In the modern world of consumerization everyone enjoys a good deal. One way to score significant savings when you shop is with 2023 Federal Electric Vechicle Tax Rebate Forms. 2023 Federal Electric Vechicle Tax Rebate Forms are a marketing strategy employed by retailers and manufacturers for offering customers a percentage refund for their purchases after they've placed them. In this article, we will dive into the world 2023 Federal Electric Vechicle Tax Rebate Forms, looking at what they are and how they function, and how to maximize your savings through these efficient incentives.

Get Latest 2023 Federal Electric Vechicle Tax Rebate Form Below

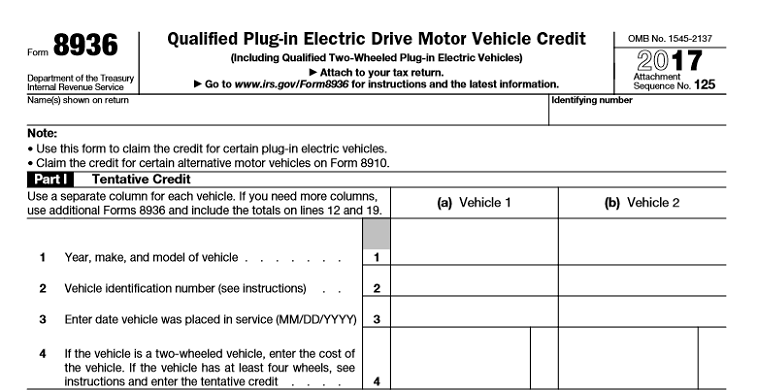

2023 Federal Electric Vechicle Tax Rebate Form

2023 Federal Electric Vechicle Tax Rebate Form -

Verkko 12 huhtik 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding

Verkko Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two

A 2023 Federal Electric Vechicle Tax Rebate Form is, in its most basic form, is a payment to a consumer after they have purchased a product or service. It's an effective way employed by companies to draw buyers, increase sales and market specific products.

Types of 2023 Federal Electric Vechicle Tax Rebate Form

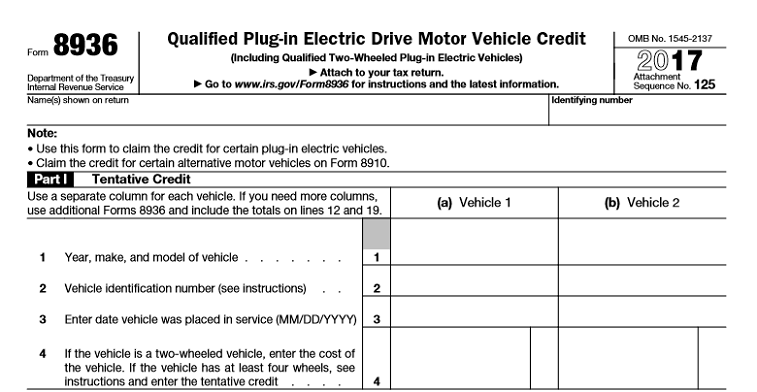

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Verkko Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax

Verkko 7 tammik 2023 nbsp 0183 32 Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some

Cash 2023 Federal Electric Vechicle Tax Rebate Form

Cash 2023 Federal Electric Vechicle Tax Rebate Form are the most basic kind of 2023 Federal Electric Vechicle Tax Rebate Form. Customers are given a certain amount of money back after purchasing a product. This is often for expensive items such as electronics or appliances.

Mail-In 2023 Federal Electric Vechicle Tax Rebate Form

Mail-in 2023 Federal Electric Vechicle Tax Rebate Form need customers to provide evidence of purchase to get the money. They're more complicated but could provide huge savings.

Instant 2023 Federal Electric Vechicle Tax Rebate Form

Instant 2023 Federal Electric Vechicle Tax Rebate Form will be applied at points of sale. This reduces the purchase cost immediately. Customers don't need to wait around for savings through this kind of offer.

How 2023 Federal Electric Vechicle Tax Rebate Form Work

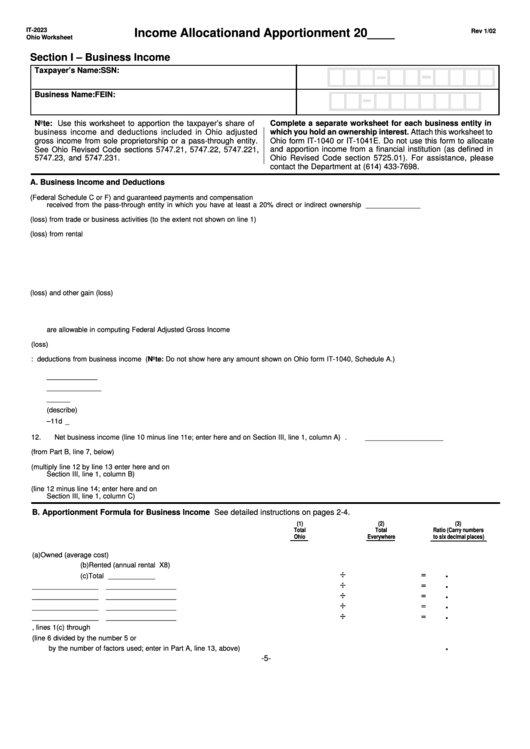

Electric Vehicle Tax Credit Form 2021 Irs Federal Phelcky

Electric Vehicle Tax Credit Form 2021 Irs Federal Phelcky

Verkko 21 kes 228 k 2011 nbsp 0183 32 Federal EV tax credits in 2023 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the automakers themselves take a 7 500 tax credit for EV

The 2023 Federal Electric Vechicle Tax Rebate Form Process

The process usually involves a few steps

-

Purchase the product: First you purchase the product just as you would ordinarily.

-

Fill out the 2023 Federal Electric Vechicle Tax Rebate Form request form. You'll need to provide some information including your address, name, and the purchase details, in order to submit your 2023 Federal Electric Vechicle Tax Rebate Form.

-

In order to submit the 2023 Federal Electric Vechicle Tax Rebate Form Based on the type of 2023 Federal Electric Vechicle Tax Rebate Form you might need to fill out a paper form or submit it online.

-

Wait until the company approves: The company will review your submission to make sure that it's in accordance with the guidelines and conditions of the 2023 Federal Electric Vechicle Tax Rebate Form.

-

Redeem your 2023 Federal Electric Vechicle Tax Rebate Form Once it's approved, the amount you receive will be in the form of a check, prepaid card, or any other method specified by the offer.

Pros and Cons of 2023 Federal Electric Vechicle Tax Rebate Form

Advantages

-

Cost Savings 2023 Federal Electric Vechicle Tax Rebate Form are a great way to lower the cost you pay for the item.

-

Promotional Deals These deals encourage customers in trying new products or brands.

-

Help to Increase Sales 2023 Federal Electric Vechicle Tax Rebate Form can increase a company's sales and market share.

Disadvantages

-

Complexity 2023 Federal Electric Vechicle Tax Rebate Form that are mail-in, particularly are often time-consuming and take a long time to complete.

-

End Dates A lot of 2023 Federal Electric Vechicle Tax Rebate Form have the strictest deadlines for submission.

-

Risk of not receiving payment Certain customers could not get their 2023 Federal Electric Vechicle Tax Rebate Form if they don't comply with the rules precisely.

Download 2023 Federal Electric Vechicle Tax Rebate Form

Download 2023 Federal Electric Vechicle Tax Rebate Form

FAQs

1. Are 2023 Federal Electric Vechicle Tax Rebate Form the same as discounts? No, the 2023 Federal Electric Vechicle Tax Rebate Form will be a partial refund after the purchase, while discounts lower their price at moment of sale.

2. Can I get multiple 2023 Federal Electric Vechicle Tax Rebate Form for the same product This depends on the conditions for the 2023 Federal Electric Vechicle Tax Rebate Form incentives and the specific product's ability to qualify. Certain companies may permit it, while others won't.

3. How long does it take to receive the 2023 Federal Electric Vechicle Tax Rebate Form? The time frame differs, but it can take anywhere from a couple of weeks to a few months to get your 2023 Federal Electric Vechicle Tax Rebate Form.

4. Do I need to pay tax in relation to 2023 Federal Electric Vechicle Tax Rebate Form montants? the majority of circumstances, 2023 Federal Electric Vechicle Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust 2023 Federal Electric Vechicle Tax Rebate Form deals from lesser-known brands It's crucial to research and verify that the brand offering the 2023 Federal Electric Vechicle Tax Rebate Form is reputable prior to making the purchase.

Revised Vehicle Classification Definition More Electric Vehicles

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained

Check more sample of 2023 Federal Electric Vechicle Tax Rebate Form below

Illinois Tax Forms Fill Out Sign Online DocHub

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

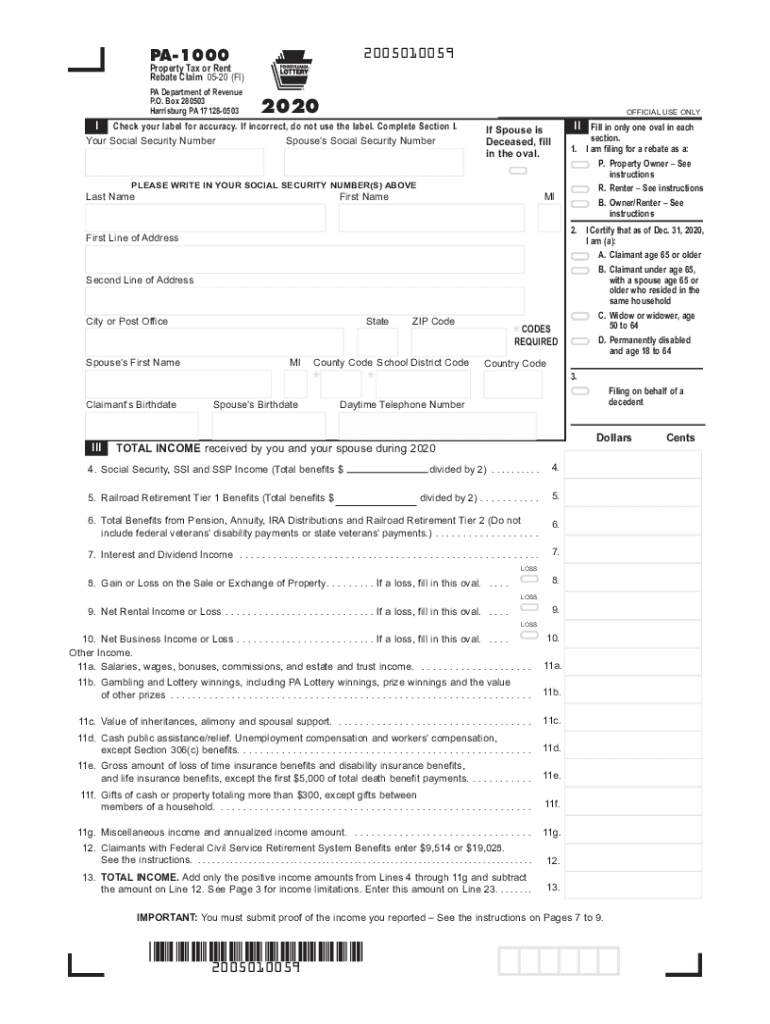

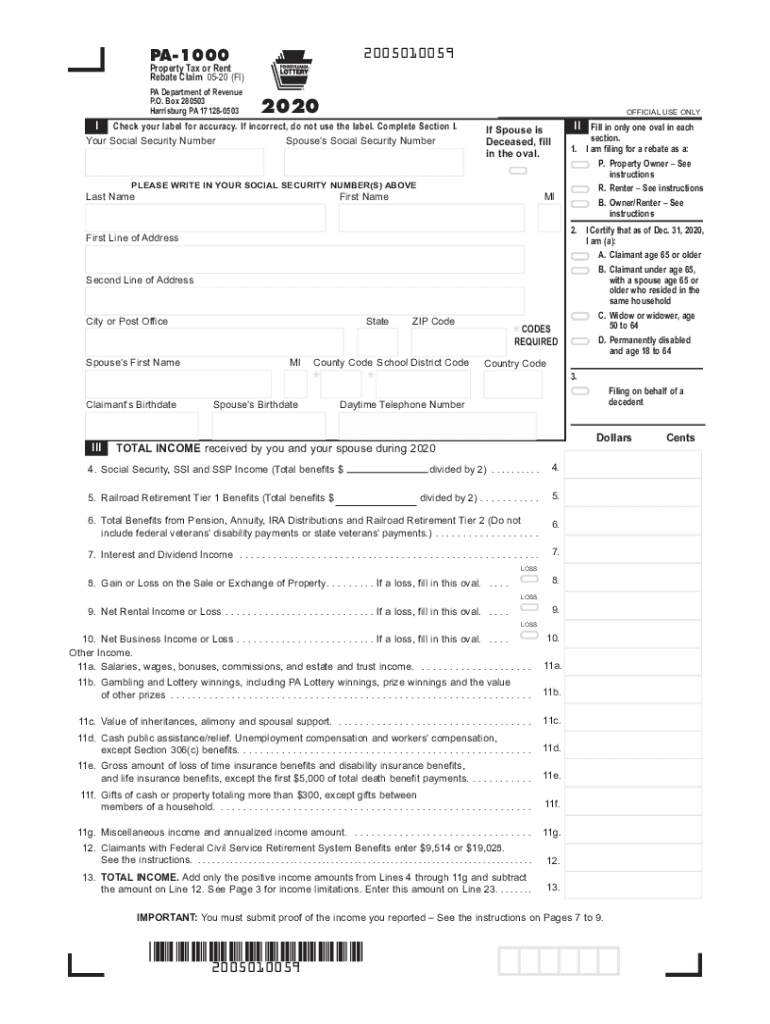

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

How To Get Tax Breaks On Hybrids YourMechanic Advice

Filing Tax Returns EV Credits Tesla Motors Club

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Verkko Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two

https://www.irs.gov/clean-vehicle-tax-credits

Verkko About Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Page Last Reviewed or Updated 01 Nov 2023 Find out if your electric vehicle EV or fuel cell

Verkko Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two

Verkko About Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Page Last Reviewed or Updated 01 Nov 2023 Find out if your electric vehicle EV or fuel cell

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

How To Get Tax Breaks On Hybrids YourMechanic Advice

Filing Tax Returns EV Credits Tesla Motors Club

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

Pa 1000 2019 Fill Out Sign Online DocHub

Pa 1000 2019 Fill Out Sign Online DocHub

Confused About The New EV Tax Credits Why You Should Buy An EV Before