Today, in a world that is driven by the consumer everyone is looking for a great deal. One method to get significant savings when you shop is with 1098 Form Tax Rebates. 1098 Form Tax Rebates are a method of marketing used by manufacturers and retailers in order to offer customers a small cash back on their purchases once they have placed them. In this article, we will go deeper into the realm of 1098 Form Tax Rebates. We'll look at what they are as well as how they work and ways to maximize your savings by taking advantage of these cost-effective incentives.

Get Latest 1098 Form Tax Rebate Below

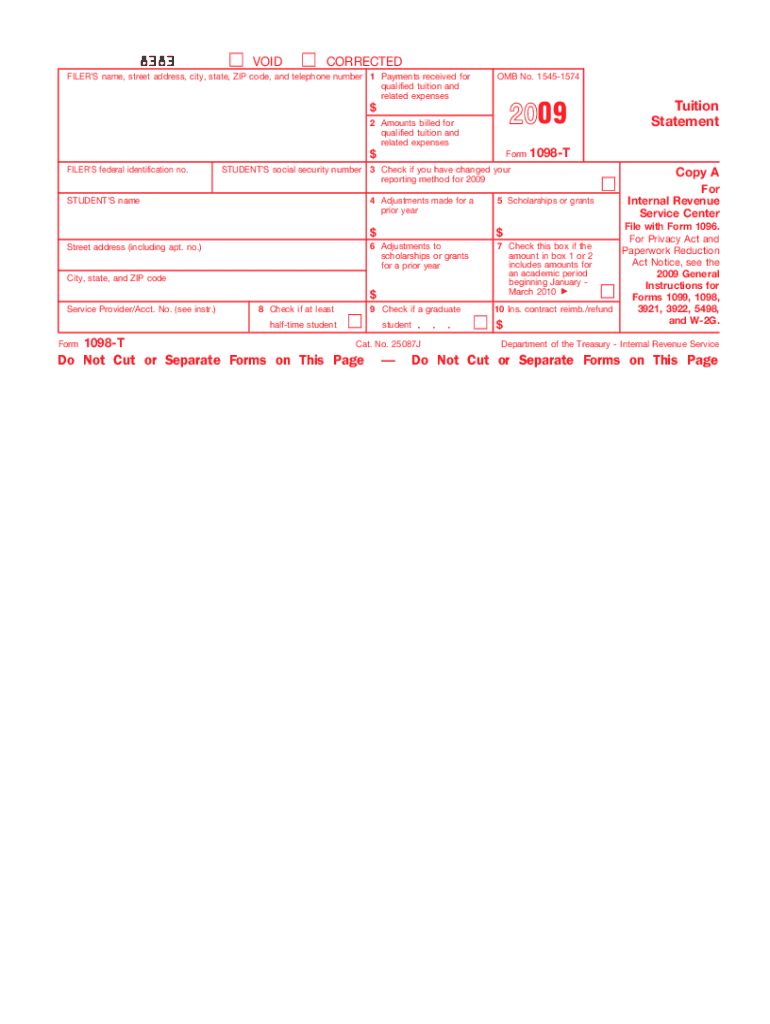

1098 Form Tax Rebate

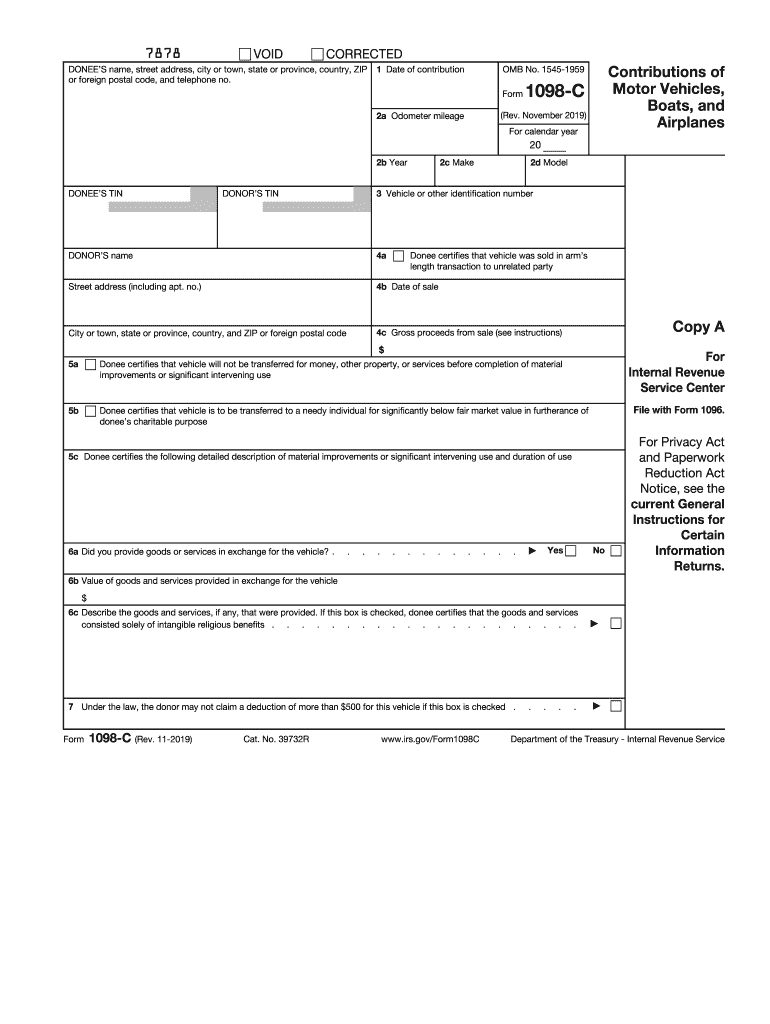

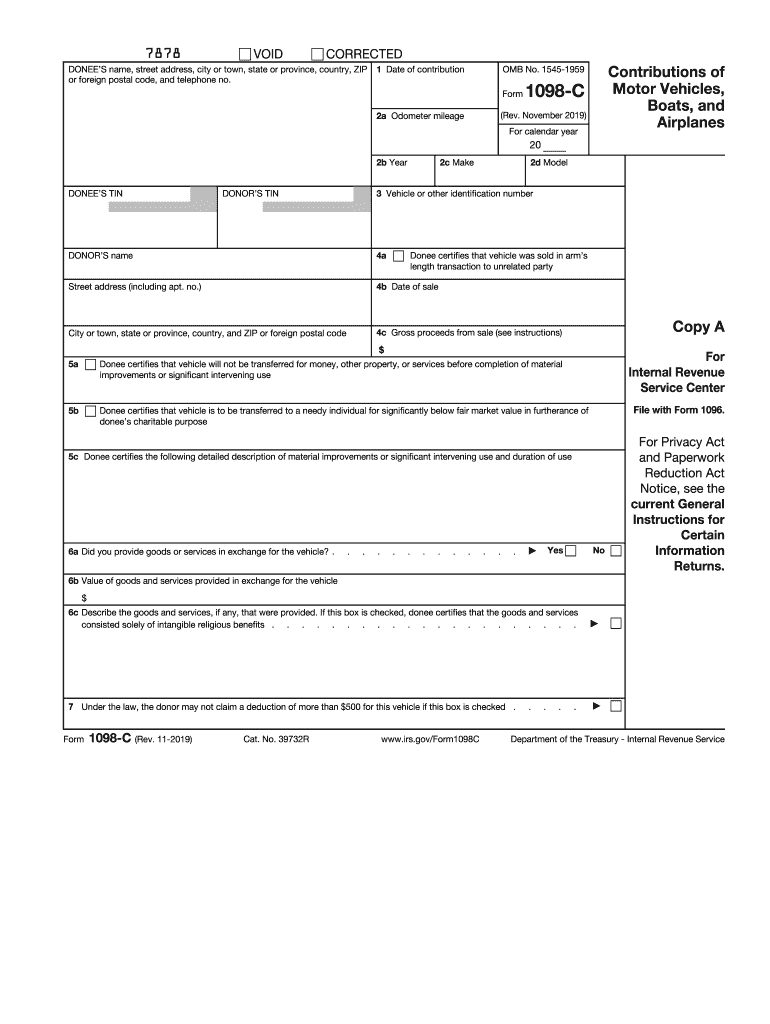

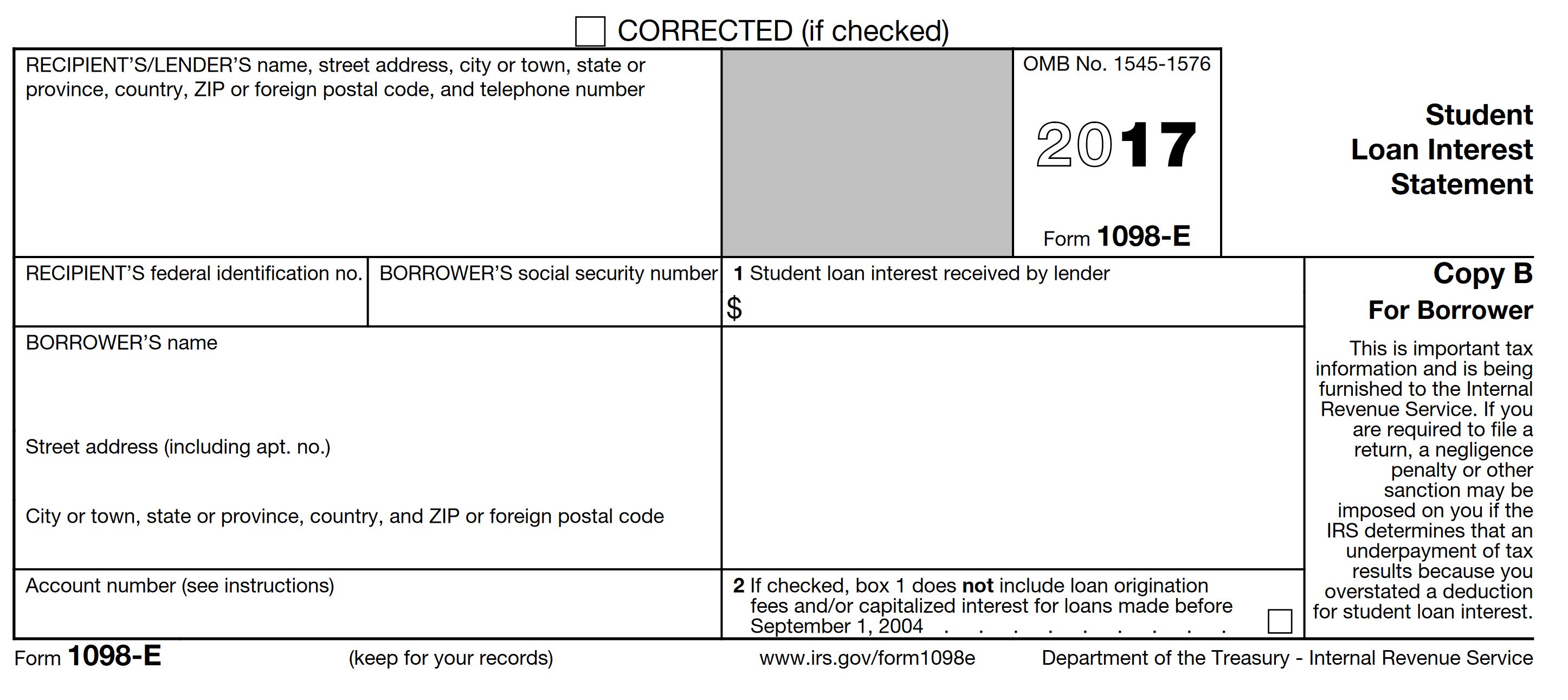

1098 Form Tax Rebate - 1098 Form Tax Return, 1098 Form Tax Credit, 1098-t Tax Credit, 1098-t Tax Credit Calculator, 1098 T Tax Return, 1098-t Tax Return Calculator, 1098-t Tax Credit Income Limit, 1098 T Tax Refund, 1098 T Tax Deduction 2022, 1098-t Tax Credit Reddit

Web 1 d 233 c 2022 nbsp 0183 32 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders

Web You are required to report reimbursements of overpaid interest aggregating 600 or more to a payer of record on Form 1098 You are not required to report reimbursements of

A 1098 Form Tax Rebate at its most basic form, is a refund given to a client after having purchased a item or service. It's a powerful instrument employed by companies to draw customers, increase sales, and advertise specific products.

Types of 1098 Form Tax Rebate

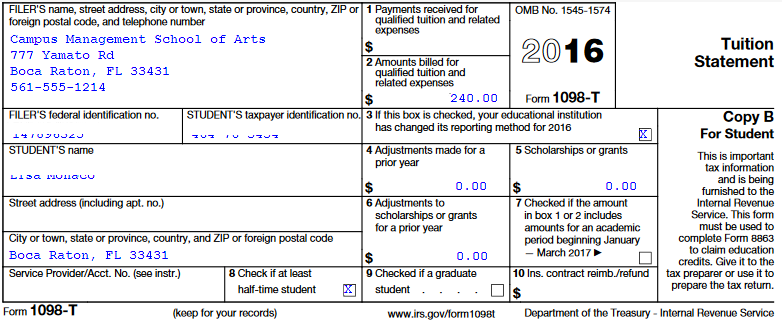

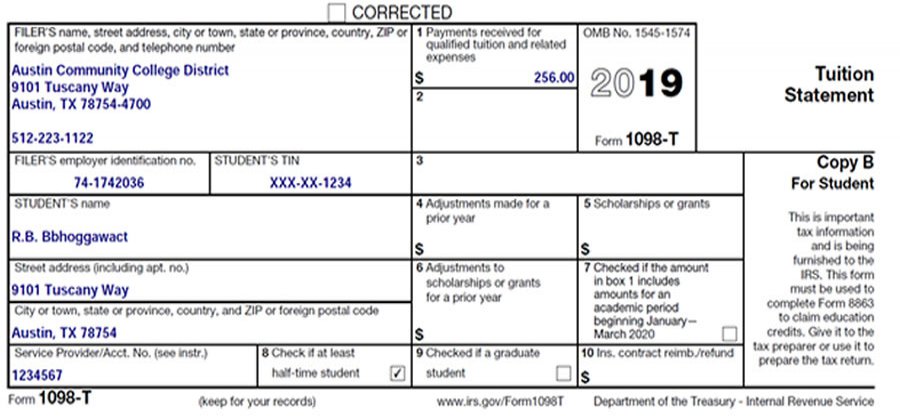

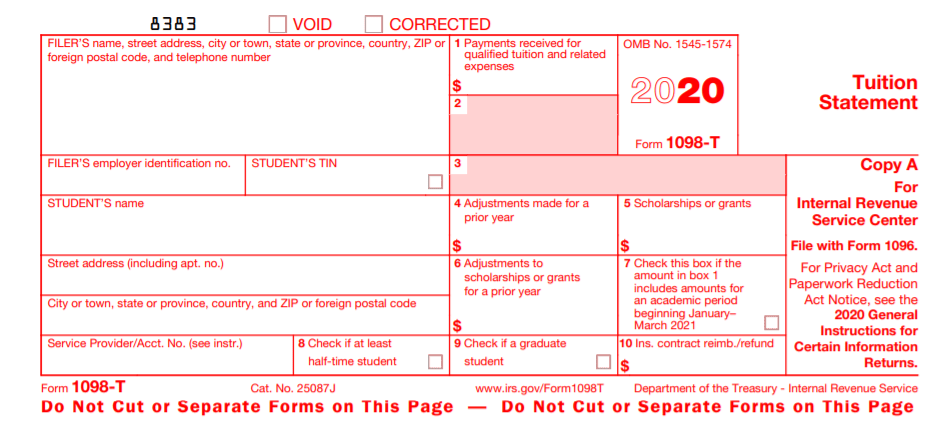

View 1098T

View 1098T

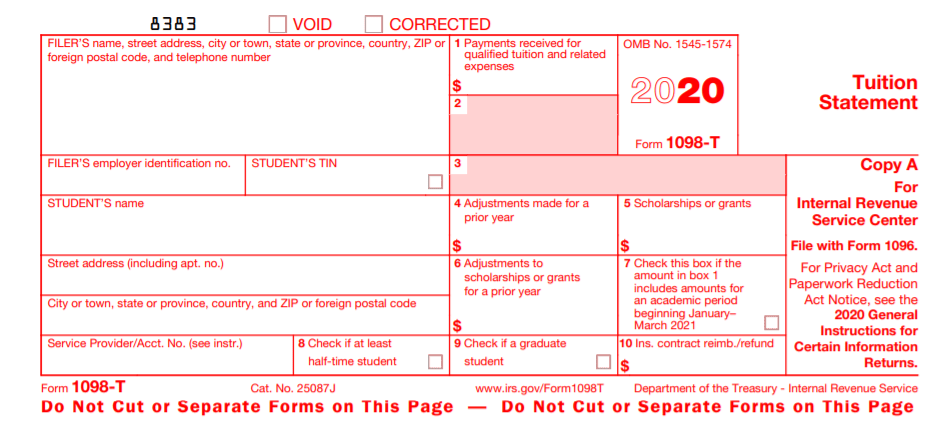

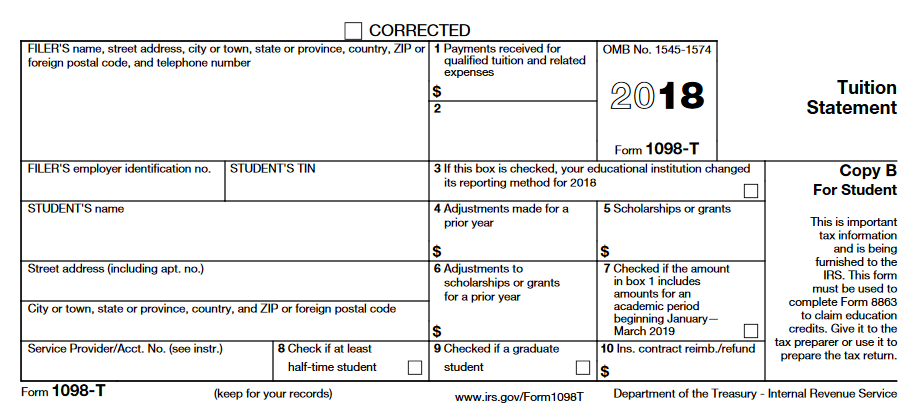

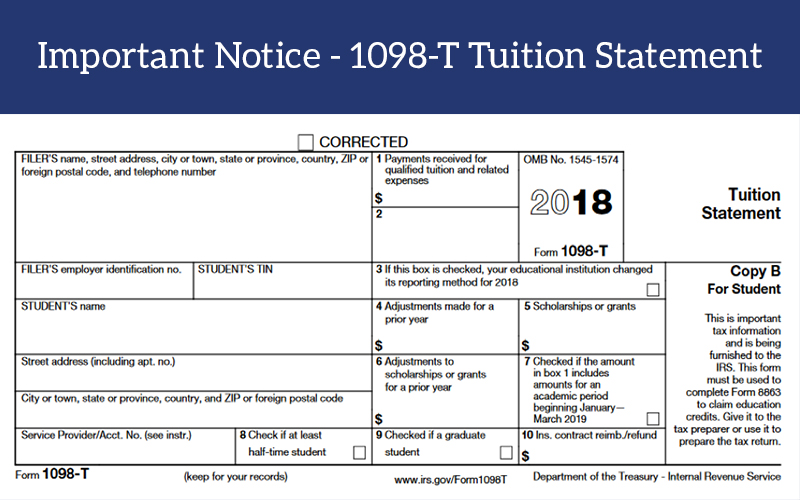

Web Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is

Web The optional method allows you to deduct the mortgage interest and state and local real property taxes reported on Form 1098 Mortgage Interest Statement but only up to the

Cash 1098 Form Tax Rebate

Cash 1098 Form Tax Rebate is the most basic type of 1098 Form Tax Rebate. Customers receive a certain amount of money after purchasing a product. These are typically applied to big-ticket items, like electronics and appliances.

Mail-In 1098 Form Tax Rebate

Customers who want to receive mail-in 1098 Form Tax Rebate must present their proof of purchase before receiving their refund. They're a bit more complicated but could provide significant savings.

Instant 1098 Form Tax Rebate

Instant 1098 Form Tax Rebate are applied at the point of sale. They reduce the price of purchases immediately. Customers don't have to wait long for savings when they purchase this type of 1098 Form Tax Rebate.

How 1098 Form Tax Rebate Work

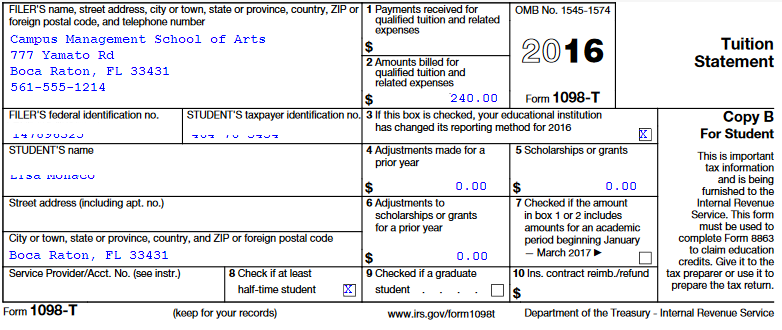

1098 2016 Public Documents 1099 Pro Wiki

1098 2016 Public Documents 1099 Pro Wiki

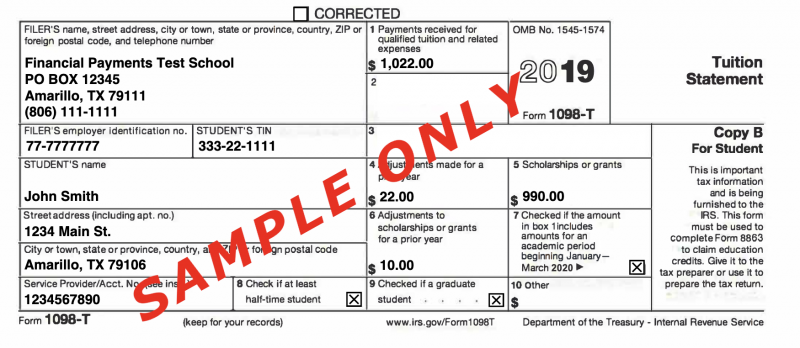

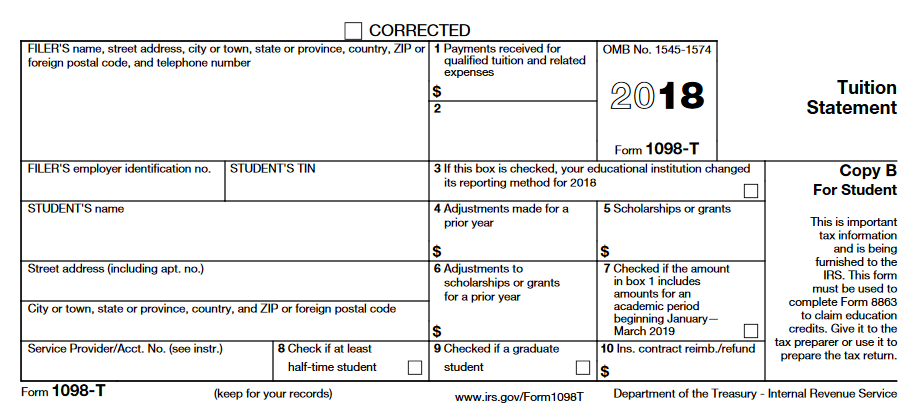

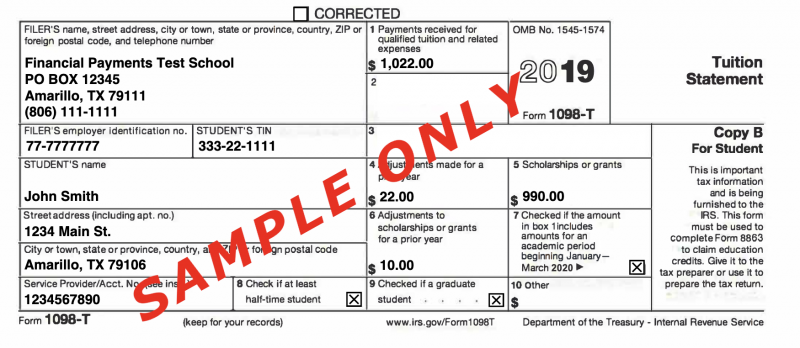

Web Generally an eligible educational institution such as a college or university must send Form 1098 T or acceptable substitute to each enrolled student by January 31 2023 An institution will report payments

The 1098 Form Tax Rebate Process

The process usually involves a handful of simple steps:

-

Buy the product: Firstly purchase the product in the same way you would normally.

-

Fill in the 1098 Form Tax Rebate questionnaire: you'll need provide certain information including your address, name, and information about the purchase to take advantage of your 1098 Form Tax Rebate.

-

Make sure you submit the 1098 Form Tax Rebate The 1098 Form Tax Rebate must be submitted in accordance with the kind of 1098 Form Tax Rebate it is possible that you need to either mail in a request form or send it via the internet.

-

Wait for approval: The company will go through your application for compliance with rules and regulations of the 1098 Form Tax Rebate.

-

Enjoy your 1098 Form Tax Rebate If it is approved, you'll receive your refund in the form of a check, prepaid card, or other way specified in the offer.

Pros and Cons of 1098 Form Tax Rebate

Advantages

-

Cost savings 1098 Form Tax Rebate can substantially decrease the price for products.

-

Promotional Deals Incentivize customers to experiment with new products, or brands.

-

Enhance Sales The benefits of a 1098 Form Tax Rebate can improve a company's sales and market share.

Disadvantages

-

Complexity: Mail-in 1098 Form Tax Rebate, particularly difficult and slow-going.

-

Extension Dates Most 1098 Form Tax Rebate come with certain deadlines for submitting.

-

Risk of Not Being Paid Some customers might lose their 1098 Form Tax Rebate in the event that they do not adhere to the guidelines exactly.

Download 1098 Form Tax Rebate

FAQs

1. Are 1098 Form Tax Rebate similar to discounts? Not necessarily, as 1098 Form Tax Rebate are a partial refund after purchase, but discounts can reduce the purchase price at moment of sale.

2. Are multiple 1098 Form Tax Rebate available on the same product? It depends on the terms of 1098 Form Tax Rebate provides and the particular product's acceptance. Certain companies might allow it, while some won't.

3. What is the time frame to get a 1098 Form Tax Rebate? The timing will vary, but it may take anywhere from a couple of weeks to a few months before you receive your 1098 Form Tax Rebate.

4. Do I have to pay tax for 1098 Form Tax Rebate amount? the majority of cases, 1098 Form Tax Rebate amounts are not considered to be taxable income.

5. Can I trust 1098 Form Tax Rebate deals from lesser-known brands? It's essential to research and confirm that the company giving the 1098 Form Tax Rebate has a good reputation prior to making an acquisition.

1098 Form 2015 Fill Out Sign Online DocHub

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

Check more sample of 1098 Form Tax Rebate below

How To Get My 1098 T Form From School School Walls

What Is A 1098 T Form Used For Full Guide For College Students The

1098 T Form Nipodcup

1098T Forms For Education Expenses IRS Copy A ZBPforms

2019 Updates 1098 T Forms

1098 T Tuition Statement Finance And Administration Oregon State

https://www.irs.gov/pub/irs-pdf/i1098.pdf

Web You are required to report reimbursements of overpaid interest aggregating 600 or more to a payer of record on Form 1098 You are not required to report reimbursements of

https://www.irs.gov/instructions/i1098

Web Report the total reimbursement even if it is for overpayments made in more than 1 year To be reportable the reimbursement must be a refund or credit of mortgage interest

Web You are required to report reimbursements of overpaid interest aggregating 600 or more to a payer of record on Form 1098 You are not required to report reimbursements of

Web Report the total reimbursement even if it is for overpayments made in more than 1 year To be reportable the reimbursement must be a refund or credit of mortgage interest

1098T Forms For Education Expenses IRS Copy A ZBPforms

What Is A 1098 T Form Used For Full Guide For College Students The

2019 Updates 1098 T Forms

1098 T Tuition Statement Finance And Administration Oregon State

Students Can Now Access 1098T Form Online On The College Website

Fillable 2017 C Fill Out Sign Online DocHub

Fillable 2017 C Fill Out Sign Online DocHub

Peoples Choice Tax Tax Documents To Bring We Provide Income Tax