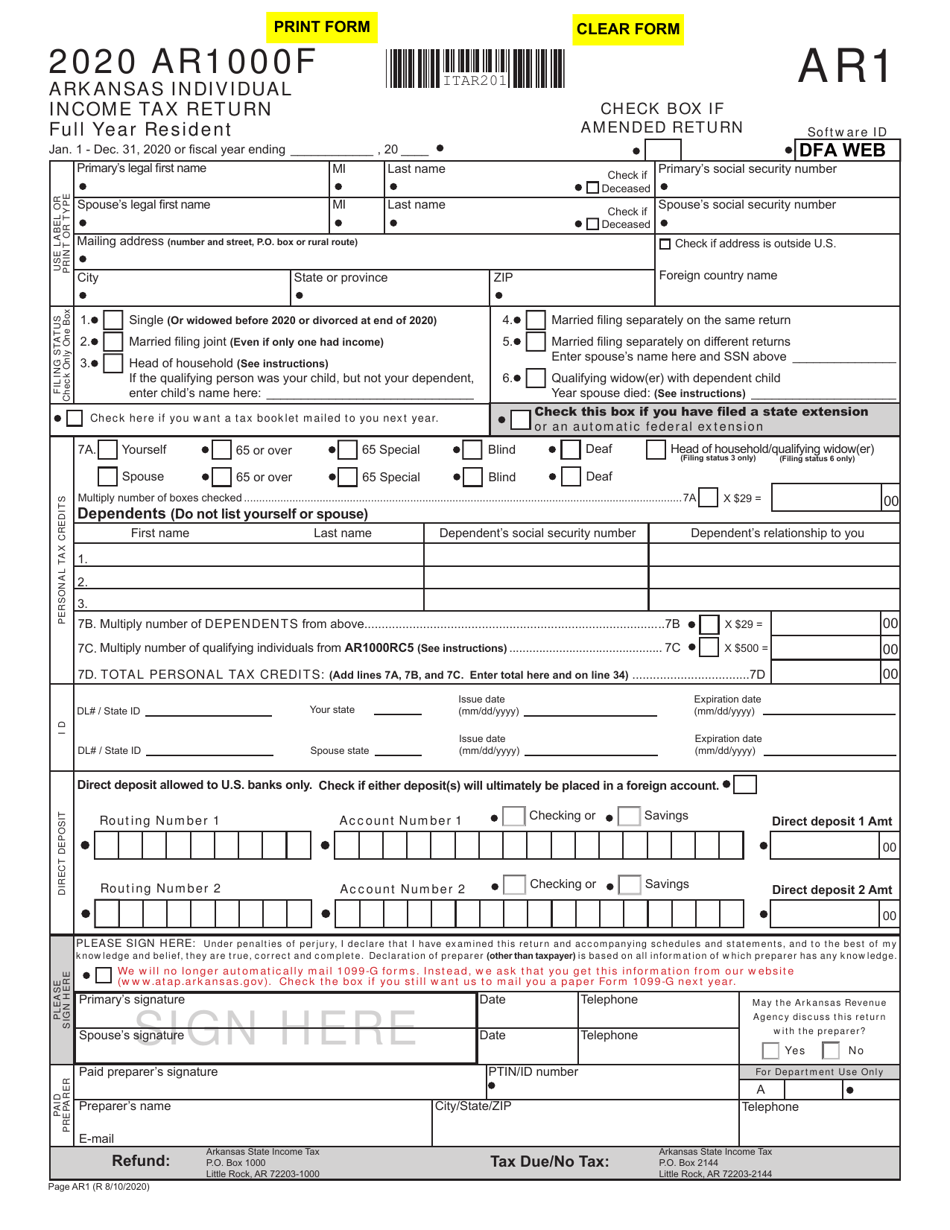

Form AR1000F Download Fillable PDF Or Fill Online Arkansas Full Year

Arkansas Exemption Tax Form Fill Out And Sign Printable PDF Template

https://www.dfa.arkansas.gov/.../sales-and-use-tax/sales-and-use-tax-f…

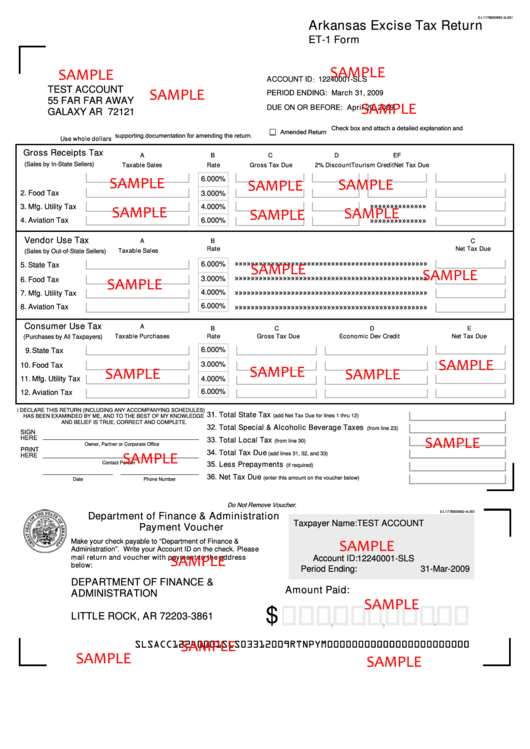

Web The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return ET 1 forms to taxpayers Contact 501 682 7104 to request ET 1 forms and the

https://www.dfa.arkansas.gov/excise-tax/sales-and-use-tax/sales-and...

Web The form may be obtained by contacting the Sales and Use Tax Section by telephone at 501 682 7105 or may be downloaded from the Sales Tax website at and selecting

Web The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return ET 1 forms to taxpayers Contact 501 682 7104 to request ET 1 forms and the

Web The form may be obtained by contacting the Sales and Use Tax Section by telephone at 501 682 7105 or may be downloaded from the Sales Tax website at and selecting

Arkansas Et 1 Form Pdf Fill Out Sign Online DocHub

Fillable Form Et 1 Arkansas Excise Tax Return Printable Pdf Download

Form AR1000F Download Fillable PDF Or Fill Online Arkansas Full Year

Arkansas Exemption Tax Form Fill Out And Sign Printable PDF Template

Form ET 180A Download Printable PDF Or Fill Online Contractor Tax Rate

Free Arkansas Vehicle Tax Credit Bill Of Sale Form PDF Word doc

Free Arkansas Vehicle Tax Credit Bill Of Sale Form PDF Word doc

Fillable Form Et 1 Sample Arkansas Excise Tax Return Printable Pdf