In the modern world of consumerization everyone appreciates a great deal. One way to make significant savings on your purchases is by using 87a Rebates. 87a Rebates are marketing strategies that retailers and manufacturers use to offer customers a partial cash back on their purchases once they've completed them. In this article, we will take a look at the world that is 87a Rebates, examining the nature of them and how they work and how to maximize your savings through these cost-effective incentives.

Get Latest 87a Rebate Below

87a Rebate

87a Rebate -

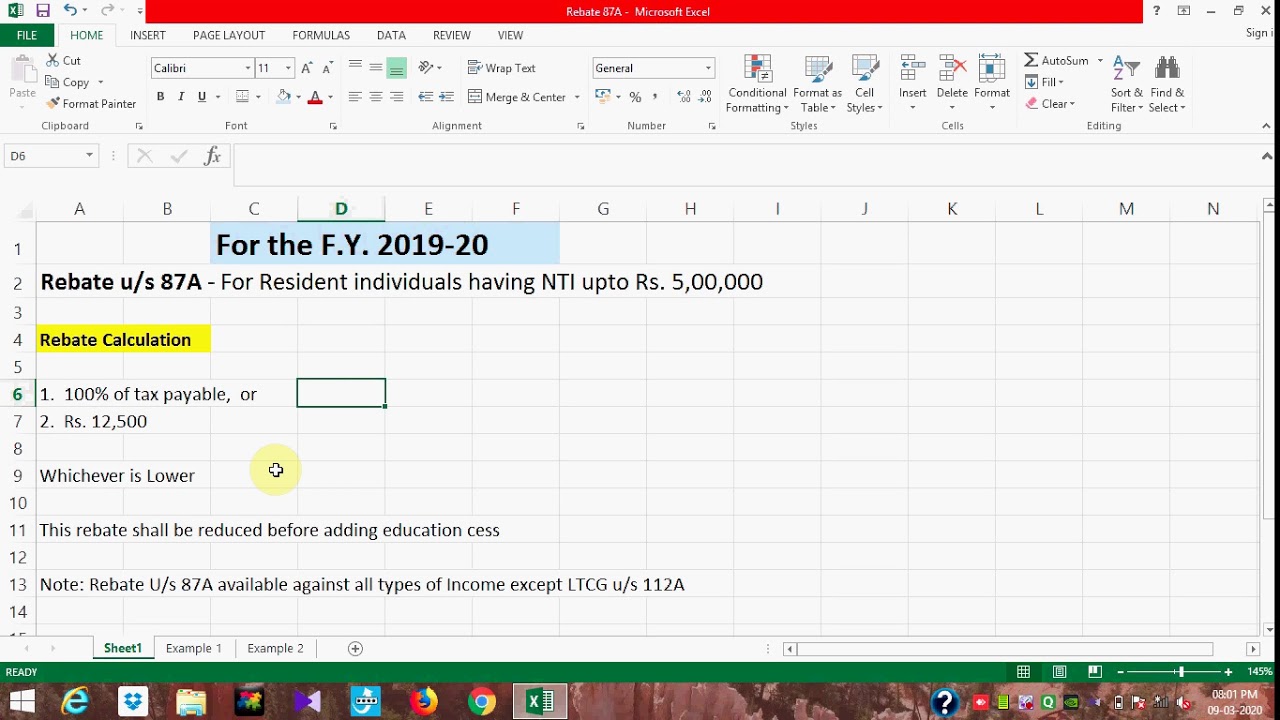

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A entitles a resident individual to claim tax rebate of up to Rs 12 500 against his tax liability in case his income is limited to Rs 7 lakh Once you start

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

A 87a Rebate is, in its most basic description, is a refund to a purchaser when they purchase a product or service. It's an effective method for businesses to entice customers, increase sales, and even promote certain products.

Types of 87a Rebate

Section 87A Tax Rebate FY 2019 20 Tax Wealth Tax Tax Deductions

Section 87A Tax Rebate FY 2019 20 Tax Wealth Tax Tax Deductions

Web Income Tax Rebate 87A The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual net

Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Cash 87a Rebate

Cash 87a Rebate can be the simplest kind of 87a Rebate. Customers receive a certain amount of cash back after purchasing a product. This is often for more expensive items such electronics or appliances.

Mail-In 87a Rebate

Mail-in 87a Rebate demand that customers submit evidence of purchase to get their money back. They are a bit more complicated, but they can provide substantial savings.

Instant 87a Rebate

Instant 87a Rebate will be applied at point of sale, which reduces the price of purchases immediately. Customers don't need to wait for their savings in this manner.

How 87a Rebate Work

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Web 2 f 233 vr 2023 nbsp 0183 32 In the Union Budget 2023 Finance Minister Nirmala Sitharaman announced that the rebate under Section 87A will be hiked from 5 Lakh to 7 Lakh bringing a big

The 87a Rebate Process

The procedure typically consists of a couple of steps that are easy to follow:

-

Purchase the product: Then, you purchase the item just as you would ordinarily.

-

Complete this 87a Rebate Form: To claim the 87a Rebate you'll need be able to provide a few details, such as your name, address, as well as the details of your purchase to take advantage of your 87a Rebate.

-

Send in the 87a Rebate The 87a Rebate must be submitted in accordance with the nature of 87a Rebate, you may need to send in a form, or upload it online.

-

Wait for the company's approval: They is going to review your entry to determine if it's in compliance with the requirements of the 87a Rebate.

-

Redeem your 87a Rebate After being approved, you'll receive the refund either by check, prepaid card, or through another method as specified by the offer.

Pros and Cons of 87a Rebate

Advantages

-

Cost Savings Rewards can drastically reduce the cost for the item.

-

Promotional Deals These deals encourage customers to explore new products or brands.

-

boost sales A 87a Rebate program can boost sales for a company and also increase market share.

Disadvantages

-

Complexity Pay-in 87a Rebate via mail, particularly, can be cumbersome and long-winded.

-

Extension Dates Many 87a Rebate are subject to very strict deadlines for filing.

-

Risk of not receiving payment Certain customers could have their 87a Rebate delayed if they do not follow the rules precisely.

Download 87a Rebate

FAQs

1. Are 87a Rebate the same as discounts? No, 87a Rebate involve one-third of the amount refunded following purchase, whereas discounts cut prices at point of sale.

2. Are there multiple 87a Rebate I can get for the same product It's dependent on the terms and conditions of 87a Rebate offer and also the item's acceptance. Certain companies may permit it, while some won't.

3. What is the time frame to receive a 87a Rebate? The period will vary, but it may range from several weeks to few months to get your 87a Rebate.

4. Do I have to pay taxes on 87a Rebate values? the majority of circumstances, 87a Rebate amounts are not considered to be taxable income.

5. Should I be able to trust 87a Rebate offers from brands that aren't well-known It's important to do your research and make sure that the company that is offering the 87a Rebate is credible prior to making an acquisition.

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Check more sample of 87a Rebate below

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

Section 87A Tax Rebate Under Section 87A Rebates Financial

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate Of Income Tax Under Section 87A YouTube

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

Rebate Of Income Tax Under Section 87A YouTube

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A YouTube

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

Tax Rebate Under Section 87A All You Need To Know YouTube