In today's consumer-driven world everyone enjoys a good deal. One of the ways to enjoy significant savings for your purchases is through 2023 Irs 1040 Form Recovery Rebate Credits. 2023 Irs 1040 Form Recovery Rebate Credits are marketing strategies used by manufacturers and retailers to give customers a part discount on purchases they made after they have created them. In this post, we'll investigate the world of 2023 Irs 1040 Form Recovery Rebate Credits. We'll look at the nature of them and how they work and ways you can increase the value of these incentives.

Get Latest 2023 Irs 1040 Form Recovery Rebate Credit Below

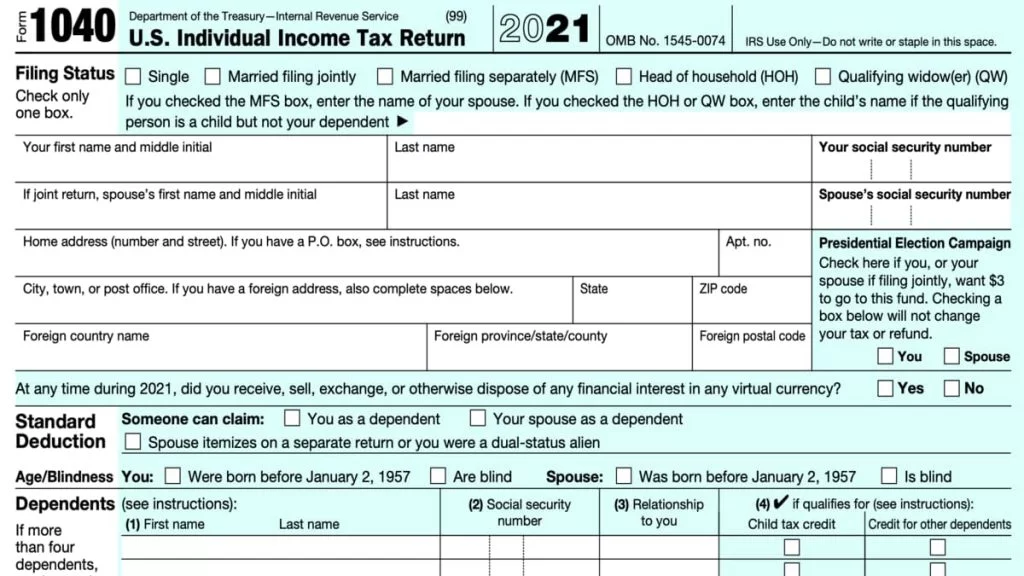

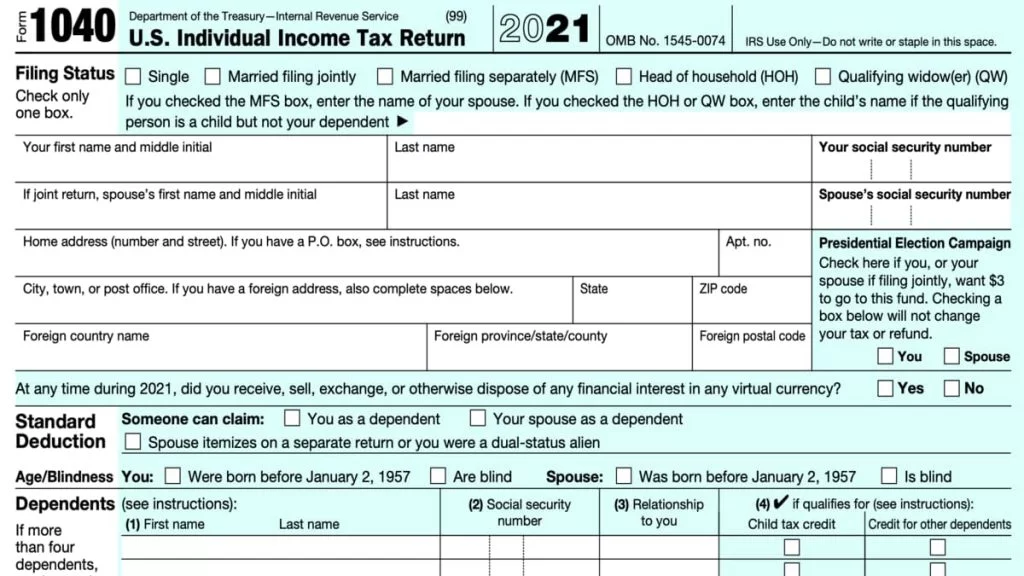

2023 Irs 1040 Form Recovery Rebate Credit

2023 Irs 1040 Form Recovery Rebate Credit -

The IRS has issued all first second and third Economic Impact Payments Most eligible people already received their Economic Impact Payments People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021

IR 2023 217 Nov 17 2023 WASHINGTON The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

A 2023 Irs 1040 Form Recovery Rebate Credit is, in its most basic description, is a cash refund provided to customers after they've bought a product or service. It's a highly effective tool that companies use to attract customers, boost sales, or promote a specific product.

Types of 2023 Irs 1040 Form Recovery Rebate Credit

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Review the 2020 tax return the 2020 Recovery Rebate Credit requirements and the worksheet in the Form 1040 and Form 1040 SR instructions The 2020 Recovery Rebate Credit questions and answers provide additional guidance for specific situations addressed in related IRS notices

Page Last Reviewed or Updated 23 Oct 2023 February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two Economic Impact Payments and won t claim it or

Cash 2023 Irs 1040 Form Recovery Rebate Credit

Cash 2023 Irs 1040 Form Recovery Rebate Credit are by far the easiest kind of 2023 Irs 1040 Form Recovery Rebate Credit. Customers receive a certain amount of money after purchasing a product. These are usually used for large-ticket items such as electronics and appliances.

Mail-In 2023 Irs 1040 Form Recovery Rebate Credit

Mail-in 2023 Irs 1040 Form Recovery Rebate Credit require customers to provide an evidence of purchase for their reimbursement. They're more involved, but offer significant savings.

Instant 2023 Irs 1040 Form Recovery Rebate Credit

Instant 2023 Irs 1040 Form Recovery Rebate Credit will be applied at point of sale, which reduces the purchase price immediately. Customers don't need to wait until they can save in this manner.

How 2023 Irs 1040 Form Recovery Rebate Credit Work

How Do I Claim The Recovery Rebate Credit On My Ta

How Do I Claim The Recovery Rebate Credit On My Ta

2020 Recovery Rebate Credit Topic D Calculating the Credit for a 2020 tax return Internal Revenue Service These updated FAQs were released to the public in Fact Sheet 2022 26 PDF April 13 2022

The 2023 Irs 1040 Form Recovery Rebate Credit Process

The process generally involves a number of easy steps:

-

Then, you purchase the product make sure you purchase the product in the same way you would normally.

-

Fill out your 2023 Irs 1040 Form Recovery Rebate Credit forms: The 2023 Irs 1040 Form Recovery Rebate Credit form will need provide certain information including your name, address, and purchase information, in order to submit your 2023 Irs 1040 Form Recovery Rebate Credit.

-

In order to submit the 2023 Irs 1040 Form Recovery Rebate Credit: Depending on the type of 2023 Irs 1040 Form Recovery Rebate Credit you may have to either mail in a request form or send it via the internet.

-

Wait for the company's approval: They will examine your application for compliance with reimbursement's terms and condition.

-

Accept your 2023 Irs 1040 Form Recovery Rebate Credit: Once approved, you'll receive the refund in the form of a check, prepaid card, or through another procedure specified by the deal.

Pros and Cons of 2023 Irs 1040 Form Recovery Rebate Credit

Advantages

-

Cost savings A 2023 Irs 1040 Form Recovery Rebate Credit can significantly reduce the cost for an item.

-

Promotional Deals They encourage customers to try new products or brands.

-

boost sales 2023 Irs 1040 Form Recovery Rebate Credit can help boost sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in 2023 Irs 1040 Form Recovery Rebate Credit in particular, can be cumbersome and costly.

-

Expiration Dates Most 2023 Irs 1040 Form Recovery Rebate Credit come with rigid deadlines to submit.

-

Risk of Non-Payment: Some customers may not receive 2023 Irs 1040 Form Recovery Rebate Credit if they do not adhere to the guidelines exactly.

Download 2023 Irs 1040 Form Recovery Rebate Credit

Download 2023 Irs 1040 Form Recovery Rebate Credit

FAQs

1. Are 2023 Irs 1040 Form Recovery Rebate Credit similar to discounts? No, 2023 Irs 1040 Form Recovery Rebate Credit are a partial refund after the purchase, whereas discounts reduce the purchase price at the moment of sale.

2. Are multiple 2023 Irs 1040 Form Recovery Rebate Credit available on the same item It's dependent on the conditions in the 2023 Irs 1040 Form Recovery Rebate Credit provides and the particular product's qualification. Certain companies may allow it, but some will not.

3. How long does it take to get the 2023 Irs 1040 Form Recovery Rebate Credit? The duration differs, but it can be anywhere from a few weeks up to a few months to receive your 2023 Irs 1040 Form Recovery Rebate Credit.

4. Do I need to pay tax for 2023 Irs 1040 Form Recovery Rebate Credit amount? the majority of cases, 2023 Irs 1040 Form Recovery Rebate Credit amounts are not considered taxable income.

5. Should I be able to trust 2023 Irs 1040 Form Recovery Rebate Credit deals from lesser-known brands It is essential to investigate and verify that the brand offering the 2023 Irs 1040 Form Recovery Rebate Credit has a good reputation prior to making a purchase.

1040 EF Message 0006 Recovery Rebate Credit Drake20

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Check more sample of 2023 Irs 1040 Form Recovery Rebate Credit below

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

2022 Form 1040 Schedule A Instructions

1040 Form Pdf Fillable Printable Forms Free Online

https://www.irs.gov/newsroom/irs-reminds-eligible...

IR 2023 217 Nov 17 2023 WASHINGTON The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

https://apps.irs.gov/app/IPAR/resources/help/recovrebate.html

Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if You are eligible but were not issued an EIP 1 an EIP 2 or neither an EIP 1 or EIP 2 or

IR 2023 217 Nov 17 2023 WASHINGTON The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if You are eligible but were not issued an EIP 1 an EIP 2 or neither an EIP 1 or EIP 2 or

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

The Recovery Rebate Credit Calculator ShauntelRaya

2022 Form 1040 Schedule A Instructions

1040 Form Pdf Fillable Printable Forms Free Online

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Form 1040 SE 2023

Form 1040 SE 2023

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return