In today's consumer-driven world every person loves a great deal. One method to get significant savings on your purchases is through Are Rebates Taxables. Are Rebates Taxables are a marketing strategy that retailers and manufacturers use to provide customers with a partial refund for their purchases after they have purchased them. In this article, we'll look into the world of Are Rebates Taxables, exploring what they are what they are, how they function, and how you can make the most of the savings you can make by using these cost-effective incentives.

Get Latest Are Rebates Taxable Below

Are Rebates Taxable

Are Rebates Taxable - Are Rebates Taxable, Are Rebates Taxable In Canada, Are Rebates Taxable In California, Are Rebates Taxable In Texas, Are Rebates Taxable Irs, Are Rebates Taxable In Florida, Are Rebates Taxable Income Irs, Are Rebates Taxable In Michigan, Are Rebates Taxable In Ny, Are Reimbursements Taxable

Web If you are a volunteer firefighter or emergency medical responder you may be able to exclude from gross income certain rebates or reductions of state or local property or

Web There are two basic arguments to support the conclusion that the rebate payments should not be taxable First it may be argued that the LI rebate should not be treated as a

A Are Rebates Taxable in its simplest version, is an ad-hoc reimbursement to a buyer who has purchased a particular product or service. It's a highly effective tool employed by companies to draw clients, increase sales and promote specific products.

Types of Are Rebates Taxable

Mw International Realty Licensed REALTORS In Orlando Florida

Mw International Realty Licensed REALTORS In Orlando Florida

Web Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on your purchase

Web Tax Tax Accounting EXECUTIVE SUMMARY The IRS has attempted for many years to categorize rebates as deductions rather than exclusions so that the restrictions of IRC 167

Cash Are Rebates Taxable

Cash Are Rebates Taxable are the most basic kind of Are Rebates Taxable. Customers are given a certain amount of money after purchasing a particular item. These are usually used for high-ticket items like electronics or appliances.

Mail-In Are Rebates Taxable

Mail-in Are Rebates Taxable demand that customers present the proof of purchase to be eligible for their money back. They're a little more involved, but can result in significant savings.

Instant Are Rebates Taxable

Instant Are Rebates Taxable are credited at the point of sale, which reduces the price of your purchase instantly. Customers do not have to wait long for savings by using this method.

How Are Rebates Taxable Work

Are ACA Rebates Taxable HealthPlanRate Healthplanrate

Are ACA Rebates Taxable HealthPlanRate Healthplanrate

Web 28 Mai 2022 nbsp 0183 32 In plain language no your business credit card rewards are not considered income and therefore are not taxable Instead credit card rewards are considered a

The Are Rebates Taxable Process

The procedure usually involves a few steps:

-

You purchase the item: First, you purchase the item just as you would ordinarily.

-

Fill in your Are Rebates Taxable form: You'll need to fill in some information like your address, name, and the purchase details, in order in order to submit your Are Rebates Taxable.

-

To submit the Are Rebates Taxable In accordance with the type of Are Rebates Taxable you will need to mail a Are Rebates Taxable form in or submit it online.

-

Wait for the company's approval: They will scrutinize your submission to make sure it is in line with the refund's conditions and terms.

-

Enjoy your Are Rebates Taxable Once you've received your approval, you'll receive a refund in the form of a check, prepaid card or another option as per the terms of the offer.

Pros and Cons of Are Rebates Taxable

Advantages

-

Cost Savings Are Rebates Taxable can substantially lower the cost you pay for a product.

-

Promotional Offers Customers are enticed to try new items or brands.

-

Enhance Sales: Are Rebates Taxable can boost an organization's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Are Rebates Taxable in particular difficult and lengthy.

-

End Dates Many Are Rebates Taxable impose deadlines for submission.

-

A risk of not being paid Some customers might not get their Are Rebates Taxable if they don't adhere to the rules exactly.

Download Are Rebates Taxable

FAQs

1. Are Are Rebates Taxable similar to discounts? No, Are Rebates Taxable offer a partial refund after purchase, whereas discounts decrease costs at point of sale.

2. Do I have to use multiple Are Rebates Taxable on the same item This depends on the conditions and conditions of Are Rebates Taxable promotions and on the products quality and eligibility. Certain companies may permit the use of multiple Are Rebates Taxable, whereas other won't.

3. How long does it take to get the Are Rebates Taxable What is the timeframe? is different, but it could be from several weeks to couple of months before you get your Are Rebates Taxable.

4. Do I need to pay taxes for Are Rebates Taxable values? most instances, Are Rebates Taxable amounts are not considered taxable income.

5. Should I be able to trust Are Rebates Taxable deals from lesser-known brands Consider doing some research and ensure that the brand offering the Are Rebates Taxable is trustworthy prior to making an investment.

Are Manufacturer Car Rebates Taxable CarsDirect

What Income Is Taxable Blog hubcfo

Check more sample of Are Rebates Taxable below

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc Rebates

Are Idaho s Tax Rebates Taxable

Are 2022 Tax Rebates Considered taxable Income YouTube

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Are Cash For Clunkers Rebates Taxable The Truth About Cars

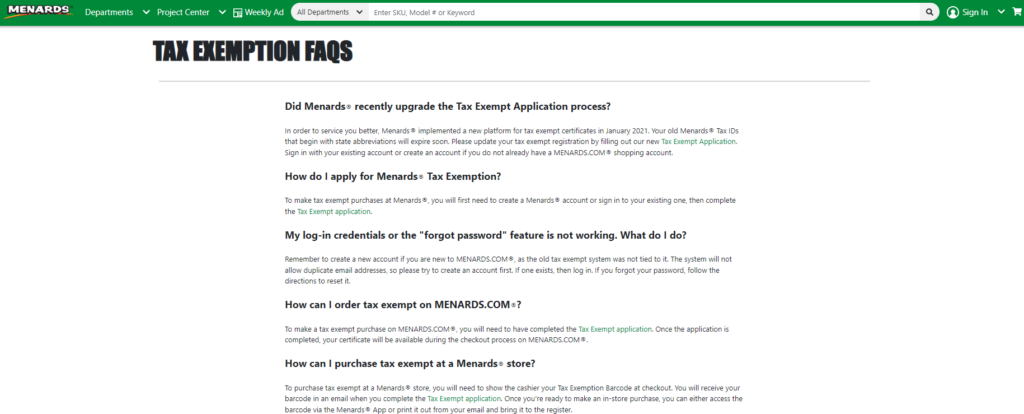

Are Menards Rebates Taxable Menards Rebate Form 2023

https://tapin.waternow.org/resources/taxability-of-rebates-federal-tax...

Web There are two basic arguments to support the conclusion that the rebate payments should not be taxable First it may be argued that the LI rebate should not be treated as a

https://turbotax.intuit.com/tax-tips/tax-relief/what-are-tax-rebates/L...

Web 19 Okt 2023 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds

Web There are two basic arguments to support the conclusion that the rebate payments should not be taxable First it may be argued that the LI rebate should not be treated as a

Web 19 Okt 2023 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Are Idaho s Tax Rebates Taxable

Are Cash For Clunkers Rebates Taxable The Truth About Cars

Are Menards Rebates Taxable Menards Rebate Form 2023

What Are 2022 Tax Rebates For Ev Cars 2022 Carrebate

Are Car Rebates Taxable In New York 2022 Carrebate

Are Car Rebates Taxable In New York 2022 Carrebate

IRS Says 21 State Rebates Including California Middle Class Tax Refunds Are Not Taxable Flipboard