Today, in a world that is driven by the consumer everyone is looking for a great bargain. One option to obtain significant savings on your purchases can be achieved through 2023 Form 1040 No Rebates. 2023 Form 1040 No Rebates are an effective marketing tactic used by manufacturers and retailers to give customers a part return on their purchases once they've done so. In this post, we'll dive into the world 2023 Form 1040 No Rebates. We'll discuss what they are as well as how they work and how you can make the most of the value of these incentives.

Get Latest 2023 Form 1040 No Rebate Below

2023 Form 1040 No Rebate

2023 Form 1040 No Rebate -

Get federal tax return forms and file by mail Get paper copies of federal and state tax forms their instructions and the address for mailing them Find easier to read tax forms for seniors and people with different needs

Reporting rules changed for Form 1099 K Taxpayers should receive Form 1099 K Payment Card and Third Party Network Transactions by January 31 2023 if they received third party payments in tax year 2022 for goods and services that exceeded 600 There s no change to the taxability of income

A 2023 Form 1040 No Rebate at its most basic description, is a refund offered to a customer after they have purchased a product or service. It's a very effective technique used by businesses to attract customers, increase sales and market specific products.

Types of 2023 Form 1040 No Rebate

8615 Form 2023 Bank2home

8615 Form 2023 Bank2home

Tax Forms Tax Codes This 2023 tax year return and refund estimator is currently based on 2022 tax year data with the exception of 2023 standard deductions The tax year 2023 data will be updated as soon as the latest information becomes available Estimate your 2022 Return here

When filing your tax return you will use Line 30 of Form 1040 or Form 1040 SR to claim the Recovery Rebate Credit You will find instructions for how to calculate the credit in the instructions for either form

Cash 2023 Form 1040 No Rebate

Cash 2023 Form 1040 No Rebate are the most straightforward type of 2023 Form 1040 No Rebate. The customer receives a particular amount of money back after purchasing a item. This is often for costly items like electronics or appliances.

Mail-In 2023 Form 1040 No Rebate

Mail-in 2023 Form 1040 No Rebate require consumers to send in evidence of purchase to get their refund. They are a bit more involved but offer huge savings.

Instant 2023 Form 1040 No Rebate

Instant 2023 Form 1040 No Rebate can be applied at the moment of sale, cutting the purchase cost immediately. Customers don't have to wait for savings when they purchase this type of 2023 Form 1040 No Rebate.

How 2023 Form 1040 No Rebate Work

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Rebates have been issued for people who filed a return by Oct 17 of last year For those who file after Oct 17 but before Feb 15 2023 a rebate check should have been issued by March 31

The 2023 Form 1040 No Rebate Process

The process usually involves a few simple steps:

-

Purchase the product: Then, you buy the product just as you would ordinarily.

-

Fill in this 2023 Form 1040 No Rebate questionnaire: you'll need submit some information including your name, address and the purchase details, in order in order to be eligible for a 2023 Form 1040 No Rebate.

-

You must submit the 2023 Form 1040 No Rebate It is dependent on the type of 2023 Form 1040 No Rebate, you may need to mail a 2023 Form 1040 No Rebate form in or upload it online.

-

Wait for approval: The company will review your submission to make sure that it's in accordance with the 2023 Form 1040 No Rebate's terms and conditions.

-

Take advantage of your 2023 Form 1040 No Rebate If it is approved, the amount you receive will be whether by check, prepaid card, or another way specified in the offer.

Pros and Cons of 2023 Form 1040 No Rebate

Advantages

-

Cost savings 2023 Form 1040 No Rebate can substantially decrease the price for the item.

-

Promotional Deals: They encourage customers to test new products or brands.

-

Enhance Sales: 2023 Form 1040 No Rebate can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Mail-in 2023 Form 1040 No Rebate in particular could be cumbersome and slow-going.

-

Expiration Dates A lot of 2023 Form 1040 No Rebate have the strictest deadlines for submission.

-

Risque of Non-Payment Customers may not receive their 2023 Form 1040 No Rebate if they do not follow the rules precisely.

Download 2023 Form 1040 No Rebate

Download 2023 Form 1040 No Rebate

FAQs

1. Are 2023 Form 1040 No Rebate similar to discounts? Not necessarily, as 2023 Form 1040 No Rebate are a partial refund after purchase, while discounts reduce your purchase cost at time of sale.

2. Are there multiple 2023 Form 1040 No Rebate I can get for the same product It is contingent on the conditions and conditions of 2023 Form 1040 No Rebate offers and the product's ability to qualify. Certain companies allow it, while some won't.

3. What is the time frame to get a 2023 Form 1040 No Rebate? The timing can vary, but typically it will take a couple of weeks or a couple of months before you get your 2023 Form 1040 No Rebate.

4. Do I need to pay taxes in relation to 2023 Form 1040 No Rebate the amount? the majority of instances, 2023 Form 1040 No Rebate amounts are not considered to be taxable income.

5. Should I be able to trust 2023 Form 1040 No Rebate offers from brands that aren't well-known You must research and verify that the brand that is offering the 2023 Form 1040 No Rebate is legitimate prior to making purchases.

2023 Form 1040 es Payment Voucher Fill Online Printable Fillable Blank

2022 Form 1040 Schedule A Instructions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Check more sample of 2023 Form 1040 No Rebate below

2022 Form 1040 Schedule A Instructions

1040x Fill Out Sign Online DocHub

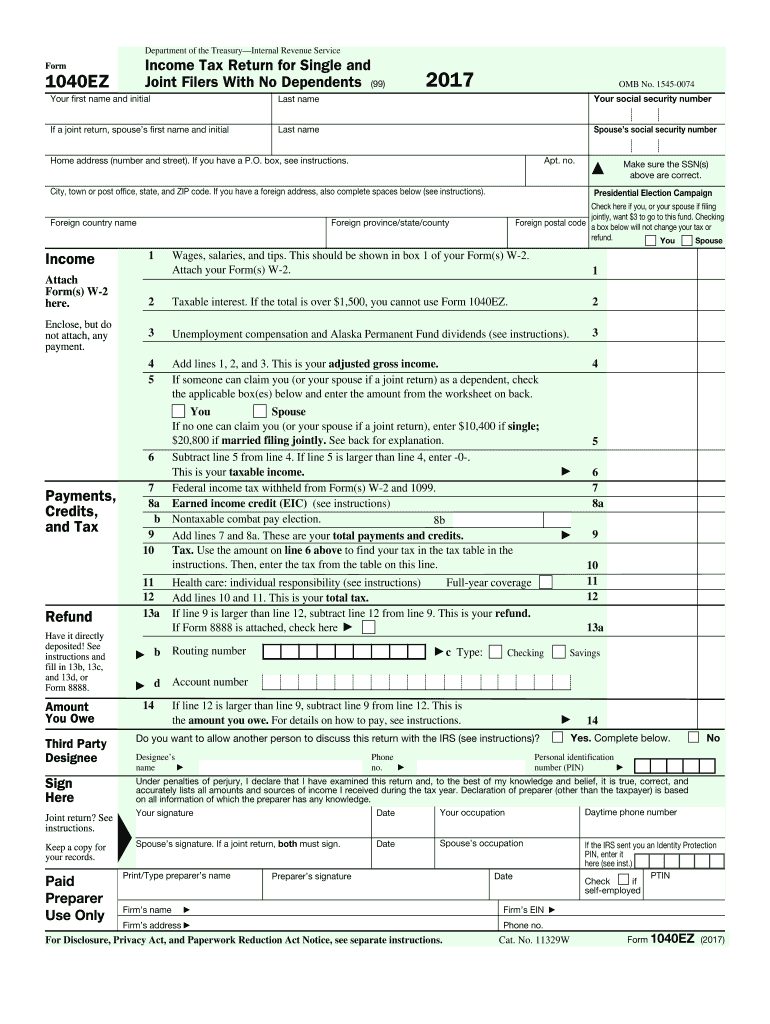

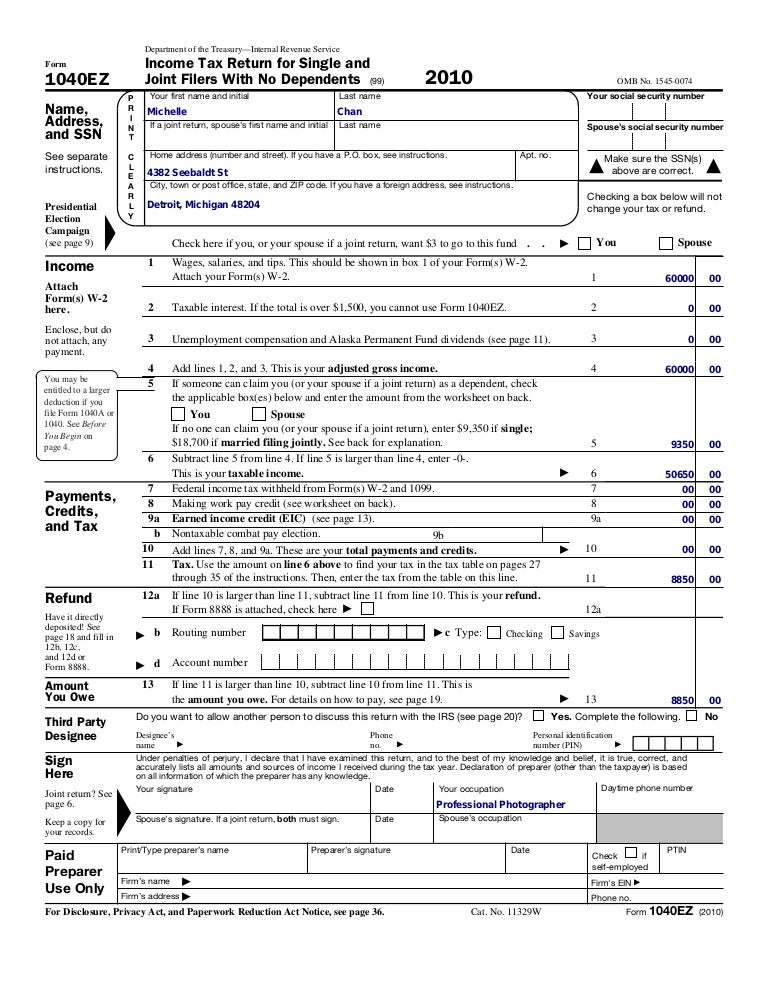

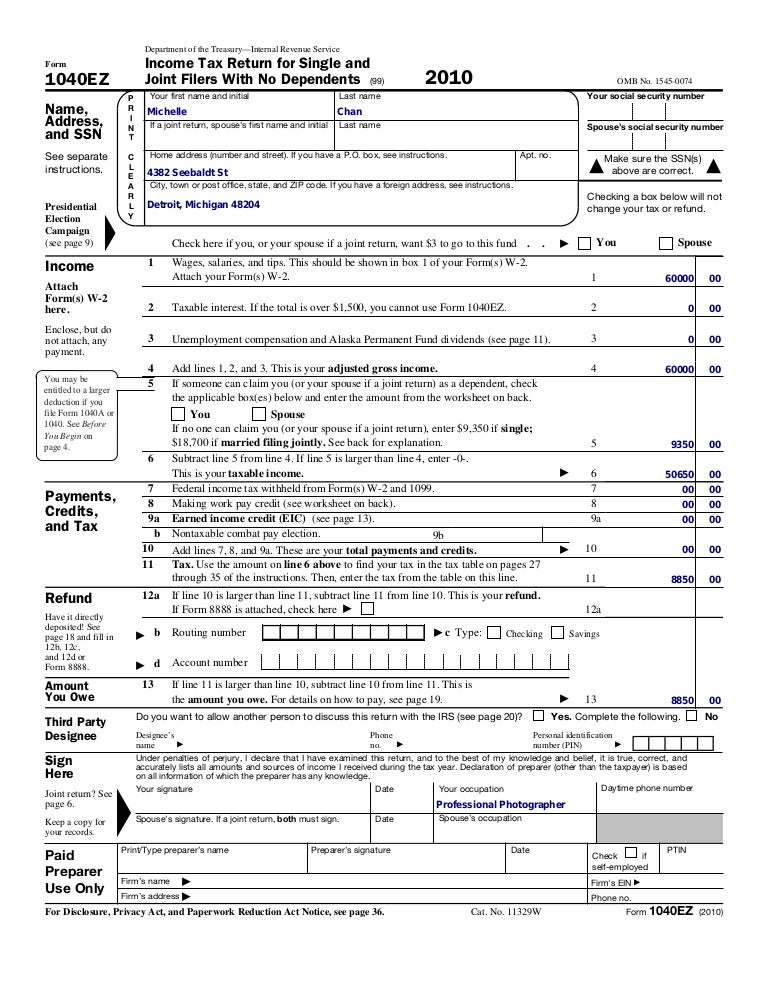

1040ez 2017 Fill Out Sign Online DocHub

Missouri Renters Rebate 2023 Printable Rebate Form

1040ez

Irs Form 1040 es nr Download Fillable Pdf Or Fill Online U s BA9

https://www.irs.gov/newsroom/get-ready-for-taxes...

Reporting rules changed for Form 1099 K Taxpayers should receive Form 1099 K Payment Card and Third Party Network Transactions by January 31 2023 if they received third party payments in tax year 2022 for goods and services that exceeded 600 There s no change to the taxability of income

https://www.irs.gov/forms-pubs/about-form-1040

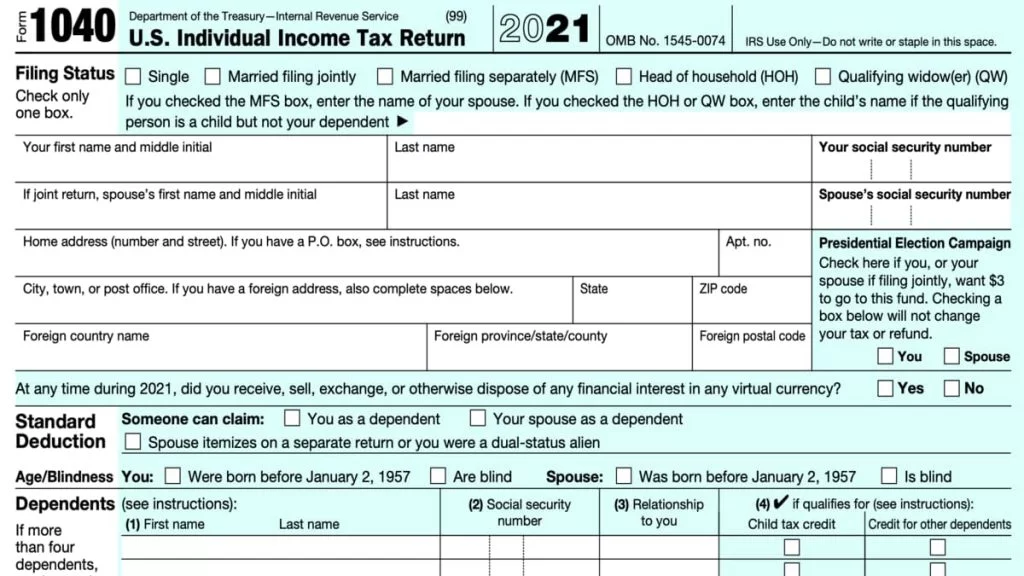

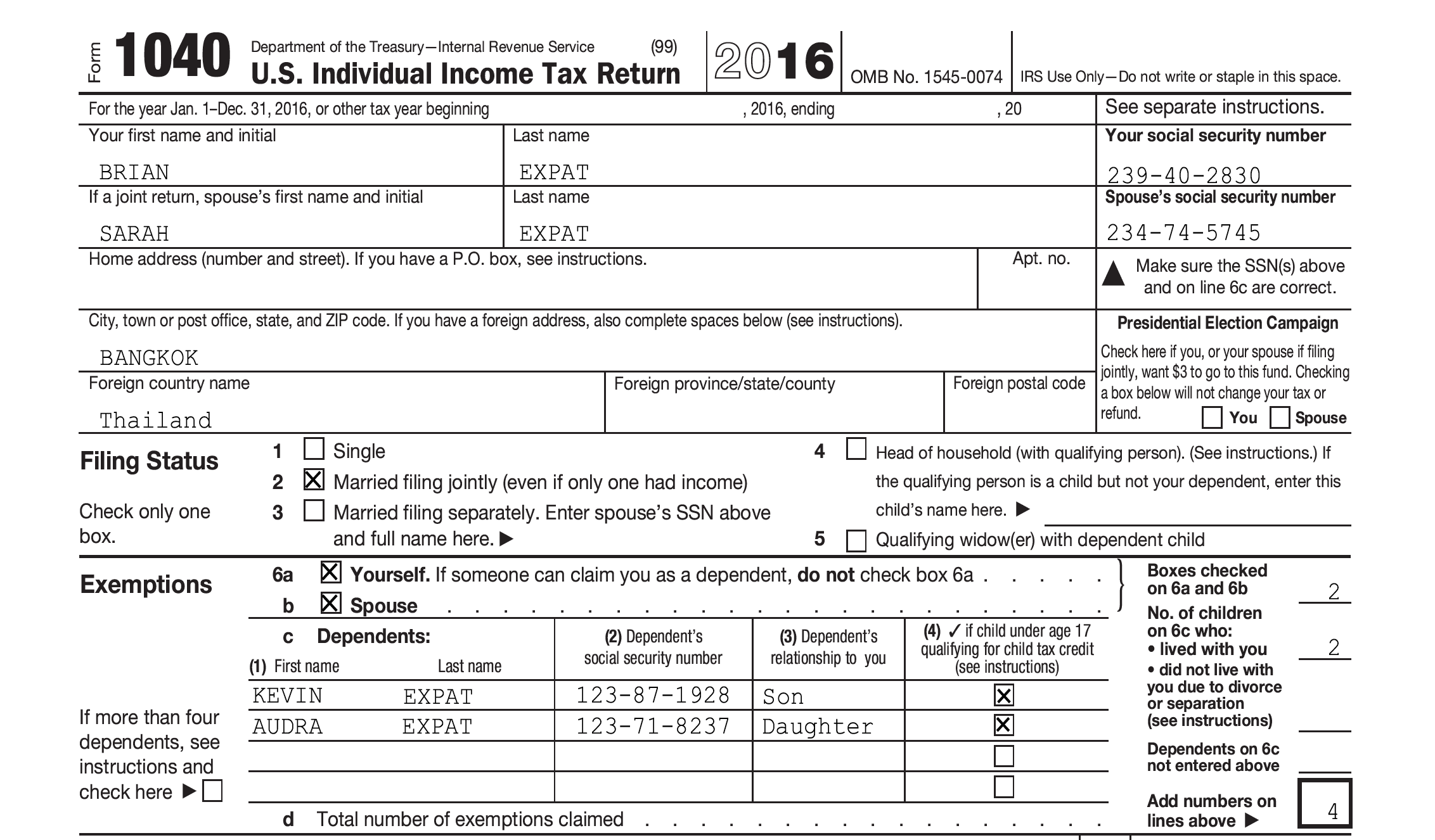

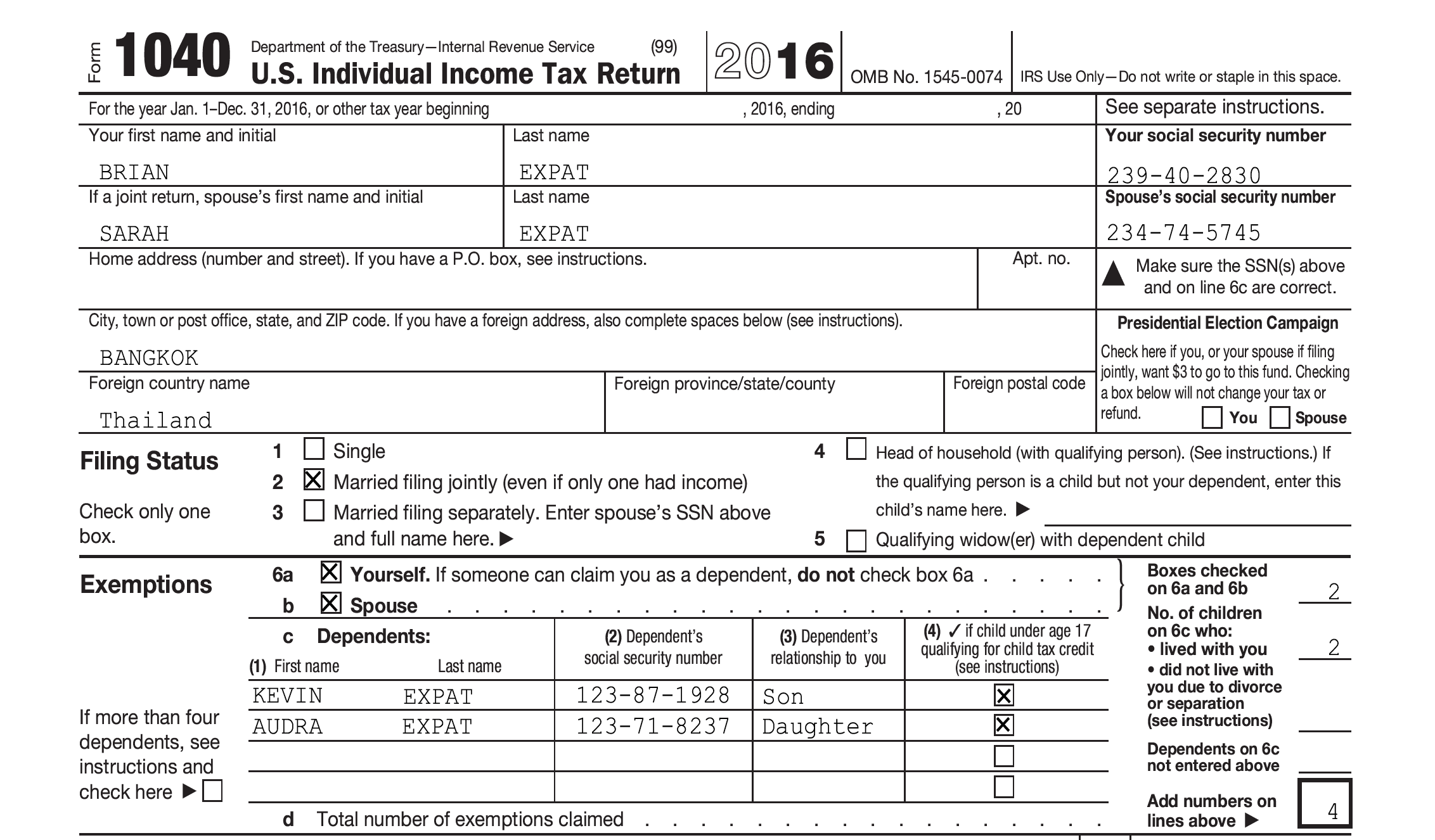

Information about Form 1040 U S Individual Income Tax Return including recent updates related forms and instructions on how to file Form 1040 is used by citizens or residents of the United States to file an annual income tax return

Reporting rules changed for Form 1099 K Taxpayers should receive Form 1099 K Payment Card and Third Party Network Transactions by January 31 2023 if they received third party payments in tax year 2022 for goods and services that exceeded 600 There s no change to the taxability of income

Information about Form 1040 U S Individual Income Tax Return including recent updates related forms and instructions on how to file Form 1040 is used by citizens or residents of the United States to file an annual income tax return

Missouri Renters Rebate 2023 Printable Rebate Form

1040x Fill Out Sign Online DocHub

1040ez

Irs Form 1040 es nr Download Fillable Pdf Or Fill Online U s BA9

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

Formulaire 1040 SR Les Personnes g es Re oivent Un Nouveau

IRS Releases Draft Form 1040 Here s What s New For 2020

IRS Releases Draft Form 1040 Here s What s New For 2020

1040 Form 2022 Printable Fillable Pdf Printable Form Gambaran